Lending in the digital era: Goldman Sachs embraces the challenge

Goldman Sachs has recently launched Marcus, its online lending platform. First mover in a changing market?

New digital technologies are disrupting the business of companies in many sectors and with no surprise also banks are facing the rising challenge represented by the so called “fintechs”, start-ups that use technology to provide financial services. One of the most adopted innovations in this space is the so called Marketplace Lending (MPL), a service that matches lenders directly with borrowers through an online platform, without the intermediation of a bank. The first of such platforms to be launched worldwide are Zopa (UK, 2005), Prosper (US, 2006) and Paipaidai (China, 2007) [1].

Let’s give a closer look at the differences in the MPLs business and operating model compared to the traditional lending system.

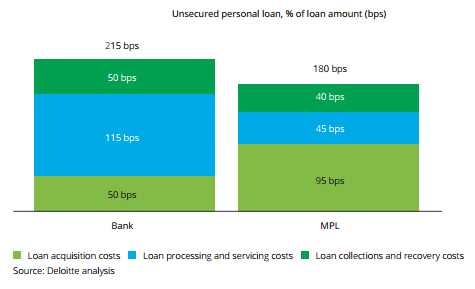

In the traditional lending model, banks take risk onto their balance sheets and generate income managing spreads between the interest charged on loans and the one paid on savings. MPLs, instead, do not take deposits or lend themselves, they act as intermediary between the lender and the borrower and therefore take no risk onto their balance sheets. They do not earn an interest income, but rather generate income from fees and commissions received from borrowers and lenders for services provided to both parties. Those services include providing the online platform to enable borrowers and lenders to match, developing credit scoring and pricing models, performing borrower credit checks, processing loan payments, providing customer service and ensuring legal compliance.

![Source: [1]](https://d3.harvard.edu/platform-rctom/wp-content/uploads/sites/4/2016/11/Figure-1-10.png)

The main elements of the customer value proposition – where customers are both lenders and borrowers – are hence:

- Convenience: lenders can earn higher returns while borrowers can borrow money at lower interest rates;

- Larger credit access for borrowers, who can borrow money from multiple investors who match their risk profile;

- Transparency and control to lenders, such as through disclosure of receivers’ credit information and statistics;

- Superior customer experience, thanks to sophisticated technology platforms and limited human involvement.

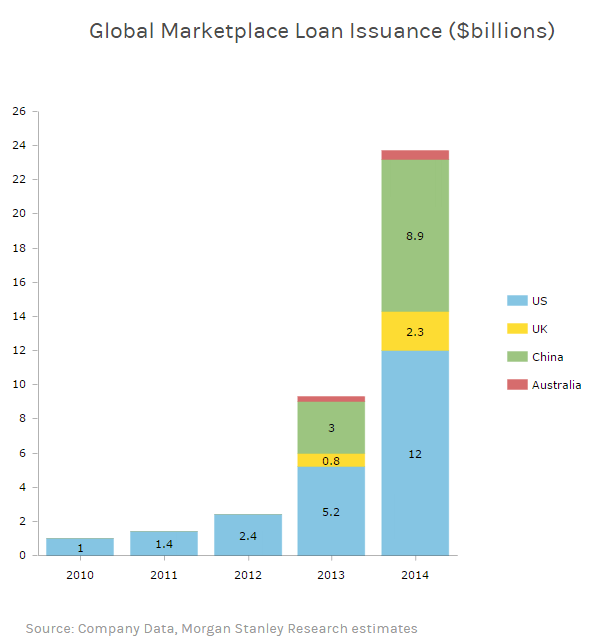

In 2014, US$23.7 billion of loans were issued through marketplace lending platforms globally, concentrated primarily in the US (51 %), China (38 %) and the UK (10 %). The total grew at a CAGR of around 120% between 2010 and 2014 [1].

A Morgan Stanley research revealed that the risk of disintermediation by non-traditional players are present in all the main lending sectors (i.e. consumer lending to commercial or student lending). In all, banks earned ~$150bn in 2014, and $11bn+ (7%) of annual profit could be at risk from non-bank disintermediation over the next 5+ years [3].

Is this a big threat for the traditional lending systems? Probably the original fear of disruption in the industry has lowered, but traditional banks realized that customer needs and expectations are changed due to the service level provided by those players and the focus has shifted to collaboration.

Early adopters banks have chosen to partner with fintechs rather than buying or building their own platform. Goldman Sachs instead was the first US bank to adopt a more radical approach and last month launched its own MPL platform: “Marcus”.

The Bank had to make several adjustments to its business and operating models in order to enter the MPLs consumer business:

- People: hire a team of around 200 people (mainly from MPL competitors) to cover the gap in technology capabilities and in serving the middle class demographic [4];

- Technology: built the online lending platform from scratch in house since early last year [5];

- Brand: launch the “Marcus” brand to target the new consumer segment.

Obviously, this is just the beginning of a risky experiment for the Bank. Only time will tell us if their in-house strategy will be successful and they will be able to act as a fintech after having spent most of the past 150 years serving wealthy individuals and corporations. Implementation improvements and additional initiatives could be adopted to leverage its first move in the arena:

- Execute fast and grant the highest possible technology infrastructure and customer experience;

- Invest in marketing and advertising, to reach the customer base and popularity of the main MPL fintech platforms;

- Scale rapidly their operations leveraging the wealth background in banking and lending;

- Investigate other forms of partnership with fintechs and expand further their MPL presence (e.g. small business segment, real estate segment).

Times of pure traditional lending are over, and if any doubts are left, let’s consider Goldman CEO himself recently hosted a podcast where he described Goldman as a tech company with 9,000 developers [6]. (791 words)

References

- “A temporary phenomenon? Marketplace lending”, Deloitte report, https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-fs-marketplace-lending.pdf

- “Can P2P Lending Reinvent Banking?”, Morgan Stanley, 17 June 2015, http://www.morganstanley.com/ideas/p2p-marketplace-lending/

- “The Future of Finance, the rise of the new Shadow Bank”, Ryan M. Nash, Eric Beardsley, March 3 2015, Goldman Sachs equity research

- “Goldman Sachs New Online Lending Platform Will be Called Marcus”, Peter Renton, August 19 2016, Lending Accademy, http://www.lendacademy.com/goldman-sachs-new-online-lending-platform-marcus/

- “2017 Will Be A Huge Year For Bank Partnerships. Banks Will Buy, Build and Partner with Fintech Companies”, Jason Jones, November 14 2016, Lend Academy, http://www.lendacademy.com/2017-will-huge-year-bank-partnerships/

- Podcast: “Exchanges At Goldman Sachs”, Episode 30: The Digitization Of Finance, Jan 2016, http://www.goldmansachs.com/our-thinking/podcasts/episodes/01-20-2016-don-duet.html

- “Goldman Sachs Is Entering P2P Lending Becoming the 1st Bank to Launch a Platform”, Ryan Lichtenwald, June 16 2015, Lending Accademy http://www.lendacademy.com/goldman-sachs-is-entering-p2p-lending-first-bank-to-launch-a-platform/

- The Future of Financial Services, World Economic Forum and Deloitte, June 2015, http://www3.weforum.org/docs/WEF_The_future__of_financial_services.pdf 2

Do you think the rise of marketplace lending will cause underwriting standards to deteriorate? One of the main issues that came to light during the financial crisis was mortgage securitization, which allowed mortgages brokers to offload borrower risk to investors and thus led to a deterioration of diligence standards. I’m concerned that marketplace lending appears to be following the same model. Marcus employees will be incentivized to increase loan volumes and, since the bank is not bearing any credit risk, they may be less concerned about borrower quality. FICO scores are helpful but there are many other factors that determine borrower riskiness. What are the steps Marcus can take to ensure we don’t have another financial crisis brewing?

Very interesting article, thank you for sharing! Marketplace lending has definitely disrupted the traditional lending model by offering an online platform that is convenient and transparent with no hidden costs. I wonder what impact Goldman’s entry into this space could have on the regulatory landscape. Marketplace lending likely benefits from lighter regulations currently as compared to traditional banking, but the entry of traditional banking incumbents could change this scenario considerably.

Goldman’s DNA is very different from fintech startups and I wonder how Goldman will change its operating model to compete with these nimble startups. Will it be able to recruit and retain the right talent given Marcus will unlikely be a meaningful part of Goldman’s overall business?

Moreover, with the sheer number of marketplace lending companies that have emerged, with some managing to scale while others having run out of business, the threat of cyber-attacks on an online-only platform with sensitive financial information flows is real. Is enough being done on the security front?

Thanks a lot for this post – very interesting that Goldman are entering this market. I am pretty amazed at the pace with which MPLs have grown – to my mind it’s just an incredibly risky way for lenders to make a return on their savings. Taking direct counter-party risk to a consumer without having the ability to properly diversify (unless you have enormous amounts of cash), just seems like a bad investment to me! When interest rates eventually rise I wonder if there will be much of an incentive for lenders to keep using the platform or if they will choose to return to more traditional products? Time will tell. Cheers!

It’s really interesting that Goldman Sachs are entering the MPL market but as we know it’s important for companies to innovate to stay relevant, particularly in industries that are fairly easy to disrupt via technology. I wonder however who the target market for Marcus will be as Goldman Sachs’ traditional clients invest in debt products in quantities so large (tens of millions of dollars) that they typically are happy to spend the time to do due diligence and so I don’t think an online platform really provides much of an advantage. Maybe Marcus is aimed at smaller clients and Goldman Sachs is attempting to broaden its customer base.