SMT: winning by enhancing sports viewership & content with technology

SMT has positioned themselves as media incumbents' solution in the race to keep up with technology for sports broadcasting applications. This strategy has made SMT a winner!

SMT (formerly SportsMEDIA Technology) has become a winner in its role in the sports media market. Unlike many other digital disruptions, SMT has become a winner by partnering with sports media incumbents instead of using technology to disrupt them. The company signs long-term contracts with sports leagues, such as the NHL, and sports media companies to provide real-time delivery of data and social media for live television of sports and entertainment. Together, the partnerships have enhanced the viewing experience and improved engagement across a growing number of platforms such as mobile and social media.

How did SMT win a foothold in the sports media market?

SMT was founded in 1988 with its first product being real-time scoring and wireless data delivery system. This product was first adopted by the PGA Tour who used this new technology to replace walkie-talkies used to deliver scores across a golf course. A couple years later, SMT signed a four-year contract with ESPN to provide sports design graphics for live televised sports events. Today, after additional product development and acquisitions, they offer enhanced digital services, on-site operations, commentator support and augmented reality products.

How does SMT create value?

I believe SMT creates value for the end-consumer (the sports fan) and the media partners. The sports fan benefits from SMT in the following ways:

- SMT technology products enhances the viewing experience of live-sporting events real-time sports data, design graphics and other products

- Real-time tacking technology adds convenience and ease of accessing sports data which leads to increased engagement of the sports fan to their favorite player, team or league

Additionally, media partners benefit to partner with SMT instead of taking on these digital technology capabilities themselves. Some of the value create for the media companies is:

- Convenience of outsourcing technology expertise and services

- A competitive advantage to other sports media stations

- Adds a selling point when bidding for big event contracts (i.e. Super Bowl or Olympics, both which SMT has been involved in)

SMT has a winning strategy for a number of reasons. First, they have found a service that compliments incumbents instead of disrupts them, which allowed them to scale quickly. They presented themselves as an easy solution for media companies to outsource technology innovation at a time when the televised sports industry was being disrupted by new platforms, such as mobile apps, streaming, twitter and social media viewing (an easier solution for incumbents than the Havas/V&S case where an incumbent tried to fully integrate with a disrupter). Second, SMT has remained a private company which has allowed them the speed and agility to keep up with the pace of technology and makes them well-suited to pair with a less-agile media incumbent. Third, after decades of expansion in sports media, SMT has endless opportunity of growth and expansion into other complimentary industries including entertainment, education and medical. While expansion into new industries has been an intention of their business, it is important that they maintain their foothold in the sports media market and they continue to set the pace of innovation in that space. We have seen this with two recent funding rounds and acquisitions of Sportsvision in 2016 and Information and Display Systems LLC in 2012.

Can SMT save sports TV viewership?

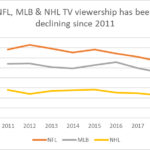

It is true that most major sports leagues have been experiencing a decline in TV viewership including the NFL, MLB and NHL. While SMT has arguably improved the TV viewing experience, TV as a viewing platform is being disrupted by other options such as mobile apps, streaming and social media, leading to a decline in TV viewership.

With TV viewership in decline, is SMT still a winner?

I would argue yes, SMT is still a winner even as TV viewership is declining. SMT services also enhance streaming and apps using technology and live updates and may even charge higher rates providing technology for multiple platforms.

Source: SBRnet

Very interesting company, Lill!

I agree with you that SMT has been wise in not trying to attack traditional broadcasters, but rather to slowly make themselves indispensable partners to these powerful networks. Their tech creates value for the entire system, and it seems like they’ve been able to capture that in profitability (certainly not always the case with disruptive media start-ups!).

That said, I wonder if they will still sustain an advantage in a context where more people watch sports via YouTube TV or Amazon Prime. Do you think SMT’s tech will be as valuable to players like Google, whose engineers could surely replicate SMT’s graphics no sweat? Particularly as the world gets more excited about e-sports, I worry that Twitch (owned by Amazon) already has much more advanced capabilities. Let’s see if SMT can keep up the pace of innovation to stay relevant.

Building on Megan’s comment above, I wonder as more sports leagues and events partner with SMT, will they continue to sustain a competitive advantage as their product is no longer a differentiation point for their customers? I’m thinking of Clay Christensen’s theory of commoditization and decommoditization cycles. As SMT’s tech becomes commoditized, value is likely to move into other area’s of the supply chain – should SMT begin to invest R&D dollars in spaces they think the value will be in the future? And where would that be in this scenario? As well, tying themselves to the incumbent rocket ship is beneficial for scaling in the short term, but what happens when those incumbents are disrupted? I’ll be curious to see how SMT continues to reinvent itself and if it ends up a winner or loser for the long term.

Very nice choice – analytics and graphics are really a plus when you watch a game.

The two previous comments where very interesting as well. Maybe if there is such commoditization, SMT could try to target some new customers. One type of customers could be the new trending apps for betting on sport. Gamblers could be very interesting to have real time data to make a decision on when to cash out, the prediction of outcomes would be also very attractive. Maybe sports clubs could be also very interested. We can think about a sport manager or coach getting analytics during or after the game. STM could used its long experience to provide the most valuable insights.

Great article Lill and very interesting read! As an avid sports fan, I was impressed to learn that SMT was able to carve itself a piece in the lucrative market of televised sports by providing a differentiated platform for broadcasters. One thing I would be interested to learn more about was if SMT had considered partnering with specific professional sports teams and leveraging their analytics expertise. As more and more professional teams begin to build out analytics departments I could see SMT begin to position themselves as a platform in which teams could use their data insights to inform player decisions and evolve in game strategies. Likewise, I would be interested to know how much value they capture from this platform and if exclusive contracts should be a part of their business model.

Great article! I think two points are interesting to think about:

1. It is so impressive that despite being such an old organization, they have stayed on top of innovation against much larger companies who could in theory build this out themselves. I think the point you raised about them being small and agile is super important.

2. I wonder if they will seek to enter the eGaming market as it continues to grow and traditional TV viewership declines. It could be interesting for them to do the same things they do for sports for newer markets like eGaming. Eventually, I think those markets may end up being more similar than they are seen to be now.

Great read!

Great article! I’d love to build on some of the comments above and leave more food for thought on the opportunity to target gamblers, as it becomes more widespread across the US market given the recent deregulation. There is definitely a market opportunity to deliver specialized data not just to gambling users, but also to the gambling platforms. In fact if SMT found that their analytics were compelling enought to drive value for gambling houses, they could go even as far as setting their own gambling platform. On that same train of thought, I’d be interested to know if they’ve ever looked to the Australian market for analysis/inspiration giving how widespread gambling is in the country.