You’re Not You When You’re Hot – Mars. Inc & Their Mission To Combat Climate Change in a Generation

As one of the largest global food manufacturers, Mars is serving as a beacon on supply chain adaptation in a world full of crisis.

Rapid global expansion of supply chains have simultaneously fueled decades of global growth of both GDP and temperatures. Now, corporations are beginning to face the costly reality of their greenhouse gas (GHG) emissions as the consequences manifest themselves in many ways, from rising raw material prices to business disruptions. Because of the resulting pressures of climate change, entire supply chains are realizing higher costs forcing corporations to decide between bearing the higher costs and generating lower profits, passing costs on to customers and risking the wrath of their elasticity, or forcing their supply chains to adapt. Mars Inc., one of the largest food companies in the world with $35 billion in sales and operations on every continent across more than 73 countries, is serving as a beacon and leading the charge in adapting its supply chain [1].

Mars Supply Chain Exposed

Raw material is one of Mars’ largest areas of exposure to climate change impacts. Rising temperatures and changing precipitation patterns have resulted in more frequent and severe heatwaves, droughts, and floods, lowering commodity supplies and causing farmers to increase planting to offset lower yields. Mars has felt this pressure in recent years via cacao, one of its largest inputs. Cacao, the primary input for chocolate, is a particularly vulnerable crop with a typical tree yielding only 10% in perfect conditions [2]. Production is extremely concentrated with 70% originating from West Africa, an area that has seen increased temperatures reduce regional humidity levels – a necessary condition for cacao tree growth – in recent years. The result has been a significant supply-demand imbalance that drove cacao prices in 2016 to multi-year highs [3].

Mars’ immense global manufacturing footprint leaves the company’s profit margin particularly sensitive to energy, transportation and warehousing costs. As climate change impacts increase, government regulation over fossil fuel-based energy will grow and prices will continue to rise hurting both production and transportation costs. Additionally, energy usage is expected to grow in order to maintain consistent facility temperatures in light of increasing temperatures – particularly relevant to Mars’ food storage [4]. Transportation costs are also further challenged by an increase in disruptions from severe weather events such as hurricanes. Beyond fossil fuels, Mars will need to deal with a growing rate of water scarcity in its chains – 43% of Mars plants operate in high-water stress areas. If water efficiency is not addressed, Mars will need to re-assess its existing footprint to areas that are less likely to be impacted [5].

Sustainability in a Generation

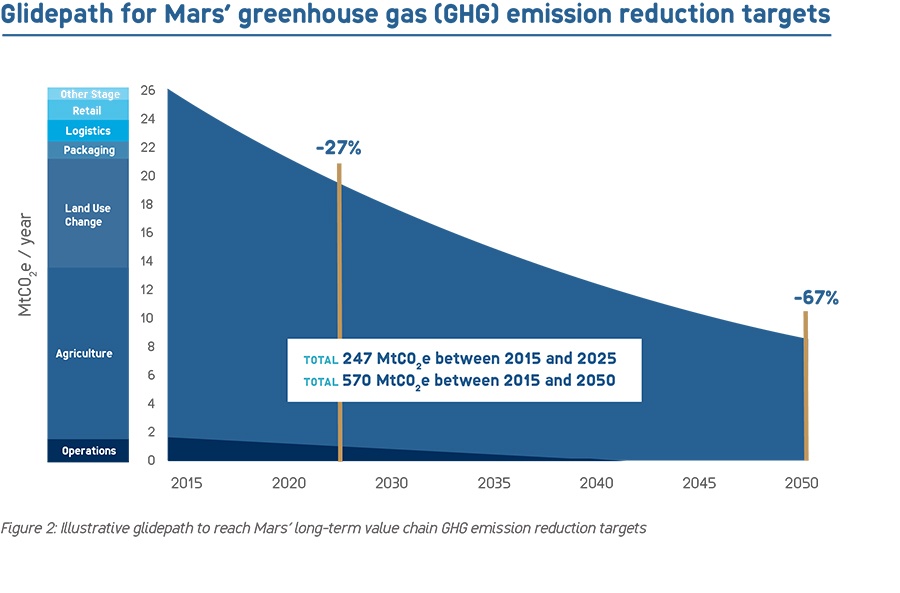

In 2017, Mars launched its Sustainability in a Generation Plan (SAGP) and has committed to investing $1 billion over the next few years to combat threats facing the world and its business, including climate change [6]. Such plans are not completely new as Mars has set specific sustainability goals in past years; however SAGP is a bold stroke plan in that it aims to create step-function change that will adapt Mars’ entire value chain to the changing environment. Furthermore, Mars is committing to do its part in helping achieve the international Paris Agreement’s goal to keep global temperatures from rising above 2 degrees Celsius from pre-industrial times by reducing GHG emissions by 27% by 2025 and by 67% by 2050 from 2015 levels [7].

Mars is adapting its value chain by working directly with suppliers to implement its plan. Only a few key examples of numerous intitaives employed by SAGP include:

- Forming development and village centers to educate farmers on efficient farming practices;

- Sourcing 23 raw materials (60% of sourcing volume) as 100% certified sustainable (varying timeframe by commodity);

- Investing in mapping of genome sequences of key crops to identify traits that improve yields, water efficiency, and climate adaptability; and

- Purchasing and producing renewable electricity to cover 100% of operations in 11 countries by 2018 [8][9].

Although the SAGP addresses the more obvious and tangible risks, it is unclear how Mars plans to mitigate supply chain disruption from the higher potential for short duration extreme weather events such as hurricanes or blizzards that have potential to cause longer-term disruption. Despite Mars scale and ability to absorb these type of historical one-time impacts, Mars must still focus its efforts on disaster recovery as these events are likely to no longer be one-time.

Profits or Social Responsibility Aside – is it Enough?

Beyond managing climate change’s impacts to their supply chain and profits, Mars is clearly also responding to a growing pressure by consumers to hold corporations responsible for their impact to our environment. The good news is that 66% of consumers are willing to pay more for sustainable brands, a statistic that has been growing steadily over the past few years [10]. However, Mars states its goal is to stay within its own share of future global GHG emissions – why should Mars’ efforts stop there? As one of the largest food manufacturers in the world, or should it carry more responsibility than just its own?

Exhibit 1

Exhibit 2

Exhibit 3: M&M’s Fans of Wind Commercial

(790 Words)

[1] “Forbes Welcome”. 2017. Forbes.Com. https://www.forbes.com/companies/mars/.

[2] “Mars, Incorporated – Improving Cocoa Yields In The Future”. 2017. Mars, Incorporated. http://www.mars.com/global/sustainable-in-a-generation/our-approach-to-sustainability/raw-materials/cocoa.

[3] International Cocoa Organization. 2015. “Annual Report”. International Cocoa Organization.

[4] BSR. 2011. “Adapting To Climate Change: A Guide For The Consumer Products Industry”. BSR Industry Series. https://www.bsr.org/reports/BSR_Climate_Adaptation_Issue_Brief_CP.pdf.

[5] “Reducing Water Use With Sustainability Methods – Mars, Incorporated”. 2017. Mars, Incorporated. http://www.mars.com/global/sustainable-in-a-generation/healthy-planet/water-impact.

[6] “Mars, Incorporated Unveils New Sustainable In A Generation Plan”. 2017. Mars, Incorporated. http://www.mars.com/global/press-center/newsroom/unveiling-our-sustainable-in-a-generation-plan.

[7] “Global Climate Action Position Statement – Mars, Incorporated”. 2017. Mars, Incorporated. http://www.mars.com/global/about-us/policies-and-practices/climate-action-position-statement.

[8] “Mars, Incorporated – Our Sustainable Sourcing Plan”. 2017. Mars, Incorporated. http://www.mars.com/global/sustainable-in-a-generation/our-approach-to-sustainability/raw-materials.

[9] “Mars, Incorporated – Improving Climate Change Efforts With Science”. 2017. Mars, Incorporated. http://www.mars.com/global/sustainable-in-a-generation/healthy-planet/climate-action.

[10] “Cite A Website – Cite This For Me”. 2015. Nielsen.Com. https://www.nielsen.com/content/dam/nielsenglobal/dk/docs/global-sustainability-report-oct-2015.pdf.

This is an interesting article to read after our IKEA discussion, as it appears that Mars has adopted a similar strategy of sourcing materials that are certified as sustainable and reducing GHG emissions in its operations. As a brand, however, Mars does not strike me as one that would benefit from marketing itself as a sustainable brand. While a consumer immediately identifies their wooden table as having come from a tree, it is a much further stretch to imagine the crops in West Africa that became a packet of M&Ms. Assuming a negligible increase in consumer willingness to pay from Mars’ sustainability actions, then, it seems like the only justification to pursue even more aggressive emissions reductions targets are (a) cost savings, or (b) an ethical argument that might be quickly dismissed by investors.

Interesting piece with helpful exhibits. A reaction to one of your questions is whether or not an increased focus on sustainability would have a detrimental impact on corporate profits. 66% of consumers state that they are willing to pay more for sustainable products, but is that enough? And can we be sure that the sustainable products will have the same taste and quality in the long term? Mars executives are responsible for making decisions that maximize shareholder equity. Too much focus on sustainability and too little focus on financials could open up the company to being targeted by activist shareholders like Icahn or JANA. Given activists’ attention to financials, overemphasizing sustainability today could derail the company’s long term commitment to the environment.

Hearing about the efforts Mars is making via SAGP makes me wonder how they will navigate the inevitable trade-offs that will accompany its implementation. What happens when, to the above comments, short-term profit may suffer as a result of the investments, even if they hopefully will pay off long term? I’m wondering how Mars is supporting suppliers, especially the smaller ones who may be less able to shoulder a new investments, in making these sustainable changes. I’m also wondering how Mars will navigate the situation of realizing via the genome analysis initiative that some crop techniques that may improve yield (one of the stated goals) may simultaneously be harmful to the environment. Another sectionmate’s essay was about coffee, and the author noted that some farmers were turning to less sustainable practices as a result of the rising costs and volatility of climate change in order to increase yield. This will be a tricky situation that Mars will run into numerous times so hopefully they have put thought into how to balance the competing goals of profit and sustainability.

Thanks for the great article! In response to the previous two comments above, the cynic in me questions if Mars somehow has something to gain financially by leading the charge toward sustainability. I wonder how much of their initiative is led by a feeling of corporate social responsibility versus a chance to make a future profit, since I would imagine that Mars has a lot to gain if some of its SAGP initiatives are successful. In particular, I see their initiatives to invest in in understanding plant genomes in order to improve crop yields and investing in renewable energy to sustain operations to be two steps that while great for the environment, may also be great for Mars’ bottom line.

Similar to the comments above, I too am skeptical regarding Mars’ real reason for this push for sustainability, as well as whether the business and economic rationale are truly there. I do not believe the PR / marketing benefits of this strategy will be significant enough to warrant Mars’ heavy investment. Therefore, they must believe that these actions will have positive impact on their bottom line (perhaps in the long-term). I think the concern that climate change and global warming will affect raw materials production worldwide and drive up costs/decrease output is a valid one, but the timeline and magnitude of these effects are uncertain. How can Mars justify a $1B investment today for something that may not yield gains for decades? Additionally, I believe their biggest challenge may be to get other companies on board. Cross-industry action groups will be key to pushing this movement forward and I’m not sure if the financial argument is compelling enough to encourage other major players to invest so heavily.