Zara: A Better Fashion Business Model

Zara has the formula to fashion retail success: fast fashion through supply chain innovation.

When we think of the fashion industry, we tend to think of long lead times and two annual designer lines or collections: Spring/Summer and Fall/Winter. Designing each of these lines often takes place a full year before launch. Thus, if a retailer misidentifies customer demands and has a “miss” with its designs, it would lose sales, face markdowns and miss targets.

Zara is a small clothes manufacturer in the north west of Spain and a pioneer of the “Fast Fashion” business model which eliminates “fashion misses” risk. The company’s strategy involves stocking very little inventory and updating collections often to deliver the latest emerging fashion trends. This means fast manufacturing, fast shipment, and thus fast purchase; the fast delivery and turnover of apparel creating a sense of scarcity and urgency. Customers understand that most items will be sold-out or replaced within a week or two so they are confronted with quick buying decisions and are encouraged to visit stores often. Case in point, Zara customers visit its store 17 times per year in contrast to The Gap whose customers visit just four times (Fashion: A better business model, 2014). The limited supply of merchandise thus allows Zara to achieve quick sales, no markdowns and limited wastage.

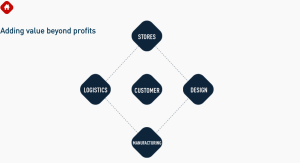

To effectively deliver on its business strategy and differentiate itself from other retailers, Zara has invested heavily in its IT infrastructure and has succeeded in implementing a nimble supply chain. Its operating model covers all stages of the fashion retail process: stores, design, manufacturing, and distribution.

Figure 1. Zara’s Operating Model Components

Source: Company Website, http://www.inditex.com/en/our_group/business_model, accessed December 2015

Design and Stores

Instead of designing a collection long ahead of its release, Zara tries to continuously recognize emerging fashion and incorporate them in its designs and products. Through sales data capture and shopper anecdotal feedback, store managers daily report tens of thousands of customer reactions to design teams. Sale trends are analyzed along to runway releases and quickly incorporated into the next line of production, creating a cycle of iteration and innovation. Once designed, new fashions are produced in relatively small quantities, so “misses” can be quickly identified and discontinued and “hits” built-upon and re-released.

Manufacturing

One of Zara’s core competencies is its ability to apply “just in time” manufacturing to fashion production. Most of manufacturing is done close to its home base, in and around the Iberian Peninsula. Garment making is subcontracted to specialists whose automated factories constantly create unfinished colorless (“greige”) goods. As soon as Zara decides on a new design, the “greige” goods are sent into Zara’s own finishing shops where they are turned into marketable products. High European manufacturing costs are offset with cost savings associated with fast turnarounds (e.g. less inventory in warehouses, less discounts and markdowns, etc.)

Logistics

Distribution takes place twice a week to ensure store inventories are constantly kept fresh and unique. The logistics system, based on proprietary software, ensures that the time between receiving an order at the distribution center to the worldwide delivery of the goods in the store is between 24 and 48 hours. Zara adopts a centralized distribution system with every single item of clothing coming through its distribution center in Spain, ensuring consolidation of orders to individual stores.

Zara has thus far been extremely successful, with sales growing approximately 10% year on year and reaching $19.7 Bn. in fiscal 2014. Its performance puts it ahead of other “fast fashion” retailers such as Uniqlo and Gap and only second to H&M (Zara leads in fast fashion, 2015). Part of this success comes from its rapid growth in emerging markets (over the past few years, 50% – 60% per cent of new store openings were in China, Russia, Poland, Mexico and a few other markets (Fashion: A better business model, 2014)). It will be interesting to see whether its winning centralized operating model will stand the strain of its global expansion.

Bibliography

Fashion: A better business model. (2014, June 18). Retrieved from Financial Times: http://www.ft.com/intl/cms/s/2/a7008958-f2f3-11e3-a3f8-00144feabdc0.html#slide0

Zara leads in fast fashion. (2015, March 30). Retrieved from Forbes: http://www.forbes.com/sites/walterloeb/2015/03/30/zara-leads-in-fast-fashion/

How Zara became the world’s biggest fashion retailer (2014, October 20). Retreived from The Telegraph:

The future of fashion retailing revisited (2015, July 23). Retrieved from Forbes:

Thanks Aya. As a loyal Zara customer, it is very interesting to see how the company supports the fast fashion idea with fast operations throughout its supply chain. The one question I have is that as Zara expands globally, does it make sense for them to maintain the centralized distribution system, with all its clothing items going through the distribution center in Spain before being dispatched to across the globe? Will it be easier and faster to also build manufacturing and distribution facilities elsewhere in the world?

Thank you for taking the time to read Zhihan! I allude to your concern at the end of my article: Zara’s expanding global reach could finally put its operating model to the test. In 2013, China became Zara’s second-largest in terms of the number of stores (142) and that comes with many challenges. It is worth noting that many base “greige” items are manufactured in China, shipped to Spain for finalization, and then redistributed back to Chinese stores – probably not the most efficient process. I suppose, to your point, Zara could decouple design from finishing and distribution and localize functions in regional hubs but the secret to its success so far being centralization of design/manufacturing/distribution, I worry it would no longer be the same Zara.

Aya, this was super interesting. Thank you for sharing. Zara opened their first store in India, a couple of years back and ever since, I have been a loyal supporter. Having now traveled to other Zara stores across some International locations – I have realised that there is a significant delay between collection launches between US/ Europe and Asia markets. Surprisingly, some collections don’t even reach emerging markets. I am wondering if this is because of the limitations of the centralized distribution model or is this is a planned strategy to test out collections in the West first? This is similar to what TV industry did earlier. Serials produced by HBO would release in India almost a year later but soon they realized that the delay harmed them, in the form of piracy. Now, they try to atleast launch the popular series on the same date across the world. As shoppers in emerging markets become more conscious to this disparity – I am wondering if this can harm them in the future.

Thank you for commenting Nishika!

To answer your question, speed in decision making plays a large role in Zara’s model. Moreover, different geographies could have different fashion trends at any given moment in time: overalls could be popular in Barcelona while midi skirts could be all the rage in Mumbai. To this end, and to keep up with the fast changing fashion requirements, Zara has decentralized its decision making structure throughout the organization. Individual store managers are given the authority to decide when items go on sale, and which items in their to store to place orders for. Managers also have autonomy to perform their jobs without any second-guessing from higher management.

This is also something I noticed first-hand. Beirut has four Zara stores and the selections are never identical. I think this is less of a collection delay strategy and more of an individual store decision, which is great for us consumers as we can influence managers decisions through purchases and feedback.

I was going to ask the same question as Zhihan, so I won’t necessarily repeat that… but now that I’m already here and have read your post I’ll ask two other questions:

– From what I know to keep up with fashion trends, Zara also uses employees on the store floor to see what people are wearing and base their designs on that, how effective do you think that is?

– In the world of fashion to you expect (like in the world of music and entertainment) that most things that are popular are popular globally with some local twists, or that fashion should be very different region to region? How would that effect Zara?

Hi Xavi! I answer your first question in my reply to Zhihan and your third in my reply to Nishika. Great minds think alike 🙂

To your second question, from my readings, I gather that Zara does empower store managers to discern and report customer wants and preferences. For example, it purposely leave store managers without computerized data on in-store stock. Instead, they receive hourly sales and replenishment reports on a handheld device. As a result, they can’t just sit in an office and read reports but must speak with sales clerks and check the racks and the stockroom frequently. Store managers also have a high incentive to collect the right data as they are responsible for deciding what merchandise to order (rather than hanging up the items sent from HQ), and their compensation is partially linked to the accuracy of their sales forecasts and sales growth. I’m not entirely sure how this information is reported back to HQ (through which systems) but designers would cross-check feedback from different locations to check wether observations were local or global and then react in new designs.

Great read Aya! What I really like about Zara is that even in the retail space where inventory is a big challenge given the large number of SKUs, they have been able to reduce inventory while at the same time launching new designs twice every week! Achieving this fine balance would not have been possible without the RFID tracking on their SKUs for instant analytics on demand trends, JIT and the soft launch trials for new designs. Having experienced Zara in Dubai and London, I do think that all designs were not available even in a shopping hub like Dubai but am not sure if it was on purpose based on the regional demand or the delay in merchandise reaching there due to centralized distribution.

Great minds do think alike! I just answered Nishika’s question which was in a similar vein. Thank you for reading and commenting Deepika!

This is a great example of a process optimized for cycle time and throughput time, since they need to be reactive. It’s clear they incorporate this strategy throughout their design funnel, which enables them to get products to the shelves quickly — and fail fast.

Yes, exactly, fail fast and recover faster. Thank you Yaro!