Ele.me, Digitizing the food delivery service in China

The incredible rise of Chinese food delivery giant Ele.ma, and how digitization has helped pioneer the food delivery industry.

Have you ever been hungry in your home at night, unable to order food other than the local pizza? This common occurrence is what led Zhang Xubao, a Shanghai Jiao Tong University student, to start an online food delivery service called Ele.me (Chinese for “Are you hungry.”)

Ele.me is an “online to offline” (O2O) platform for mobile users created in 2008. Their platform provides users the ability to interact with restaurants for food delivery in a way that was previously not available. By the end of Q2 2017, over 130 million users ordered food from 1.3 million restaurants in over 1400 cities, and their system processed more than 9 million orders daily [1].

Digitalization and fast expansion

With the rapid increase in mobile devise users, Ele.me strategically designed their product to be mobile friendly. By doing so 99.5% of orders made are now from a mobile device. In 2014, they were able to work a strategic partnership with Dazhongdianping (China’s Yelp) that provides user dining preference data into their app [2]. This partnership gave them the push they needed to get large numbers of restaurants agreements, and drove a huge influx of new consumers.

They quickly realized that being able to process orders through an e-payment system was necessary. Their strategic partnership, and investment of USD1.25b in 2016 from Alibaba solved that issue as they incorporated Alipay into their system [3].

On-going Digitalization

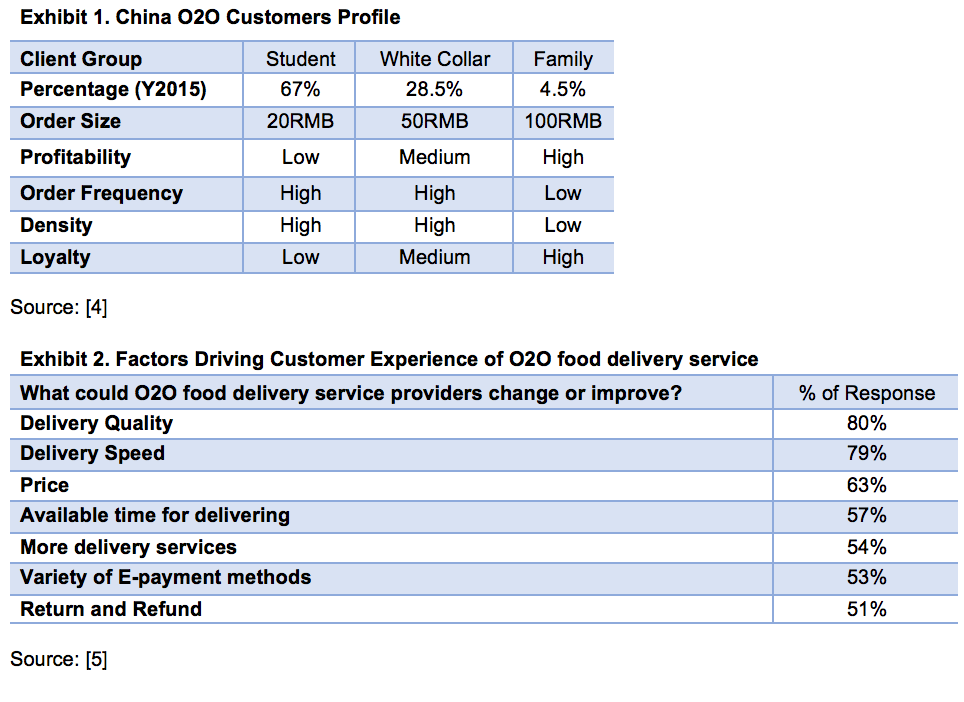

Until recently the company was focused on growth, but with its leading size and market command, it is now moving its focus to profitability. They believe the key to profitability is to continually build and maintain a customer base of middle-high income white collar individuals and households. These people maintain loyalty and spend more on higher end restaurants, hence the ability to turn a profit is greater than focusing on younger, less loyal student customers (See Exhibit 1). In order to provide the required levels of service to maintain this consumer base, a certain level of delivery speed and food quality is vital (See Exhibit 2). Ele.me has been looking to better leverage digitalization to reduce cost, increase efficiency and improve the client experience.

Some customer experience initiatives include:

- User friendly tracking system: The implementation of an advanced tracking system which allows the user to see where the order is in the process, including preparation status, pick-up, and where the food is in-route etc.

- Creation of their own delivery team: Rather than purely relying on 3rd party delivery companies, Ele.me built their own delivery capacity. This allows them to have better control of the delivery process and charge both the restaurant and the consumer delivery fees [6]

- Implementation of machine learning: Strategic partnership with Ali Cloud has helped Ele.me better understand eating habits and trends of their customers. AMap (acquired my Alibaba) helps Ele.me to plan delivery routes, and station drivers in locations that are estimated to be closest to restaurants that are highest in demand at any given time [7].

- Supply chain consultancy and finance: They have recently begun to incorporate supply chain finance and consultancy to member restaurants, as their systems allow them to provide order management to smaller sized establishments. Also, restaurants that have high customer feedback and strong orders volume may be provided funding opportunities through Ant Financial (subsidiary of Alibaba). Alibaba’s Zhima Credit service provides good a reference on these restaurants’ credit ratings [8].

The Future

Ele.ma needs to find ways to increase efficiencies. One way they could do that is by using their data to black out restaurants from the user interface when it is clear that they are running at or above capacity. Also, as there are 2 peak hours during the day (lunch and dinner) they need to find ways to keep their employee drivers productive. Expanding their forms of delivery, possibly by providing grocery delivery services to residential homes for example, could do the trick. They could use their already robust interface to provide data on best price, and product freshness, thereby allowing people to pick where to shop from and when to have the goods delivered to their homes.

Ele.me is still not profitable, and profits have been elusive because, like their rivals, Ele.me has been spending heavily toward customer acquisition and technological upgrades and advancements, as well as offering heavy discounts to consumers, and higher employee incentives.

Digitization has been integral in Ele.ma’s growth and success to date, but issues and concerns, like profitability, remain. Other concerns include mitigating food quality risk, and retention of their core consumer base. How best can they use digitization to achieve those goals?

Also, would it make sense to diversify their product suite and actually own their own kitchen to produce meals, or build inventory of raw materials to sell as a whole seller to their customer restaurants?

Word count: 798

[1] “2017 Q2 China Online 3rd Party Food Delivery Market Report”, Big Data Research, August 21, 2017, http://www.bigdata research.cn/content/201708/563.html , accessed November 2017.

[2] Yuan Huang, “Dazhongdianping invested USD 80million in Ele.me and formed strategic partnership”, Yicai.com, 6 May, 2014, http://www.yicai.com/news/3780808.html, accessed November 2017.

[3] “What attracts Alibaba to invest USD1.25 billion in Ele.me?”, History.people.com.cn, April 14, 2016, http://history.people.com.cn/peoplevision/n1/2016/0414/c371452-28276110.html, accessed November 2017.

[4] “2015 H1 China O2O Food Delivery Industry Report”, Analysys, July 30, 2015, http://www.cctime.com/html/2015-8-3/2015831735414559.htm, accessed November 2017.

[5] “2015 H1 China O2O Food Delivery Industry Report”, Analysys, July 30, 2015, http://www.cctime.com/html/2015-8-3/2015831735414559.htm, accessed November 2017.

[6] “2017 Q2 China Online 3rd Party Food Delivery Market Report”, Big Data Research, August 21, 2017, http://www.bigdata research.cn/content/201708/563.html, accessed November 2017.

[7] Nan Feng, “10 Key Words: The truth behind USD1.25billion investment from Alibaba and Ant Financial to Ele.me”, Huxiu.com, April 14, 2016, https://www.huxiu.com/article/145280/, accessed November 2017.

[8] Nan Feng, “10 Key Words: The truth behind USD1.25billion investment from Alibaba and Ant Financial to Ele.me”, Huxiu.com, April 14, 2016, https://www.huxiu.com/article/145280/, accessed November 2017.

Love the topic Cissy! I used to work as a pizza delivery driver, so I’m always intrigued by new entries into this space. I agree that Ele.me should continue to expand their internal delivery capacity. By operating their own delivery service, the company can reduce variability and increase quality in the supply chain. As a Grubhub customer, I’m continually disappointed with the quality of the food and the accuracy of the tracking feature on the app. I’m sure that Chinese customers have the same complaints with food delivery services. It would benefit Ele.me to use digitalization to internally/externally score restaurants that are not meeting company standards. Lastly, since speed and quality are highly correlated (late deliveries also tend to be cold), Ele.me could dynamically rank restaurants by delivery speed. Real-time data on traffic and restaurant order volume could be used to accurately estimate which restaurants are below capacity at any given moment.