Launch of the Toyota Mirai

Toyota’s operations have been fundamentally affected in two main ways by climate change:

Changing consumer preferences:

As an automotive producer, Toyota is vulnerable to the fluctuations in the price and supply of fossil fuels. Higher and more variable costs of fuel for vehicle operation, in addition to other factors such as worsening urban air quality, have been increasingly influencing consumers to favor lower-carbon automotives.

In addition, states such as California are increasing the tax rate imposed on traditional gasoline, causing cost-conscious consumers to look even more to alternative-fuel vehicles [1].

Emissions regulations and recent industry scandals:

Tougher greenhouse gas emissions regulations is also challenging Toyota and the rest of the automotive industry. These regulations include:

- US Congressional mandates for automotive manufacturers to reach an average of 54.5 miles per gallon per vehicle by 2025 [2]

- Zero-emission regulations, like the one in California that mandates 4.5% of sales come from cars that have zero emissions. If an automaker surpasses this benchmark, the credits can be banked and sold to other automotive manufacturers for a profit [3]

In addition, in 2015, the Japanese government announced subsidies for hydrogen fuel-cell vehicles and for the development of hydrogen fueling stations across the country (California has committed to building stations as well) [4].

Lastly, the Volkswagen diesel-emissions cheating scandal has resulted in intensified scrutiny of auto emissions, and the collective outrage that resulted can be taken to demonstrate that consumers are caring more about violations of emission regulations nowadays than ever before.

Toyota is responding to these shifts in two major ways:

Doubling down on commitment:

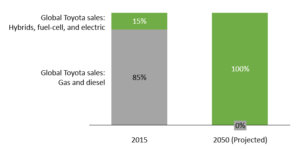

Toyota is extremely committed to driving sales of its fuel-efficient/alternative-fuel vehicles (including gas-electric hybrids, plug-in hybrids, fuel-cell cars, and electric vehicles) – in fact, it hopes that sales of traditional gasoline- and diesel-engine cars will be near zero by 2050. As Senior Managing Officer Kiyotaka Ise said in late 2015,

Toyota is extremely committed to driving sales of its fuel-efficient/alternative-fuel vehicles (including gas-electric hybrids, plug-in hybrids, fuel-cell cars, and electric vehicles) – in fact, it hopes that sales of traditional gasoline- and diesel-engine cars will be near zero by 2050. As Senior Managing Officer Kiyotaka Ise said in late 2015,

“It won’t be easy for gasoline and diesel cars to survive…it’s like the world is turning upside down and Toyota has to change its ways.” [5]

In addition, Toyota has committed to a 2050 global environmental challenge to eliminate carbon emissions in all of its operations, not just from the cars that they sell.

Focusing on innovation:

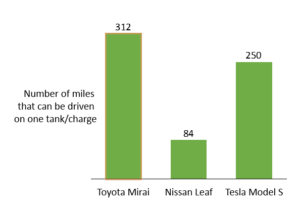

Toyota is trying to position itself as one of the foremost innovators in using technology to reduce harmful greenhouse-gas emissions. In 2015, Toyota started selling the Toyota Mirai, a hydrogen fuel-cell car that emits only water, plus has a longer driving range than other competitor alternative-fuel vehicles. As mentioned above, these fuel-cell vehicles will help Toyota earn emission credits under California and US regulations [5]. While the company is positioning itself well in this new environment, there is one main way that Toyota can continue to do better:

Build out supporting infrastructure:

Adoption of fuel-efficient cars has been gradual and slow – Toyota can speed up the rate of adoption by investing more into building out the supporting infrastructure, primarily charging and filling stations for electric and hydrogen vehicles. Lack/scarcity of this infrastructure has prevented consumers from adopting these vehicles on a large scale.

Currently, there are significant hurdles to fuel-cell vehicles becoming a viable options for mass-market consumers. There are only a handful of hydrogen refueling stations in the US, mostly on the West Coast [6].

Improve affordability:

The Toyota Mirai is also cost prohibitive to the vast majority of would be consumers. Toyota’s mid-sized gasoline sedan known as the Corolla in the United States, comes with a suggested price tag of $18,500, and sold an estimated 363,000 units in the United States, and more than 1.3 million world wide. The Mirai retails for more than 3 times a Corolla and has far fewer fueling options. For the Mirai to gain wide-spread acceptance both of these factors will need to be mitigated. [7]

[710 words]

References:

[1] “California Passes Toughest Greenhouse Gas Emission Curbs”, Bloomberg, 2016 http://www.bloomberg.com/news/articles/2016-08-24/california-passes-toughest-greenhouse-gas-emission-curbs

[2] “Obama Administration Finalized Historic 54.5 MPG Fuel Efficiency Standards”, Whitehouse.gov, 2016 https://www.whitehouse.gov/the-press-office/2012/08/28/obama-administration-finalizes-historic-545-mpg-fuel-efficiency-standard

[3] “What is California’s Zero Emission Vehicle (ZEV) Regulation?”, UCSUSA, 2016 http://www.ucsusa.org/clean-vehicles/california-and-western-states/what-is-zev#.WB1cOPorI2x

[4] “Toyota Accelerates Rollout of Fuel-Cell Cars”, The Wall Street Journal, 2014 http://www.wsj.com/articles/toyota-accelerates-rollout-of-fuel-cell-cars-1403700630

[5] “Toyota Maps Out Decline of Conventionally Fueled Cars”, The Wall Street Journal, 2015 http://www.wsj.com/articles/toyota-maps-out-decline-of-conventionally-fueled-cars-1444824804

[6] California Fuel-Cell Partnership, 2016 http://cafcp.org/stationmap

[7] Auto Guide, 2016 http://www.autoguide.com/auto-news/2016/01/top-10-best-selling-cars-in-the-world-for-2015.html

I’m interested to see how the battle for prominence between electric (battery powered) vs. fuel cell plays out. I think this situation is analogous to the HD DVD vs. Blu-ray competition, where ultimately only one solution will be adopted by the market. Historically, it seemed like hydrogen fuel cells had the advantage, but in the past few years, batteries seem to have gained the upper hand as the technology has evolved, and manufacturers like Tesla proved that you can make exciting, high quality luxury/sports cars which are powered by batteries. Your post mentions the barriers to consumers adopting the product, due to the lack of hydrogen refuelling stations. I think this is a critical issue – battery powered cars are further along the consumer adoption curve, and as such we will see more supporting infrastructure built out to support them, reinforcing their relative advantage over fuel cell powered vehicles. If Toyota (and other manufacturers) don’t produce a significant number of quality, hydrogen powered vehicles which sell in good quantities, then I fear the hydrogen fuel cell will be dead in the water.

Toyota’s bet all depends on what technology will win out in passenger vehicle propulsion: batteries or fuel cells. Although fuel cells have a big advantage in their higher range – that really is a minor problem for many motorists. The average motorist only drives 40 miles per day and extended trips are much rarer. Will batteries be able to solve this problem for extended trips through improved charging or replacement batteries? Ultimately, either of these solutions requires a huge infrastructure investment and auto manufacturers would do well to team up to build it.

This was a fascinating article. I am impressed by the investment Toyota has made into “green” technology and the Mirai sounds like a very practical solution to the problem. I wonder about the two things you mention being in the way of mass adoption – the high price tag, and the lack of fueling stations. With regards to the second, what is the infrastructure investment needed to make this a more practical purchase for consumers? What role should the government play in driving this new infrastructure? It would seem that this is the future of automobiles, but only if there’s enough momentum and scale to back it.

I would be curious to see what the margins are by line of car. I recall reading that American car companies like Ford actually are losing money on the smaller, more fuel efficient vehicles, but have to continue producing and selling them in order to meet regulatory standards. Turns out they make up that lost profit by selling more of their larger fuel guzzling trucks. If the regulators are serious about curbing car manufacturers’ contribution to climate change, I would expect them to move towards establishing MPG limits based on the individual car (or perhaps class of vehicle) as opposed to on average. Long term this will help curb emissions, but would likely mean increased prices of eco-friendly cars.

I really enjoyed reading this article, particularly about the Toyota Mirai. I’d be interested to learn about what R&D partnerships Toyota have currently (or is their innovation entirely done in-house?). Could they could be doing more on this front (given the mention of the need for greater infrastructure) and what are their constraints? I’d also like to understand if (and how) they hedge or buffer themselves from exposure to fossil fuel prices, given this in part drives consumer demand for their product.

This is one industry where Toyota has a compelling, for-profit reason to pursue climate change initiatives. The consumer will be more insulated at the pump from volatile swings in crude oil. However, I totally agree that the path to commercialization is all about justifying the payback period in the buyer’s eyes. At a price of 3x the Corolla, the gasoline savings aren’t justified in a reasonable time period. Perhaps one of the things Toyota can due is ask for more subsidies from the government or another third party to close this gap. The Wind industry currently offers this and it has spurred investment in an area where the payback periods are not yet attractive enough to necessitate massive standalone investment.