Preparing General Motors for the Effects of Isolationism and Trade Disruptions

Discussion of preparing GM for trade disruptions and supply chain challenges.

“History doesn’t repeat itself, but it does rhyme” – Mark Twain

Globalization and Isolationism’s Economic Legacy

In the early 20th century, the world was more “globalized” than it had been at any point in history. However, World War I and post-war isolationism led to the Great Depression and destroyed countless businesses, especially those which relied on international trade.[1] Globalization accelerated after the Cold War, which led to further economic integration between countries and regions. Companies embraced distributed supply chains; however, these adaptations also created vulnerabilities, particularly to isolationism and political upheavals. The automotive industry is particularly susceptible to these threats, having developed extensive international supply chains, which assume continued economic openness between countries.

Historical Context for General Motors and Corresponding Concerns

General Motors (GM) has built supply chains which include many countries, at great expense.[2] [3] Leveraging opportunities of international trade, economic alliances and partnerships, and labor and capital arbitrage, GM has adapted to stay competitive in response to globalization. However, the same changes that kept GM competitive also make it vulnerable to political shifts towards isolationist policies. This transforms international supply chains from competitive advantages into dangerous liabilities.

For GM, investments in plants and supply-chain design are made with a fundamental assumption that underlying economic and political conditions will change gradually (if at all). However, both recent and distant history are replete with examples of whole industries which were disrupted by political events- the US auto industry was similarly upended by the Oil Crisis in the 1970’s, and the September 11th terrorist attacks decimated the airline industry.[4] These events highlight the importance of businesses preparing for low-likelihood events, and leaders at GM must consider how to mitigate these possibilities.

President Trump indicates a high likelihood of US withdrawal from the Trans-Pacific Partnership (TPP) and North American Free Trade Agreement (NAFTA).[5] These foundational changes to the economic conditions on which GM has built its business would cause major disruptions. There are other severe potential shocks GM’s global business, too. For example, tensions on the Korean Peninsula or in the South China Sea could escalate into hostilities which would disrupt supply chains and cause significant losses of property, inventory, and production capacity for GM.

GM’s Strategy and Actions

GM’s CEO, Marry Barra, and her leadership team have made some short- and medium-term efforts to mitigate these risks. Barra joined the Trump Administration’s business advisory forum, presumably to influence policy decisions favorably for GM and the auto industry.[6] However, President Trump disbanded the forum, forcing GM to rely more on traditional government lobbying, which may fail to achieve goals of preserving economic stability for GM’s business.

Since the 2008-09 financial crisis, GM has made significant advances to consolidate and economize its operations.[7] These efforts included relocating/consolidating production, new part sourcing arrangements, and focusing on new technology and emerging markets. However, many of these adaptations make GM more vulnerable to the risks mentioned above.

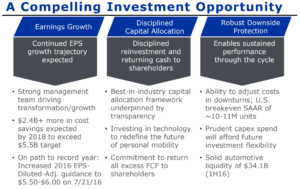

GM’s 2016 Strategy Statement shows prioritization of achieving cost efficiencies and risk mitigation to make the company more resilient.[8] However, GM’s downside risk consideration focuses on downturns, not the more severe shocks this essay addresses. While the strategy seems proper for the current political climate, it was conceived before current threats to international trade. Though it could be adapted to isolationist challenges, GM should take additional steps to insulate itself against economic risks.

Figure 1: GM’s 2016 Strategic Overview[9]

Recommendations and Remaining Questions

Fortunately, Barra and GM still have time to refine their plans and take action to prepare GM to deal with potential disruptions. First, GM should continue its efforts to prevent US withdrawal from trade agreements, or if they occur, facilitate favorable new arrangements as quickly as possible. Preventing rash action by governments is a critical element of any effort to protect GM from potential political/economic shocks.

Next, GM should continue its robust global development, while protecting its investments by ensuring supply chains are redundant and resilient to disruptions. This may mean holding larger inventories of parts and increasing lead times, but the short-term costs would be well worth the insurance against events like armed conflicts or economic disruptions. Another element of this strategy would be designing supply chains to rely primarily on domestically available parts, which would mitigate the effects of international strife should it occur. Finally, GM should monitor and proactively respond to political developments. Quick action in the face of a disruptive event could minimize the effects and allow GM to adapt quickly to new circumstances.

Suggesting these actions for GM is easy; however, there are competing considerations GM’s leaders must consider as well. How much added inventory or domestic consolidation is warranted by these threats? What costs to the bottom line of preparing for potential disruptions is acceptable? Is it worth preparing for political upheaval when it may not happen? Business leaders always grapple with uncertainty, but considering these hard decisions is imperative to prepare GM for the future.

(Word Count: 798)

[1] “The World Today Looks Ominously Like it Did Before World War I.” Swanson, Ana. December 29th, 2016. https://www.washingtonpost.com/news/wonk/wp/2016/12/29/the-world-today-looks-ominously-like-it-did-before-world-war-i/?utm_term=.33c6aeef59a0

[2] “GM’s Global Strategy: A Brand for Every Place.” Pfanner, Eric. February 4th, 2008. http://www.nytimes.com/2008/02/04/business/worldbusiness/04gm.html

[3] “General Motors Announces Growth Strategy for China” March 21st, 2016. http://media.gm.com/media/cn/en/gm/news.detail.html/content/Pages/news/cn/en/2016/Mar/0321_annoucement.html

[4] “Ten Way the 1973 Oil Embargo Changed the Industry.” Treece, James. October 14th, 2013. http://www.autonews.com/article/20131014/GLOBAL/131019959/10-ways-the-1973-oil-embargo-changed-the-industry

[5] “Trump Abandons Trans-Pacific Partnership.” Baker, Peter. January 23rd, 2017. https://www.nytimes.com/2017/01/23/us/politics/tpp-trump-trade-nafta.html?_r=0

[6] “GM’s Barra in Tight Spot Among Executives on President’s Advisory Panels” Colias, Mike. August 15th, 2017. https://www.wsj.com/articles/gms-barra-in-tight-spot-among-executives-on-presidents-advisory-panels-1502841112?mg=prod/accounts-wsj

[7] “General Motors Announces Growth Strategy for China” March 21st, 2016. http://media.gm.com/media/cn/en/gm/news.detail.html/content/Pages/news/cn/en/2016/Mar/0321_annoucement.html

[8] “General Motors Strategic and Operational Overview 2016” General Motors, https://www.gm.com/content/dam/gm/events/docs/5237319-645997-GeneralMotorsStrategicandOperationalOverview-9-21-2016

[9] Ibid.

I thought this was a fascinating essay and captured the current political risk outlook facing a global/diversified firm such as GE very well.

I was reminded as I read the analysis of the breakdown of risks between ‘firm specific’ and ‘market wide’ events that we have discussed in FIN – and wondered whether it might be possible to argue that these two types of risk begin to converge the larger and more global a firm becomes, e.g. if the US withdraws from trade agreements that may harm the profitability of individual GE product lines, but also reduce overall demand for all of it’s products if the economy slows. With that in mind (and in the context of your great depression example) I wondered if an additional way GE could mitigate market-wide political risk might be to invest in product lines that might experience ‘counter-cyclical’ demand. One possible example might be thinking about what sorts of machinery/equipment the government might need to procure if it wanted to implement a fiscal stimulus during a recession, e.g. to build new infrastructure.

I also thought your suggestion that GE could consider how it would redesign supply chains to rely more on domestic parts was very sensible. As further risk mitigation, I wondered if it might make sense for it to think about how/whether it could become a supplier of those parts itself.

Based on the company’s assessment of the level of risk, your question of ‘what cost to the bottom line of preparing for potential disruptions is acceptable?’ seems to be the key issue across both these points.

Very interesting read Troy. I agree with you that Trump’s nationalistic policies represent a significant threat to GM. However, I think your suggestions to build redundant plants, hold more inventory and onshore manufacturing would be overreactions. All of these actions would increase costs, which would most likely force GM to increase car prices. They already face intense competition and higher prices would make it more difficult for them to compete.

But as you point out, taking a short-term hit would be worth it if it benefits the company long-term. I just believe the threat of a trade war or global conflict are overstated.

Troy – great post. Given that Mexico is one of the largest trading partners of the U.S., abandoning NAFTA altogether would cause a tectonic shift in the supply chain of many industries, especially those that significantly benefit from labor arbitrage. I believe that abandoning NAFTA would put additional pressure on industries, such as the U.S. automotive industry, that already face heavy competition and margin compression. Given the current administration’s unpredictability, it is hard to justify making material shifts, which may have material impact on the bottom line, to the business model. Nevertheless, I think that GM’s leadership must be alert and have a plan in place ready to execute in the event the Trump administration decides to pull out of NAFTA. I believe that Barra’s decision to join the business advisory forum of President Trump of was a very smart and proactive step to not only influence policy makers but also take the temperature of the White House as a means to inform GM’s strategy as fast as possible.

First of all, great tagline. Really drew me in.

I agree with the basic construct of GM’s dilemma. Beyond costs, I think key metrics to consider are current domestic supply chain capacity and time horizon for developing additional capacity. The two are closely related. Assuming the market doesn’t currently allow massive excess production capacity to just float around in the US, that capacity would have to be either created from scratch via large capital expenditures or wrenched from current users via higher WTP. If GM has plans to create new capacity, the lead time on that development would have to be weighed against likely time horizons for geopolitical catalysts. If they plan to pull capacity from current domestic players, the higher purchasing costs would have to be considered, as well as the fact that whatever impetus brings GM home will likely do the same to other auto players. The competitive landscape will become more cutthroat on the home front.

As GM figures out their ability to supply, they should also take a critical look at demand. War or economic disruption would also have an effect on markets, specifically what and how much customers want. Failure to consider this could result in wasted capital developing new unnecessary capacity.

Great post Troy! Based on your paper and general knowledge I have of the automotive industry, I believe GM is highly exposed to risk. The actions you have proposed are excellent and will move them in the right direction but much more needs to be done. Your question around preparing for political upheaval particularly resonated with me. In my opinion, the problem with putting together an action plan at this time is not only the amount of uncertainty and risk in regulation, which you mentioned, but the ambiguity in the direction the current administration wishes to take. We are in new territory and unchartered waters at this time in history, and companies who are highly invested in NAFTA have the most to lose.

My guidance for GM and others facing these risks would be to work out the multiple possible scenarios that could occur in preparation for potential changes, but not to act in any significant manner until we know more about regulatory changes, if any. Due to the automotive industry’s tight margins and competitive nature, “getting it wrong” in one direction or another (i.e. investing in the wrong plan) could be damaging beyond repair for GM.

Troy – thanks for sharing this assessment of GM, I found it really interesting. I particularly appreciated you putting these challenges in historical context (which may be no surprise, as my comments in class too often try to do the same…). I also found it helpful that you challenge status-quo thinking or complacency in planning. While the complete de-stabilization of trade markets may appear to be low-probability, it has happened before, and CEO’s need to prepare their companies in case it happens again.

I found your analysis of GM’s actions so far to also be enlightening and helpful. Seeking to inform policymakers of the implications of their actions is critically important, and it seems like Bara is already taking action there. I also appreciate you grappling with the tradeoffs between longer lead times and holding larger inventories to compensate for over-exposure to global disruption. But do you think GM’s business model can persevere with such costly changes to their structure? Would they not be put out of business by Japanese companies who may be less susceptible to shocks from isolationism?

The essay lead me to think about how does GM marry consolidation with the necessary efficiencies of its supply chain? The ability for a company to insulate itself from political climates by consolidating domestically seems like it should be the best play here, but there in lies the concern of can GM still compete on a global scale by running a supply chain from just one country to the rest of the world? I really appreciate the perspective the essay takes and wonder if the move to domestic consolidation will make GM an even better supply chain management partner? They certainly would need to realize more efficiencies and rely on more relationship currency to source volume down the supply chain and to the world. The impact on their clout in the auto-manufacturing industry could spike if they approach this the right way or in a way that is more equitable for all parties involved.