Hitting the Target in Retail

Currently Target’s digital sales only account for 5% of total sales, but through management’s strong investments in digital transformation, Target is on a promising path.

The retail industry has faced some of the biggest challenges with the rise of digital innovation.

Target faces a highly competitive retail landscape with Amazon and Wal-Mart. Currently Target’s digital sales only account for 5% of total sales, but through management’s strong investments in digital transformation, Target is on a promising path.

Challenges

Rise of e-commerce competition/decrease in foot traffic – The rise of e-commerce has led to decreased foot traffic for brick-and-mortar retailers and Target is no exception. With weakening in-store sales, Target has been suffering the pressure from high fixed costs of its stores.

In addition, Target has been slow in improving its own e-commerce website. Target’s competitor, Wal-Mart, had accelerated its move into e-commerce with the acquisition of Jet.com, which brought in more technology know-how as well as broadened its customer base with younger, more urban consumers.

Lastly, Target faces a strong threat from the most innovative player, Amazon, due to significant overlaps in product offerings and customer base. A recent Goldman Sachs study found that Target customers are more likely to have an Amazon Prime membership than customers of Wal-Mart and other discount retailers.

High capital investments for faster fulfillment and shipping – Amazon has also led the way for customers to come to expect 2-day shipping or even faster offerings in urban areas, and Target is still trying to catch up on fulfillment and logistics investments. However, building more fulfillment centers require time and high investment costs. Amazon has managed to do so by keeping margins near zero but like most public companies, Target has pressure to maintain or grow margins, and faces stronger scrutiny from shareholders for its capital investments.

Disruption from direct-to-consumer specialty startups – Many startups with direct-to-consumer models have taken share from retailers like Target with their more digital-forward business models. Some startups like Stitch Fix have gone public and now have more funds to compete against large players like Target. Other startups such as Bonobos (menswear) and Dollar Shave Club have been bought by large incumbents, also accessing more capital and resources to grow.

Opportunities & Recommendations

Leverage physical stores for fulfillment

Target already offers consumers to order online and pick-up in stores, but many consumers still want home delivery. Since fulfillment centers are costly, Target can dedicate part of its existing store space to become mini-fulfillment centers that ship online orders directly to consumer homes. These physical stores are located closer to consumers than fulfillment centers, so transportation costs will be reduced.

Leverage physical stores for unique customer experiences

Target can differentiate itself from other retailers by providing a unique and more enjoyable in- store shopping experience. There are particular items that consumers still want to touch and interact with before buying (e.g., apparel, electronics, large ticket items) and even online players are now launching an offline presence.

To create a better in-store experience, Target can optimize its inventory for those types of products and also improve inventory management through RFID tags. Levi’s has been piloting RFID for item-level tracking and found inventory accuracy rose from 63% to 95%.

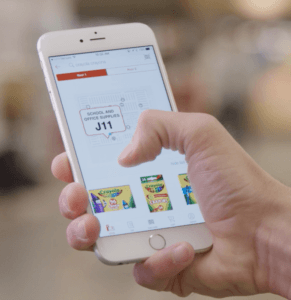

Target can use technology to create more convenient and interactive experiences for shoppers. Currently it’s rolling out Bluetooth beacon technology that adds an indoor mapping component to the mobile app, with the goal to help shoppers find their way through stores and locate the products they need. The app will actually show the shopper’s own location on the map and update as the shopper moves around the store. As a result, Target can connect a user’s online browsing habits with its in-store shopping behavior, and also send push notifications on recommendation and special deals to the shopper while in the store.

Some other retail innovations that Target could consider include streamlined/cashier-less checkout, personal stylists, AR tools for home goods shopping, and digital mirrors/in-store body scanners in fitting rooms.

These changes would require Target to invest in new store design and formats, seek 3rd party partners to provide many of the digital tools, and train employees for a new level of customer service.

Acquisitions and partnerships

The retail landscape is very competitive and Target must move fast to keep up with competition. Especially in attracting a new customer segment or certain technical know-how, Target will benefit from acquisitions and partnerships rather than building in-house since that is not its core competency.

Target has made great strides last year to catch up on fulfillment and delivery expertise. Last year Target made one of its biggest acquisitions in recent history: spending $550 million cash to purchase an Instacart competitor, Shipt, a startup that offers same day delivery for groceries. Target has started integrating Shipt to offer same-day delivery on Target.com and the Target app. Importantly, Target is joining Shipt’s online marketplace and sees value in building an ecosystem of partner retailers, including brands such as Costco and Meyers.

In addition, The company also acquired Grand Junction, a San Francisco based transportation technology company that has developed proprietary technology tools and has relationships with more than 700 carriers, allowing retailers flexibility in choosing the most efficient method for last mile delivery.

Collect more data to improve personalized offerings

To avoid having its stores simply become “show rooms”, Target must build brand loyalty and add value by offering personalized experiences.

Target is already starting to do some of this through beacon technology mentioned earlier, that will connect online to offline behavior. Target recently also launched a non-credit rewards card (Target Red) that will target younger consumers which studies found are less likely to apply for credit cards.

In addition, Target can also consider building other customer relationships, such as offering subscription services on its apparel, a key category for the company. Similar to Amazon’s Prime Wardrobe or Stitch Fix, it enables customer discovery of new offering, more convenience, customer engagement, as well as allow Target to gather more insights on its customers.

Organization changes, potential resistance and potential mitigants

There’s limited public data on organizational changes and internal resistance at Target. However, based on my experience working at a large, brick-and-mortar retailer (albeit in food/beverage rather than consumer goods), I will propose some important changes, potential resistance areas and potential mitigants.

Clear up technical debt – Many of us remember the 2013 data breach at Target, and I think outdated IT systems is a common occurrence at non-technical, large companies. There is usually a lot of technical debt with internal systems as funds are historically used at retailers for building stores and marketing costs. Target must be willing to allocate funds for the long but necessary process of improving internal systems.

Allocating to IT means less funds for other divisions, and shareholders may also push back on these investments that take longer-term to realize. Thus, management must conduct rigorous ROI calculations for the investments, prioritize the most important and urgent ones, and communicate the important of a longer-term perspective.

Change to digital-first culture to attract talent – Target must overcome its image as a slow-moving incumbent and demonstrate its digital-first culture to attract the engineering and technical talent (often younger employees) who often prefer the technology industry. A good first start is that Target has partnered Techsstars, a startup accelerator, to create a retail accelerator program in Minneapolis. Target must start to develop its technical capabilities in-house instead of continuing to outsource.

Managing labor – However, corporate employees with traditional physical retail experience may feel threatened by tremendous focus on digital innovations and move to e-commerce sales. To combat this, Target must integrate digital and physical assets as one, and not pit the e-commerce team against the in-store retail team. Performance incentives can reward their cooperation and emphasize overall sales.

Similarly, in-store employees may find their job roles changing as the store format and store purpose changes to add fulfillment and other skills. Although some employees may need to depart, there is value in the tenured, experienced employees and Target can invest in training the store employees with new skills which will motivate the employees to stay on (often cheaper than acquiring new employees).

Cultivate data-driven decision making – Many companies often have lots of customer data but don’t know how to gather insights. At my prior company, we often didn’t have the industry-leading tools to calculate to such a granular level, and decisions often lacked sufficient data support.

Although older employees may initially be intimidated or want to rely on their years of expertise and gut feeling, Target can offer more training to them and also get the employees involved in creating and launching pilot tests so they feel involved and see the feedback and results from using those tools. This will also help create a culture of experimentation and continuous improvement with feedback. One example is that Target has invested in Domo, a business intelligence tool that the whole company, including senior management, use frequently, to help make real-time decisions.

Conclusion

Target has come a long way from its 2013 data breach and its management has launched many promising initiatives to leverage its physical assets while building strong fulfillment capabilities. Whether Target succeeds will depend on whether it can continue to stay ahead of competition and overcome its organizational barriers to adapt to the new digital era.

Sources

- https://diginomica.com/2018/03/07/loving-store-puts-digital-transformation-target-looking-cybermonday-bullseye-year/

- https://www.cio.com/article/3183486/internet/targets-reimagined-store-aims-to-win-in-the-digital-world.html

- https://www.recode.net/2017/12/13/16771646/target-shipt-acquisition-price-550-million-grocery-delivery-same-day

- https://corporate.target.com/press/releases/2017/08/Target-to-Acquire-Grand-Junction-to-Expand-and-Imp

- https://techcrunch.com/2017/09/20/target-rolls-out-bluetooth-beacon-technology-in-stores-to-power-new-indoor-maps-in-its-app/

- https://diginomica.com/2017/08/17/target-bullseye-digital-delivery-transformation/

- http://www.mytotalretail.com/article/how-target-is-evolving-for-retails-digital-future/

Great post JY! I also wrote about Target and worked there before HBS. I think your recommendations are very good. At least one of them has already been implemented in a major way: using stores as miniature fulfillment centers to ship orders. Over 1,000 of Target’s stores ship orders to guests. In fact, during this past November/December over 70% of digital orders were fulfilled by stores as opposed to fulfillment centers through a combination of order pickup and ship-from-store. That is a pretty massive supply chain transformation for a company that has only been shipping out of stores for a few years. As you mentioned, shipping from stores reduces shipping costs. It also speeds up the delivery times and allows customers to purchase items that are out of stock at the fulfillment center. Prior to ship-from-store capabilities, out of stocks at the fulfillment center meant the customer would likely leave the website disappointed and without making a purchase. Shipping from stores also allows Target to adapt to seasonal demand (by adjusting store staffing up/down as needed) rather than incurring the huge costs necessary to build enough fulfillment centers to meet peak seasonal demand. Initially, getting store team members on board with the idea of evolving job responsibilities was a challenge but I think the company was mostly able to mitigate that with incentives. Stores were given full credit for the digital orders that they fulfilled, meaning that stores that fulfilled a lot of orders were rewarded with higher staffing. Over time stores began asking HQ if they could increase the number of digital orders being sent to them.

I thought you also had some very good ideas about adapting the store experience. Target intends to spend billions of dollars over the next few years remodeling hundreds of stores and reimagining how stores should function in the digital age. I think both your RFID and AR ideas would be beneficial. Target was doing some RFID testing while I was there, but I’m not sure what the rollout status is. It’s especially useful for apparel which can easily get out of place on the sales floor (thus, store team members have a very difficult time fulfilling digital orders for apparel products). And given how important the home category is for Target, I think implementing some AR functionality to shop those products would be very effective. I think Wayfair has implemented some AR capabilities in their app, but I would think that technology would have an even bigger impact in a store environment.

Sources:

https://www.digitalcommerce360.com/2016/11/16/target-now-ships-online-orders-more-1000-stores/

https://www.retaildive.com/news/target-hits-a-bullseye-with-holiday-sales/514391/

https://corporate.target.com/article/2017/03/reimagined-target-stores