Ready Logistics, Set, Go! A drive through changes in the automotive landscape

Will traditional automotive partners rise to meet emerging connected-car technology?

Thirty Chevrolet Tahoes, just retired from a police fleet, sit in a residential cul-de-sac of the small town Maysville, Kentucky, looking ahead to their next lives as ordinary, lay-vehicles. The future that awaits a remarketed vehicle is unclear, as each SUV will embark on a long and different journey from Maysville to a used-car dealership and eventually to a new home.

Key to this route is Ready Logistics, a company offering pick-up and delivery services to new and used vehicles. Their end-to-end transportation solutions rely upon a network of 6,500 carrier partners who handle over 1.8M vehicles per year. [1] While Ready emphasizes short lead-times to their dealership, fleet-owner, and vehicle auction clients, the company lacks the infrastructure, coverage, and flexibility to react swiftly to all variables involved in a transaction, an ability that emerging connected-car technology offers. This technology, once installed in fleet vehicles and offered in networks of semi-trucks, would eliminate variability that drives costs and shipping times, ultimately providing higher visibility of shipment status to end customers. By looking at the mounting challenges faced by automotive transportation partners, as well as the differences in responses from traditional companies like Ready and emerging ones, it becomes clear that a transformed future awaits new and remarketed vehicles.

With record sales of 17.5 million new vehicles, 40 million used vehicles, and 2.5 million certified-pre-owned vehicles in 2016[2], demand and pressure by automotive retailers and resellers on partners like Ready Logistics have increased in recent years. As the number of shipped vehicles has increased, so has complications stemming from coordination, as differences in shipping distance, available partners, and order sizes become increasingly difficult to resolve at high volume levels.

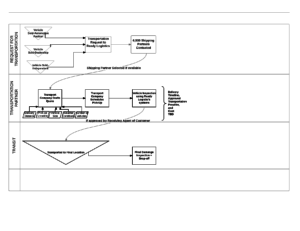

While connected-car technologies and telematics automate the tracking and resolution of these variables, Ready Logistics resorts to hiring more resources and partners to address complications manually. Instead of looking towards in-car devices and telematics to increase supply-chain visibility, the company has deployed their own digital tracking mobile applications, which it expects all customers to download and utilize. As seen in the flow chart below, this expectation requires partners to complete a complex number of tasks, from pricing to inspection:

Figure 1

Each of these tasks represents variability and potential loss of control as partners handle, track, and inspect vehicles differently. Additionally, even with 6,500 transportation partners, Ready’s services are limited by truck driver shortages, which reached 48,000 in 2015. With their current internal optimization efforts, the company lacks the flexibility to resolve such factors outside of their control. [3]While Ready’s technology improvements focus on internal operations, digitalization advancements across the industry introduce solutions at the software and individual-vehicle level. In the near-term, advanced transportation companies increasingly are purchasing connected vehicles, relying on these internal systems to monitor and improve route optimization, capacity utilization, and shipping quality. [4]With telematics sales expected grow 16% annually[5], traditional companies like Ready can expect their oversight processes to fall behind installed-technology offerings offered by competitors. Additionally, standardized and real-time reporting available within shipping vehicles may reduce the need for third-party logistics coordinators at large. Ready would need to partner exclusively with connected-shipping transportation companies, as well as offer ancillary oversight and protection services, in order to stay relevant in this digital-dominated future.

Then, in the long-term, Ready will face increased pressure as autonomous-systems begin to dominate the trucking industry, offering customers quicker delivery lead-times, reduced reliance on supply of drivers, and higher control and visibility of an automobile’s journey. Adoption of this technology could lower costs for trucks by as much as 35%, according to McKinsey and Company, ultimately eliminating any bottlenecks caused by driver shortages. If regulations evolve to allow for completely driverless trucks, the question then becomes will transportation and logistics companies be needed at all provided individual vehicles could transport independently.

With such rapid and disruptive technological change emerging across the automotive industry, Ready must reduce its reliance on layered, internal oversight and capital-intensive processes that demand inputs, adherence, and adoption by its 6,500 partners. Instead, the company should focus investments on connected-car technology that automatically monitors and executes the numerous steps involved in a vehicle’s journey, ultimately reducing variability across providers and shipping routes. Only by identifying and embracing emerging industry trends can Ready hope to remain a leader in this portion of the vehicle lifecycle. At that point, the largest question that remains is how much independence will be instilled in smart vehicles, roads and cities as to eliminate the need of once-relevant support companies. (752 words)

[1] readylogistics.com. (2017). Ready Logistics About Us. [online] Available at: http://readylogistics.com/about-us/ [Accessed 15 Nov. 2017].

[2] Manheim.com. (2017). Manheim 2016 Used Car Report. [online] Available at: https://publish.manheim.com/content/dam/consulting/2017-Manheim-Used-Car-Market-Report.pdf [Accessed 15 Nov. 2017].

[3] Bloomberg. (2017). Bloomberg ‘Smokey and the Bandit’ Charm Fades as Truck Driver Hiring Lags. [online] Available at: https://www.bloomberg.com/news/articles/2017-08-17/-smokey-and-the-bandit-charm-fades-as-truck-driver-hiring-lags [Accessed 15 Nov. 2017].

[4] Dunandbradstreet.com. (2017). Quarterly Trucking Update. [online] Available at: http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1961031595?accountid=11311 [Accessed 15 Nov. 2017].

[5] Deloitte.com. (2017). Global Truck Study 2016. [online] Available at: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/manufacturing/us-manufacturing-global-truck-study-the-truck-industry-in-transition.pdf [Accessed 15 Nov. 2017].