Moving Ethiopia and Tanzania Forward: Public and Private Sector Collaboration in Intercity Transportation

By promoting private investment in hard infrastructure that fuel regional and intra-country transportation linkages, Ethiopia and Tanzania can lead 21st century growth and resiliency in East Africa, on the continent, and around the world.

Addis Ababa and Ethiopia. How to create additional value in the Industrial Parks strategy?

Ethiopia’s Industrial Parks strategy is a bold move to transform its economy into a manufacturing hub. Based on our research and analysis in and around Addis Ababa, we believe Ethiopia should formulate strategies to build cluster-based industrial parks around the city. In addition to building industrial parks scattered across the country, the clustering of industrial parks nearby Addis can maximize the return of infrastructure investment, improve productivity, and support Ethiopia’s export-oriented strategy.

The public sector can also put in place policies that actively support private investment in industrial park infrastructure. Currently, we see that park-supporting assets have low utilization. For example, we see that companies choose to use trucks instead of rail to transport goods because they see rail as prohibitively expensive and are unaware of its benefits. If this continues, it will ultimately make the construction and maintenance of railway assets economically unsustainable. To combat low utilization among all infrastructure assets, the government should follow a two-pronged strategy. First, it should support private sales and marketing companies to promote use of the assets by corporate actors and private individuals, which would increase concession revenue. Second, the government should guarantee some level of return to investors building the infrastructure up until the point in which concessions can close the ROI gap. Together, the government is incentivized to promote asset utilization and the private sector is incentivized to invest in more projects because it bears less risk.

Additionally, private investment in ICT solutions and/or opening up the telecommunications sector can help improve productivity and efficiency in the industrial parks, drawing more private investment overall. For example, incentivizing the creation of a single online platform to share information and data on supplies and processes, supported by reliable a internet connection, can make the logistics and communication among industrial parks more efficient. Ethiopia can consider inviting foreign and private domestic IT companies to diagnose technology needs, design a platform, and implement the appropriate systems and protocols for industrial park companies, in exchange for subscription fees or other equipment or usage fees. By enabling a competitive marketplace among firms, the government would allow for investment in the most cost-efficient and useful products and services.

For both of these, a strong public-private partnership framework is needed. Ethiopia should set up a centralized PPP project supervisory organization tasked with defining high-level PPP policies and improving process transparency to support its export-oriented economic development goals. And, it doesn’t need to be done all at once; the government can launch pilot projects, test policies, and then revise program designs, accordingly, based on learnings.

Dar es Salaam and Tanzania. How to create value by reducing sprawl and the impacts of sprawl?

We recommend that the Tanzanian government consider formulating a multicore economic development strategy that leverages the emergence of Bagamoyo Port to alleviate sprawl in Dar es Salaam. Currently, the government and Chinese investors have already agreed on investing in a new port in Bagamoyo. The next step is to create a clear, differentiated value proposition for Bagamoyo, so it can take on and grow some parts of the Dar es Salaam economy. As increased economic activity and accompanying jobs come to Bagamoyo, the area can also serve as a new core for residential development to help solve overpopulation in Dar es Salaam, making waste collection, water and energy provision, and urban transit more manageable for the separate municipalities.

Bagamoyo should be positioned as a free economic zone to promote liberal economic environment and accompanying benefits, and to connect Tanzania to global markets, such as India and China. In Bagamoyo, the main public-private partnership opportunities will be in setting up an industrial park that is complementary to the economic activities in Dar es Salaam. The new cluster should support Tanzania’s goals to diversify its economic structure and develop new manufacturing industries, like processing and electronic component-manufacturing.

To attract private investment in the logistics sector and the associated opportunities that become available in and around Bagamoyo, Tanzania should focus on three initiatives. First, the government should focus on limiting business-facing bureaucracy. For example, creating a single platform for e-permits and using automated cranes and vehicles at ports can improve overall operational efficiency. Second, policies must be designed that are favorable to the private sector. Aside from tax breaks for brokers, owners, and operators, strengthening the Tanzanian flag by setting high-standard maritime labor and environmental laws would be another point to push forward. This also includes providing an attractive legal framework around ship financing and insurance instruments, such as ship trusts or stock listings. Finally, an accelerated arbitration process around maritime disputes would further establish Tanzania as the regional hub for shipping.

What are our recommendations for the main avenues to attract private capital to the finance and delivery of public infrastructure in intercity transportation in the next decade?

We found that there were a number of avenues for the private and public sector to work together to finance and execute intercity transportation projects. The specific opportunities we found most promising and impactful fell into two categories: 1) risk-sharing structures or models, and 2) new and expanded markets.

Risk-sharing Structures or Models

Addis Ababa, Ethiopia

On the path to national development, Ethiopia plans to establish 15 industrial parks by mid-2018, and many more after. However, these parks are not currently linked to the public transport system, and the movement of workers in and out of the parks is organized by tenant-owned private vehicles. This is both inefficient and limits the total catchment area of labor for the parks. Private operators are wary of setting up a more integrated transportation link due to significant demand-side risks in terms of rider volume and fares. Here we see potential for a public-private partnership with two possible profit-risk sharing models.

First, with a gross-cost contract the government would collect fares and the bus operator would receive a pre-defined payment based on a metric, such as miles driven. This essentially shifts the demand-side risk away from the private operator and towards the government. The Cape Town Bus Rapid Transit (BRT) is one example of a successful implementation of such a contract. A private company operates the buses for a specific time and manages repair and maintenance, while the government collects fares and bears the revenue risk.

Second, in a net-cost contract the private operator would collect revenue and the government agrees to pay a subsidy if the operation is unprofitable. However, if the private operator is profitable, it pays a royalty back to the government. This contract balances risk more equally between the government and the private operator, with both participating in the down and upside scenario.

Given the large stock of underutilized bus assets in industrial parks, we believe there is real potential for a private operator to set up a public bus system, while mitigating the demand-side risk using innovative gross- or net-cost contracting. Lastly, supply exclusivity through an area or route contract would further incentivize a private operator and mitigate competition risk.

Dar es Salaam, Tanzania

In speaking with freight forwarders and port operators in Dar es Salaam, we consistently found that there was frequent non-compliance with Tanzania’s comparatively lower cargo weight limits, which furthered road deterioration and increased dwell time. Relatedly, poor road conditions also increased dwell time and forbid the ability to raise cargo allowances. Together, these put more cost pressures on shippers, freight forwarders, and the port itself, ultimately limiting the competitiveness and resilience of Dar as it seeks to become a regional economic gateway for the world to the rest of land-locked East Africa.

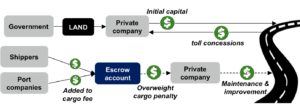

In an effort to fix this dual-sided, self-reinforcing problem, we suggest a new type of PPP model. First, we suggest the Tanzanian government provide land to private developers free of cost. With this land, these companies would be required to front the initial capital to build or renovate toll roads. To obtain a return on investment, they’d then be able to collect toll concessions from truckers an other drivers using the road. This step would clearly help direct investable capital to greater capacity, bankable road projects that are needed for Tanzanian competitiveness. Our estimates show that a toll project from Dar to the Zambian border, for example, could recover its cost in roughly 25 years, an estimate that does not include potential revenue generation from on-road retail concessions and advertising.

Second, in cooperation with the government and the banking sector, we suggest the establishment of escrow accounts for all shipping running through the Dar Port. When shipping cargo, shippers and port companies would be required to leave some portion of the total shipping fee in an escrow account, ideally taken from an existing, redundant or extraneous fee. Should the cargo be overweight, those escrow funds would go directly to the private company operating the toll road and would be mandated to be used for road maintenance and improvement. If not overweight, the cargo fee would be returned. This piece would safeguard the quality of roads, allow for consistently greater weight allowances through mandated maintenance fees, limit the incentive for overweight cargo for all stakeholders, and ultimately increase the number of shipments as the attractiveness of the Port and road improves. Secondarily, establishing the soft infrastructure around escrow accounts would help to further professionalize the legal and banking sectors and promote economic trust among counter-parties in transactions. (See figure below.)

New and Expanded Markets

Addis Ababa, Ethiopia

We believe Addis Ababa should position itself as an East African airport hub due to its proximity to tourist destinations and the strength of Ethiopian Airlines’ brand. In order to accomplish this, we expect private capital to be initially required to enhance the airport and its operations. Second-order economic activity would essentially help new infrastructure ‘pay-for-itself’ through more tax revenue and attractiveness to foreign investors.

In the near term, the government should open direct flights between secondary and tertiary cities. Currently, they follow a hub-and-spoke model where all flights are routed through ADD. In a new point-to-point model directly between secondary cities, additional revenue flowing to the secondary airports would provide funds for infrastructure improvements (i.e., better commercial options in terminals, enhanced runways, etc.). These new routes would be sustained by private airlines, who competitively bid on the opportunity to operate them.

In the long term, the government must incentivize companies to leverage ADD as a layover stop in lieu of Johannesburg or Nairobi. In order to accomplish this, the government must attract other airlines through incentives. The creation of a bidding system for preferred landing and takeoff times would offer a revenue-generating opportunity. This revenue, too, could then be used to enhance the quality of the facilities.

Additionally, Ethiopia should eliminate transit visas to promote longer tourist layovers. These longer layovers could be harnessed to promote economic activity inside Ethiopia. The Ethiopian government could commission exclusive rights through a competitive bidding process for private tour companies to facilitate activities (excursions, museums, hotel arrangements, etc.) for these extended layovers. Companies would see the profit potential in this opportunity and would therefore be willing to pay the government for the concession.

As a result of these collective activities, Addis Ababa would experience an influx of tourism. Funds from these new visitors could be earmarked for different development projects, such as a light rail connection from the airport into the city. These actions would trigger a self-perpetuating cycle, where investment in ADD brings in tourism, which increases tourism revenue, which allows for more investment into infrastructure, which attracts both new tourists and private capital.

Dar es Salaam, Tanzania

We learned that trucking is the crucial mode of transport for goods transiting from the port of Dar es Salaam, through Tanzania, to landlocked neighbors such as Zambia and the Democratic Republic of Congo. Currently, trucking firms operate in a centralized fashion; if a truck breaks down en route to neighboring countries, they send a replacement truck all the way from Dar to meet it en route for repair or to pick up the load and continue. This creates additional operational costs on trucking firms, increases dwell time, spoilage, and opportunities for theft, and creates negative environmental impacts

We see an opportunity for the government of Tanzania to eliminate these inefficiencies by incentivizing the creation of a decentralized truck maintenance platform. A decentralized model would have maintenance facilities distributed throughout the country along major trucking routes, so that trucks could be repaired quickly on-site and then efficiently returned along their journeys. In the PPP, the government would lease or sell public land along the main transit roadways to private companies below market rates. Private companies would buy or lease the land and invest their own private capital to build truck maintenance facilities. These private companies would earn revenue from trucking firms by providing them with contracted maintenance services.

This system will create several benefits. One, it will reduce costs for trucking firms by increasing uptime. Two, it will also reduce dwell time for cargo, reducing spoilage and opportunities for theft throughout for the entire logistics system. Three, there will be less pollution caused by replacement trucks driving unnecessary, duplicate routes. Finally, it will create a new industry bringing knowledge accumulation and skilled job opportunities.