Walmart takes on Amazon: The Journey from Brick & Mortar to Click & Mortar

The retail industry is facing a digital revolution at a pace never seen before. With the digital behemoth that is Amazon, traditional brick & mortar retailers are challenged to find ways to integrate analytics to remain competitive. This article looks at how Walmart is taking large bets in artificial intelligence and machine learning (ML) to support its long-term growth and their vision of a 'newly imagined future of retail.'

Artificial Intelligence in Retail

The retail industry is facing a critical inflection point. Gone are the days where big box retailers could claim to be digital by creating an e-commerce business unit. As consumers shift a larger portion of their wallet to online platforms and grow increasingly demanding amid more options on/offline, traditional retailers have been trying to keep up in building analytical competency: they must move beyond finding indicators of success in historical performance, instead identifying future areas of opportunity. To complicate matters, Amazon is bolstering its presence as it reaches ~$1 trillion in market capitalization1, posing an insurmountable threat to competition.

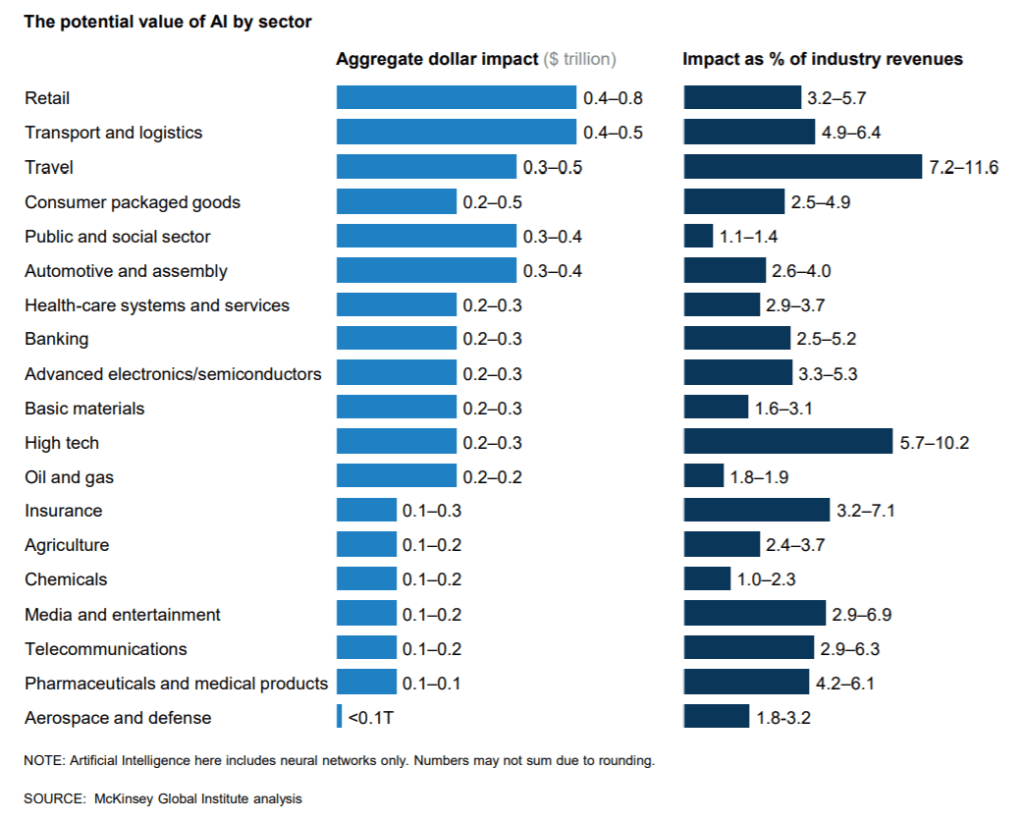

Fortunately, the future looks promising for retailers that are proactively addressing the shifting dynamics. A recent report shows that the retail industry could be the biggest beneficiary of artificial intelligence (AI) and machine learning (ML)2.

The granularity and depth of customer- and SKU-level data in the industry create a wealth of opportunity for the retailer that can recognize patterns and draw forward-looking insights from this repository. Conventionally, the more common applications of AI and ML in retail so far have been grounded in Marketing & Sales: personalized recommendations (Next Product to Buy), targeted marketing campaigns, and assortment optimization. Increasingly, retailers are beginning to use the same technology in supply chain management, e.g., predictive maintenance or inventory control, as well as using analytics to make more critical M&S decisions, such as pricing and promotions3. In his recent letter to shareholders, Bezos states how ML can permeate all integral aspects of retail operations:

“Machine learning drives our algorithms for demand forecasting, product search ranking, product and deals recommendations, merchandising placements, fraud detection, translations, and much more.4”

Case Study: Walmart

As one of the largest big box retailers in the world and a significant competitor to Amazon in the digital space, Walmart has exhibited a track record of taking AI seriously. Since appointing its current e-commerce unit CEO Lore, Walmart has taken strides in leveraging ML across major facets of its business, with both shorter and medium-to-long time horizons:

- Customer Service – faster shopping:

- Patents issues for Scan & Go technology where customers can ring up purchases on their smartphones and avoid checkout lines altogether5.

- Pick up towers that retrieve customers’ online orders from receipt barcodes within 45 seconds to speed up checkout6.

- Store operations: Autonomous robots used to scan shelves and monitor inventory using machine vision and learning7.

Its newly opened Sam’s Club Now (Dallas) is a pilot store that will test all new technologies, including plans for augmented reality, voice navigation, and auto-filled shopping lists in the future8

- Acquisitions: Acquired prominent e-commerce players such as Bonobos, Jet.com and Flipkart9 (India) to build relevancy and talent, and explore further synergies. Also recently invested in Team8 to better understand the cybersecurity landscape and protecting itself (and customers) from fraud10.

- Talent: Outside of acquisitions, also actively recruiting experts in ML/AI. Recently it opened its Emerging Technologies office in Dallas to capture value from the vast amount of data held by the retailer. Walmart plans to build up a ~50-person team of ML, IOT, and computer vision experts by year-end11.

Where next?

While the retailer has garnered the accolade of “out-innovating every retailer under the sun, with the exception of Amazon12”, there are further opportunities to consider to fully leverage its omnichannel presence in competing against Amazon. One idea to entertain is personalized marketing campaigns that utilize customer information form both in-store and online purchases. Walmart is already investing in ways to track better quality input from in-store shopping; marrying this with Walmart.com data can create as comparable of a dataset to Amazon as any retailer can, and allow Walmart to better predict its customers’ demands despite significantly lower online traffic13.

Research14 shows that customers that shop both online and in-store are 2-3x more valuable, and that Walmart shoppers who shop in-store that have been converted to shop online actually purchase more in-store afterwards. I would argue that the biggest asset Walmart has against Amazon is its physical store business: Walmart should continuously look at ways to generate value through synergies across channels.

Further areas for discussion

Considering developments discussed so far, I would love to hear from peers on the following topics:

- Walmart has recently struck a multi-year contract with Microsoft to use their cloud servers and team up to compete against Amazon using combined AI and ML capabilities. What kind of synergies could we expect from this combination?

- Recently several retailers have stopped using ML-enabled service chatbots due to customer backlash. Is there room for ML in customer-facing services?

- What other types of companies could make sense for Walmart to invest in / acquire in light of establishing presence as an analytics/ML-driven digital company?

(Word Count: 795)

1 Franck, Thomas. “Amazon closes in bear market a little more than two months after hitting $1 trillion market cap.” CNBC, November 12, 2018. https://www.cnbc.com/2018/11/12/amazon-falls-into-bear-market-2-months-after-hitting-1-trillion.html

2 Chui, Michael et al. ‘Notes from the AI Frontier: Insights from Hundreds of Use Cases.’ McKinsey Global Institute, April 2018. https://www.mckinsey.com/~/media/mckinsey/featured%20insights/artificial%20intelligence/notes%20from%20the%20ai%20frontier%20applications%20and%20value%20of%20deep%20learning/mgi_notes-from-ai-frontier_discussion-paper.ashx

3 Begley, Steven et al. “How analytics and digital will drive next generation retail merchandising.” McKinsey & Company, August 2018. https://www.mckinsey.com/industries/retail/our-insights/how-analytics-and-digital-will-drive-next-generation-retail-merchandising

4 Bezos, Jeff. Letter to Shareholders. April 12, 2017. https://www.sec.gov/Archives/edgar/data/1018724/000119312517120198/d373368dex991.htm

5 Halzack, Sarah. “Walmart’s plan to get you in and out of stores faster.” The Washington Post, February 28, 2017. https://www.washingtonpost.com/news/business/wp/2017/02/28/walmarts-plan-to-get-you-in-and-out-of-stores-faster/?noredirect=on&utm_term=.4472e712e711

6 Peterson, Hayley. “Walmart is building giant towers to solve the most annoying thing about online ordering.” Business Insider, July 5, 2017. https://www.businessinsider.com/walmart-builds-pickup-towers-for-online-orders-2017-6

7 ‘The Smarter Store: How AI is powering the future of retail.’ CB Insights, November 2017. https://www.cbinsights.com/reports/CB_Insights_AI-Retail-Briefing.pdf?utm_campaign=ai-in-retail_2017-11&utm_source=hs_automation&utm_medium=email&utm_content=58295005&_hsenc=p2ANqtz-_jdv6RwKCZjOApRQcGUYjwsg-8VPpc0pOYsZVsBqeGOoz3w_iMLgNj-hswdMHW1-YDW_PoJ0FmkzrgyxVaMzH7rNK1Xg&_hsmi=58295005

8 Iannone, Jamie. “Sam’s Club Now – Reimagining the Future of Retail.” Sam’s Club, October 29, 2018. https://corporate.samsclub.com/blog/2018/10/29/sams-club-now-reimagining-the-future-of-retail

9 O’Shea, Dan. “Walmart CFO Biggs touts retailer’s e-commerce build-up.” Retail Dive, June 19, 2017. https://www.retaildive.com/news/walmart-cfo-biggs-touts-retailers-e-commerce-build-up/445266/

10 Cheng, Andria. “Why Walmart is Investing in a Startup Founded by Former Leaders of Israel’s Top Intelligence Unit.” Forbes, October 23, 2018. https://www.forbes.com/sites/andriacheng/2018/10/23/why-walmart-is-investing-in-a-startup-founded-by-former-leaders-of-israelis-top-intelligence-unit/#45041c0c6d73

11 Hensel, Anna. “Walmart plans to open a computer vision and machine learning office in Dallas on April 5.” VentureBeat, March 6, 2018. https://venturebeat.com/2018/03/06/walmart-plans-to-open-a-computer-vision-and-machine-learning-office-in-dallas-on-april-5/

12 Ruff, Corinne. “The retail winners and losers of 2017.” Retail Dive, December 20, 2017. https://www.retaildive.com/news/the-retail-winners-and-losers-of-2017/513576/

13 Sevitt, Daniel. “Amazon vs Walmart – The Battleground for Online Retail – Part I.” The Market Intelligence Blog, April 25, 2018. https://www.similarweb.com/blog/amazon-vs-walmart

14 Safian, Robert. “As Amazon and Walmart Duke It Out, Niche Retail Can Thrive.” Fast Company, January 9, 2018. https://www.fastcompany.com/40509026/as-amazon-and-walmart-duke-it-out-niche-retail-can-thrive

Dook, your point about Walmart’s physical presence being an advantage over Amazon is an interesting one. In my own experience, I feel pretty brand loyal to Target and thus often buy both in store and online from Target, when I could easily purchase the same or similar products from Amazon.

To address one of your questions, I think that ML does have a place in customer service. However, I agree with the customers you cite above that chatbots are not the right area. Personally, whenever I am confronted with a chatbot, I find their answers to be too generic and get frustrated with the lack of personalized service and attention. Instead of chatbots, I think firms should use ML to improve their ability to detect, predict, mitigate, and/or resolve common customer issues and pair that with human contact.

Nice paper on one of the most critical challenges today i.e. bricks-and-clicks vs. Amazon. One area that I find pretty fascinating is exactly linked to how physical presence can be leveraged vs. online only (even if also Amazon is in the offline business now, with Whole Foods and Amazon Go, the self-checkout grocery store). In fact, while many technologies linked to AI/ML are active online (with a high level of sophistication), there is still a big gap vs. offline (where sophistication is limited). The ability to bridge these two worlds will be critical. For this, AI/ML focused on facial recognition, consumer attention and shopping behaviors can power the omni-channel experience and help connect the physical world to the online one (e.g. with data that may be used for advertising and/or even product development). This is an area where it could be interesting to see if the Walmart-Microsoft collaboration will explore.