Walmart’s Dual Incentive To “Do Good”: Bottom-Line Profit Through Elimination of Food Waste

Can Walmart be at the forefront of a solution to alleviate global food waste, while prospering themselves?

Eden: Optimizing the Fresh Food Supply Chain

Just over one year ago, Walmart was managing its entire fresh food supply chain’s quality audits through a highly manual combination of visual inspections and photos, referenced against USDA specifications to determine if the product should be accepted or rejected [1]. Fast forward to today; born from an internal hackathon one year ago, the organization created an algorithm that leverages machine learning to inspect and manage the quality of produce from its farm to shelf lifecycle. The program, Eden, has the ability to collate the numerous and always-changing produce specifications to develop a “freshness algorithm” that optimizes the movement of perishable goods. Eden’s goal is to bring transparency and efficiency to this complex fresh food supply chain, with the end results being to 1) offer consumers the freshest produce available, and 2) eliminate food waste [2].

Walmart’s Roll-out and Expected Impact

Since being launched six months ago, Eden has been rolled out to 43 distribution centers and has saved Walmart $86M, with the goal of eliminating $2Bn of produce waste in Walmart’s supply chain over the next five years [2]. Beyond the environmental and human welfare implications, this technology will also be impactful for the customer experience and for Walmart’s bottom line. For the customer, the technology ensures he or she is purchasing the freshest fruits, vegetables and even dairy. For Walmart, this eliminates food waste write-offs, and also helps manage inventory levels to increase customer satisfaction, further growing the topline. This is significant, as today fresh products account for up to 40% of a grocers revenues [3].

In the medium term as Eden continues to scale, Walmart’s stated intention is to eventually predict the exact shelf life of fresh products leveraging actual product imagery and live temperature tracking inside of trucks and warehouses where perishables are stored. Further down the road, Walmart plans to channel this into active inventory management; as an example, if temperatures were to rise on trucks carrying produce, Eden could reroute the truck to a closer destination to extend customer-facing shelf life [4].

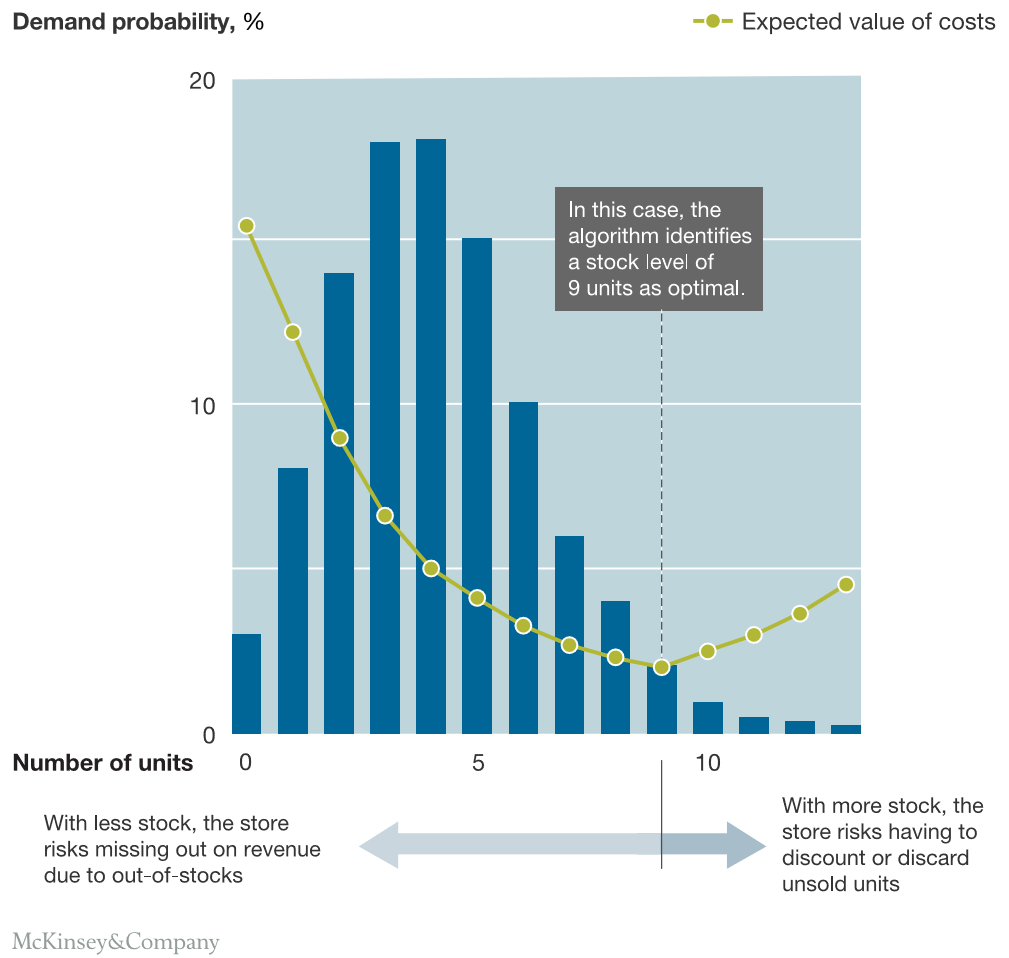

Further consideration when measuring Eden’s financial opportunity will be determining the tradeoff between decreased food waste at the risk of out of stocks, seen across the horizontal axis of Figure 1 below. Today there is a higher focus on avoiding out-of-stocks to battle for customer loyalty, but perhaps there is room to run retailers at lower inventory levels if armed with Eden. If so, this could result in lower food waste for Walmart, while achieving quality levels that rival competitors such as Whole Foods, who has been recently plagued by declining quality and stock levels [6].

Figure 1: In-Stock & Quality vs Food Waste Tradeoff [3]

Global Expansion

Because Walmart’s core strength is its command of a global supply chain, I would recommend Eden be spread to all distribution centers following this pilot in order to leverage the full network effects. In practice, this would enable all distribution centers across the word to optimize overall freshness and transportation. However, I would caution Walmart to ensure that this same global competency is eradicated by Eden, and it continues to allow its customers to enjoy the benefits of a global supply chain (e.g., not letting the machine optimize decreased waste so extreme that grocery stores only get locally grown products).

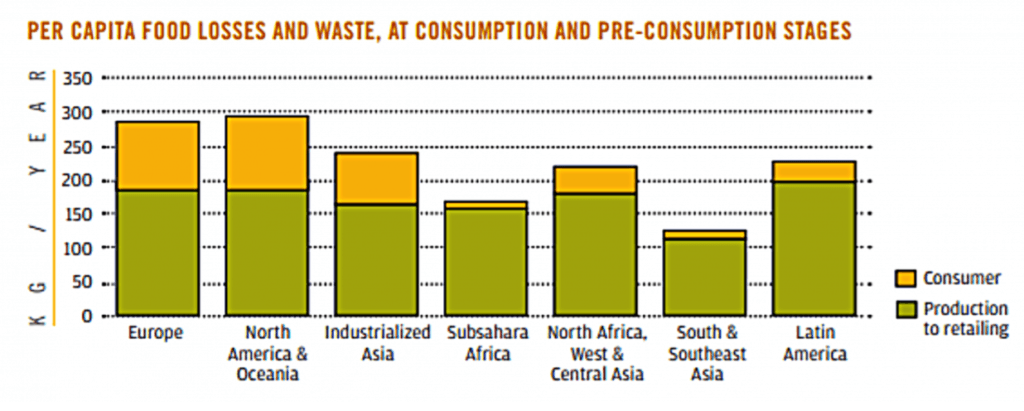

As Eden continues to scale, its greatest potential could be in developing countries. Although in these countries consumer waste is minimal, the per capital total food waste is actually equivalent to developed nations, since these countries have weaker supply chain infrastructure and technology, as seen in Figure 2 [5]. However, this is also where food shortages are most dire, making this a top candidate for benefitting from Eden.

Figure 2: Food waste by region [5]

Once proven out, Eden could be a solution to global food wastage in developing areas where every kilogram of food counts, resulting in profound impact on the lives of fellow humans and the well-being of our environment. This change is being catalyzed by big organizations such as Walmart that have the resources and financial incentives to solve this pressing issue; now it is time to continue to test and expand to see just how big of an impact Eden can have.

Questions to Consider

Should Walmart double down on piloting Eden in developing nation supply chains, or first fully develop and test the product in more developed supply chains such as the United States? Should the “doing good” aspect be ascribed any value?

Will improving the quality of produce to be best in class in the industry give Walmart the opportunity to compete directly with Whole Foods? Will Walmart need to explicitly tell customers about Eden in order to gain goodwill and customer conversions, or will the quality improvement be obvious?

(word count: 792)

Bibliography

- Walmart Wants To Sell The Freshest Produce, And It’s Using iPhones To Do It. Forbes, Mar 1, 2018, https://www.forbes.com/sites/phillempert/2018/03/01/walmart-wants-to-sell-the-freshest-produce-and-are-using-iphones-to-do-it/#20bf6f68593e, accessed November 2018.

- Eden: The Tech That’s Bringing Fresher Groceries to You. Walmart Blog, Mar 1, 2018, https://blog.walmart.com/innovation/20180301/eden-the-tech-thats-bringing-fresher-groceries-to-you, accessed November 2018.

- Glatzel, M. Hopkins, T. Lange, and U. Weiss . The secret to smarter fresh-food replenishment? Machine learning. McKinsey & Company (November 2016).

- Walmart is unleashing a weapon worth $2 billion that could deal a blow to Whole Foods. Business Insider, Mar 1, 2018, https://markets.businessinsider.com/news/stocks/walmart-saves-2-billion-with-machine-that-inspects-food-for-spoilage-2018-3-1017567256, accessed November 2018.

- How are food losses and waste an environmental concern? Foodsource.org, https://foodsource.org.uk/56-how-are-food-losses-and-waste-environmental-concern, accessed November 2018.

- Whole Foods has a ‘high class’ problem that’s leading to ‘entirely empty’ shelves. Business Insider, Jan 9, 2018, https://www.businessinsider.com/whole-foods-out-of-stock-problems-and-deteriorating-produce-2018-1, accessed November 2018.

Very interesting article! I was very surprised that the goal is to ultimately be on par with Whole Foods in terms of quality. It would definitely be a shake up in the current grocery market sector. I also see the benefits that this could bring to developing countries. I think that Walmart will first implement in the US and then expand elsewhere in order to gain market share and control more variables.

This is a really interesting application of machine learning. What’s not fully clear to me is where the $86M in savings thus far come from. I would expect what the author describe as “active inventory management” to be the way cost savings are achieved, but I suppose it’s currently more of a static way of tracking based on inputs? I would be curious to understand the distinction further. I wonder how Walmart will be able to leverage this to even influence growers on the supply side. Did the author find any information about how this could address overproduction as well as a way to reduce waste, or has it been mostly viewed to manage distribution?

Thanks! This was a great read. As Walmart continues to compete in an industry that is becoming more and more competitive, this investment in machine learning makes a lot of sense. Particularly, it is certainly a mechanism that can enhance profitability while top-line sales grow at a slower rate. Food waste through the supply chain is enormous and the more advance a company can become in managing it, the better they will be in the long-term. Concerning next steps though, I do think further developing Eden in developed markets in the right way to go. Working out the glitches in a more robust supply chain is probably safer than moving directly to developing countries. However, I do see long-term value at helping multiple geographies better manage their food supply chains.

As for the consumer angle, I am not sure I agree with the article’s stance. Although Walmart may be able to improve their quality of fresh produce, I believe that the Whole Foods customer is a completely different audience. And pulling that target market to Walmart may be a bigger ask than just fresher produce.