The Battle of the Skies is Being Waged on the Ground – The Isolationist Impact on the Fight to Control International Air Traffic

The major US airlines, Delta, American and United, are trying to shut out their Middle Eastern rivals from accessing US markets by appealing to Trump’s protectionist agenda. Instead, they should focus on winning the market with a superior product, service and price.

If your multinational company was losing market share to new competitors, would you run from the problem or try to fix it? Talented CEOs would attempt to diagnose the issues driving the share loss and devise a strategy to combat the competition. However, America’s three largest airlines, Delta, American, and United (“US3”), have instead decided to take advantage of President Trump’s “America First” economic agenda by lobbying for government intervention in liberalized aviation markets. Their strategy is short-sighted and dangerous, both because it relies on weak arguments and risks alienating customers and limiting access to US markets.

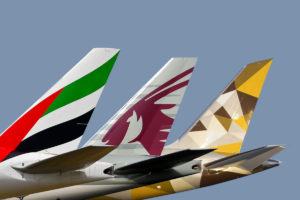

For the last three years, the major US airlines have been battling their fast-growing Persian Gulf counterparts, Emirates, Qatar, and Etihad (“ME3”). [1] But rather than compete on product, service and price, the US3 are waging war in the political sphere. They charge that the ME3 carriers have received over $52bn worth of illegal subsidies from the governments of the UAE and Qatar and act as extensions of these sovereigns, who equip them with an unfair advantage that threatens US jobs. [2] In an unlikely alliance, the US3 have rallied union employees, powerful lawmakers and Washington lobbyists, including Senator Trent Lott and Obama staffer Anita Dunn, around calls for increased protectionism under the specious guise of job protection. [3] They argue that each long-haul route foregone as a result of ME3 expansion kills 1,500 American jobs and are spending $20mm annually lobbying this message in Washington. [4] Their goal is for the government to rescind or curtail existing Open Skies agreements with the UAE and Qatar.

Open Skies treaties are negotiated bilateral agreements between governments to allow liberalization of air routes between the two countries. Since 1992, the US has signed over 120 of these agreements, which have fostered reduced airfares and more flights to hundreds of international destinations. [5]. US carriers, until now, have always championed the increased access to global markets that follow from Open Skies, making their current about-face so remarkable. In February, the CEOs of the US3 met with President Trump to raise their concerns. Trump empathized, “I know you have a lot of competition that is subsidized by governments, big league…It’s a pretty unfair situation. What can we do?” [6] Recent reports suggest he is considering taking a stance against the ME3 as a way to fulfill his protectionist campaign promises. [7] If he does, the ME3’s access to US markets would be restricted, reducing competition and leading to increased prices, and profits for the US3.

On paper, this sounds like a great outcome for the US3. The problem is the strategy is narrow-sighted and ignores more important, long-term considerations. First, there is no guarantee that Trump will even side with the US3. After all, ME3 carriers have spent billions of dollars purchasing Boeing aircraft and have billions more on order. These orders support thousands of US jobs, the very jobs the US3 argue are being lost. [8] Moreover, not all stakeholders are aligned. US cargo operators like FedEx established hubs in Dubai that depend upon the same Open Skies agreements that the US3 are fighting to eliminate. [9] But even if Trump changes the rules, nothing is stopping the next President from reversing course and pushing the country back on a path to liberalization.

On paper, this sounds like a great outcome for the US3. The problem is the strategy is narrow-sighted and ignores more important, long-term considerations. First, there is no guarantee that Trump will even side with the US3. After all, ME3 carriers have spent billions of dollars purchasing Boeing aircraft and have billions more on order. These orders support thousands of US jobs, the very jobs the US3 argue are being lost. [8] Moreover, not all stakeholders are aligned. US cargo operators like FedEx established hubs in Dubai that depend upon the same Open Skies agreements that the US3 are fighting to eliminate. [9] But even if Trump changes the rules, nothing is stopping the next President from reversing course and pushing the country back on a path to liberalization.

More importantly, the US3’s charges are not credible and claims of unfair subsidies are boldly hypocritical. According to a government report unearthed by WikiLeaks, US airlines have benefited from $155bn of government subsidies over the last 50 years. [10] And while airlines are finally profitable, consumers have been left with such bad service and price gouging the DOJ recently opened an investigation into possible collusion amongst the US3. [11] It is hard to imagine a rational administration winning in the court of public opinion by taking the US3’s side while sticking the consumer with even fewer choices and higher prices than they already face today.

The reality is that competition from the ME3 is here to stay. The US3 are better served gearing up for the long haul and finding creative ways to win back the market. Investing in product and service would go a long way to narrowing the quality gap that exists today between US and foreign carriers. Perhaps the solution is to work with, rather than against, the ME3, as Qantas has successfully managed to do with Emirates. [12] In any event, managers must ask themselves whether doubling down on protectionism is the right long-term strategy for their airline. If so, what are the potential negative consequences they may face down the road? If not, what can they do to counter the looming threat of the ME3?

(777 Words)

Footnotes

[1] Wright, R. “Emirates Airlines warns US against dismantling ‘open skies’ deal,” Financial Times (June 9, 2015)

[2] Partnership for Open and Fair Skies. “Massive Subsidies Are Distorting the International Aviation Market.” Feb. 1, 2017. http://www.openandfairskies.com/subsidies/, accessed Nov. 14, 2007.

[3] Fang, L. “CEOS of Delta, United and American Hope Trump Will Block Arab Competition,” The Intercept (Feb 9, 2017)

[4] Jansen, B. “Trump meeting with airline CEOs to focus on jobs,” USA Today (Feb. 7, 2017)

[5] Mouawad, J. “Open-Skies Agreements Challenged,” New York Times (Feb. 6, 2015)

[6] The White House Press Office. Remarks by President Trump in Meeting with the Aviation Industry. State Dining Room. Feb 9, 2017.

[7] Restuccia, A. and M. Grunwald. “Trump rethinking aviation agreements with Gulf countries,” Politico (July 12, 2017)

[8] Alkhalisi, Z and J. Ostrower. “American airlines want Trump to take on their Gulf rivals,” CNN (Feb 7, 2017)

[9] Sumers, B. “3 U.S. Legacy Airlines Hope Trump’s Administration Will Block Emirates Expansion,” Skift (Jan 24, 2017)

[10] Luce, E. “The not so friendly skies of America,” Financial Times (July 12, 2015)

[11] Ibid, Financial Times

[12] “Qantas-Emirates partnership changes shape as a restructured Qantas reasserts itself,” CAPA Centre for Aviation (July 10, 2017)

I completely agree that being defensive is a troubling path. Undoubtedly, Americans represent a large portion of global flyers and if US3 continues to play hardball and pointing fingers, I can only assume that international airspace may become more difficult for US3 to access. Etihad, for example, provides immigration clearance in Abu Dhabi for all US-bound passengers. This provides a significant operational advantage for American airports and allows security forces to thwart risks outside US borders. Such services are important for the US and can be put at risk if the government and US airlines become overly isolationist. Recently, Emirates decided to reduce their US flights for nearly 50% of their US destinations as a response to declining demand. Rather than take this as an opportunity, the US3 continued their defensive tirade by highlighting Emirate’s lack of profitability and claims of fraudulent government subsidies. Ultimately, these airlines will face biggest losses to their customers. As business becomes more global and younger countries more developed for global tourists, foreign service providers may no longer need to rely on American customers. Inevitably, to compete and provide global services, American airlines will increase prices in response to increase the cost of services, ultimately passing their faults to customers’ ticket prices. And despite Trump’s efforts to throttle middle east air travel, his past ties to the UAE and Qatar and push for American manufacturing of planes will make it difficult for US3 to hold their ground, especially when they fail to seize the opportunity to capitalize on retracting ME3 routes.

To counter the looming threat of the ME3, the US3 need to examine their global reach. Their partnerships with the western European airlines and the east Asia airlines are insufficient for the increased travel in the middle east and Indian subcontinent beyond major cities like Dubai, Doha, Mumbai, Delhi, or Kolkota. The have missed the opportunity to connect more than a billion people. The reality is that most travellers are traveling through the middle east to get to other destinations, and in the last decade the middle east has become a popular tourist stop increasing the sales of the ME3 airline tickets, though not profitably. Delta is most at risk because it lacks key partnerships like Air India.

Where the ME13 have excelled is as stopover and connecting airlines. They have differentiated themselves on the ability to shuttle any passenger through their hubs in Dubai, Abu Dhabi and Qatar and connect distant parts of the world. I agree with the sentiment that it would benefit US carriers to work more closely with their counterparts in the Middle East. ME13 carriers carry a lot of weight in the Eastern Hemisphere. If American carriers can link their passengers more closely with ME13 airlines, they improve their customer experience by linking their customers to new flight paths and schedules not otherwise available.

In a way we’re living in an isolationist world, but in another way, it’s hard to turn back the tides of globalization. I’m taking a flight from Rio to Buenos Aires this January that is operated by Emirates Airline. Middle East carriers continue to expand their reach. This isolationist agenda feels like a blip and for US carriers, if they want to remain competitve in the long term, they should be getting closer to their ME13 counterparts and not fighting them. If Emirates is now fully competing in the Western Hemisphere, they’re not going anywhere. Whining to the government is not a long term strategy.

Fantastic piece, David. While there are certainly macro-externalities at play in the fierce competition with the ME3, I don’t think we can undersell the complete lack of apparent interest that the US3 have shown in maintaining and growing there market share in terms of customer service/promise. It doesn’t take a Nobel Prize winner to understand that if your business model is “service quality down, prices up”, you are in trouble. While the US3 have spent time and money lobbying for “help”, they have failed to do anything to entice passengers to choose them over the ME3, who have put an incredible focus on top-of-the-line customer service, superior equipment and marketing, and best-in-class safety performance. I used to fly on ME3 planes on a weekly basis, and they are still the airlines to which I compare US3 performance. I am consistently disappointed.

Really good article, thanks David. I think you do a good job of articulating why the US3 claims of unfair competition are more an appeal for unwarranted government interference than they are legitimate grievances. But I’m still left wondering, to what extent do government subsidies distort the basis of competition internationally, and could the US3 be on firmer ground in other cases? The fact that the US government has subsidized the US airline industry to the tune of $150bn over the past 50 years (unclear from your post how much of that was pre- vs post- deregulation) doesn’t to me say that other airlines don’t benefit even more from government subsidies. Should the same WTO anti-dumping rules that apply in other industries also apply here? Do you view a healthy domestic airline industry as something of a strategic imperative for a country (similar to other strategically important industries such as agriculture and steelmaking) that merit some loss of consumer surplus in the name of national security and thus worth subsidizing/ protecting? In cases where foreign governments really are “unfairly” subsidizing airlines, what if anything should the US government do about it?

Also curious as an aside the extent to which you’d place the blame for poor customer service in the industry on the FAA and public authorities responsible for airport construction/ enlargement vs. the airlines themselves

Excellent post David. I find myself wondering if the airlines fully comprehend the long term ramifications that increased regulation, larger unions, and reliance on subsidies will have on their own businesses. While short-sighted from a globalization perspective, it seems that the US3 are placing themselves at great risk of significantly increased exposure to the political climate within the US and demands of unions in the future. I won’t comment on the efficacy or need for unions here, but I will say that the US3 need to be weary of the shift in power they may cause by attempting to undermine the ME3 in the near term. Perhaps most curious though, is that these points seem somewhat obvious. The analysis here is sound, but how are airline executives or their boards not asking the same questions? Do they know something that we don’t, or are they incentivized based on near-term earnings targets more than long-term value creation?

Great post David. This is a classic case of US3 pointing at a threat without understanding opposition’s context. The UAE has, throughout its history, been a hub for global trade. A little known fact is that Dubai has little oil, and evolved as a trade center for the pearling industry. As a result of this strategic location the British began their protection of the Trucial States long before oil was discovered there in the 1950s. The UAE’s extension of this identity into the modern era is seen in its airlines. As countries with i) oil and ii) a strategic location between Europe and Asia – and few other resources – it only stands to reason Qatari and Emirati governments would allocate disproportionate subsidies toward airlines. This becomes increasingly important in a “low for longer” oil price environment and a depressed GBP environment in which flights for UK business travelers are comparatively more expensive. On a go forward basis substantial subsidies are warranted. In my view, ME3 is uniquely positioned to win in terms of global international travel.

And don’t get me started on the laptop ban – it’s my own conspiracy theory that this was an underhanded attempt at the same agenda you describe (https://www.theguardian.com/us-news/2017/jul/20/us-ends-laptop-ban-flights-middle-east)

Very insightful article David – thanks for your thoughts on the topic. It’s certainly concerning to see the U.S. airlines relying on a a fickle administration to set an strategic direction. While companies of course have to react to any shifting political or regulatory policies, I am concerned that the Trump administration’s volatile tendency to waffle between positions makes operating in this environment very challenging. To that effect, it seems that a better strategic course would be to focus on fundamental improvements in their business model (better service, higher quality product offerings, optimized service routes) versus reliance on isolationist policies (which, to your point, could be reversed by the next administration or even this White House).

Another alarming policy from the Trump administration that similarly affects the airlines is the “travel ban” – how much will that compound the effect isolationism will have on the airlines?

Thanks, David. You lay out a well written, strong argument, and I think your advice about investing in products and services in spot on. That said, I do not think that complaints about foreign governments subsidizing competition and flawed business strategy are mutually exclusive. In other words, the US3 may both be rightly aggrieved and have strategic deficiencies. I can’t say that I am very familiar with the Open Skies dispute. Taking a step back and looking at trade policy more globally, I am sensitive to the fact that state-owned enterprises (SOEs) pose a serious threat to the competitiveness of U.S. businesses; leveling the playing field for U.S. companies facing such competition is an important (and largely bipartisan, as you note) component of U.S. trade policymaking. In fact, and again not knowing a lot about the Open Skies dispute, I would argue that it is not protectionist or isolationist to seek to ensure a level playing field; it is the same basic reason I think robust environmental and labor standards must be achieved in any trade agreement.

More broadly, you surface two excellent points that I think are worth highlighting (and which are closely connected to one another). First, it is important to always remember that, free market rhetoric aside, many companies champion regulation in the narrow instances where it advantages them. That should shed light on the instances when they rail against it. Depending on your perspective, they might be “right” in some cases and they might be “wrong” in others, but many are consistently inconsistent. Similarly, I very much appreciated you mentioning the anti-competition issue. Last year, the Department of Transportation also took action to spur competitiveness in the industry [1]. I truly hope that rooting out anticompetitive behavior within our domestic industries is an area that can achieve bipartisan support.

1. “U.S. Department of Transportation Announces Enhanced Protections for Air Travelers, Actions to Promote Airline Competition,” Department of Transportation, October 18, 2016, https://www.transportation.gov/briefing-room/us-department-transportation-announces-enhanced-protections-air-travelers-actions, accessed December 2016

This is a really comprehensive piece! You’ve addressed the broad-reaching ramifications of a protectionist policy.

I think ultimately a holistic cost-benefit analysis has to be done. Who would benefit from the enactment of the policy? Who would lose out? It seems like the airlines’ pockets are the biggest gainers if we are to suppress competition – whether the competition was fair or not. However, consumers get slapped with higher prices all around – for their cost of air travel, delivering packages overseas, the sudden reduction in air travel options restricting their plans. Related industries that rely on air freight, like transportation companies (as you’ve pointed out), importers, manufacturers who procure foreign raw material, also face higher costs.

What should be done depends on whether you want to please the airlines because of some political agenda, or whether you’re concerned about the welfare of society and related domestic industries.