Weathering the Storm: Kleiner Perkins and the Tragedy of Clean-Tech Venture Capital

A brief look at why the first wave of clean-tech VCs failed–and how they might do better in the future.

John Doerr, TED 2007

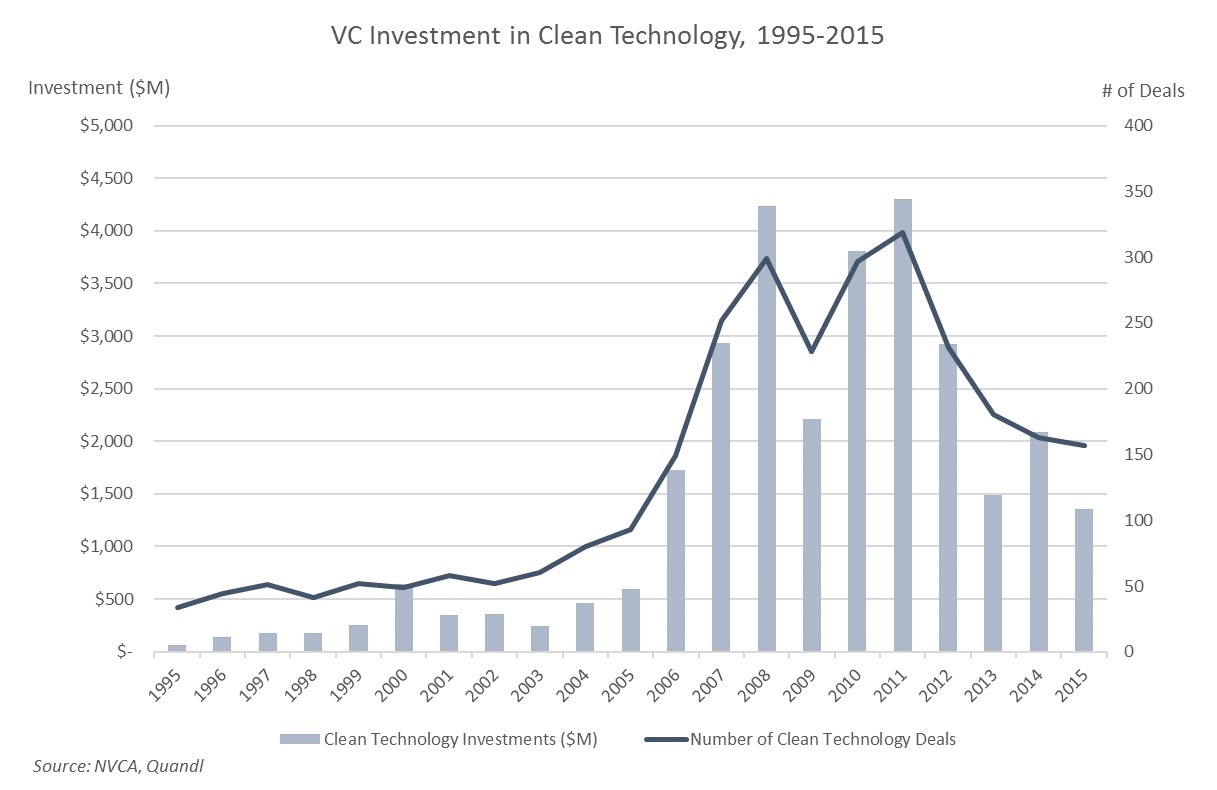

In March 2007, John Doerr—the legendary partner at storied venture capital firm Kleiner Perkins Caufield & Byers—delivered an impassioned and tearful TED Talk where he laid out the sheer magnitude of challenges and opportunities posed by climate change. Doerr told the crowd, “Green Technology…is bigger than the Internet. It could be the biggest economic opportunity of the 21st century.”[1] Kleiner Perkins, which made a name for itself by investing in internet giants like Netscape, Amazon and Google, had recently committed $100M of its most recent fund to back clean-tech companies, including technologies related to renewable energy sources, biofuels, electric cars, water purification, and air quality.[2] Bolstered by major government incentives, VCs began to pile into the space as well, and total VC investment in clean-tech soon increased tenfold—growing from ~$400M a year in the early 2000’s to $4.2B in 2008.[3]

By 2015, however, interest and activity in clean-tech VC had stalled for a variety of reasons. First, many VCs underestimated the sheer amount of capital and time required to build a successful clean-tech company. The typical venture firm made investments between $10-$50M and often relied on “quick wins” within 3-5 years in order to drive success; by contrast, companies like Bloom Energy (a fuel cell technology company backed by Kleiner) had taken $800M in capital and 15 years of operations to reach scale.[4] Investors also misunderstood the genuine scientific and technical risks clean-tech businesses faced. Fisker Automotive (an electric car company also backed by Kleiner) drew in $1.4B of capital without ever bringing a product to into production.[5] The clean-tech venture industry suffered due to external pressures as well. The global financial crisis in 2008 left many funds with an uncertain capital environment, and markets were suddenly less receptive to the IPO and M&A transactions required to return capital to investors. Moreover, competition from inexpensive Chinese solar panels and the shale gas boom in North America made many projects in the renewables space economically unviable.[6]

As a result, Kleiner Perkins’ clean-tech portfolio (which had grown to 88 companies by 2013) was struggling, and investments like Fisker were on track to become among the biggest venture capital losses in history. To add to its troubles, industry experts suggested that Kleiner’s focus on clean-tech had caused it to miss out on the early rounds of consumer web companies like Twitter and Facebook, which drove outsized returns for competitors like Benchmark, Accel and Greylock.[7] The firm’s reputation within Silicon Valley has undoubtedly suffered, and Doerr eventually stepped down as an active investment partner for future KPCB funds in 2016.[8]

Despite these setbacks, however, the global business opportunity created by climate change has not changed since the first wave of clean-tech VC began. What Kleiner Perkins and other VC firms need to address is how to capture that opportunity. There are a few options going forward:

- Refocus: Though many of the more capital intensive sectors were disastrous for KPCB and its peers (e.g., upstream renewable energy projects), there have been a few bright spots as well. Technologies and services that touch the end customer have generated several fairly large success stories, such as in residential solar installation (Solar City – IPO in 2012, $1.9B market cap) and smart home technologies (Nest – acquired by Google in 2014 for $3.2B). Software for the energy vertical is another exception; oPower, a Kleiner-backed company that provides a suite of technology solutions to help utility companies control and manage energy efficiency, was successfully sold to Oracle this year for $552M.[9] By narrowing the focus to these subsectors in the future, KPCB and others may be able to improve returns and stay active in the future of clean-tech, albeit in a more limited fashion.[10]

- Restructure: Another possibility is to change the structure of clean-tech investment vehicles themselves, noting that the ten-year lifecycle of the typical tech VC fund may not be the best way to fund clean energy innovation. One possibility is to steal a page from the biotechnology playbook and lengthen the duration of clean-tech funds to 13 or 15 years. Another possibility would be to target specific types of limited partners with longer time horizons and socially-responsible investment mandates (i.e., family offices, foundations and endowments). The Prime Coalition, a non-profit investment network started at MIT and backed by the Pritzker Innovation fund and the Will & Jada Smith foundation, serves as a great example of this type of structure.[11]

Ultimately, the next generation of clean energy VCs must decide how best to participate in the future of climate change innovation–if they participate at all.

Wordcount: 760

[1] TED, “John Doerr: Salvation (and Profit) in Greentech,” published March 2007, https://www.ted.com/talks/john_doerr_sees_salvation_and_profit_in_greentech?language=en, accessed November 2016

[2] Terence Chea, “Doerr firm invests in ‘green technology,'” USA Today, April 10, 2006, http://usatoday30.usatoday.com/tech/news/2006-04-10-green-venture-capitalist_x.htm, accessed November 2016

[3] National Venture Capital Association data, accessed through Quandl, November 2016

[4] Company tearsheets, Capital IQ Inc., a division of Standard & Poors

[5] Bill Vlasic, “Breaking Down on the Road to Electric Cars,” New York Times, April 23, 2013, http://www.nytimes.com/2013/04/24/business/fisker-broke-down-on-the-road-to-electric-cars.html, accessed November 2016

[6] Juliet Eilperin, “Why the Clean Tech Boom went Bust,” Wired, January 20, 2012, https://www.wired.com/2012/01/ff_solyndra/, accessed November 2016

[7] Randall Smith, “A Humbled Kleiner Perkins Adjusts its Strategy,” Dealbook, May 7, 2013, http://dealbook.nytimes.com/2013/05/07/a-humbled-kleiner-perkins-adjusts-its-strategy/?_r=0, accessed November 2013

[8] Ellen Huet and Emily Chang, “Kleiner Perkins’ John Doerr to Step Aside from New Venture Funds, Become Chair,” Bloomberg, March 31, 2016, https://www.bloomberg.com/news/articles/2016-03-31/john-doerr-to-step-aside-from-new-venture-funds-at-kleiner-perkins-become-chair, accessed November 2016

[9] Company tearsheets, Capital IQ, Inc., a division of Standard & Poor’s

[10] Cromwell Schubarth, “TechFlash Q&A: Kleiner Perkins VC shares lessons from IoT attacks, cleantech bubble,” Silicon Valley Business Journal, November 1, 2016, http://www.bizjournals.com/sanjose/news/2016/11/01/kleiner-perkins-vc-on-internet-of-things-attacks.html, accessed November 2016

[11] Prime Coalition, “What is Prime,” http://primecoalition.org/what-is-prime/, accessed November 2016

Note: in addition to secondary sources, this post was prepared following an interview with Shervin Ghaemmaghami, Principal at F-Prime Capital, November 2016

Doug – I loved this piece.

I also wonder whether the relative failure of cleantech investments of that vintage has to do with VC tendency to fall for pitch slides touting massive TAMs. Cleantech founders (invariably?) tend to size their potential market in the multi-billions. More than other sectors, this has the effect of lulling the VC hearing the pitch into a ‘roll-the-dice’ mode: after all, when the TAM is massive, why spend the extra time worrying about the probability of a downside scenario?

Agreed with Miras – this was a concise and terrific post. Doug points out that clean-tech VC investments failed for a number of reasons. Naturally, some of these are due to external influences: macroeconomic factors affecting capital markets, and other factors that presumably led to Fisker not being able to commercialize a product. What is even more interesting however, is that there seems to be a capital mismatch, as Doug points out.

There are plenty of similarities between clean-tech and other areas of VC investment like consumer internet companies. Participants in each industry develop cutting-edge technology, and have huge addressable markets. And so it seems intuitive that a given venture capital fund could invest in both industries. However, when required investment timeframe differs, problems emerge. One of these problems can be divergent expectations for timing of return of caspital. This may create a capital mismatch: i.e. if Kleiner is forced to exit, or reluctant to invest more capital, before a project is completed because of Kleiner’s fund structure.

As Doug notes, this problem has been solved before in venture, with biotech funds having a longer duration. The same thing has occurred in private equity. Certain funds have longer time horizons, which reduce these timing mismatches. Additionally, private equity funds that at one point invested in many industries out of one fund have decided to separate into multiple funds to match the demands of limited partners. Many such firms have launched real estate funds and energy funds, given the unique characteristics of these industries. That this kind of segmenting has been so successful in the past should give additional credence to its viability in the future. Aligning the incentives of the investors and the entrepreneurs seems crucial if the next generation of VC-backed clean-tech firms are to be successful.

I will echo the previous two comments that this is well thought-out piece. Personally, I don’t think VC is the right form of private capital deployment in clean-tech/clean-energy space. The lead time of technology development to large adaptation of it can take decades unless it is an innovation in business model as SolarCity has done. Jigar Shah, an industry veteran, argues that we currently have all the technologies developed to solve the climate change. So what we need is a massive push for deployment of these technologies. A potential path for VCs going forward could be in deploying capital to early staged commercialized technologies.

Is it a bad sign that John Doerr’s TED Talk made me laugh? Watching him cry reminded me of the time that Bill Ackman opened the floodgates and practically sobbed [video link: https://youtu.be/bQc6L4ieMwo?t=7964%5D in the midst of his infamous 2014 attempt to spike the stock of Herbalife International into the ground. The market didn’t buy the act, and Ackman’s Herbalife short has remained a thorn in his side for the last couple years – a relatively low “return on invested brain damage,” as he would put it. It sounds like the ROIBD wasn’t too attractive for Doerr or the rest of the VCs at Kleiner Perkins, either. Perhaps LPs should be worried if they see one of their money managers crying on stage while trying to garner support for an investment thesis.

In all seriousness, the disappointing results at KPCB should serve to warn investors of the dangers of betting heavily on emerging themes in technology. I sincerely hope clean-tech will get its day in the sun (ha), but in this case, it seems that investor optimism got way too far ahead of market reality, and a lot of otherwise-promising companies fell into a chasm. As an outsider, what makes this sub-sector appear even more perilous to navigate is the fact that the fortunes of clean-tech companies are not only driven by innovation, but also by outside forces (as mentioned in the post – entry of Chinese companies, shale gas boom, etc.) and other macro factors.

Loved this post, Doug, thank you.