The Internet of Trash

Technology turns trash into treasure for Waste Management, Inc.

In 1893, Harm Huizenga, a Dutch immigrant, pulled a cart through the streets of Chicago and hauled away trash for $1.25 per cart load[i]. Huizenga’s business grew through industry consolidation and acquisitions into Waste Management Inc. (NYSE: WM), a $14 billion firm that offers comprehensive waste management environmental services beyond traditional solid-waste hauling and recycling. Technology and digitization have introduced efficiencies into Waste Management’s operating model and created new business opportunities for the firm in sustainability software and services.

Deploying Technology in the Waste Collection Process

Waste Management (“WM”) hauled over 90 million tons of trash for municipal, commercial, and industrial customers in 2012[ii]. The vertically integrated company maintains a large “hub and spoke” trash collection system[iii] with fleets of trucks collecting trash from customers along collection routes (spokes) to 297 transfer stations and 249 landfills (hubs)[iv]. Transfer stations sort trash from reusable materials and consolidate and distribute non-recyclable materials to landfills for long-term storage.

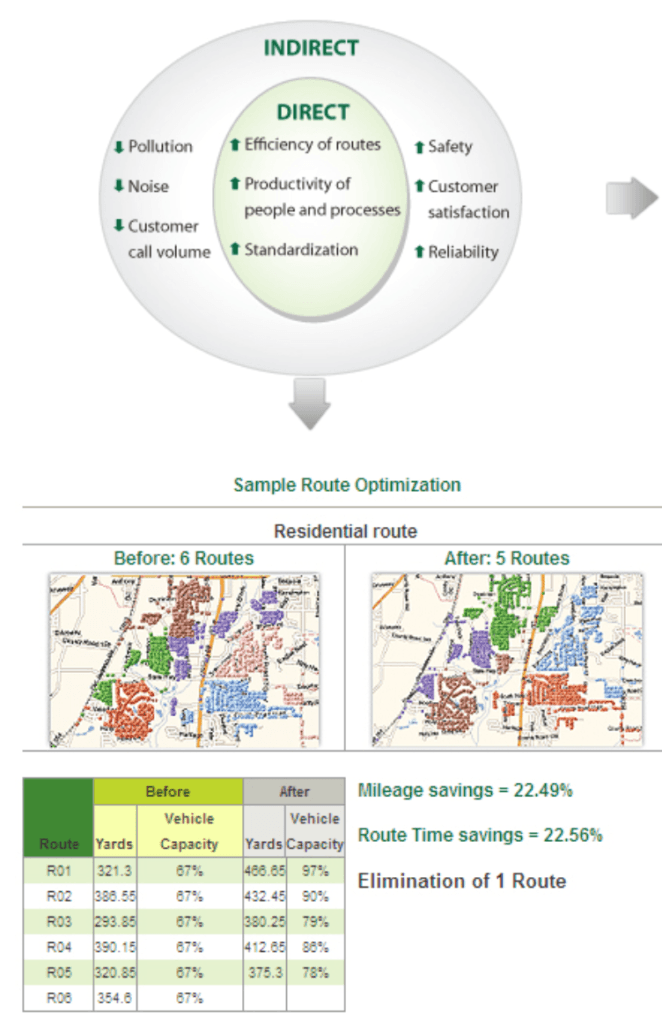

WM’s traditional trash hauling business has benefited from digitization in the form of physical asset management and utilization. It has deployed smart sensors in its fleet of over 5,000 pieces of machinery across 700 locations in North America.[v] These sensors transmit maintenance and operating information to a central software platform that allows managers to efficiently schedule maintenance and train operators resulting in “reduced breakdowns and costly downtime” for the company.[vi] GPS-tracking technology implanted in WM’s trucking fleet and subsequent analysis by WM managers using cloud-based logistics software enables optimization of collection routes and more efficient utilization of employees and assets as shown in figure 1.[vii]

WM has also turned to start-ups with emerging technologies to improve its trash collection business. In 2009, WM partnered with BigBelly Solar to distribute a “smart” solar-powered trash compactor that can accommodate 5 times the amount of trash as a typical 35-gallon trash barrel.[viii] When full, the unit wirelessly transmits a signal to the municipality allowing for efficient collection by WM and municipal partners.

Digitization in WM’s Service Business

Technology and digitization have created business opportunities for WM beyond its traditional trash collection business. Using expertise developed in its own physical asset management and GPS-fleet tracking capabilities, WM manages a logistics business that designs fleet-optimization and tracking solutions for its customers.[ix] Similarly, WM is leveraging its own investments in security technology such as software and a security operations center to offer customers cloud-based security services.[x]

Technology also has the potential to come into conflict with WM’s existing businesses. WM’s sustainability advisory services business unit develops environmental management systems for customers to reduce waste and environmental costs and meet sustainability goals. As part of this business unit, WM developed ENSPIRE, a web-based analytical software that tracks waste and environmental metrics including tonnage trends, waste diversion, and energy consumption in a “cloud based, interactive analytic interface”.[xi] WM’s waste reduction solutions directly conflict with the volume-based revenues of its trash hauling business. However, substitute revenues from deploying and servicing such software based solutions serve as an example of how a business can pre-empt a business-disrupting technology by integrating it into its business model.

Additional Steps for WM

While WM has invested in biofuel and alternative energy start-ups that allow WM convert materials destined for landfills into fuels,[xii] WM must consider investing in or acquiring start-ups that are developing IoT hardware and software that enhance its business and operating models. WM partnered with BigBelly as a product distributor to increase efficiencies in its own collection process in 2009, but BigBelly is now pursuing additional IoT capabilities such as sensors that communicate bin usage, bin content, and community messages.[xiii] These capabilities complement WM’s environmental management software and services, but may result in competition between BigBelly and WM if not properly integrated with WM’s software.

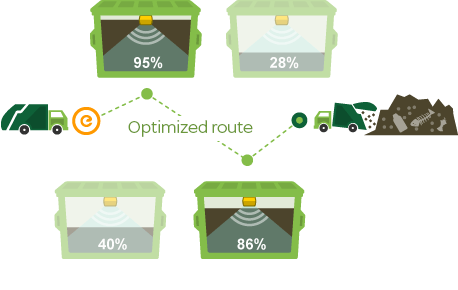

Similarly, the Finnish firm enevo is directly competing with VM’s logistics service by offering fleet optimization software that is combined with a data collection device inside of dumpsters and trash cans. The device provides real-time trash level monitoring beamed to the cloud and accessible via a web-based platform (see figure 2).[xiv] WM should acquire enevo or develop similar sensing hardware to expand its trash monitoring capabilities and long-term service contracts with its existing customers.

WM’s embrace of digitization has increased efficiency in its operating model and introduced new innovative services that complement its business model. However, the company must look to start-ups and sensor hardware to maintain an edge in the increasingly digital waste management and environmental services business.

(Word Count: 754)

[i] Swanson, Stevenson. March 29, 1993. “Lucrative lure of garbage hauling has long been a dutch treat. The Chicago Tribune. Retrieved from http://articles.chicagotribune.com/1993-03-29/news/9303290044_1_garbage-dutch-waste-management.

[ii] Bomgardner, Melody M. 2012. Transforming Trash: Waste Management is partnering with a diverse group of renewables start-ups. Chemical and Engineering News. 90, 45. p. 19-21.

[iii] Rogers, Heather. 2005. Gone tomorrow : the hidden life of garbage. New Press. p. 186-188.

[iv] Waste Management. 10-K Disclosure Form 2015. Retrieved from http://services.corporate-ir.net/SEC.Enhanced/SecCapsule.aspx?c=119743&fid=14215151. Accessed on November 13, 2016.

[v] Van Hampton, Tudor. 2015. “Moving Data and Dirt.” ENR: Engineering News-Record 274, no. 10: 21. Accessed November 13, 2016.

[vi] Van Hampton, Tudor. 2015. “Moving Data and Dirt.” ENR: Engineering News-Record 274, no. 10: 21. Accessed November 13, 2016.

[vii] Waste Management. Logistics. Retrieved from http://wmlogistics.wm.com/resource-library/roi-and-white-papers.jsp. Accessed on November 13, 2016.

[viii] Roush, Wade. June 12, 2009. “BigBelly Strikes Big Agreement with Waste Management.” Xconomy. Retrieved from http://www.xconomy.com/boston/2009/06/12/bigbelly-strikes-big-agreement-with-waste-management/# Accessed November 13, 2016.

[ix] Waste Management. Logistics. Retrieved from http://wmlogistics.wm.com/solutions/by-product/eroutelogistics.jsp. Accessed on November 13, 2016.

[x] Waste Management. Security Services. Retrieved from http://www.wm.com/business/security-services.jsp. Accessed on November 13, 2016.

[xi] Waste Management. Enspire Sustainability Services Factsheet. http://www.wm.com/sustainability-services/documents/solutions/ENSPIRE%20Information%20Sheet.pdf.

[xii] Bomgardner, Melody M. 2012. Transforming Trash: Waste Management is partnering with a diverse group of renewables start-ups. Chemical and Engineering News. 90, 45. p. 19-21.

[xiii] Clancy, Heather. 2015, February 3. “Bigbelly wants to be more than a smart trash company.” GreenBiz. Retrieved from https://www.greenbiz.com/article/bigbelly-wants-be-more-smart-trash-company. Accessed on November 13, 2016.

[xiv] Enevo Products Webpage. Retrieved from https://www.enevo.com/products/. Accessed on November 13, 2016.

I’m so glad you focused on a subject that many people prefer to ignore! We talked about externalities during our climate change class discussion, and trash and recycling are great examples of externalities. People usually don’t like to think about their trash, and thus they don’t acknowledge the huge environmental cost of removing trash and recyclables from our residential and commercial areas.

Waste Management has done a great job at introducing new technology to its trash collection business, but I think we’ll need to see more paradigm changes within`. As WM is able to obtain more real-time information through wireless technology, such as the capacity and payload wireless information provided by the BigBelly Solar unit, hopefully it will then move to changing how we PAY for trash.

Trash collection is unique among utilities, in that it is not priced based on actual consumption. In fact, there would probably be public backlash if local or state governments tried to charge people for trash collection. However, we need to find a way to link the cost of waste management (reclamation and landfill) to actual practice.

As a caveat, one result of charging for trash based on consumption might be an increase in littering. If people are faced with the choice of paying more, they may choose to dump their trash in others’ dumpsters, or worse, litter.

Thanks for a wonderful post.

When it comes to logistical improvements stemming from digitization’s impact on WM’s operating model, I am very curious where specifically the gains have been made. I presume that better, real-time data and ‘smart bins’ would provide for better information with less lag — and, in turn, that informational advantage could lead to an optimized pickup/drop-off route. In this way, it’s interesting to see how better information process flow directly cuts out time and inefficiency in the physical flows.

There is one other area that it would be interesting to see WM take on a more active role in: changing consumer behavior in terms of waste disposal / sorting for recycling. Of course, a huge piece of the issue is cultural and governmental, but the difference between the US and Germany is just staggering. In Germany, 65% of waste is recycled– it is sorted so efficiently that an entire industry has blossomed that converts waste into energy [1]. This industry is, in fact, so effective that Germany is now importing trash from neighboring countries to fuel its incineration plants [2]. Is there some way that WM could establish economic incentives that could drive consumer behavior in waste disposal?

[1] http://fortune.com/2015/10/20/germany-import-trash/

This is a super interesting post !

As mentioned by MS_2018, it will be interesting to see if WM will take any initiatives to educate more consumers in terms of waste management. Do you think it will also be imperative that WM starts educating the industries which deliver the trash as well? This could be done by having a transparent waste management system across the value chain resulting in the use of more recyclable waste. For example, a company like Unilever does this by having a sustainability goal of having zero waste. [1]

[1] http://www.supplychain247.com/article/achieving_zero_waste_across_the_value_chain