Inovalon: health insurers’ secret weapon

The health care industry has (finally) embraced digitization. But how can insurers organize data from multiple sites of care—and drive better outcomes for patients?

Introduction

Founded in 1998, Inovalon helps health care payors[1] measure and report their performance. Performance data are particularly important in Medicare, where payors are evaluated and reimbursed according to documented quality outcomes. The company’s client base includes hundreds of health plans, or roughly half the U.S. managed care market.[i][ii]

To fulfill its promise to customers, Inovalon extracts medical records information from health care providers[2] and identifies any gaps in documentation. The digitization of health information has made this effort vastly easier.

Industry background

Historically, the health care industry has been one of the slowest from a technology adoption standpoint. Predetermined fee-for-service reimbursement[3] limited the incentive for providers to seek efficiencies through digital technology.

Recently, government incentives have accelerated the move toward data transparency. The American Recovery and Reinvestment Act of 2009 (ARRA) created financial incentives to physicians and hospitals using electronic health record (EHR) systems, with penalties for non-adopters.[iii]

From the program launch through September 2016, approximately $35 billion in ARRA incentive payments have been made.[iv] [v] Over 95% of acute-care hospitals have now implemented some type of EHR.[vi]

Inovalon’s value

Despite these investments, health data remain difficult to access and interpret across the continuum of care.[4] Inovalon has achieved interconnectivity with providers and EHR vendors, allowing it to organize information from various points in the health care ecosystem. The company’s dataset covers nearly 140 million unique patients.[vii]

Inovalon uses these data to help payors measure quality outcomes, such as preventative screenings and chronic disease management. These outcomes are reported to government agencies to determine plan quality ratings, which influence financial bonuses/penalties. Inovalon also identifies gaps in care and documentation which, if addressed, could result in rating improvement. For example, Inovalon’s Medicare clients achieved an average two-year cumulative rating increase, more than triple the national average.[viii]

In 2015, Inovalon launched a suite of patient-specific data analyses, which clinicians can order on demand to easily learn patients’ medical histories, preventing duplicative procedures or other inefficiencies that result from delayed information flow.[ix][x]

Recommendations

Inovalon has focused on connecting with hospitals historically, but given patient care volume shifts outside the acute care setting, the company should target post-acute care sites as well.[xi]

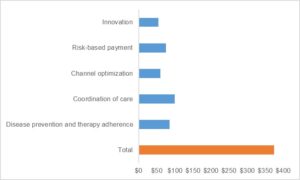

Additionally, Inovalon can expand outside its core payor customer base. The broader ‘health data’ industry is underpenetrated: employing data and analytics could reduce U.S. health care costs by $300-$450 billion (12-17% of total). [xii]

Finally, the regulatory outlook is uncertain, with hospitals lobbying for less stringent technology standards and President-elect Trump pledging to “modernize Medicare.” Inovalon must urgently work with providers to protect investments in technology infrastructure.[xiii][xiv][xv]

(800 words)

[1] Health care payors (hereafter also referred to as health insurers or managed care) administer health care plans on behalf of employers and government agencies (for Medicare and state Medicaid programs).

[2] Health care providers directly provide care to patients. For example, physicians and hospitals can both be considered providers.

[3] “Fee-for-service” reimbursement pays the provider for each service rendered, rather than for the value delivered. For example, patients readmitted to the hospital (perhaps due to inadequate care or follow-up) imply additional reimbursement to the provider.

[4] The continuum of care includes the spectrum of providers patients see during a course of treatment or his or her lifetime. For example, the continuum can include acute-care hospitals, independent physicians, and rehabilitation centers.

Sources

[i] Inovalon Holdings, Inc., December 31, 2015 Form 10-K (filed February 26, 2016), https://www.sec.gov/Archives/edgar/data/1619954/000104746916010478/a2227452z10-k.htm, accessed November 2016.

[ii] Robert Willoughby, Elizabeth Blake, and Erin Wilson, “Health plans’ preferred ally; Initiate with Neutral, $33 PO,” Bank of America Merrill Lynch, March 9, 2015, via Bloomberg, accessed November 2016.

[iii] “U.S. Hospital EHR Market 2009-2016,” Frost & Sullivan, October 14, 2011, ww2.frost.com, accessed November 2016.

[iv] “Data and Program Reports,” September 2016, on Centers for Medicare and Medicaid Services website, https://www.cms.gov/Regulations-and-Guidance/Legislation/EHRIncentivePrograms/DataAndReports.html, accessed November 2016.

[v] “U.S. Hospital EHR Market 2009-2016,” Frost & Sullivan.

[vi] Robert Willoughby, “Health plans’ preferred ally.”

[vii] Inovalon Holdings, Inc., September 30, 2016 Form 10-Q (filed October 31, 2016), https://www.sec.gov/Archives/edgar/data/1619954/000104746916016488/a2230155z10-q.htm, accessed November 2016.

[viii] Robert Willoughby, “Health plans’ preferred ally.”

[ix] “Quest Diagnostics and Inovalon Advance Value-Based Healthcare with Industry-First Real-Time Analytics At the Point of Care,” Inovalon press release (Madison, NJ, September 29, 2015).

[x] Ryan Daniels, Jeffrey Garro, and Robert Munnings, “Inaugural Analyst Day Highlights Strong Long-Term Outlook and Market Leading Position,” William Blair, December 8, 2015, via Thomson Reuters, accessed November 2016.

[xi] “Use of clinics, other alternative care sites, swells, survey finds,” March 18, 2016, on Healthcare Finance News website, http://www.healthcarefinancenews.com/news/use-alternative-care-sites-clinics-has-swelled-significantly-survey-finds, accessed November 2016.

[xii] Peter Groves, et al., “The ‘big data’ revolution in healthcare,” McKinsey & Company, January 2013, file:///C:/Users/Elizabeth/Downloads/The_big_data_revolution_in_healthcare.pdf, accessed November 2016.

[xiii] “AHA urges Congress to enact EHR meaningful use flexibility,” November 14, 2016, on American Hospital Association website, http://news.aha.org/article/161114-aha-urges-congress-to-enact-ehr-meaningful-use-flexibility, accessed November 2016.

[xiv] “Where President-elect Donald Trump Stands on Six Health Care Issues,” on Kaiser Family Foundation website, http://kff.org/health-reform/issue-brief/where-president-elect-donald-trump-stands-on-six-health-care-issues/#medicare, accessed November 2016.

[xv] “Healthcare,” on President-elect Donald J. Trump website, https://www.greatagain.gov/policy/healthcare.html, accessed November 2016.

Thank you for this post, Elizabeth! Noticed that you have referenced an earlier article coauthored by you as well – very cool!

You mention that “Finally, the regulatory outlook is uncertain, with hospitals lobbying for less stringent technology standards and President-elect Trump pledging to “modernize Medicare.” Inovalon must urgently work with providers to protect investments in technology infrastructure.” I’m surprised to hear that hospitals are lobbying for less stringent technology standards. Given instances such as this http://www.businessinsider.com/hospitals-are-becoming-targets-for-hackers-thanks-to-poor-security-2016-4 and https://krebsonsecurity.com/2016/10/europe-to-push-new-security-rules-amid-iot-mess/, do you think hospitals are wrongly trading off the extra cost of upgrading their technology vs having safe and secure data?

Awesome post! I agree that Inovalon is in an interesting position to provide value to many different entities. Faster and more consolidated information will help physicians provide better care and hospitals to reduce operational costs. Based upon ransomware attacks at places like MedStar Health, I am curious how Inovalon approaches cybersecurity and protects patient information [1].

1. Cox, J.W. (29 March 2016). MedStar Health turns away patients after likely ransomware cyberattack. The Washington Post. Retrieved from: http://www.washingtonpost.com

As soon as you mentioned the American Recovery and Reinvestment Act of 2009 and the push to digitize the health records, I immediately thought of what the future would hold with president-elect Trump. I couldn’t help but wonder if he will push to repeal the act and the penalties associated with not moving to electronic health records. With increasing pressure to deliver value-based care, I would be interested to see how hospitals will justify spending millions of dollars to update to digital systems (which are often not compatible with each other). Will the value still be there? Or will this be kicked further down the road and further strain our healthcare system?