Pearson PLC’s Shift from Traditional Print to Digital

Pearson's shift from traditional print to digital learning and the exciting new possibilities it presents to improve access and outcomes in education.

UK-based Pearson PLC (FTSE: PSON) is the world’s largest education and book publishing company with revenue of 4.5 billion GBP and EBITDA of 779 million GBP in 2015 [1]. The company’s business model consists of publishing K-12 and higher education textbooks for the US (over 60% of revenue and 66% of operating income in 2015 came from the US) and offering testing/assessment services and professional qualifications. In recent years, Pearson has been under considerable financial pressure amid slowing demand for print textbooks and dwindling college enrollment in the US.[2] Subsequently, the company has undergone a series of major restructurings, the most recent including the elimination of 4,000 jobs announced in the beginning of 2016 (approximately 10% of its total workforce). [3]

In addition to its core business of education and book publishing, Pearson has historically owned several globally renowned, non-core assets within financial news/information including the Financial Times newspaper and a 50% stake in The Economist. In 2015, as part of a shift in its strategy to focus 100% on education (as well as to strengthen its balance sheet), Pearson sold these assets to the Nikkei Group and Agnelli family, respectively. [4] In regards to the disposal of these high-profile assets, CEO John Fallon said in a statement that the “pace of disruptive change in new technology poses a direct challenge to how leading news organizations produce and sell their journalism.” [5] The same argument extends towards traditional print textbooks, an area that accounts for approximately 40% of Pearson’s total revenue and is facing serious structural headwinds. [6]

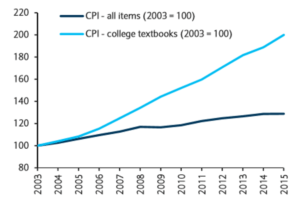

In the past, educational institutions, faculty and students had limited alternatives to purchasing new textbooks. This problem is exacerbated by the fact that the price of textbooks have significantly outpaced inflation.[7]

Exhibit 1

Source: Bureau of Labor Statistics

Nowadays, with the rise of digital transformation, there are many more alternative channels available including “second hand” markets (through Amazon and other retail channels) and “rental” markets (also through Amazon and firms such as Chegg) that are significantly lower in cost.

Used book market

The used book market sees students who have bought a new textbook selling it back online through Amazon or other comparable vendors (e.g. Ebay). Students also sell back used books to the campus bookstore from which they originally purchased the book. Any purchase in the used book market is a “lost” sale in the new book market.

Physical textbook rental market

Companies such as Amazon and Chegg buy physical books from publishers and make them available for rent on a semester-by-semester basis at a significant discount to buying a new book outright.

Pearson and other education publishers have responded to these alternative channels by publishing newer editions of textbooks at increasingly frequent intervals. The problem with both of these is that it has resulted in push back from consumers as the difference between “new” editions and previous editions can be unclear.

In order to take on the competition presented by the used book market and book rental market, Pearson is increasingly turning towards digital textbooks. As Pearson gradually shifts its operating model from a traditional print supply chain to a global digital model, the downstream channels that it has historically relied on will invariably change over time. For example, the aforementioned campus bookstores – which have traditionally been a very important part of Pearson’s supply chain – are likely to decline in importance as students and educational institutions go towards more direct avenues such as buying digitally direct from Pearson (individual student) or moving toward institution-wide direct digital access (educational institutions).[8]

With a digital sale, the student effectively is paying for a license fee to access the text (this is the same for non-textbook eBooks).[9] The benefit is that this is not transferable and it cannot be traded around in the secondary markets. For this reason, education publishers in the long run are looking to phase out physical textbooks in favor of digital versions.

As the industry continues to shift towards digital, Pearson should diversify its business in order to further expand its digital footprint. Diversifying into Open Educational Resources (OER) and Massively Open Online Courses (MOOCs) are potential options.

IBM’s Watson?

In late October 2016, Pearson and IBM (NYSE: IBM) announced a global alliance with IBM to explore the creation of what Angie McAllister, senior VP of personalized learning and analytics, described as an “intelligent tutoring system.”[10]

Despite the structural headwinds in its traditional print business, as the largest education material publisher in the world, Pearson enjoys a massive wealth of content. Combining this content with IBM’s technology as a potential way to offer one-on-one tutoring has the potential to significantly change education as we know it. As Tim Bozik, president of global product at Pearson, said “Digital learning opens up exciting new possibilities to improve access and outcomes in education.”[11] Time will be the judge whether Pearson can successfully execute on that strategy.

(Word count: 797)

References Cited

[1] Capital IQ (accessed 11/16/2016)

[2] Mance, Henry, “Pearson’s strategy comes under fire after share price collapse” Financial Times (https://www.ft.com/content/9a3003f6-7cd7-11e5-98fb-5a6d4728f74e) (accessed 11/17/2016)

[3] Pearson 2015 Annual Report (accessed 11/16/2016)

[4] Mance, Henry, “Pearson’s strategy comes under fire after share price collapse” Financial Times

[5] Ibid

[6] Ibid

[7] Bureau of Labor Statistics (accessed 11/17/2016)

[8] Reingold, Jennifer “Everybody hates Pearson, http://fortune.com/2015/01/21/everybody-hates-pearson/ (11/17/2016)

[9] Ibid

[10] Straumshein, Carl, “Augmented Intelligence for Higher Ed” https://www.insidehighered.com/news/2016/11/16/blackboard-pearson-join-ibms-ecosystem-bring-watson-technology-higher-ed (accessed 11/16/2016)

[11] Ibid

I am very curious about what Pearson’s foray into intelligent learning/tutoring systems (ITS). A large number of studies have shown that these systems are associated with higher outcome scores regardless of the level of schooling (elementary to postsecondary). [1] (*See details on learning gains by types of treatment groups). Given these results, it seems that ITS systems are best suited to replace large teacher-led instruction and I wonder whether, in the long run, they are going head to head with their buyers of content – schools and colleges. And what the implication of this would mean for their traditional content-driven business.

[1]http://www.apa.org/pubs/highlights/spotlight/issue-37.aspx

(*) “The effect size obtained from an evaluative study of an intelligent tutoring system depends on what instructional treatment the intelligent tutoring system is compared to. Studies that compared a group of learners who used an intelligent tutoring system with a group of learners who received no instruction had a large mean effect size of g = 1.23. For the 107 results in which the comparison group did receive instruction, the mean effect size was g = .41.

Dividing the comparison treatments into categories, intelligent tutoring systems showed statistically significant benefits compared to large-group, teacher-led instruction (g = .44); individual, non-intelligent tutoring system computer-based instruction (g = .57), and individual study with a textbook or workbook (g = .36). When intelligent tutoring systems were compared with small-group instruction (g = .05) and one-to-one human tutoring (g = -.11) there were no statistically significant differences.”

Greetings, Uther the Lightbringer. While it is interesting to see Pearson partnering with IBM Watson to develop intelligent tutoring systems, I am a bit doubtful about whether the volume and quality of Pearson’s textbook-based learning data is at all sufficient for data-hungry machine learning systems such as Watson. Two primary data sourcing strategies in this digital era are (1) micro-tracking user interactions (e.g., Google’s page click signals, Facebook’s “like” and sharing profiles) and (2) collecting end-point sensory data (e.g., IoT smart devices, GE’s digital twins). Since paper textbooks neither track reader interactions nor gather real-time peripheral data, Pearson’s traditional print media may contribute very little machine-compatible data to the intelligent tutoring systems. Digital versions of those textbooks, while more promising on surface, may well be an equally poor data contributor because it is difficult, if not impossible, to link students’ success to their patterns of interactions with the digital media – hence the scarcity of labeled training data for Watson. One recommendation for Pearson as a prerequisite for its ITS is to develop education materials with rich multimedia interactions with students and real-time logging/inferences of user success. I have to say that some of the pedagogical contents at HBS (e.g., digital case studies, interactive FRC tutorials) are worth researching and emulating by Pearson going into the digital learning era.

Interesting that Pearson is seeing digital providers as a threat and deciding to enter into the market; however, digitized curriculum poses new challenges – it reminds me of lessons learned from the news of Curriculet closing for business in June 2016. The company was one of the earliest providers of online textbooks who amassed 1.2 million active users since its founding in 2012. The founder cited problems with getting pricing right, student hardware access to read online textbooks, and adoption challenges as teacher training and finding the right school administrators to champion rollouts proved more difficult than expected. For now, it seems as if physical textbooks in the K-12 markets are here to stay and that the focus on university-level digital textbook play is more fitting. (See here for more info: https://www.edsurge.com/news/2016-05-25-curriculet-closes-shop)