The Uberization of Uber: Rebounding from a Terrible, No Good, Very Bad Year

Can Uber fight financial risks and competitive forces with (even more) digitalization?

Global Rivals on the Horizon

We’re all familiar with how Uber disrupted the industry with its innovative rider services; today, Uber continues to be the fastest growing company in the world with over 1 million active cars on the road in over 400 cities globally [1]. But, financial risks, new rivals and threatening technologies loom on the horizon.

Though gross bookings doubled to $20 billion, Uber lost $2.8 billion in 2016 [2]. In January 2017, Uber lost 200,000 customers in a single weekend during the #DeleteUber movement as customers deleted the app over its connections to President Trump [3]. In a play that could cripple the tech giant, Alphabet’s self-driving car company Waymo demanded $1 billion in damages from Uber (and a public apology) in a court case that claims Uber unlawfully stole technology for its autonomous vehicle development [4]. And, in a kick-them-when-they’re-down moment, Lyft began to raise $500 million to fund its growth and gain market share against cash-flush Uber [5].

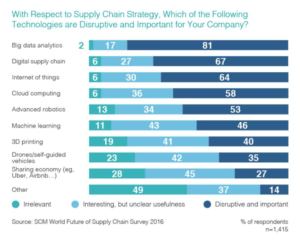

Uber also faces a growing number of competitors globally, thanks to a digitalization revolution in supply chain services; in 2016, the SCM World Future of Supply Chain Survey found that 67% of 1,415 practitioners consider digital supply chain both disruptive and important for their companies, while 27% regard sharing economies like Uber as key disruptors [6]. Competitors now include Dubai-based Careem, Easy Taxi and Cabify in South America, and regional rival Lyft [7].

Even more notable are the driverless cars that threaten to curtail the ride-hailing company’s exponential growth. While Uber (and others, like Toyota and Waymo) forge on in the machine-learning race toward fully autonomous vehicles [8], as an anticipatory short-term play, Uber has no choice but to turn its head to alternative sources of revenue to keep it afloat [9].

Upping Their Digitalization Game

Over the past several years, Uber has actively tried to mitigate the digitalization risk by 1) introducing new services like UberEATS and UberRUSH, 2) continuing to improve its data analytics, and 3) forging on with its driver-less car technology.

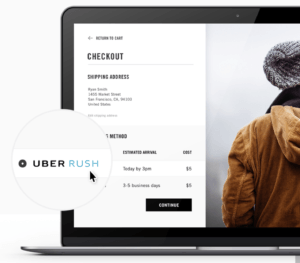

Uber found success in 2014 with its launch of UberEATS, an online meal ordering and delivery platform. In its latest innovation, Uber again broke the mold with UberRUSH, sparked when the company noticed how much collective trunk capacity remained unused within its drivers’ cars: more than FedEx’s global fleet [10]. The rest is digitalization history.

UberRUSH is a B2B and B2C delivery service, used by both small businesses and larger enterprises (like Nordstrom and Walmart). UberRUSH works with commerce platforms like Shopify and Clover, allowing businesses to avoid costly bottlenecks by building deliveries right into their day-to-day operations without additional installation [11]. Uber also recently introduced UberRUSH API, which allows developers to integrate the checkout flow directly with the Uber network, enabling services to be triggered automatically with purchase [12].

By leveraging smart, connected products, Uber enables up-to-the-minute visualization of current supply and demand [13] for its ride-sharing services. By continuing to crunch data and improve its algorithms, Uber could mitigate the digitalization risk by using big data to continue to drive down the cost of deliveries, making it better for consumers, small businesses and the environment (if efficiencies require fewer vehicles on the road).

Beyond the short-term, former CEO Travis Kalanick cited autonomous cars as crucial to Uber’s future financial health, since if another company “gets there first, it could provide far cheaper services by cutting out the human drivers who take a cut of the fares” [14]. Uber, however, must first prove in court it did not steal its technology from Waymo [15].

What’s Next for Uber Technologies

In the short-term, UberRUSH will help Uber alleviate financial competitive pressures from its ride-sharing peers and digitized delivery services like Instacart for Whole Foods and Costco, meal-kit services like Blue Apron, or startups such as Convoy and Cargomatic. UberRUSH is incredibly scalable, and in the short-term, should be rolled out to every small business that competes with Amazon in all 400 cities where there are drivers capable of delivering physical goods, as well as humans. Amazon’s massive advantage in terms of delivery could suddenly crumble, as Uber makes it more convenient to order deliveries via its app.

But for the medium term, as Amazon readies its army of drones and taxi-hailing competitors nip at its tail, Uber has no choice but to continue to invest in driver-less technology. Digitalization is, after all, no longer an option, but an imperative.

The real open question is, if it does lose the court battle against Waymo, how will Uber recover from having to sit out of the self-driving car race? How will Uber compete with one-hour deliveries from Amazon Prime Now? Will the next Uber service be a (more public) consumer behavior data play (e.g., selling consumer data on traffic and purchasing patterns)?

Word Count: 800

[1] Clark, Tim. Facebook and Uber Reveal Secrets of Digital Disruption. (2017, Apr 12). Digitalist Magazine. Retrieved from http://www.digitalistmag.com/digital-economy/2017/04/12/facebook-uber-reveal-secrets-of-digital-disruption-05021535.

[2] Carson, Biz. Uber booked $20 billion in rides in 2016, but it’s still losing billions. (2017, Apr 14). Business Insider. Retrieved from http://www.businessinsider.com/uber-2016-financial-numbers-revenue-losses-2017-4.

[3] Carson, Biz. Uber’s no-good, very bad month: The stunning string of blows that have upended the world’s most valuable startup. (2017, Mar 26). Business Insider. Retrieved from http://www.businessinsider.com/uber-scandal-timeline-2017-3.

[4] Mullin, Joe. Waymo Than Uber Can Afford — Waymo’s staggering settlement demand for Uber: $1 billion. (2017, Oct 12). Ars Technica. Retrieved from https://arstechnica.com/tech-policy/2017/10/waymos-staggering-settlement-demand-for-uber-1-billion/.

[5] Carson, Biz. Lyft is trying to raise $500 million in its fight against Uber. (2017, Mar 1). Business Insider. Retrieved from http://www.businessinsider.com/report-lyft-is-trying-to-raise-500-million-in-its-fight-against-uber-2017-3.

[6] O’Marah, Kevin. Digitization in Supply Chain: Five Key Trends. (2016, Nov 17). Forbes. Retrieved from https://www.forbes.com/sites/kevinomarah/2016/11/17/digitization-in-supply-chain-five-key-trends/#71a50b05428a.

[7] Hinchliffe, Emma. Uber’s global rivals are teaming up, and here’s who they are. (2017, Aug 16). Mashable. Retrieved from http://mashable.com/2017/08/16/uber-global-rivals-didi/#Nz42Boh4SgqQ.

[8] Metz, Cade. What Virtual Reality Can Teach a Driverless Car. (2017, Oct 29). The New York Times. Retrieved from https://www.nytimes.com/2017/10/29/business/virtual-reality-driverless-cars.html?_r=0.

[9] Forget Amazon Prime – UberRUSH is the future of deliveries. (2016, Feb 1). Business IT. Retrieved from https://www.bit.com.au/news/forget-amazon-prime-uberrush-is-the-future-of-deliveries-414452.

[10] Clark, Tim. Facebook and Uber Reveal Secrets of Digital Disruption. (2017, Apr 12). Digitalist Magazine. Retrieved from http://www.digitalistmag.com/digital-economy/2017/04/12/facebook-uber-reveal-secrets-of-digital-disruption-05021535.

[11] UberRUSH. (2017, Nov 4). Retrieved from https://rush.uber.com/enterprise/.

[12] Forget Amazon Prime – UberRUSH is the future of deliveries. (2016, Feb 1). Business IT. Retrieved from https://www.bit.com.au/news/forget-amazon-prime-uberrush-is-the-future-of-deliveries-414452.

[13] Porter, M. and J. Heppelmann, “How smart, connected products are transforming competition,” Harvard Business Review (Nov 2014).

[14] Marshall, Aarian and A. Davies. The Scariest Threats to Uber’s Future, from Waymo to Money Worries. (2017, Jun 8). Wired. Retrieved from https://www.wired.com/2017/05/scariest-threats-ubers-future-waymo-money-worries/.

[15] Ibid.

While the competition for autonomous cars and alternative means for capacity utilization increases, there has been a clear shift in focus away from public transportation to purely movement of goods. If Uber is blocked out of the next frontier of single occupancy/vehicle mobility, what keeps it from innovating in areas where other companies have neglected? Public transportation in the US is a mess and with the data that Uber currently owns, perhaps there are opportunities to provide the transportation ecosystem that the country desperately needs. Understanding local trends in the movement of humans throughout the day and throughout the year, Uber should consider developing solutions that can start moving masses of people, which helps enhance capacity utilization and provide disruptive solutions in an environment that has seen little interest or movement in decades. While nearly all major European countries have robust and affordable rail and bus systems, America places significant reliance on ownership of vehicles. Solutions already exist and what Uber can capitalize on is the execution. As an “asset-less” business, as it claims, Uber would have to prioritize changing its business model and associated cost-structures to accommodate a pivot to a more asset-intensive market of public transportation. However, I find this to a be a great opportunity to consider as an effort to reduce climate change due to vehicle congestion, reduce commute times, and make cities more affordable for citizens to be active contributing members of the larger economy.

Although we are still likely 3+ years before autonomous vehicles start to infiltrate urban areas, I think it is interesting to watch how different companies are approaching their position in the value chain. For example, GM is expected to launch its own autonomous vehicle “well ahead of competitors,” and additionally launch its own transportation service that would compete with others such as Uber and Lyft [1]. Compare this to Uber, which recently announced a deal with Volvo to purchase up to 24,000 vehicles to use in their future autonomous fleet [2]. The vehicles are expected to use a combination of Volvo installed components and add-on technology by Uber. To me, OEMs could have an advantage in the future if they are able to design, produce, and run their own vehicles and services as compared to an Uber or Lyft that has to rely on a partner to deliver on their needs. With that said, Uber and Lyft have a massive head start in acquiring customers to their platforms.

[1] Cheng, E. “GM jumps to record after Deutsche Bank says it will launch self-driving car fleet as soon as 2020,” October 2, 2017, https://www.cnbc.com/2017/10/02/gm-to-launch-self-driving-cars-uber-competitor-soon-deutsche-bank.html, accessed November 2017.

[2] Isaac, M. “Uber Strikes Deal With Volvo to Bring Self-Driving Cars to Its Network,” November 20, 2017, https://www.nytimes.com/2017/11/20/technology/uber-deal-volvo-self-driving-cars-.html, accessed November 2017.

It will be very interesting to see what happens here. For a long time, Uber has thought themselves invincible, and it was to be expected that their chickens would come home to roost when they kept creating so much bad will in markets they entered. As you point out, the outcome of the legal battle with Waymo will be crucial, and could damage both Uber’s finances and its development progress for the project. However I would expect that that would still be no more than a temporary setback. The expected impact of autonomous vehicles on Uber’s business is too great for them to stay out of the game indefinitely.

Really cool topic and analysis, Alison! Uber’s investment in new services is very exciting. Time will tell whether they can create a reinforcing product ecosystem that shields them from competition.

While investment in autonomous cars may be merited today, we will probably not see the benefits of those investments for decades to come. Simply put, it seems that widescale adoption of autonomous technologies may be far into the future. By 2035, autonomous cars are expected to capture 25% of the new car market [1]. This will represent a smaller portion of overall cars on the road, which means overall public adoption or approval may be somewhat low.

Some industry observers believe that adoption may come down to societal factors rather than the underlying technology. A recent Fortune article on driverless cars proposed that “[societal] friction will delay full autonomy for at least a decade, or however long it takes for the tech community (which hasn’t always been particularly empathetic) to collaborate with policymakers, regulators, insurance providers, and consumer advocates to address the significant social, regulatory, and legal challenges AVs will create” [2].

Eventually, Uber may face operational difficulty and growing pains in transitioning its “fleet” to driverless cars. My primary concern on this topic is that the public may not be comfortable with using autonomous car services as a method of transportation. Also, as you noted, Uber has shown that it is susceptible to negative PR and public backlash. I’m concerned about how the public might react to Uber essentially “laying off” hundreds of thousands of drivers by shifting to autonomous cars. With this technology several years down the road, I’m excited to see how digitally enabled driving and delivery services will change in the short term.

1. https://www.bcg.com/en-us/industries/automotive/autonomous-vehicle-adoption-study.aspx

2. http://fortune.com/2017/07/22/driverless-cars-autonomous-vehicles-self-driving-uber-google-tesla/

The main question I am left with thinking about Uber is whether they are spreading themselves too thin as they are fight battles on many fronts: 1) They are fighting against Lyft in the US ridesharing market, 2) they are fighting against Careem, EasyTaxi etc in the international ridesharing market, 3) they are fighting against Google and most car manufacturers on autonomous vehicles, 4) they are fighting against logistics companies with UberRUSH and 5) they are fighting against food delivery companies with UberEATS. This reminds me about the Chinese Proverb that if you chase two rabbits, you will catch neither. The only difference is that Uber is chasing five rabbits and at the same time are dealing with sexual harassment internally, a new CEO and a gigantic lawsuit at the same time. All of this will strain Uber’s resources both financial and non-financial. Perhaps the better way forward for Uber is to focus their efforts rather than doing more.

thanks for sharing Alison. I would like to respectful disagree with the fact that Uber will have to sit out of the autonomous vehicle race with regards to the ongoing Waymo litigation. Uber, with it’s acquisition of Otto, is leading the industry in autonomous trucking and fleet management – which may end up being the largest piece of the autonomous vehicle pie. While the Uber acquisition of Otto resulted in unwarranted and unjustified litigation as a result of Mr. Lewandowski – the future lies in both the vehicle technology but also in the management and customer base.

Uber recently ordere 100 cars from Volvo. The bigger concern is whether they can manage the pivot to an asset heavy model as an owner of these vehicles versus being the middle man as part of the platform