Yara International: Adapting to a shifting industry

Yara has re-organized its operations to address increased global pressure on crop yields

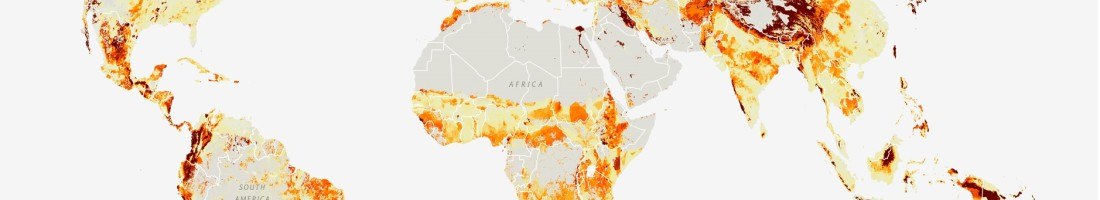

Feeding 9 billion people

World population is forecasted to grow to 9 billion people by 2050. This coupled with the rise of emerging economies and changing consumer habits will require that food production be doubled to meet demand. The Economist, as an example, estimates that meeting increased rise demand would require an increase in yields of 1.2 to 1.5% per year, however growth in recent years has been roughly half of that. Changing this trend has been putting significant pressure into the value chain and requires companies to shift the way they approach the market and their internal operations.

Fertilizers and Yara International

One of the key components of driving increased productivity is by applying more, better and more efficient fertilizers. The fertilizer industry is commoditized and thus historically companies have focused on obtaining good production facilities and ensuring efficient upstream operations, often not providing sufficient attention to downstream operations (i.e., distribution and sales to farmers). One of the key companies in this market is Yara International, a leading global producer of fertilizers, especially nitrogen fertilizers. Aware of the significant challenges ahead, Yara has recently been refocusing to address this productivity challenge. Namely the company has redesigned its product development and commercial organizations with a crop focused strategy, strengthened its R&D department and been a leader in establishing a global vision for agriculture.

Business Model

Yara generates value internally in two main ways: 1) through highly efficient upstream production facilities that are capable of producing nitrates, a more efficient and environmentally friendly fertilizer and ensuring efficient supply chain and 2) tailoring its product offering to address local needs of crops and farmers to optimize application on the field. The company manages to capture this value obtaining a price premium over commodity competitors and higher brand loyalty from farmers. Externally, the company allows access to higher quality products that allow farmers to increase productivity (up to 300% for some farmers in Sub-Saharan Africa, but also to a smaller extent in developed markets) and improve their livelihoods, thus increasing food security.

Operating model

The operating model manages to create and sustain value through three main initiatives. First, contrary to most competitors, Yara’s commercial and marketing organization is crop focused. This allows the company to dedicate significant time to understanding the particular challenges faced by crop in different regions and work with farmers to determine the most efficient applications for these crops. The norm in the industry is being product focused and ignore crop specific needs. Second, the company invests significantly in R&D. The deep knowledge of local needs allows the company to identify hidden needs in the market and develop tailored fertilizers and applications to help farmers. For example, the company has developed sensors that allow farmers to identify his plant’s fertilizer need through low-cost solutions that are easy to use. Lastly, the company is establishing itself as a leader in thinking about the challenges and solutions for agriculture globally. One example is that Yara played a key role in developing the 2009 World Economic Forum’s New Vision for Agriculture, which is currently co-chaired by a company executive, and subsequently the Grow Africa initiative, which it also co-chaired during its first two years. Another example is Yara’s cooperation in establishing Agriculture Growth Corridors in Tanzania. The project is aimed at strengthening agricultural infrastructure and increasing supply chain efficiency through joint efforts with private institutions, the local government and farmers and farmer associations and has already benefited thousands of farmers.

Conclusion

Yara identified the industry shift before its competitors and has been able to change its way of operating significantly to address it. The company aims to being a thought and product leader in increasing crop and farmer productivity and has put in place the structure, people and investment required to achieve it. Changes in this industry come slow and it might still be early to assess whether this will materialize in financial results on the longer term, but from current observations the company is establishing itself as a benchmark on the industry.

Sources:

- National Geographic: Feeding 9 billion (http://www.nationalgeographic.com/foodfeatures/feeding-9-billion/)

- The Economist: A bigger rice bowl (http://www.economist.com/news/briefing/21601815-another-green-revolution-stirring-worlds-paddy-fields-bigger-rice-bowl)

- HBS Professor Michael E. Porter and Mark R. Kramer’s case “Yara International: Africa Strategy” (https://hbr.org/product/yara-international-africa-strategy/715402-PDF-ENG)

- Company website: (yara.com)

- Sagcot website: (http://www.sagcot.com/)

Very cool post… interesting organization. Seems like a great candidate for a case study…

Very interesting topic. Agriculture and foods are absolutely important for our future growth. I know some Japanese companies started buying agricultural fields in Brazil because of the business potential these lands would have in the near future. On the other hand, I wonder if famers in emerging markets such as Sub-Saharan Africa can afford these fertilizer when they still live with income below the poverty line ($2/day).

Cool post. To Yuta’s point above, affordability will be key in some of these emerging markets. In addition, I think education is paramount even if they can get their hands on fertilizer. There is an awesome non profit you should check out: https://www.oneacrefund.org/our-approach/program-model

These guys have had outstanding results increasing yields and productivity and focus on the entire chain from seeds to market facilitation.