SLACK: Reimagining the (Network) of Workspaces

Slack is a network of networks, people and apps.

As a business leader, I’ve had the ‘pleasant’ experience of digging through my email inbox to find what documents to share with new hires. I’ve experienced a sense of deep searing loss when you realize that the one person who had the most updated version doesn’t know where it is.

Enter SLACK.

Slack is an acronym that stands for Searchable Log of All Communication and Knowledge, according to CEO, Steward Butterfield. Like many great inventions, Slack seems to have started as a side effect of a larger project. Slack began as an internal tool to manage communication and coordination among a Tiny Speck team who were then working on Glitch (a virtual reality game). Although the game itself did not take off as well, and the team pivoted, that IRC (internet relay chat) system formed the basis for what is Slack today.

Value Creation

Slack’s tagline, “where work happens,” captures the CEO’s vision of replacing email as the primary means of communication within every organization. Email is a fragmented channel that puts the “individual first” at the expense of the company. Slack uses a system of “channel first” communication that allows multiple users to engage with the same content. Channels can be theme-based, project-based, or designed in any way that reflects the dynamic structure of the original organization. Slack makes it easier for employees collaborate across departments.

While Slack has leaned into enterprise sales, it still is a network where almost anyone can set up a workspace for free. This flexibility allows it to also serve as a connector for people outside individual workspaces. Slack has become an “interstitial” space where networks e.g., product managers in Boston connect, exchange ideas, and engage with a shared interest. Slack is thus playing a network bridging role, and this enhances the value they create for individual users.

Value Capture

According to Slack’s latest investor update (March 12th, 2020), there are 12 million+ daily active users on the platform with 110,000 paid customers. The company runs a freemium model, where the first 10,000 messages are free within the workspace. Its top 70 users spend more than 1 million each. It also has 893 customers who spend more than 100,000. These figures translate to approximately 24% of revenues originating from large clients. There is “rapid Slack adoption across a broad array of businesses,” including small and medium enterprises that Slack can monetize to generate the remaining 75% of its revenues (year ended 2020).

Sustainability

From the Investor report, annual revenue for 2020 was at 630 million, with a 132% net dollar retention rate, reflecting a company that can retain its users and increases spending on the platform. Users don’t just use the platform; they also play a crucial role in recruiting other users and companies through word of mouth. Slack thus engaged the user in growing its market share in a way that competitors do not.

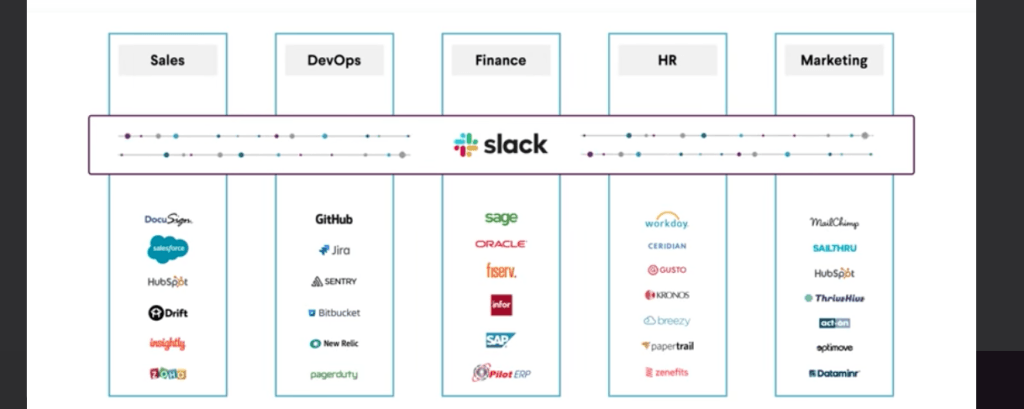

Instead of a “bundled” strategy, which is taken by competitors e.g., Microsoft Outlook, Slack pursues an integrated approach. Slack integrates with the 2000+ apps that are being used by the companies on the platform. Slack’s integration numbers are comparable to Microsoft which integrates with 2000+ apps- however, unlike Microsoft which has bundled its office suite of applications and needs to worry about continual development of the office tools that it originated, Slack can leapfrog this stage and almost “externalize” the development costs of these apps.

The more apps that companies use on Slack, the more valuable the Slack platform becomes to them because it reduces the costs of coordination significantly. Slack also experiences a positive data network effect (learning effect) because of the positive loop that it sets off.

Scalability

In the age of rapid growth, driven by remote work requirements- Slack is set to grow faster than ever. The number of companies that have workers remotely (especially with covid19 safety concerns) is at an all-time high. The biggest bottleneck remains the cost of having institutions form new habits. If you have a long institutional track record of working on email- it will seem costly to switch over the new platform- thus, Slack has to put in extra effort to onboard new organizations. That said, once onboarded, the efficiency of the onboarding itself becomes a defensive moat against competitors. Combined with their ability to integrate with other apps and platforms without worrying about competition, Slack will only become more valuable as a platform of networks, apps, and people over time, and extra even more value from all this data. It might just become the “Amazon of the workplace”.

Name: https://www.businessinsider.com/where-did-slack-get-its-name-2016-9

Investor Report: https://investor.slackhq.com/news/news-details/2020/Slack-Announces-Fourth-Quarter-and-Fiscal-Year-2020-Results/

Interesting article! I wonder about competition with Microsoft Teams – which offers some of the same functionality and features as Slack (though with more limited tech integrations). Especially in enterprise sales where the service is bundled with Office365 and many of Microsoft’s products are core to company operations (Excel, Outlook, etc.). My impression is that the simplicity of onboarding with Slack and more app availability may benefit smaller and more tech-focused companies, but IT departments at more traditional firms may be more inclined to stick with a stack that they’re already familiar with.