The Northern Sea Route: Will the LNG shipping industry follow Dynagas’s lead?

In 2012, Dynagas LNG Partners Limited controlled LNG carrier “Ob River” made history by becoming the first LNG vessel that utilized the Northern Shipping Route (“NSR”) to transport LNG. Will climate change make it easier for other shipping companies to compete with Dynagas in the NSR? What are the advantages associated with utilizing the NSR? Can Dynagas really insulate itself from competition?

The Northern Sea Route (“NSR”) runs from the Atlantic Ocean to the Pacific Ocean along the northern coastline of Siberia. Climate changes have been increasing this route’s accessibility to shipping companies. In 2014, the amount of ice in the Arctic was 30% less than in the 1980s while in 2012 the ice in the Arctic melted to a record low of approximately 60% of the 1980s average level [1]. The NSR is accessible mostly in the summer and autumn months when ice thickness reaches the lowest level in the year. Traveling through this route reduces the distance between Northern Europe and Japan by approximately 40%. A vessel sailing at a speed of 17 Knots from the Yamal LNG Plant in Russia to Japan via the Suez Canal will complete the trip in approximately 35 days. Alternatively, if the vessel sails through the NSR, it will complete the same trip in only 15 days at a speed of 16 Knots per hour.

Dynagas LNG Partners Limited (“Dynagas”) is the only liquefied natural gas (“LNG”) shipping company that has successfully utilized the NSR to transport LNG. In 2012, Gazprom chartered Dynagas’s LNG carrier “Ob River” to transport LNG from the port of Hammerfest in Norway to the regasification terminal in the port of Tobata in Japan [2]. This is a historical voyage as it demonstrated to the LNG shipping world that climate changes have made shipments of LNG cargo via the NSR technically feasible and economically viable.

The ability to utilize the NSR has opened new opportunities for Dynagas and the LNG shipping world. Sailing through the NSR enables a company to reduce environmental emissions since a vessel is in transit for a shorter period of time. Ship-owners also achieve significant fuel savings per ton of cargo transported due to the shorter distance of the trip. Furthermore, the quantity of LNG that evaporates while in transit is reduced due to the shorter distance that has to be covered, leading to a larger quantity of delivered LNG at the regasification terminal. Finally, avoiding transit through the Suez Canal mitigates risks associated with attacks from pirates [2] [3].

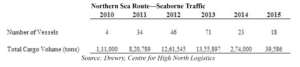

Although Dynagas has been the only LNG shipping company that has utilized the NSR, over the years, we have seen a significant increase of different types of cargoes being transported through the NSR. Specifically, the number of vessels that utilized this route increased from four in 2010 to a maximum of 71 in 2013 and fell to 18 in 2015 [3]:

Despite the recent growth in the NSR trade, traditional LNG shipping players have been hesitant to utilize the route. Oil & Gas majors such as Gazprom are willing to charter only state of the art LNG carriers from leading and highly experienced shipping operators because of the technological complexity of the vessels and the complexity of cargo handling operations. Furthermore, building an ice class LNG carrier that is capable to transit the NSR requires a significant amount of capital, which ship owners and their financiers are usually willing to commit only if the new building contract of the vessel is backed by a long term charter contract at a hire rate that offers an acceptable return.

Going forward however, I expect to see a growing number of major LNG players that will follow the steps of Dynagas and build vessels that can transit the NSR. This move will be facilitated partly by rising temperatures that are expected to further reduce ice levels in the Arctic, making the trip easier in terms of technical and operational requirements [4]. This view can be supported by the recent orders placed by Teekay, CLNG, MOL, and China Shipping for the construction of nine LNG carriers that will be capable to transit the NSR [5].

In conclusion, Dynagas should expect to face significant competition from other LNG shipping companies as climate change will make it increasingly easier for companies to utilize the NSR. This will result not only to increased competition in securing long-term charter contracts with charterers who are looking to charter ice class LNG carriers, but also to an increase in the effective world LNG cargo carrying capacity since more vessels will be able to carry cargo through shorter distances, potentially amplifying downward pressures to LNG charter rates. To mitigate increased competition, Dynagas can only utilize its first mover’s advantage and focus on establishing long lasting relationships both with major shipyards to ensure it has access to attractively priced newbuilding tonnage, and with major LNG charterers in order to become the transportation provider of choice for as many clients as possible.

Words (excluding citation): 770

[1] Climate change; new findings reported from Norwegian university of science and technology (NTNU) describe advances in climate change. (2014). Global Warming Focus, 290. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1518472545?accountid=11311

[2] http://www.gazprom.com/press/news/2012/december/article150603/

[3] https://www.sec.gov/Archives/edgar/data/1578453/000091957416012495/d7124083_20-f.htm

[4] Cosy amid the thaw; arctic politics. (2012, Mar 24). The Economist, 402, 61. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/940868001?accountid=11311

[5] http://www.lngworldnews.com/dsme-clinches-9-lng-newbuildings/

Hi Dimitri,

Very neat (and sad in many ways) analysis of the impact of global warming on changing oceanic trade routes. A few questions that come to mind.

(1) Why are the LNG boats that are traveling this route so much more costly? Is it simply that they need stronger “ice-safe” type hulls and that this is more expensive? Or is it simply that LNG boats alone are more expensive than other boats (you did mention this was part of the story above).

(2) Why the focus on LNG boats and not other types of boats? (i.e. bulk freighters, container ships, oil ships, etc.). It would seem to me that pretty much any boat would want to travel from Europe to Japan/China using this route if possible given the substantially shorter sailing times. If so, it would seem that this might substantially reduce total carbon footprint from the shipping industry.

Taki

The threat of competition to utilize the NSR over the coming years could also be compounded by the expected increase in demand for LNG in the Asia Pacific region. Exxon, for example, expects this region will comprise the bulk of increasing LNG demand for the foreseeable future. As the NSR continues to open up, it may become even more commercially significant as competitors try to take advantage of the expanding Asia Pacific LNG import market. As you’ve stated, exploiting the first mover advantage would seem to be key for Dynagas. [http://cdn.exxonmobil.com/~/media/global/files/outlook-for-energy/2016/2016-outlook-for-energy.pdf]

Dimitris, this was an incredibly interesting read. It is certainly sad to read about the increased melting of polar ice, but I do agree that it is only logical that businesses such as Dynagas take advantage of this opportunity. One aspect of the data that I was wondering about is why did the number of vessels using the NSR drop precipitously after 2013? Is it because of a fluctation in energy prices that made the route unviable again? One possibility could be a difficulty in obtaining permits after the the Russian government created a Northern Sea Route Adminisitration that governs this passage. In addition, these permits add cost as the infrastructure of the route is built and the ships are required to accept Russian icebreaker assistance (http://www.businessinsider.com/russia-intensifies-control-over-shipping-route-2013-9). It will be intriguing to see if the number of ships using the NSR begins to rise again.

I think this is one of the few posts I have read where climate change is actually creating business efficiency (making it easier for vessels to use the erstwhile difficult route). The way I read this post was that climate change will make it easier for Dynagas’ competitors. This would give Dynagas a huge huge incentive to prevent this – though I am not sure how much it can directly effect global warming. Do you see any viable ways that Dynagas can actually slowen the icecap melting or is the way out only to leverage other competitive advantages?

Great post, Dimitri, as the opening of the Northern Sea Route clearly demonstrates a game-changing effect of a warming climate. As this shipping passage becomes more navigable and widely accessed, I wonder what the geopolitical ramifications will be. Historically, there have been many flare-ups and power struggles over shipping lanes and canals, and I imagine this will be no different. How will companies like Dynagas navigate these new political waters and will governments which are at odds (i.e. the US and Russia) hinder or help the development of the channel? If the NSR demonstrates one thing for sure it’s that climate change will surely have impacts on businesses and the balance of global power at large.

Dimitris—this was an interesting blog post as it seems to be one of the few instances where an industry actually directly benefits from climate change as rising temperatures reduce ice levels and make it more economically and operationally feasible for shippers to take advantage of the Northern Sea Route. Is there any concern that companies like Dynagas would actually be incentivized to accelerate the impact of climate change so as to increase their access to the NSR, or is it unlikely that a few shipping companies could do enough to materially change the situation in any negative way? Also, are there environmental or ecological impacts of utilizing this shipping route beyond what one would have with a traditional (non-Arctic) shipping route?

Really interesting perspective on how companies are actually taking advantage of the new global landscape brought about by climate change. I am also very curious as to why the number of ships using the NSR passage has been decreasing so significantly from 2013 to 2015. Have there been any safety concerns with transporting large amounts of very flammable LNG through a passage way that is so far from the rest of civilization? I would imagine that the response time of outside resources to come help a ship deal with an LNG leak would be extremely slow and maybe a near miss accident led to the decrease in usage.

I also found this one quite interesting. There are also other industries benefiting from the ice melting, namely the luxury tourism industry. As you can see from the article below, some cruise companies are trying to monetize the opportunity to tour the famed “Northwest Passage” which is now starting to open up due to climate change.

It would be nice if companies like these could create a fund whereby they set aside some of their profits to support research into protecting certain aspects of the regions they are financially benefiting from.

http://www.cbsnews.com/news/northwest-passage-cruise-crystal-serenity-ice-choked-waters-concerns/

One thing I find interesting about this is that while the opening of the Northwest passage allows for shorter travel times and this lower costs, at the same time, lower oil prices cause ships to take longer routes to avoid high charges for the Suez and the Panama Canal. This worsens environmental impact to a much greater degree. I would thus argue that the shipping industry as a whole is not concerned about the environment but only about their cost at this point because the industry in such big trouble given the surplus of ships which will worsen as routes shorten.

See BBC article form earlier this year: http://www.bbc.com/future/story/20160303-cheap-oil-is-taking-shipping-routes-back-to-the-1800s

Very interesting post. In addition to some of the political concerns raised by commenters above, I wonder what some of the implications to the local environment by opening this route could be as the route becomes more popular. Very clearly, the local environment in this area has already been harmed as the ice cap melts opening up the route in the first place, but how can introducing ships further amplify the impact to the local land, water, atmosphere, animals, and plants? I found this journal article (http://www.sciencedirect.com/science/article/pii/S2405535214000096) which states some of the main areas to control and watch out for are ship collisions and emissions. I wonder what processes can be used to avoid ship collisions and if there are any special considerations in this area compared to other passages throughout the world? How do you balance some of the potential environmental risks to this localized area with the overall gains in curbing climate change with the decreased distances ships would travel?

This is a fascinating read that reminded me of a similar opportunity opened up by the melting ice caps. Similar to how Dynagas is now able to pilot a ship through an area that was previously unnavigable, ships that lay the fiber optic cable that connects continents and enables worldwide internet access are able to lay cable to connect the UK to Japan across the arctic ocean[1]. There’s also a proposed cable that could be laid between Tokyo and Alaska that is also possible because of the melting ice caps. This cable would allow high speed internet to remote communities in Alaska and Canada for the first time[2].

It’s interesting that while climate change is undoubtedly a huge problem, opportunities like more efficient shipping lanes and communications lines are a positive side effect.

[1] IEEE, 2015. Fiber Optics for the Far North. IEEE Spectrum, 1

[2] Pitch Interactive, 2016. A Northwest Passage for the Internet. Scientific American, June 2016, 1-2.

Great article Dimitris. When we think of Climate Change, very often we only see it through the lens of negative externalities. I wonder however wether the positive effects are not temporary. In reality, one could think that increased competition will lead to increased traffic hence further climate deterioration. Would that not have a Long Term negative effect on the ships carrying capacity? Also increased traffic can increase over reliance on O&G which has negative effect in other sectors?

A few have commented on the steep decline in the number of ships traversing the Northern Sea Route between 2013 and 2014. Part of the decrease in 2014 can be attributed to the weather which made traversing the route in 2014 more dangerous compared to 2013. However, there are some issues involved from an operational standpoint. Reducing the absolute transit time (e.g. from 35 days to 15 days) is one thing, but ensuring that the ships arrives on time at its scheduled arrival date is another. In shipping, as in TOM, the concept of “just-in-time” (JIT) is important. Moreover, many of the newer container ships that are being built today are too bulky and cumbersome to use in the Arctic, thereby making the Northern Sea Route less attractive than it would originally appear.

Dimitris,

Thanks for this informative posting. Clearly the world is changing fast not only environmentally but also technologically. Given the challenges of not only transporting but also storing LNG, do you believe that LNG will continue to be an economically viable fuel source for consumers vs. other fueld sources? There is significant competition from other energy forms that can be more easily transported and require lower capital costs. Has the shipping industry’s perspective on the economic business potential for LNG transportation changed in the last few years given low energy costs and constant technological advancements? Thanks