Innovation through acquisition at General Mills

Innovation through acquisition and creation of its own venture capital fund is setting General Mills up for success in the future.

For years multinational consumer food conglomerates such as General Mills have relied on large mergers and acquisitions to help boost sales and expand into new categories. Acquisition targets such as Pillsbury and Yoplait have come with their own legacy, established customer base, and production capabilities, allowing General Mills to increase shareholder value and reduce competition nearly overnight. However, as a plethora of startups continue to flood the consumer packaged food industry (one with a low barrier to entry) General Mills has expanded its acquisition sights to include early stage startups looking to disrupt a particular category and appeal to a changing consumer base. Not only do these ambitious entrepreneurs offer General Mills a new revenue stream and attractive investment, but they are increasingly being leveraged as sources of open innovation used to drive overall brand strategy and product development.

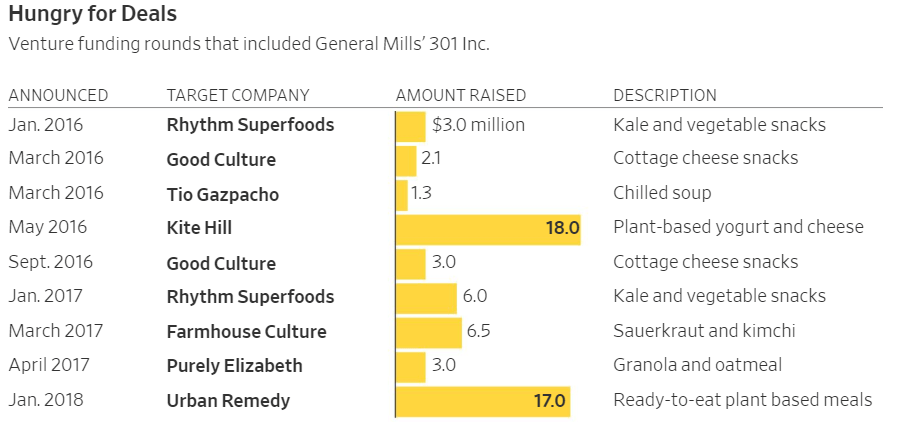

In 2015 General Mills established 301 Inc., an internal venture capital fund aimed at funding and guiding new consumer food startups. [1] Previously focused on furthering the ideas of its own employees, 301 Inc. was redesigned to make incremental investments in external startups with the prospect of General Mills eventually acquiring the startups outright and bringing the founders on as employees and stewards of the brand. As evident in the table below, many of 301 Inc.’s investments are in companies that offer unique, niche products that are outside General Mills’ grain-based core product lines, Good Culture’s Cottage Cheese Snacks and Farmhouse Culture’s Sauerkraut and Kimchi. By taking relatively small investments in many different startups, General Mills can test a range of innovative products with established operations, marketing, and customer bases.

Given the potential high reward these incremental investments and source of innovation, it seems as if General Mills will continue 301 Inc.’s program into the foreseeable future. Acknowledging the importance of innovation to his company’s success, General Mills CEO Jeff Harmening recently stated, “The reason we are able to outperform our peers right now is because we have some really good innovation.” [2] This sentiment echoes 301 Inc. Vice President, John Haugen’s belief in General Mills approach to open innovation when he stated, “We believe we can meet consumer needs faster than ever by combining the vision and passion of entrepreneurs with General Mills’ extensive capabilities.” [3]

Despite the benefits of 301 Inc. to General Mills, the company is aware of the inherent risks and challenges that exist when a large 100-year-old behemoth acquires a new startup. In 2016, General Mills acquired three-year old Epic Provisions, a meat-based protein bar company, for $100m. Founded in 2013, Epic reached annual revenues of $20m in three years with only 12 employees. Despite being a wild success by any standard, the Epic team provided some pushback in assimilating into the General Mills larger organization, one in which their company was now just a small piece of. [4] While the issues with the Epic team have been resolved, General Mills will undoubtedly face more challenges that result when trying to have small and dynamic startups join the operations and adopt the mission of a much larger parent company. To succeed with this model moving forward, General Mills must find a way to anticipate these challenges in the coming months.

Once General Mills solves the culture shock challenge in the short term, the company will look to discontinue some of its more outdated and declining brands, especially as the new investments through 301 Inc become more profitable. [6] Over time, General Mills can adopt a cyclical approach for growing new startups with the intention of replacing products or sub-brands with declining revenues. By taking risks now to expand their 301 Inc. program, and establishing practices to deal with the inherent challenges of investing and advising early stage, successful startups, General Mills will be able to maintain a competitive advantage in open innovation in the future.

For future analysis of General Mills’ approach to open innovation, the following two questions should be explored:

- Given the extreme focus on external ideas to fuel innovation, should General Mills maintain an R&D department at all? If so, what should their role be?

- As more large consumer food companies adopt this model, how does General Mills keep a competitive advantage?

(701 words)

[1] Star Tribune. (2018). As yogurt options multiply, General Mills, rivals strive to innovate. [online] Available at: http://www.startribune.com/general-mills-rivals-strive-to-build-a-better-yogurt/498055251/ [Accessed 13 Nov. 2018].

[2] Back, A. (2018). The Newest Venture Capitalists: Food Companies. [online] WSJ. Available at: https://www.wsj.com/articles/the-newest-venture-capitalists-food-companies-1533288601 [Accessed 12 Nov. 2018].

[3] Inc.com. (2018). Can a Startup Transform General Mills? The Saga of Epic Provisions. [online] Available at: https://www.inc.com/magazine/201811/tom-foster/epic-provisions-general-mills-meat-snacks.html [Accessed 13 Nov. 2018].

[4] Fitzpatrick, A. (2018). Start-up Incubators Will Help Fuel Innovation for These Consumer Giants — The Motley Fool. [online] The Motley Fool. Available at: https://www.fool.com/investing/2018/09/07/start-up-incubators-will-help-fuel-innovation-for.aspx [Accessed 13 Nov. 2018].

[5] Gasparro, J. (2018). Food Executives Look to Better Integrate Smaller Brands. [online] WSJ. Available at: https://www.wsj.com/articles/food-executives-look-to-better-integrate-smaller-brands-1538218800?ru=yahoo?mod=yahoo_itp&yptr=yahoo [Accessed 14 Nov. 2018].

[6] Finance.yahoo.com. (2018). Selling a Legacy: Food Companies Seek to Boot Their Dated Brands. [online] Available at: https://finance.yahoo.com/news/selling-legacy-food-companies-seek-110000563.html [Accessed 13 Nov. 2018].

The idea of outsourcing innovation is very effective in some ways, but it has some potential pitfalls that companies like General Mills need to understand. It is the extension of the Epic problem to further iterations. General Mills cannot help being slightly changed by the addition to the company. This is natural, but through a repeated process of additional acquisitions, General Mills runs the risk of diluting its own culture to the point where it is unrecognizable compared to the company today.

I’m struggling to see how 301 at General Mills can truly serve as a method for open innovation. When I think about open innovation, I think of distribution of responsibility in the typical funnel of product design such that a better design (in this case product design) is achieved by incorporating feedback from variety of outside parties (developers, end-consumers, etc). It’s not clear to me that R&D at General Mills is using the 301 in this fashion. Rather it seems like they are relying on perhaps traditional R&D processes at other firms and are using this VC arm to just acquire additional brands that they feel hold potential.

There is value in maintaining R&D spend at General Mills to push for a platform for open innovation based on active engagement of the consumer , rather than acquisition of innovation processes at other brands. Both of those components will likely be necessary for the firm’s long-term success.

In the same vein as “someone” above, I also wonder if venture arms should / can be considered ‘open innovation.’ While the rest of the CPG market is trending toward acquisitions and positioning themselves as strategic buyers from the early stages of new food brands, these companies are the innovation hubs of the largest brands in the market to date. Very few acquisitions have turned into the megastars of the the brand portfolio. Will Epic ever be the next Yoplait? The next Betty Crocker?

General Mills’ approach to open innovation seems like an important differentiator as consumer food trends involve, with its 301 Inc VC fund serving an important role in this strategy. However, my view is that internal R&D is still important to help General Mills advance products in its existing categories. 301 appears to be making logical investments in niche categories where GM does not currently play – as such, it seems important that GM continue to innovate in products where it is the market leader to protect its share and also create an R&D capability to help new acquisitions accelerate growth.

Even though it is hard to conceptualize how 301 is a source of open innovation at first, I agree with the author that this model is providing General Mills with a competitive advantage over competitors by accelerating their innovation process and by giving the company a new avenue to experiment.

I think 301 is a very innovative, yet expensive (average ticket of USD6mm per investment as per graph in original post), way of approaching their innovation process. They are basically fast-tracking their innovation process by acquiring companies that have already gone through it and have a product that has been tested and is currently in the market. This fast-tracking comes at a step price vs. regular contest-based open innovation and it also comes with some complications to their portfolio companies which are trying to grow using General Mills’s best practices and expertise but as subsidiaries are subjected to slower processes and internal bureaucracies. What I think is really powerful from this model is that General Mills can try out new approaches on these start-ups with no effect on their master brands and implement later on if results are favorable. In other words, General Mills is buying these companies, helping them grow, and seeing how some innovative practices from these companies can be applied to their main brands after they are market tested.

Acquiring startups and using those companies as a form of open innovation is an interesting proposition. What becomes challenging here, as you noted, is the integration issues – this more than just an idea generation engine; these companies and individuals are actually coming onboard forming many cultural and operational challenges. How do these companies strategies influence actual process? Without much influence there, General Mills won’t improve the value of the brand and process and those startups would feel incentivized to stay independent or join another platform that is more in line with their independent visions.

Undoubtedly General Mills should keep their R&D department. Having it allows this company to innovate within their product portfolio. While the VC allows them to capture new products and stay at the forefront of what the external forces in the market are doing, General mills also needs to improve their product line and adapt it to developing consumer tastes. The R&D department will focus on developing the brands while the VC firm focuses on capturing edgy new products or technology that General Mills can incorporate in their portfolio.

Thanks for the interesting read, Patrick. Open innovation—particularly through incubators or venture capital arms—is a trend we are seeing more and more in the food / broader CPG landscape, of late. Having spent some time myself in food investing, I completely agree with your characterization of the challenging position the large legacy house of brands now find themselves in as consumer preferences migrate more towards better-for-you start-up brands with very different value propositions than what companies like General Mills offers.

The tradeoff between Mills choosing to simply acquiring start-up brands that have demonstrated momentum (e.g. Kellogg’s acquisition of RX bar in 2017[1]) as opposed to incubating these brands and folding them into their organization is one worth considering. By backing them first, you have the benefit of closely monitoring them, assessing performance, and having the fast-track to integration. However, it’s also not necessarily their core competency – they aren’t a venture firm. Plus, it will require buy-in from General Mills’ investors, that they are comfortable with “kissing a lot of frogs” until they find their “prince” (given many VC-backed companies will ultimately fail).

With regards to their R&D department, I think they should absolutely keep their R&D department. However, it may not need to be nearly as extensive as it was. Embracing open innovation will require new capabilities that they didn’t have before, but a key success factor in such initiatives will be the ability to manage and ultimately integrate these technology and businesses into the broader Mills engine. Though these upstart brands may exist on a standalone basis, there could be other potential applications within Mills. Plus, line extensions and incremental innovations will still need to be led by the Mills R&D team (rather than the start-up). Either way, I think there is opportunity for complementarity.

Also by coincidence, competitor Mondelez recently announced their plans to pursue a very similar approach as Mills, whereby they will be investing capital behind promising start-ups as a way of immersing themselves in the latest emerging brands, concepts, and technologies[2]. So clearly, Mills is onto something!

[1] Kellogg. “Kellogg adds RXBAR, fastest growing U.S. nutrition bar brand, to wholesome snacks portfolio.” Kellogg, Kellogg, 6 Oct. 2017, https://newsroom.kelloggcompany.com/2017-10-06-Kellogg-adds-RXBAR-fastest-growing-U-S-nutrition-bar-brand-to-wholesome-snacks-portfolio.

[2] International, Mondelez. “Mondelēz International Launches SnackFutures™ Innovation Hub to Lead the Future of Snacking.” Mondelez, 30 Oct. 2018, https://ir.mondelezinternational.com/news-releases/news-release-details/mondelez-international-launches-snackfuturestm-innovation-hub.

I like the new idea that you have brought as part of this article. However, I believe given General Mills is a big conglomerate that has invested heavily in their R&D for tens of years – both in terms of human resources and machinery etc, it makes little sense to outsource innovation now. I think we can utilize the combination of internal and external resources – but complete shift would not be very productive for the company.

The idea of quick growth through start-up acquisition within food industry intrigue me pretty much. Normally, we see more innovation acquisition in tech industry rather than consumer goods. One potentially reason is the cost of development and barrier to entry. However, General Mills shows us that there are many food-base start-ups. And there is a space for them to grow their innovation quickly. But as the article discuss cultural shift, companies that are acquiring need to align the goal between start-ups and the company. I think this is the area that we can learn from studying various acquired start-ups and how they run the businesses after being acquired.

This is an interesting article. I believe this is a great business strategy for General Mills. As a company that has been around for 90 years, innovation has to be their main focus. Through this VC arm, the company is able to find and fund innovations from startups in an early stage. Paying a lot less for these companies than they would pay to acquire them in a later time. This is a very efficient way to manage smaller competitors. However, there are definitely challenges to acquire startups and have them work with the same focus and mission of a big conglomerate.

General Mills should absolutely retain their R&D team, specifically for the reasons you stated around cultural differences between a nimble startup and a behemoth such as GM. Going the acquisition route can be viewed as a way of “hacking” the innovation system; however, I would recommend that GM works harder to create an environment where this kind of innovation is fostered and promoted internally.

I imagine many start-ups looking for funding share the concerns of the effects Epic Provisions experienced when GM invested in their business. GM is, in many ways, the epitome of the type of company they are trying to disrupt and the cultural clashes likely will be stark. 301 inc should push to remain as “incubator-like” for as long as possible in order to delay these inevitable cultural conflicts. From the start-up entrepreneurs’ point of view, they must balance the potential cultural disruption (versus taking more traditional VC money) with the likelihood of a premium strategic exit by selling to GM one day.

Thanks for this article. I think General Mills should retain both their R&D departments as well as their method of gaining ideas externally, since they are a well established company that needs to maintain cutting edge R&D and innovative ideas in order to stay competitive and relevant in the industry. I think Open Innovation should be used as an add-on to any normal departments the company operates, rather than replace them. This would be their competitive advantage.

Large consumer product companies have had the reputation of not being able to innovate for a long time and it is very interesting to be able to hear about how General Mills has fought to combat this slowing growth. It would be interesting to hear more about how exactly General Mills differentiates itself from a venture capital or incubator standpoint especially given that a lot of other CPG companies have been starting their own funds. See below for some examples:

Campbell Soup – $125M fund – http://fortune.com/2016/02/17/campbell-soup-vc-fund/

Kraft Heinz – $100M fund – https://www.businesswire.com/news/home/20181005005048/en/Kraft-Heinz-Announces-Launch-100-Million-Venture

I wonder if product expertise (Kraft Heinz with its condiments or Campbell with its canned soups) is something that motivates founders to want to sell to these companies, or if it’s purely based on price. I also wonder if it is the expertise of those who run these funds that drive these decisions. Regardless, General Mills should look to see how those motivators potentially leave gaps in their overall portfolio or if perhaps they’re losing to these other CPG companies due to human capital, reputation or other factors.

Can innovation be acquired? I believe yes. General Mills strategy of acquiring innovation and knowledge through acquisition can be an effective tool for rather large organizations that are too large to truly innovate. As others have pointed out, this strategy is not unique to General Mills, but has also been pursued by others including Kraft.

The issue that I see in a large, want to stab list organization purchasing a much smaller agile and innovative company is the negative impact on innovation post acquisition. For instance, when Walmart acquired Jet.com, innovation slowed and Jet.com stopped growing at its historically impressive rate. While I do believe that large companies that acquire innovation do benefit, it remains to be answered whether acquisition also simultaneously stifles innovation.

I think General Mill’s R&D and acquired innovation can work synergistically if the R&D department takes fresh exogenous ideas and hones them to further the company’s specific goals and requirements. Often external ideas need only be the seed to point a specialized internal process in the right direction.