Duck, Duck, Goose: Why Canada Goose should ensure the shift towards e-commerce on the front-end drives digitalization throughout its supply chain

As Canada Goose has grown exponentially in recent years it has shifted towards a direct-to-consumer model, but is its supply chain stuck in the wholesale era?

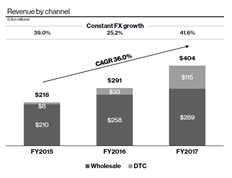

As consumers increasingly prefer to purchase online and directly from brands, Canada Goose is adapting its go-to-market strategy from being a purely wholesale brand towards direct-to-consumer (“DTC”) channels e-commerce capabilities and its own retail stores.

DTC creates significant opportunities for Canada Goose by making the brand more accessible, giving the company more control its brand, and expanding margins.[2] However, If Canada Goose does not concurrently evolve its supply chain with its channel mix it could have significant reverberations throughout a supply chain designed for a wholesale business and have considerable ramifications for the future by inhibiting sales growth and/or creating excess inventory.

Why the shift to DTC has implications for Canada Goose’s supply chain

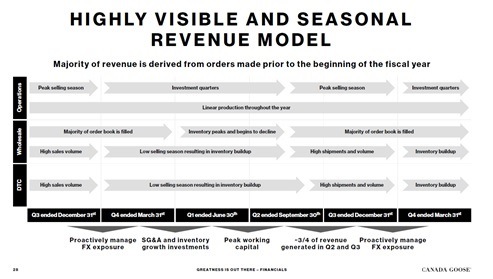

Under its traditional wholesale model, Canada Goose typically receives orders by March, produces inventory throughout the year, and ships finished goods to retailers ahead of the winter. This revenue model significantly de-risks Canada Goose’s near-term operations by providing very clear visibility into sales, which allows Canada Goose to optimize its supply chain as order quantities are fixed. While retailers may order too much or too little, Canada Goose is effectively insulated from these risks as its demand is fixed.

In contrast, under the DTC model, Canada Goose bears the risks for inaccurately forecasting demand. If Canada Goose incorrectly forecasts volumes, it may be left with excess inventory or miss out on potential sales. Given Canada Goose’s parkas retail at $1,000, excess inventory or foregone sales can rapidly mount. The proliferation in SKUs as the company seeks to expand beyond parkas[4] further exacerbates these risks.

How management is addressing the concern (or not)

As Canada Goose has recently publicly listed and is still growing rapidly, management understandably appears to be much more focused on continuing to expand DTC and other top line initiatives rather than evolving the company’s supply chain. Nonetheless, management’s belief in the advantages of a flexible supply chain[5] and desire to increase the proportion of in-house manufacturing[6] indicates the company is taking some steps to address supply chain concerns in the short-term.

Over the medium term, management has made clear that it intends to harness the wealth of data generated by DTC sales, but they have acknowledged they are very much in the early stages of this process and, notwithstanding, their intentions also appear to be more focused on using this data predominantly for consumer facing marketing initiatives rather than for optimizing Canada Goose’s supply chain.[7]

Recommended supply chain initiatives

While management continues to build Canada Goose’s DTC business, it would be prudent to simultaneously also take some additional steps to concurrently evolve Canada Goose’s supply chain. For example, in the short-term, the organization should seek to become a true omni-channel business by increasing integration across channels rather than treating its e-commerce sites and brick-and-mortar stores like external wholesale customers, which results in inventory being stuck in a channel rather than finding its way to the consumer.[8]

Over the medium term, the overarching goal for management should be to increase the overall flexibility of Canada Goose’s supply chain to better serve the needs of customers. Rather than producing inventory over the course of 12 months, Canada Goose should take a leaf out of the books of fast fashion players and try to be more responsive to customer demand. Instead of a plethora of items being marked as “sold out” on the website, customers should be able to place orders.[9] Focusing on increasing flexibility could also encompass other initiatives that could drive sales growth, such as enabling some customization/personalization of products and being able to more readily fulfil spikes in demand due to particularly adverse weather conditions.

Big picture trade-offs

A fast-growing company like Canada Goose has the enviable problem of having multiple attractive initiatives and the benefits of longer-term initiatives may not seem readily apparent. However, supply chains do not evolve overnight and it would arguably be easier for organization to gradually implement changes now. Given the highly seasonal nature of Canada Goose’s business, an execution misstep will only manifest itself during the key winter months, which would have considerable consequences on overall business performance – a risk that will only get bigger for a company growing at 50% per year.[10]

However, fashion is inherently irrational – is there a risk in being too responsive to customers? If products are readily available, will the brand still continue to generate allure?

(724 words)

[1] Canada Goose Holdings Inc., 2017 Investor Presentation, p26 [https://s21.q4cdn.com/699882010/files/doc_presentations/2017/10/Canada-Goose-Investor-Handout.pdf], accessed November 2017

[2] Any jacket sold through the DTC channel provides 2-4x greater contribution to operating income than through the wholesale channel. Canada Goose Holdings Inc., March 2017 prospectus for C$340 million of subordinate voting shares, p. 81 [http://d18rn0p25nwr6d.cloudfront.net/CIK-0001690511/0e519e5a-d14a-4200-86d1-73a1cb2eab6e.pdf], accessed November 2017

[3] Canada Goose Holdings Inc., 2017 Investor Presentation, p28 [https://s21.q4cdn.com/699882010/files/doc_presentations/2017/10/Canada-Goose-Investor-Handout.pdf], accessed November 2017

[4] Canada Goose Holdings Inc., 2017 Investor Presentation, p4 [https://s21.q4cdn.com/699882010/files/doc_presentations/2017/10/Canada-Goose-Investor-Handout.pdf], accessed November 2017

[5] Canada Goose Holdings Inc., March 2017 prospectus for C$340 million of subordinate voting shares, p. 78 [http://d18rn0p25nwr6d.cloudfront.net/CIK-0001690511/0e519e5a-d14a-4200-86d1-73a1cb2eab6e.pdf], accessed November 2017

[6] Canada Goose Holdings Inc., 2017 Investor Presentation, p30 [https://s21.q4cdn.com/699882010/files/doc_presentations/2017/10/Canada-Goose-Investor-Handout.pdf], accessed November 2017

[7] Credit Suisse, “Canada Goose Spreads Global Warmth”, June 7, 2017

[8] Interview with Canada Goose employee, November 13, 2017

[9] Based on various website visits to www.canadagoose.com from October 2015 to November 2017

[10] Canada Goose Holdings Inc., 2017 Investor Presentation, p3 [https://s21.q4cdn.com/699882010/files/doc_presentations/2017/10/Canada-Goose-Investor-Handout.pdf], accessed November 2017

Based on my (limited) understanding of fast-fashion retailers like Zara and H&M, these retailers are constantly changing their product line-up every 4-6 weeks. As a result, not only are their supply chains more nimble, but their consumers are excited to constantly find new products in stores. But retailers like Zara and H&M produce relatively cheap products. If one product design turns out to be a total flop, it’s a relatively inexpensive mistake. With Canada Goose, $1,000 jackets that don’t sell–even in limited batches–can add up to pricey mistakes for the company. Will increased customization and SKU proliferation actually create more complexity and risk within the supply chain?

interesting article! I absolutely agree.

I also think that the DTC would provide them with a feedback loop to continue or stop producing certain products that are not in high demand during the season. I would also recommend that they use digitization to forecast demand more accurately by starting to allow people to pre-order, which have seen on many retailers websites especially amazon, as it will create more visibility.

Adi, you raised some great questions. I do agree that a shift from wholesaling to DTC does require some major retooling of their supply chain and internal processes. A few things come to mind:

1) How has Canada Goose been keeping track of end-demand historically? Have they been gathering data from the wholesalers, and has there been meaningful patterns observed? My thought is that if they have not been gathering data before, they might struggle with predicting end-demand when shifting to a DTC model. My hope is that their omni-channel model will allow them to gather meaningful customer data, and hence be able to improve their DTC demand forecasting going forward.

2) That said, the Barilla case surprised me to the upside, where they successfully forecasted end-demand better than the distributors, despite the thousands of pasta and non-pasta SKUs. Given that Canada Goose has much less SKUs, with the classic parkas being the majority, I would not be as surprised if they have been able to forecast demand rather accurately. In fact, I’d imagine that one reason Canada Goose doesn’t ever give discounts [1] is because they have been able to predict inventory rather accurately, and are not sitting on massive amounts of unwanted inventory. This gives me confidence that the seasonality of Canada Goose jackets are more predictable than we imagine, and as such, a DTC model might be less troublesome as we might worry about.

3) You didn’t touch on this, but I wonder how the collaborators in the Canada Goose supply chain have reacted to this shift to DTC?

Footnotes:

[1] http://altitude-blog.com/en/cheap-canada-goose-doesnt-exist/)

You raise some interesting questions, Adi. Your first question on the risk of being too responsive to customers is an important one. I see a tradeoff between the use of Big Data to provide custom products and customer experiences and the ability of a company to independently set and project fashion trends. On the one hand, Big Data can be leveraged to tailor and personalize everything from in-stores experiences to online shopping and products. Big Data initiatives have the potential to increase customer loyalty and generate top-line growth. Numerous retailers, such as The Gap, are focused on implementing such technology in order to react quickly to changing customer demands. [1]

On the other hand, initiatives utilizing technology to collect consumer information and inform production decisions run the risk of being so reactive that companies lose touch with what their unique brands represent and who their target consumer is. In this situation, is there no longer a role for a creative director or unique vision? I would argue that holding someone accountable at the company for determining and maintaining a brand vision is essential.

Scale and growth stage are other key factors to consider here, since Canada Goose may have capacity and resources to integrate channels in a way that is very responsive to consumers, but smaller scale, later stage companies are likely more limited in terms of how they can respond to consumer demands.

In terms of product availability, I think this answer will vary depending on where products fall on the spectrum of value to premium. Traditional luxury companies, such as Dior and Chanel, have been able to achieve a perception of exclusivity through high price points, a selective distribution platform, and limited production volumes. Thus, I think that expanding accessibility (e.g., lowering prices or selling through the mass channel) and catering to all consumer needs would actually prove to be a detriment to a luxury brand like Canada Goose in the long run.

[1] “Gap Gets Personal With Big Data.” Retail Best Practices | RIS News: Business/Technology Insights for Retail, Supermarket Executives, 30 Apr. 2013, risnews.com/gap-gets-personal-big-data.

[2] “Has Luxury Gone Too Mass?” The Business of Fashion, 18 Jan. 2016, http://www.businessoffashion.com/community/voices/discussions/has-luxury-gone-too-mass.

It will be exciting to see how this plays out. I was surprised to read that some Goose products could be listed as “sold out” online – this seems like a huge miss, but reveals how far they have to go in improving their supply chain’s responsiveness.

A potential idea to consider is introducing mini-Canada Goose guide shops similar to what Bonobos or Warby Parker does. The goal would be to allow potential customers come into a shop (could even be a dedicated section of a retail store where Goose is sold) to try on different SKUs and then place an order via their phone or digitally via a dedicated employee. This would reduce the need for Goose to hold the inventory at the store and the customer could expect to receive their jacket in 2-4 days. Additionally, this would help Goose centralize it’s manufacturing and more effectively optimize it’s supply chain.

Thanks Adi, really interesting read!

I agree with your view that the move to e-commerce should be leveraged to improve demand forecasting and inventory management. However, I believe there are two further areas of the supply chain that require immediate focus:

(1) Distribution centers designed for e-commerce – typically traditional distribution centers are designed for bulk shipping whereas e-commerce calls for warehouses where orders composed of individual SKUs can be packaged and shipped directly to a customer’s home. Is this a current management consideration?

(2) Last mile customer delivery – how is Canada Goose planning on ensuring timely, inexpensive delivery of online orders and managing customer returns given they have not historically needed to do so?

Really interesting read on Canada Goose – particularly relevant to our class as these jackets are ubiquitous around campus. What I find most interesting is actually that their GTM approach is almost the reverse of other retailers – starting with selling through wholesalers and then opening up their own DTC channels. Hindsight is 20/20, but I wonder if had they used the other approach, and had they been able to build a strong brand reputation, they could have negotiated better contractual agreements with wholesalers and other retailers than they currently have. With that said, it will be interesting to see how channel sales shift over time. I could potentially see the value in some brick & mortar shops – given that this is such a large ticket item, customers will want to see them and try them on in person; however, I am curious how many sales will then ultimately be generated from in-store vs. online.

Love the idea of being able to place an order online instead of having a jacket shown as sold out. However, I’m not sure the Zara or other fast-fashion model works for Canada Goose given their fairly intricate, complex, and high quality makeup. Depending on how automated and efficient jacket production is, jacket production may not be very scalable particularly in a fast manner. This could explain why they need to have a buildup of inventory before each winter season.

The Canada Goose store in NYC has had a round-the-block line since opening in 2016, with customers bravely enduring abuse and jeers from the protesters that have been picketing the store. I agree with your comment about exploring a truly omni-channel strategy, and particularly think that the e-commerce component of the DTC model will be critical post-IPO. E-commerce will facilitate Canada Goose’s launch online in multiple markets, avoid the costs of brick & mortar stores in smaller markets, and mitigate the marketing nightmare of protesters outside the store, especially as the Company has been dealing with significant adverse press in light of its unethical treatment of animals . Over the long-term, however, I agree that Canada Goose should go beyond marketing and harness the power of the data to actually improve the supply chain. After all, this is an expensive product that most consumers will only own one of and will replace infrequently, so ensuring that they can actually meet demand is critical to long term success.