Plaid: A $5.3 Billion Winner

Visa recently announced plans to acquire Plaid for $5.3 billion dollars. How did this company become one of fintech’s biggest winners in only a few years?

Fintech is Everywhere

The financial services landscape is rapidly changing. User adoption has skyrocketed in recent years. In 2019, 75% of people with internet access used a fintech application for money movement compared to just 18% in 2015. However, the financial system is historically very disjointed. Anyone who has ever waited for a few cents to be deposited into their bank account to confirm their account has been verified in the traditional way knows that this isn’t a great user experience.

This is where Plaid comes in. Plaid serves as a gate-lifter in a highly fragmented industry. Their services allow users to access new financial service products including Venmo, Robinhood and Coinbase that require a link to their bank accounts. Being the go-to connector of financial services data has proven to be incredibly valuable as Visa announced it would be acquiring Plaid for $5.3 billion dollars in January 2020.

Discretely Connecting Apps with Banks

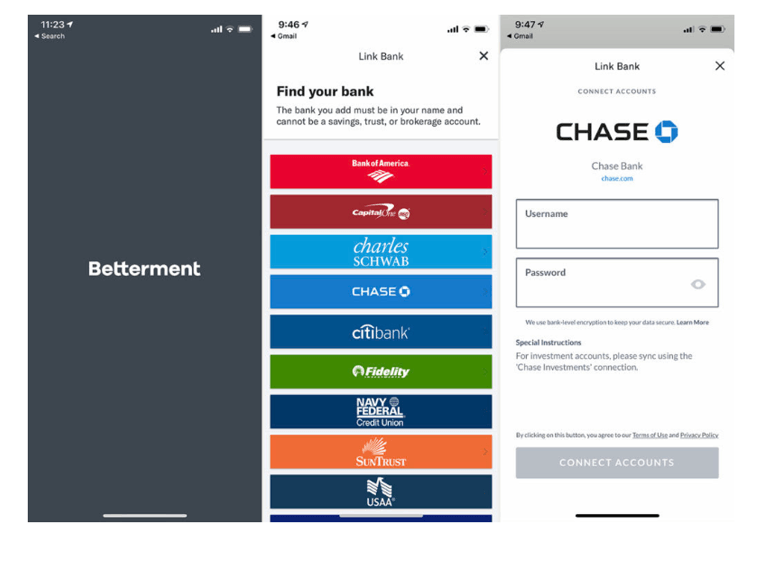

It might come as a surprise to discover that one in four people with a bank account in the U.S. has used Plaid’s services. Flying under the radar is a key element of Plaid’s strategy. Below is the interface a user sees when they add a bank account on Betterment. Although a user may believe this is an interface with Chase, their bank, in fact they are supplying their banking credentials to Plaid.

Online banking credentials are some of the most sensitive data for an individual. If Plaid was not so discrete about the service they are providing, a user may be less likely to provide their banking login information to a third party they may not be familiar with.

Easy Access for Consumers

Plaid makes the customer experience simple for any app that requires users to connect to their bank account. In a matter of minutes, a user can now connect their bank account to many popular apps including Venmo, Chime and Betterment.

Through these integrations, fintech apps can pull data on a variety of financial information for a user including:

- Verifying real time account balances

- Investment portfolios

- Liabilities including student loans

- Income and employment verification

Further, Plaid’s services provide access to fintech products for customers who do not bank with a major institution. Since Plaid has built integrations with thousands of financial institutions it is highly likely that a user’s bank will be available to connect with. No bank wants to disappoint customers who want to connect their account to a third-party app by not providing an integration. However, it would be challenging to integrate with every app that one of their customers may want to use. This is why banks are willing to work with Plaid and build just one integration that will work with apps across the industry.

Supporting Fintech Innovation

In addition to providing consumers with easy access to new fintech apps, Plaid makes developing new fintech products much simpler. In a world without Plaid, a developer of a new app that requires access to a users’ bank account would have to build out custom integrations to many financial institutions. This is not only costly but also slows down the development and innovation process. Building integrations with financial institutions can be particularly challenging since many banks do not have APIs that provide access to an individual user’s account. For those that do, their APIs are not consistent with each other. Plaid’s services allow developers to integrate with just one company seamlessly allowing new products to reach customers sooner.

What’s Next

With one of the world’s largest card payment organizations now behind it, it will be interesting to see what the future has in store for Plaid. First, the acquisition provides Visa with control over core fintech infrastructure and the data that comes with it. By buying the gate keeper of fintech data, Visa has positioned itself to be able to charge transaction and set-up fees on the increasing number of transactions happening via apps. Second, Visa now has access to insight of small, but potentially disruptive, companies that Plaid is integrated with. This could provide valuable information into threats and opportunities for Visa. Finally, Visa’s global footprint can help Plaid expand its presence enabling fintech transactions around the world.

Sources

- https://www.forbes.com/sites/jeffkauflin/2020/01/13/why-visa-is-buying-fintech-startup-plaid-for-53-billion/#198ed9672a8b

- https://www.wsj.com/articles/visa-nears-deal-to-buy-fintech-startup-plaid-11578948426

- https://stratechery.com/2020/visa-plaid-networks-and-jobs/?utm_source=Memberful&utm_campaign=cbf84be3ba-weekly_article_2020_01_14_free&utm_medium=email&utm_term=0_d4c7fece27-cbf84be3ba-111120181

- https://www.thestreet.com/investing/why-visa-bought-plaid

- https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.16856.html

- https://www.forbes.com/plaid-fintech/#1b9f2ccb67f9

- https://plaid.com/financial-institutions/

I hope that Plaid/Visa is pretty soon going to dab into bank transfers and make them faster and cheaper that they are now. I didn’t know about Plaid until I started specifically looking into the Fintech industry for my personal interests, although I’ve used apps that are integrated with Plaid in the background. So what is described above as being very “discrete” has worked so far. But not sure how the educated customers will perceive the “discrete” integration, I would prefer to know who I am giving permission to connect to my bank and other finances. Now that they have the Visa name backing them up there is no more need to play the discrete game under the radar.

I’m very curious about what Visa’s long term strategy with this acquisition is, especially from a geographic perspective because of the trend of open banking regulations in both emerging economies as well as parts of the developed world (UK, EU). Plaid creates value by aggregating the drastically different APIs (if any) and various methods of collecting account data (screen or statement scraping etc.) What would the role of Plaid be in a market where regulation dictates that all banking institutions are required to provide consumers their data when requested over standard APIs? I see the rationale of acquiring Plaid as a purely domestic player in the US market, and I really hope I am wrong, but I am not convinced that this would scale around the world!

I’m curious about Plaid’s branding going forward, now that they fall under the Visa umbrella. As you mentioned, I had no idea about Plaid until the past year or so, although I may very well have been using their technology. While this is a good strategy for them to build traction in the early days by leveraging the trust that customers place in the companies that built these apps, I wonder if it’s a lost opportunity for them going forward in gaining consumer awareness. If they were to brand their services, would it even be under the Plaid name, or perhaps under Visa’s name? It will be interesting to see how this plays out.

Great article!

Plaid is really a fantastic Fin-Tech success story. From your article, it seems as if Plaid exhibits cross-side network effects. You have banks and financial products providers (i.e., FinTechs) on either side. Financial product providers choose Plaid because they have a long-list of compatible banks – which maximizes their potential users. For the remaining reluctant banks, they are almost forced to work with Plaid – or risk alienating their customers who want to use these financial products with their bank account. These network effects seem to have been part of Plaid’s ‘secret sauce’ over the past few years.

To @ssingayapally’s comment above: I believe the main benefit of Visa’s acquisition of Plaid is distribution. Visa’s network will give them a tremendous ability to roll out Plaid’s services globally quickly. This may work better in some geographies than others – because of the trend towards open banking you mentioned. But open banking is still very juvenile: even in the UK, where open banking launched recently, there are major issues with the rollout. Even though they are required to comply, banks are dragging their feet and trying to resist sharing their data – so it will still take a significant amount of time before it can match Plaid’s API.