‘Uber-ization’ of the insurance industry: Aviva embracing digital innovation to increase customer engagement and fend off digital disruptors

Insurance industry has been slow to promote digital innovation, but the changing customer expectations and growing importance of digital channels are pushing all players to step up digital investments and offer customer-centric products and services.

Importance of going digital to take customer connection to a new level

In an industry not exactly known for its digital innovation, major insurance players are now struggling to meet demands of increasingly tech-savvy customers who want simplicity, transparency, and accessibility that they have become accustomed to in other sectors. They want policies tailored to their requirements and easy access to quotes and prices when they want it via the platform they choose. They look at value rather than price, and do not seek to forge a long-term relationship with their insurers.

However, few insurers are able to meet these demands. Given their traditional focus on risk and ratings, their understanding of their customers lags behind the advanced techniques being developed by internet and telecommunications’ businesses [1]. Compared to other sectors, a customer experience in the insurance industry is undermined by limited integration between channels and lack of flexibility and accessibility in policy adjustments.

These shortcomings led some customer-centric competitors, including the data-rich and tech-enabled entrants, to come into the competition and chip away at insurance markets. While traditional non-life insurers have been relatively slow at adapting to such changing dynamics, several players have started to leverage their digital assets to provide more customer-oriented services.

Aviva pushing to transform its business and become a digital insurance company through innovation

Aviva, a leading UK-headquartered non-life insurance company, is at the forefront of digital innovation, investing heavily into digital innovation and product development to offer differentiated customer experience and services.

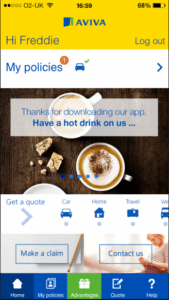

For example, the Company launched a new mobile application MyAviva, a one-stop-shop for a unified customer acc ount, where users can log in and access information on all their Aviva products in one place, review terms and conditions and make alterations to policies. The app, costing GBP 13.5 million to build over 12 months, also gives customers access to a wealth of information and special offers, ranging from tips of home renovation and maintenance to rugby news and highlights[2]. Aviva hopes that digital products will help increase the number of products and services taken up by individual customers, raising its average products holding per customer from the current 1.7 products per customer to more than three products per customer.

ount, where users can log in and access information on all their Aviva products in one place, review terms and conditions and make alterations to policies. The app, costing GBP 13.5 million to build over 12 months, also gives customers access to a wealth of information and special offers, ranging from tips of home renovation and maintenance to rugby news and highlights[2]. Aviva hopes that digital products will help increase the number of products and services taken up by individual customers, raising its average products holding per customer from the current 1.7 products per customer to more than three products per customer.

The Company also recently appointed Andrew Brem as Chief Digital Officer, whose role is to focus on product innovation and development through data analytics, customer insights and risk management. Through this appointment and assembly of new leadership team, the Company plans to strengthen its capabilities to manage direct distribution, interactive communication and claims handling, as well as marketing and branding across social media and the mobile internet.

In addition, Aviva set up a ‘Digital First’ tech hub in London’s Tech City area in Shoreditch. This initiative aims to encourage digital start-ups to focus on insurance industry projects and bring tech experts within Aviva into one location to develop new digital offerings for existing and new customers.

Digital innovation accelerating the Company’s efforts to expand into global markets

Last year, Aviva, the Monetary Authority of Singapore (MAS) and the British government signed a statement of intent to promote digital innovation in insurance and across Asia and to develop new business models and products in areas such as life, savings, retirement and health insurance [3]. The alliance will also be exploring options to promote competition, lower costs and minimize barriers to digital products and distribution. Furthermore, they also aim to support financial technology (FinTech) start-ups with expertise, resource and facilities.

Whether Aviva will be able to replicate its UK success in Singapore remains to be seen, but the Company believes it is critical to be at the forefront of innovation in these developing markets with strong growth potential and is confident about the direction of the Company’s new strategy.

Insurance industry poised for more innovation and growth

While insurance industry has been relatively slow in embracing digital innovation to increase customer engagement, several market leaders including Aviva have started to explore untapped commercial opportunities through significant investments in some interesting areas. With more agile, innovative FinTech companies entering the market, the pace of digitalization will accelerate even further to increase connectivity with customers and offer more differentiated services, enabling ‘uber-ization of the insurance business. Going forward, it will be important for all players to compete or collaborate with one another to reshape the industry and discuss how to change key components of the insurance business value chain, such as products, marketing, pricing, and distribution. (word count: 780)

[1] PWC, Insurance 2020: The digital prize – Taking customer connection to a new level

[2] iPMI Magazine, “Aviva launches MyAviva app”, May 29, 2014

[3] Company, “Aviva, the British government and the government of Singapore to promote digital innovation in insurance”, Jul 29, 2015

Great article that addresses the problems facing the insurance industry, one of the most antiquated industries in business today. I really think insurance will undergo radical transformation over the next decade, and digitalization will inevitably play a huge role as the industry shifts. One other example of how digitalization has impacted insurance can been seen through how Liberty Mutual recently partnered with Nest Labs to grow their digital presence. Using the technology that Nest providers user through their smoke alarm and theft protection systems, Liberty Mutual has begun to lower homeowner premiums believing that this technology will be able to reduce loss ratios meaningfully. This represents a fundamental transformation of the insurance industry business model from “reactionary” (address claims after the fact) to “preventative” (addressing the risks before they happen). This is important because all stakeholders are now better informed about potential hazards, all while creating a more cost friendly ecosystem. Specifically, this is good for consumers because they will benefit from lower premiums. This is good for insurance companies because it will lower costs through claims. Lastly, society will benefit from increased accountability and responsibility in using technology to prevent events from happening in the first place.