When Scaling Alone No Longer Scales: Maersk’s Digital Transformation Journey

While Maersk and others in the shipping and logistics industry historically have maintained profits through scaling ship size and market consolidation, new challenges require them to embrace digitalization of the supply chain in order to survive.

Self-inflicted Growing Pains from Economic Downturn

Today, the container fleet market – led by Maersk – accounts for more than half of the 80% of global merchandize trade that travels by sea and for more than one third of the global trade. [1] Despite this continuing YoY growth in TEU volumes, the revenue per TEU has been volatile and not grown in line with rising costs – resulting in declining profitability, see Table 1 below. [2]

Table 1: Maersk Financial Performance

| Billion USD | 2013 | 2014 | 2015 | 2016 | LTM 2017 |

| Revenue | 47.386 | 47.569 | 40.308 | 35.464 | 37.925 |

| Gross Profit | 12.383

|

12.701 | 9.466 | 6.989 | 7.710 |

| Operating Income | 6.825 | 7.552 | 4.261 | 2.263 | 2.931 |

| Net Income | 3.450 | 5.015 | 791 | (-1.939) | (-4.259) |

Historically, Maersk and other companies in this global transportation and logistics business, maintained profitability by growing scale – building larger ships, consolidating vendors, etc. However, as the market reaches consolidation and bigger has stopped meaning better due to current excess capacity in the system as a result of the unforeseen economic downturn – companies like Maersk must now look to work smarter rather than larger. (Note, this does not ignore Maersk’s $4.3 billion takeover of Hamburg Sud – the 7th largest carrier – just this month but is intended to state that scale alone is not going to be sufficient in the future and opportunities to further consolidate will likely be blocked.) [3]

Digital as a Driver of New Business Models and Value

McKinsey & Company recently reported a future in which 3 or 4 major container-shipping companies will emerge as “digitally enabled independents with strong customer orientation and innovative commercial practices”. [4] If this is to become reality, Maersk must ensure it is one of these three companies left standing. To do so, Maersk must invest in digital technologies such as the internet of things, big data, and machine learning to “differentiate their products, disintermediate value chains, improve customer service, raise productivity, and cut costs.” [4]

Becoming the Global Integrator of Container Logistics

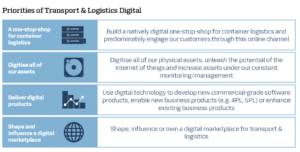

Maersk has begun taking actions in the short term to address its survival imperative of investing to develop digital products and services across its brands. Maersk’s CEO, Søren Skou, has placed digitization as an important pillar for growth in 2017 and stated, “digital innovation will be vital in creating and expanding synergies between the five brands that enable Maersk to deliver on the new vision of becoming the global integrator of container logistics.” [5] In terms of setting the tone for the organization and formalizing the organizational structures to drive the necessary changes, Maersk appointed Ibrahim Gokcen to be the companies first-ever Chief Digital Officer. Gokcen has since set the priorities for the Transport and Logistics Digital Organization as shown in Figure 1 below.

Figure 1: Priorities of Transport and Logistics Digital [5]

Gokcen cautiously notes, “While technology will play a big role in this process, our domain expertise will allow us to play and win in the race to digitize.” [5] In the short term, to accelerate their digital journey , Maersk has begun forming partnerships with tech giants such as Microsoft to use its cloud computer platform Azure and IBM to explore the benefits of blockchain technology for Maersk’s digital efforts. [6] Over the long-term, as Maersk is able to become more digitally savvy its aim is to “simplify and enhance visibility in supply chains by providing a seamless end-to-end digital experience for customers.” [6]

Tech Startups and VCs: Competitors or Collaborators?

A major risk that Maersk should take actions to mitigate very early on is that tech giants and digital disruptors will capture value from customer relationships by moving faster. Forbes reports that “Every five days, a digital logistics startup is born somewhere around the world.” [7] Competitors of the future could include a whole new set of fast-moving technology players such as Google and Amazon – note, Amazon has already launched its own air freights. Similarly, VC-backed startups such as ClearMetal are taking new approaches to generate dynamic predictions in real-time made possible by application of artificial intelligence, granularity at scale, big data cloud computing, machine learning, and predictions via APIs to the complex, global supply chain. [8] With pressure coming from outside their own industry, Maersk must take steps now to ensure they are positioning themselves to take advantage of these new developments – even going so far as to perhaps seed some existing revenue streams or the promise of next-generation growth and innovation strategies. [7]

Questions Left Unanswered

- As Maersk undertakes its digital journey, a malware attack earlier this year shutdown systems resulting in negative impacts of 200-300M USD. How should Maersk account for these risks and what is an acceptable risk tolerance?

- “Maersk has a window right now to capitalize on the energy and agility of digital startups – or else risk meeting these new entrants head-to-head as competitors in the future.” [8] What is the duration of this window? What approach would you take to assessing different engagement opportunities and partnership approaches?

(Words: 798)

[1] “Global Container Fleet Market 2017-2021,” Research and Markets (December 2016), TechNavio – Infiniti Research Ltd., https://www.researchandmarkets.com/research/bss4g2/global_container, accessed November 2017.

[2] Source: Maersk Income Statements, Capital IQ, Inc., a division of Standard & Poor’s.

[3] Rob Ward, “Maersk get green light on Hamburg Sud takeover,” Journal of Commerce, Sep 25, 2017, https://www.joc.com/maritime-news/container-lines/hamburg-sud/maersk-gets-green-light-hamburg-sud-takeover_20170925.html, accessed November 2017.

[4] Steve Saxon and Matt Stone, “How container shipping could reinvent itself for the digital age,” McKinsey Quarterly (October 2017), McKinsey & Company, https://www.mckinsey.com/industries/travel-transport-and-logistics/our-insights/how-container-shipping-could-reinvent-itself-for-the-digital-age, accessed November 2017.

[5] John Churchill and Flemming J. Mikkelsen, “Everything will be digitized,” press release, June 7, 2017, on Maersk website, https://www.maersk.com/stories/everything-will-be-digitised, accessed November 2017.

[6] John Churchill, “Maersk partners with Microsoft to power digital,” press release, April 26, 2017, on Maersk website, https://www.maersk.com/stories/maersk-partners-with-microsoft-to-power-digital, accessed November 2017.

[7] Catherine Shu, “ClearMetal gets $9M from Prelude Ventures and Eric Schmidt’s Innovation Endeavors for its logistics platform,” TechCrunch, September 20, 2017, https://techcrunch.com/2017/09/20/clearmetal-gets-9m-from-prelude-ventures-and-eric-schmidts-innovation-endeavors-for-its-logistics-platform/, accessed November 2017.

[8] Joris D’Inca and Max-Alexander Borreck, “Digital Logistics Startups Are Both Chalenge and Opportunity for Industry Incumbents,” Forbes, July 28, 2017, https://www.forbes.com/sites/oliverwyman/2017/07/28/digital-logistics-startups-are-both-challenge-and-opportunity-for-industry-incumbents/#4ddb17f31589, accessed November 2017.

The idea of start-ups and large tech companies making their way into the digital logistics market poses the concern of just how much true value a firm like Maersk will be able to acquire through partnering or funding one of these entrants to the changing domain. As digital logistics starts be come a prominent platform for tech companies to sell to a firm like Maersk, the opportunity for a firm like Google to take severe advantage of the heat their new product is getting or the underlying necessity their product may service could pose the another large problem for a logistics giant to have to combat through negotiations or by simply constructing their own technology internally. Then is this another race to the bottom in a field that only one firm is a master of?

Thanks for sharing this article! The first question you pose is an interesting one and I think Maersk can address the challenge by partnering with a cyber security company or acquiring a startup in the cyber security space. Companies usually look at minimising risk following the “as low as reasonably practical” approach, by determining the level of risk at which the cost of implementing a cyber security software is offset by the cost of potential penalties. In general, the law of diminishing marginal returns plays a key role in determining the minimum risk that is acceptable.

With regards to the second question, Maersk can look at setting up a corporate VC arm, similarly to many billion-dollar companies. As a result, Maersk can not only build competitive digital capabilities and defend itself from the likes of Google and Amazon, but also create an additional revenue stream by contributing with its supply chain know-how to the creation of disruptors to other players in the global supply-chain.

Finally, Maersk can look at adding drone ships to its fleet and further increase the digitalisation of its operations. One company that invests significantly in the development of “drone” ships is Rolls-Royce [1].

[1] Rolls-Royce. “Ship Intelligence”. https://www.rolls-royce.com/products-and-services/marine/ship-intelligence.aspx#section-overview1

. Accessed on December 1st, 2017.