Unpacking Trader Joe’s

In an industry dominated by large incumbent players and razor thin margins, Trader Joe's has discovered a winning recipe. That strategy married with flawless execution has resulted in one of the most recognized success stories of recent history.

In a heavily competitive industry, Trader Joe’s (TJ’s) has proven to differentiate itself from the traditional grocery store. That differentiation is rooted in its business model of offering value products and excellent customer service. Yet, what has led to its tremendous success is arguably its effectiveness of aligning its business and operating models.

Value Products

Trader Joe’s delivers value to customers by adopting an everyday low price strategy. It executes on this strategy partly by carrying a limited number of products. In fact, TJ carries 5x fewer products (~2,500 SKUs) than the traditional supermarket. TJ’s doesn’t aim to be a one-stop shop like a full-service supermarket and rather serves as the secondary store. For example, TJ’s intentionally lacks a pharmacy, meat and fish counters, and wide selection of produce and staples.

Another way to deliver on its low price value proposition is through private label. Over 75% of TJ’s product offerings carry the TJ’s label. Unlike competitors, such as Bristol Farms and Whole Foods, TJ’s doesn’t carry any national brands. Executing on this strategy allows it to keep costs low without compromising on quality.

The buying process is another source of differentiation. TJ’s buys directly from manufacturers and by cutting out middleman distributors, the company is able to keep prices low. Beyond this streamlined process, the purchasing team is also disciplined about buying products that it can sell for a better price than supermarkets. Its strategy lies in part in its ability to buy in large volume and strike deals with suppliers. TJ can thus pass the results of its buying efficiencies through to customers.

Exhibit 1: Range of TJ’s Private Label Products

Source: Huffington Post

Good Customer Service

TJ’s executes on this customer centric strategy by empowering its employees, specifically through training programs, its hiring process and compensation packages. Employees collectively exude a level of enthusiasm and energy, and are cross-trained across multiple functions such as cashier, stocker and customer interface roles. They are also trained in communication skills, teamwork, leadership skills and product knowledge. Besides opportunities for personal development, employees also enjoy attractive compensation packages. For example, part-time clerks earn between $8-12 per hour and full-time clerks make ~$16 per hour. Assistant store managers can make an average of $94,000 a year while store managers can make on average $132,000, comparable to that of a Wal-Mart store generating 6-7x in store revenue. Compensation is a key driver of employee satisfaction, which is particularly pertinent in any customer facing role. On the talent acquisition side, TJ’s looks to hire people who are ambitious, friendly, and engaging. These qualities are also stressed in performance evaluations as they are key to employing good customer service. At the corporate level, the company runs on a lean organization with only two levels between the CEO and a cashier. All of these factors create a strong culture and results in a low annual turnover of 4% amongst full-time employees. A happy and motivated workforce allows TJ’s to maintain a high level of customer service.

Alignment Between Business and Operating Models

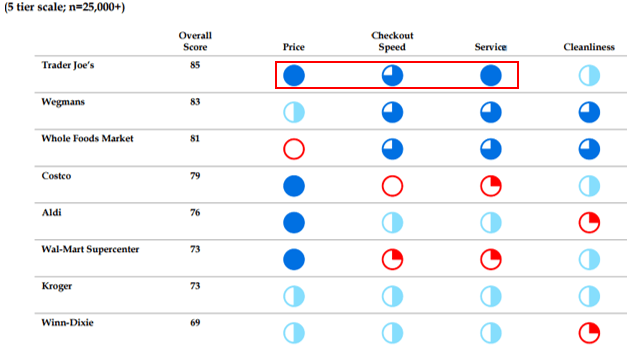

The success story of Trader Joe’s has proven the importance of aligning a company’s business and operating models. Every aspect of its business from its purchasing process and private label strategy align with its commitment to low prices. Similarly, its focus on instilling a customer-centric culture and hiring the right talent delivers on its promise for excellent customer service. Trader Joe’s epitomizes a company’s business model aligning with its operating model as evident in the results of the satisfaction survey below (Exhibit 2). Thus, it’s no surprise that Trader Joe’s is has one of the highest sales productivity metrics in the industry (Exhibit 3) and has proven to be a formidable player in the grocery business.

Exhibit 2: Reader’s Satisfaction Rating by Category by Select US Supermarket Chains

Source: Coriolis Research

Exhibit 3: Grocery Store Sales Per Sqft and Store Opening Plans

Sources

Aiken, Kristen. “Who Really Makes Trader Joe’s Food?.” Huffington Post. <http://www.huffingtonpost.com/2013/02/12/who-makes-trader-joes-food_n_2664899.html>

Lutz, Ashley. “How Trader Joe’s Sells Twice As Much As Whole Foods.” <http://www.businessinsider.com/trader-joes-sales-strategy-2014-10>

Mallinger, M., Rossy, G. “The Trader Joe’s Experience.” Graziadio Business Review. <https://gbr.pepperdine.edu/2010/08/the-trader-joes-experience/>

Palmari, Christopher. “Trader Joe’s Recipe for Success.” http://www.bloomberg.com/bw/stories/2008-02-20/trader-joes-recipe-for-success

“Understanding Trader Joe’s.” Coriolis Research. May 2006. < http://www.coriolisresearch.com/pdfs/coriolis_understanding_trader_

joes_final.pdf>

Very informative and well written. It is amazing that Trader Joe’s is able to outperform many of its much larger peers by executing well on a lot of the “soft” stuff (employee satisfaction, hiring practices, organizational structure and customer service). I also found it interesting that TJ’s decided to bring distribution in-house as many of the grocers don’t view managing distribution/logistics as a core competency. Do you have a sense of whether return on capital metrics (essentially any metric capturing capex required for internalizing distribution) for TJ’s are still superior to its peers?

My TJ’s runs will never be the same again!

Great article and very interesting! I did not realize that they were so well known for employee satisfaction. Thinking back to my most recent trip to TJs, all the employees were very happy and friendly!

I’m very curious about one additional aspect of their operational strategy. How do they handle distribution? Do they ever use a locally sourced method for meats/produce? Do they utilize a massive warehouse to distribute to a large region? I’m sure having 75% of their SKUs be private label will affect their decision. I’m sure their distribution method is one way to keep prices low!

This is very interesting post. As an avid client of Trader Joe’s, it was great reading about them and having a better understading of how they manage their business. They certainly seem to have a very good business model and a strong supporting operating model.

A few questions:

(a) Do you know how they started? I suppose their strategy (few items, private labels, large volumes) must have been hard to execute when they had only a few stores.

(b) Do you know how their margins compare to other players?

Thanks a lot!

Francisco

I think I had heard somewhere that when a food manufacturer wants to distribute at TJ’s, they get only a small amount of shelf space to begin with, and if the product sells well, they can only get more shelf space / stay in distribution if they agree to sell the product under the TJ’s private label. To me I thought this was a fascinating aspect of TJ’s purchasing strategy, especially as they’ve achieved large enough scale that they can enter this virtuous cycle of attracting manufacturers who are looking for the volume, and then pushing out a lower-cost product for the consumer.

I also am curious about TJ’s internal product innovation model. One of the things I’ve noticed, as a loyal fan, is that over time their offerings of unique, incredibly tasty products has really exploded, from very addictive snacks (that I sometimes prefer to those produced by the large national brands) to baking mixes and frozen food offerings. I’m very curious how much of this unique product development process occurs in-house (which would be pretty cost-intensive) vs. through its food manufacturing partners, and if the latter, how they maintain the exclusivity of the new product given that it would be competing indirectly with the manufacturer’s branded products being sold in other retail channels.

Balancing low cost with profitability is always hard, and I don’t think any business can do that without getting their operations right. In the case of Trader Joes, private labeling seems to be central to their strategy. It would be interesting to know, why TJ has been so successful at private labeling compared to others. Based on personal experience, it seems like they’ve been able to maintain the quality and broken the stereotype that private label stuff is cheap and poor quality.

Great job of organizing the key drivers of TJ’s success so succinctly!

Trader Joe’s is certainly a great place to shop and the experienctial aspect is enhanced due to its customer service. However, the fact that they don’t sell many products is unfavourable to me as a grocery shopper. We are all pressed for time these days and when I go grocery shopping, being able to pick everything from a single location is extremely helpful. That is why, at times, I prefer going to wholefoods because of their greater variety.

One way that TJs does differentiate itself is their private label products which, I agree, are very unique but I would personally like to see them scale their model and perhaps start stocking more products. In my view, it would help them drive more traffic through their stores and cross sell their private label even more.

JJ – you unpacked TJ very well!

Great analysis on the store’s competitive advantage and comparative metrics. Along with EDLP and customer-centric focus of the retailer, I would think a key driver is their choice of retail locations. (1) To that end, how would you characterize their site selection process and what are the attributes that TJ benchmarks for in new markets?

Similarly, the closest comp to TJ appears to Whole Foods and potentially local mom-n-pop groceries.

(2) What do you think however is the threat from on-demand grocery distributors such as InstaCart and Peapod to TJ’s business model? Do the friendly service and satisfied employees benefits get mitigated by a growing demand for home deliveries by the same customer segments?

Looking forward to a location soon in Gotham,

Batman