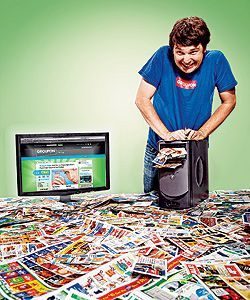

So Long, Groupon!

Groupon: How Has Once a Wall Street Tech Darling Failed?

How many people still shop on Groupon today?

Just a few years ago, Groupon, the discount voucher company, was hailed by the Wall Street as a revolutionary star in the bargain business. It expanded rapidly around the world. It turned down a $6 billion acquisition offer from Google. But such glory faded away quickly leaving Groupon with a gloomy outlook.

Today, investors don’t like its shares anymore as the prices hovered around about a quarter of its initial offering of $20 per share in 2011. Customers are turning away from the site too, while the number of its active users peaked in 2014, according to research firm Statista. (Well, maybe my friend Jane, a hard-core Groupon fan, would disagree with me.) In fact, Groupon has been struggling to bolster growth and profit since its IPO.

What has gone wrong?

Unsustainable Business Model

Betting on the collective buying power, Groupon makes money by offering steep discounts on almost everything from school bags to hot spa massage services. It then shares the revenue with the suppliers. The idea is that the online traffic lured by the discounts will transfer to offline, meaning more store-goers.

However, most of the Groupon users are not my friend Jane. About 80 percent of them are new buyers, who would never come back to purchase the full-price products nor shop at stores, according to a study by Rice University. With fewer returning customers, merchants are less likely to offer deals on the Groupon site in future. As the thrill of the deal faded for many consumers, the vicious circle started.

Growing Too Fast

Alarm bells should have rung. But with the initial success, the company’s executives buried their heads in the sand, Groupon aimed to grow as big and as fast as it possibly could be. It quickly morphed into the online marketplace to compete with eBay, while its deals business was still in competition with retailers like Overstock.com. It then entered dozens of foreign markets without conducting thorough market research.

Just like many other aggressive tech companies, Groupon underestimated the local competitors and copycat services. It had to pull out from 17 countries including China, Denmark, and Norway. Groupon even pushed out its Co-Founder Andrew Mason.

Unclear Reviving Strategies

In an effort to turn around its plunging business, Groupon has increased its marketing budget by spending as much as $200 million in 2016. It sends out numerous daily e-mails to users loaded with deal information. However, throwing tons of money in advertising won’t help it revive the local deals space.

There are just too many offers on Groupon that are either useless or lack of mass appeal. Even my friend Jane complained that the emails sometimes could be very annoying, while it became so hard to find good deals on the site.

Groupon also tried to diversify from its roots in daily deals. It has since cut jobs and sold off stakes in overseas businesses as it transforms into an online marketplace. But wouldn’t it be too late? After all, it cannot keep on burning money to retain and gain customers like my friend Jane.

As Mason told the Seattle Times in 2015, Groupon was a “stupid, boring idea that just happened to resonate.”

“I Google it from time to time, but I have moved on,” Mason said.

Definitely agree that the business model is questionable. Personally, I’ve never felt compelled to return to a place I used Groupon/Living Social at. This begs the question though, why would Groupon buy Living Social? Their business models were the same and they both suffered the same fate. Even if Groupon could realize cost savings + additional customers, the vicious cycle will continue. Groupon probably could have put that money to better use by pivoting their business model.

The Groupon business model is troubled not only from the customer perspective but also from the retailer perspective. The value add of Groupon is it is a way to enable local business to acquire new customers, which is reasonable. If you were a small business, how would you acquire customers? – online ads seem hard, flyering is low yield and likely ineffective. Groupon seems like a good option because you only pay for customers that you gain, and don’t pay for anything that you don’t similar to the way CPC pricing works on Google Ads. This sounds good, but do the economics work? On a $100 item you would offer a 50% discount and sell for $50 of which you would split 50/50 with Groupon so Groupon gets $25 and you get $25. Let’s assume your margin on the item is 10% or $10, so the COGS associated with the item is $90. You just sold $90 item for $25 of profit netting a $65 loss which you must recover. As mentioned by you and Yi, that requires a lot of recurring purchase to make up the lost margin making it really tough for businesses to make the math work. Meituan-Dianping is a Chinese group purchasing company which has been able to be successful in the group purchasing market in Chinese – why? – because it has much lower take rates than Groupon, allowing businesses to be more sustainable.

What else made Groupon compelling? – well it was an expensive form of getting working capital and financing. You get paid by the customer upfront and get cash and don’t have to deliver the goods until later (or potentially never). However, I feel like many retailers misjudged the real cost of this financing as the profit hit from using Groupon is oftentimes too much to overcome.

In undergrad, I used to look for deals on Groupon frequently, and had mixed experiences. From a customer perspective, low prices and getting new ideas seemed compelling. However, I think a major flaw is the lack of quality control over the partners. First, many deals were oversold and businesses couldn’t keep up with high order demands. Second, a few businesses provided very low quality. Third, some deals turned out to be no real deals for Groupon, but e.g. normal bundled offers.

At the same time, stories of massive losses for businesses surfaced, and that slowed participation from businesses. This in turn reduced the variety and number of offers, which then reduced consumer interest.

I think Groupon’s monetization strategy (which financed their rapid expansion) was too aggressive, taking too much margin from every deal. Furthermore, Groupon failed to do due-diligence of their partners.