YouTube Effect: A Whole New Supply Chain – Will TV Thrive or Die?

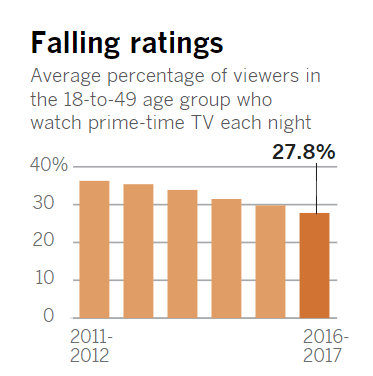

Television ratings are falling [1] and 95% of new television show concepts fail [2], but that’s about to change. Digitization is disrupting the television supply chain – and it’s not only Netflix! Data driven content selection is shifting power to the audience [3], improving demand prediction and accelerating content creation throughput time from months to days. Thought supply chains digitization only applied to manufacturing? Think again!

ABC’s customer promise is to provide entertainment that matches its audience’s viewing preferences (which is hard to predict and frequently change). This customer promise is not unique, ABC is in fierce competition with other television studios and internet competitors such as YouTube and Netflix. Supply chain efficiency (measured in high viewership & low production costs) is critical to profitably delivering on this promise. [4]

Digitization allows the supply chain to have greater visibility on demand signals across the network and offering the ability for mass customization. [5] This is having a significant impact on the media supply chain.

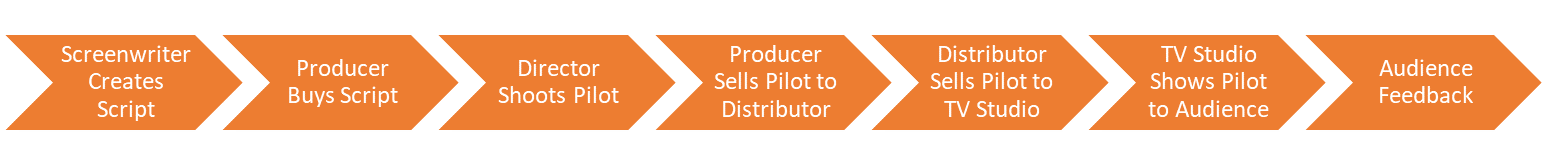

The traditional media supply chain is slow and prone to forecast error (not unlike the TOM Beer supply chain!). Similar to the traditional fashion industry, it relies on a long chain of producers, directors and distributors that each strive to predict end consumer demand and produce content 6-18 months ahead of delivery. [6] When this works, ABC is able to deliver a hit show to its customers. When it does not, it is left with a product with little customer demand and an expensive replacement process (requiring a long throughput time if starting a new show from scratch or carrying expensive safety stock of extra purchased shows).

Figure 1: Traditional Supply Chain (6-18 months)

This is being disrupted by a smarter and shorter supply chain that leverages real-time viewer data to predict (and constantly re-predict) what content will be popular.

Figure 2: New Data Driven Supply Chain

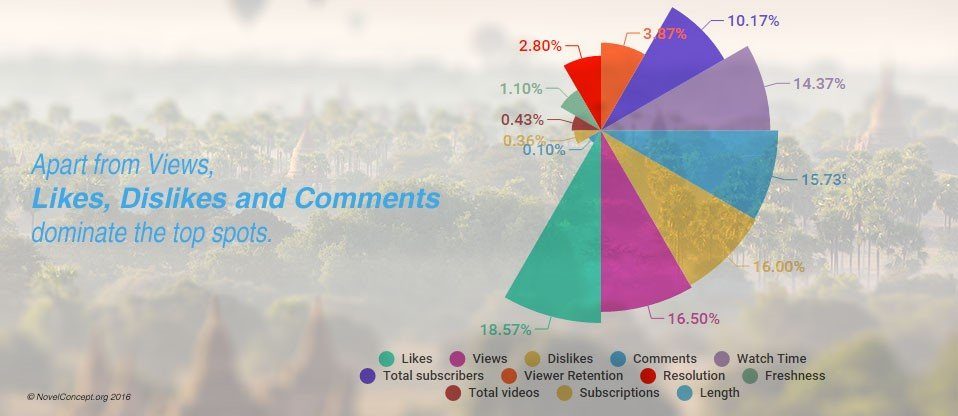

This happens in real-time, if YouTube initially predicts a video will be popular based on the first set of viewers and puts it at the top of the page but there’s a sharp demand drop the next minute, it will update immediately. As a result, instead of a producer predicting and choosing what is shown to the audience, the consumer is deciding real-time what gets shown by voting with their views, likes, comments and shares. [7]

Figure 3: YouTube Ranking Factors

Source: NovelConcept.org & [7]

What is ABC Doing? (Short-Term & Medium Term)

As a short-term strategy, ABC is working with data analytics firms such as Brandimensions and PropheSEE to leverage real-time user data from digital sources such as Twitter, discussion groups and blogs to predict hit shows. Doing so, PropheSEE was able to predict that ABC’s Desperate Housewives would be a breakaway hit two months before it premiered. [2]

This allows ABC to invest more in high potential shows and have less wastage, improving overall hit production yield (hit shows divided by total shows produced). This allows the supply chain to better predict end-user demand and reduce variability associated with cancelled shows; lowering overall industry costs associated with cancelled shows. [8]

As a medium-term strategy, ABC is incorporating popular user generated content into its shows. ABC partnered with Jukin Media to license and show popular user-uploaded YouTube clips on Good Morning America. [9] And ABC’s parent Disney is exploring a competing service to Netflix that could provide ABC further data about its audience. [10] While this is a good start, ABC could be doing much more.

Recommended Steps (Short-Term & Medium Term)

In the short-term, I recommend that ABC goes beyond its third-party data relationships and conducts deep data analytics (from both television and ABC.com) on what specific characteristics of its existing hit shows are favored by customers. It could use this data to predict which future shows will be a hit. By using deep data analytics, it may be able to identify certain actors, themes, directors and formats that will work well. This data could be used to augment decision making by ABC’s producers. Netflix has successfully done this with its House of Cards series:

“Executives at the company knew it would be a hit before anyone shouted “action.” It already knew that a healthy share had streamed the work of Mr. Fincher, the director of “The Social Network,” from beginning to end. And films featuring Mr. Spacey had always done well, as had the British version of House of Cards. Big bets are now being informed by Big Data, and no one knows more about audiences than Netflix.” [11]

I would also recommend that ABC shortens the feedback loop from its customers by showing pilot TV shows to online audiences far ahead of the series premiere. Amazon has successfully used this strategy to help predict demand.

“A group of 14 “pilot” episodes had been posted on Amazon’s website a month earlier, where they were viewed by more than one million people. After monitoring viewing patterns and comments on the site, Amazon produced about 20 pages of data detailing, among other things, how much a pilot was viewed, how many users gave it a 5-star rating and how many shared it with friends.” [12]

In the medium-term, ABC should explore innovative ways to leverage popular YouTube videos and the shorter associated supply chain. For example, Fox has successful created an TV series made up entirely of popular YouTube clips with Terry Crews as a narrator.

“Hosted by star Terry Crews, the show has been a solid performer for the network on its frequently spotty Friday, averaging a 1.1 rating among adults 18-49 since its debut and performing especially well among young men and teens.” [13]

ABC could also incorporate popular audience generated videos in its broadcast news coverage of special events such as the Grammy’s and the NBA finals. This could include videos from both celebrities at the event and regular audience members. Snapchat has successfully utilized this strategy to attract millennial viewers, showing audience provided videos (“stories”) of major events. [14]

ABC has the opportunity to combine both the talent of its TV producers and deep data analytics to more reliably predict consumer demand and gain a competitive advantage [15] – this is similar to how the combined human + IBM Deep Blue team could beat the best human-only and computer-only chess competitors. [16]

Open Discussion Questions

- Will we lose out on the “art” of making television as companies increasing turn to data? (parallels to The Gap case on using Big Data instead of fashion designers?)

- Should studios invest in bold avantguard shows that push into new directions that are not supported by existing audience data? If so, what can they do to mitigate risk of failure?

- Where will the media supply chain go next?

[791 words]

References

- Battaglio, Stephen. 2017. “Broadcast Networks’ Premiere Week Ratings Take A Hit As Viewers Watch On Delay.” LA Times. http://www.latimes.com/business/hollywood/la-fi-ct-ratings-premiere-week-20171004-story.html.

- Mcclellan, Steve. 2015. “Does The Web Know Which TV Shows Will Be Hits?”. AdWeek. http://www.adweek.com/brand-marketing/does-web-know-which-tv-shows-will-be-hits-77455/.

- Van Dijck, José. 2009. “Users Like You? Theorizing Agency In User-Generated Content”. Media, Culture & Society 31 (1): 41-58. doi:10.1177/0163443708098245.

- “The Agile Supply Chain : Competing In Volatile Markets”. 2000. Industrial Marketing Management, Vol 29 (1): 37-44.

- Harvard Business Review. 2017. “Digitizing The Supply Chain”, 2017.

- Owens, Jim. 2016. Television Production. New York, NY: Focal Press.

- Gallagher, John R. 2017. “Writing For Algorithmic Audiences”. Computers And Composition 45: 25-35.

- Guo, Zhiling, Fang Fang, and Andrew B. Whinston. 2006. “Supply Chain Information Sharing In A Macro Prediction Market”. Decision Support Systems 42 (3): 1944-1958.

- “Our Work | Jukin Media”. 2017. Jukin Media Inc. https://www.jukinmedia.com/our-work.

- Flint, Erich. 2017. “Disney Unveils New Streaming Services, To End Netflix Deal”. WSJ. https://www.wsj.com/articles/disney-unveils-new-streaming-services-1502226133.

- Davenport, Thomas H, and Jeanne G Harris. 2010. Competing On Analytics. Boston, Mass: Harvard Business School Press.

- Sharma, Amol. 2017. “Amazon Mines Its Data Trove To Bet On TV’s Next Hit”. WSJ. https://www.wsj.com/articles/amazon-mines-its-data-trove-to-bet-on-tv8217s-next-hit-1383361270.

- O’Connell, Michael. 2015. “Fox Orders More ‘World’s Funniest Fails'”. The Hollywood Reporter. http://www.hollywoodreporter.com/live-feed/ABC-orders-more-worlds-funniest-773139.

- Haimson, Oliver L., and John C. Tang. 2017. “What Makes Live Events Engaging On Facebook Live, Periscope, And Snapchat”. Proceedings Of The 2017 CHI Conference On Human Factors In Computing Systems – CHI ’17.

- Thomas C. Redman. 2008. Data Driven : Profiting From Your Most Important Business Asset. MIT Press.

- Newborn, Monty. 2012. Kasparov Versus Deep Blue. New York, NY: Springer.

Note: Word count excludes embedded exhibits and references.

This is a fascinating topic and an insightful application of supply chain management. I agree that data on viewer preferences will improve ABC’s ability to predict the success of pilot programs and thus improve its overall hit production yield. However, data analytics cannot change the fact that lead times for content creation are 6-18 months ahead of delivery. Thus, while ABC may possess data today that indicates viewers prefer medical dramas, by the time a show airs 6-18 months later consumer preferences may have changed. Data can help inform content creation but long lead times reduce the value of that data. GAP may offer a marginally improved assortment due to Big Data, but if GAP cannot rationalize its supply chain to match Zara’s speed, it will never be able to adapt its merchandise quick enough to keep pace with fast fashion. If ABC wants to compete long-term it must generate premium content more quickly at lower cost. I question whether this is even possible.

Very interesting topic Paul – I agree that using data analytics to predict future hits will be a key differentiating factor for the entertainment industry going forward. As you highlighted, the immediate concern that arises is whether creativity will lose space in this new world. I believe this will not be the case because of two key mitigating factors:

a) Dissemination of the content creation: with technological developments, producing content is more and more accessible and disseminated, especially through platforms such as Youtube or Patreon offering quick feedback and financial incentives for popular content [1]

b) The power of experimentation: even major content producers such as Netflix still allocate part of their portfolio to testing and expansion of their data universe – some of those bets have potential for huge payoffs, bringing fresh air to content creation [2]

[1] Robertson, Adi. 2017. “Inside Patreon, the economic engine of internet culture”, The Verge. https://www.theverge.com/2017/8/3/16084248/patreon-profile-jack-conte-crowdfunding-art-politics-culture (Accessed on November 29th 2017).

[2] Persaud, Christine. 2015. “Netflix original series goes international, new show 3% shot entirely in Brazil”, Digital Trends. https://www.digitaltrends.com/movies/netflix-original-series-3-percent-shot-in-brazil (Accessed on November 29th 2017).

Interesting read. I think the biggest risk to using a short feedback loop (customer preference) to determine the production of art (content generation) is a long term loss of innovative and diverse viewing experiences. While the rapid production cycle allows studios to capture the momentum of customer preference trends, they cede the power to create trends. Eventually, this leads to the homogenization of the art form, and (in my opinion), its eventual death. Rather, studios should work to offer and promote new art (even if its heavily commercialized) in order to introduce consumers to new and interesting material that they did not know they want.

While I agree that a shorter supply chain using real-time data to predict demand has the potential to enable more tailored programming, I do agree with UserError that this will likely come at the price of innovation and diversity. I think this is because most shows that have become large-scale hits, usually spent the at least half the first season developing the plot. If viewers were to cast judgement on the show based on these preliminary shows, we would no longer have long-form, story-telling shows and instead shift towards very simplistic plot-lines that can more easily instantaneously capture audiences.

I do think that this shorter supply chain approach could be used to diversify content production. As people increasingly have access to the internet, content used in shows can increasingly come from individuals as opposed to relying solely on creatives at production studios. In think this is a significant untapped source of content that needs to be integrated into main-stream media. Companies such as ABC could host shows on their platform that are created by every-day people, thus both diversifying their content whilst also decreasing production costs.

This was a fascinating read, PJ. I think you hit the critical questions, but I am still left wondering how much the supply chain can really be shortened here. Creating and producing a high quality television show is a time consuming, laborious process. Would your recommendation be that studios like ABC essentially just create a pilot, see how well it does, and then make a go / no-go decision? Movies would seem to be even more challenging, in that you don’t have the opportunity to just make a pilot and see how well it performs. In a scenario where television and movie studios adopt this trial balloon process on a large scale, would we lose movies that initially wouldn’t have had broad appeal, but ultimately became cult classics (i.e., Napoleon Dynamite, The Big Lebowski, etc.)?

When it comes to creating and producing original content, I am still not convinced that major studios like ABC, NBC, etc. will be able to withstand the competitive threat from growing streaming services.

PJ,

This is a very interesting take on digitalization within the supply chain. I feel like we do not have to argue against the success of the Netflixes, YouTubes, and Hulus of the world. It is clear that over-the-top digital entertainment platforms have been able to utilize big data and consumer behavior to better predict which shows and movies will resonate based on the consistent growth in both revenues and subscribers these platforms have exhibited.

I understand the concern you posited about the lead times of movies and TV shows, and that although you know what consumers find interesting now, does this necessarily mean after 18 months of production this will still resonate? I would argue that the case for entertainment is extremely different than predicting fashion trends (i.e. the Gap case that you mentioned). Entertainment is somewhat timeless and does not succumb to seasonal trends in the way fashion does – that is why people still love the classic movies and TV shows. What the data predicts today about what viewers want to see will still hold true 18 months from now after production wraps, and for this reason I think it is absolutely critical for all movie studios and production companies to adopt the digital Netflix/Hulu model in order to track viewer behavior more effectively.