The impact of Brexit on pan-European champions: the example of Airbus.

Increase in isolationist movements throughout the world questions the model of globally integrated supply chains. Focus on the Brexit and its consequences for Airbus.

How the UK’s exit from the single market threatens Airbus’ current commercial division supply chain.

Trade relationships between the UK and the European Union (“EU”) have been ruled by the single market, which guarantees freedom of circulation of goods, services, capital and people. This has allowed industrial players from various European countries to invest in facilities in the UK and to gain exposure to the British expertise in manufacturing of highly technological products.

However, the recent vote for Brexit challenges the UK’s position in the single market and calls for new trade agreements between the UK and the EU. These agreements are currently under discussion and outcomes remain uncertain, but the position of foreign players settled in the UK are definitely endangered. One such player is Airbus, a European aircraft manufacturer, operating two large industrial sites in the UK (Filton and Broughton). Both sites receive parts from other Airbus factories and suppliers in Europe and manufacture complex components, including wings, fuel systems and landing gears. These complex components are then shipped to final assembly lines located in Europe (Toulouse and Hamburg), China and in the US.

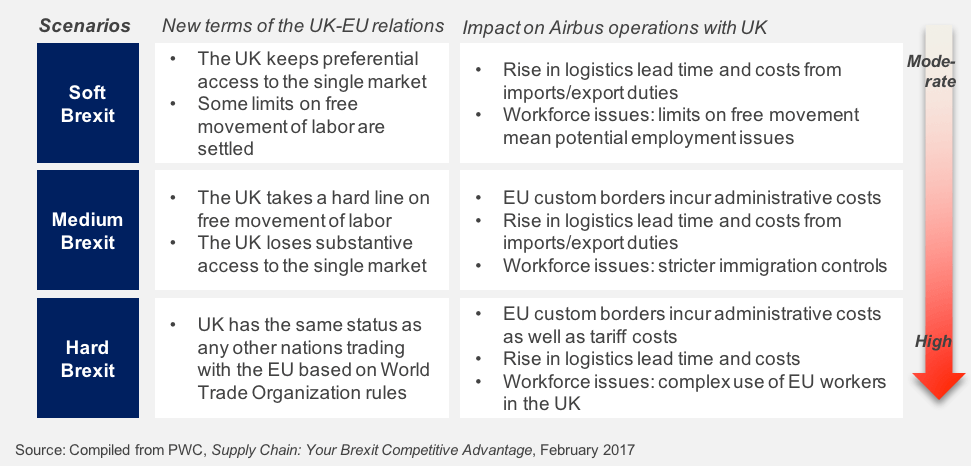

The impact of Brexit on Airbus’ supply chain in Europe will vary depending on the new terms of the trade relationship between the UK and the EU. Several scenarios are possible.

Figure 1: Distinct scenarios for Airbus operations in the UK.

A still-to-be-defined action plan for Airbus.

In the short run, Airbus has chosen to leverage its position as a large employer in the UK (it claims to support 110,000 jobs in the UK, directly or indirectly[1]) to advocate for a “soft Brexit” and encourages UK politicians to do their best to reach similar trade terms as those of the single market. This is how for instance, Fabrice Brégier, Chief Operating Officer at Airbus stated that the Company would find it “very easy to have a new plant somewhere in the world for new projects. We would have plenty of offers” and added that Airbus “wants to stay in the UK provided the conditions to work in an integrated organization are met”[2].

As far as the medium-term horizon is concerned, Airbus has not yet provided information around any specific risk hedging policy. Still, the Company follows a strategy of geographical diversification of its supplier base[3], which should de facto limit its exposure to risks arising from isolationist movements in some specific West European countries. Thus, Airbus targets to get 40% of its supplies outside Western Europe by 2020 and has created a dedicated team to achieve this goal; the team currently operates in strategic countries including the US, China and India.

Some recommendations: the A320 case.

Figure 2: Overview of Airbus A320 supply chain geographies

Airbus’ current commercial bestseller is the A320, which actually designates a wide range of distinct narrow-body, commercial passenger jet airliners. A320 represents 83% of Airbus commercial orders backlog[4]; outlook for the future seems positive (Airbus just signed an all-time high order for 430 A320 with the US investment firm Indigo Partner[5]). Most of the A320 are currently manufactured in final assembly lines in Europe (over 80% in volume as of early 2017), in Hamburg (Germany) and Toulouse (France). Both of these factories receive their wings from Airbus’ production sites in the UK. Other A320 assembly lines are located in China (since 2009) and in the US (since 2016).

Airbus already struggles with the delivery times of its A320[6], and any additional delays could be fatal to the Company’s reputation and market position. Therefore Airbus’ top priority should be to maintain a fluid and integrated supply chain. More specifically, Airbus could build up wing production capabilities around different countries within the wider EU territory by sharing of expertise with its current UK facilities. Airbus could also consider increasing the share of A320 produced in its China production facility (currently less than 10%) as it is supplied by a local wing manufacturer.

All in all, it should be noted that isolationist risks for Airbus do not lie in European territories only. It would be interesting to get views on potential consequences of Trump election on global players which have chosen to locate part of their supply chain in the US.

(743 words).

[1] Airbus Company, “Airbus in the UK”, http://www.aircraft.airbus.com/company/worldwide-presence/airbus-in-uk/. Accessed November 2017.

[2] “Airbus may look beyond UK unless Brexit demands met – Sunday Times.”, Reuters, June 10, 2017. Accessed November 2017.

[3] Airbus Company, “Global Sourcing”, http://company.airbus.com/company/for-suppliers.html. Accessed November 2017.

[4] Airbus Company, “Orders and Deliveries”, http://www.aircraft.airbus.com/market/orders-deliveries/. Accessed November 2017.

[5] “Dubai Airshow : Airbus seals order with US firm Indigo”, BBC, November 15, 2017. Accessed November 2017.

[6] “Engine delays hit Airbus profits, delivery targets fragile”, Reuters, July 27, 2017. Accessed November 2017.

Maud– this is an interesting read. Agree that Airbus would do well to diversify its production capabilities beyond the EU in the post Brexit era. I wonder if Airbus might consider the U.S to be an attractive and viable alternative? As part of its “America First” policy the Trump administration has put increasing pressure on U.S companies like Boeing to increase their manufacturing operations in the U.S with the promise of lowering corporate taxes. The administration has also signaled that it is prepared to give tax and repatriation concessions to foreign multinationals, potentially even Airbus, who are willing to bring manufacturing jobs to the U.S.

Boeing already has a sizable manufacturing presence in the United States (South Carolina) yet the commercial, non-defense, arm of its business continues to face increasing pressure to scale back its agreements with its international suppliers and source plane parts from within the United States instead. It will be interesting to see how the Trump Administration’s anti-globalization policies will impact Boeing’s commercial airplane manufacturing operations relative to the company’s defense manufacturing operations.

It will be interesting to see how Airbus and the industry at large manage the increase in costs associated with Brexit. Whether Airbus chooses to keep production in the UK and absorb the costs associated with unfavorable Brexit terms, or relocate production to a more favorable country (such as the U.S., as suggested by TS), it seems highly likely that labor and duty costs are likely to rise. Will Airbus pass these costs on to the airline, who will they pass them on to air travelers? How will airlines manage the cost increase? It will be interesting to see whether Brexit and its implications for Airbus will have a material impact for the end consumer. My hypothesis is that consumers will see an impact in the medium term, but that in the long-term as Airbus optimizes its supply chain under these new conditions, costs will normalize to what they were prior to Brexit.

Thanks for posting Maud! I found the Brexit scenarios you shared to be very interesting in the context of Airbus’ continued operations. Given the threat of rising costs and lead times it certainly makes sense for Airbus to look at options to diversify its manufacturing base away from the UK. That being said, though the COO claims that it would be very easy to set up a new plant elsewhere in the world, my fear is that the ramp up time, human capital challenges, and costs implied by this move would in reality prove much more difficult for their operations.

I’m curious to see how the mere threat of their movement away from the UK (and the 110k jobs that go with it) will shape the ultimate decision of how the company will be treated in an increasingly protectionist environment.

Maud, great points! And Sara, interesting take as well! I am curious if you see any potential for a reduction in costs as well, Sara. This brings in to the question the effects of another megatrend: climate change. Perhaps counterintuitive, but my perception is that the UK has been kept in line and forced to comply with EU climate change policy, which seemed effective, yet costly. My hypothesis is that various industries will experience deregulation, certainly harmful for the environment and the communities long term, but reducing inefficiency that will allow companies like Airbus to hedge against some of the labor and duty costs Sara worried about above.

Interestingly, Airbus is considering China as its next production destination and has already sent a warning to the UK business. According to a report by Katherine Bennett, the company’s senior corporate representative in the UK, released on Nov 21st, the main threats resulting from Brexit that deter long-term investments are new customs bureaucracy and reduced employee mobility, that add to approximately £1.5bn a year to the industry’s costs. While no current plans to move are in place, it seems like China is already knocking doors as the scenario of non-tariff barriers appears to be critical for the business.

Even though Airbus has been engaging in conversations with the UK government, the latter seems to appear reluctant to take action. “The Department of Existing the EU has so far refused to publish 58 sectoral analysis reports produced by civil servants into the issues raised by Brexit for different parts of the economy” [1]. Tensions have been developing and apparently they only have about a week to fully disclose the documents to the public or a judicial review proceedings would take place in high court [1].

We’ll see how this all plays out next week!

[1] Roberts, Dan. “Airbus boss says Brexit risks losing UK aviation’s ‘crown jewels’ to China”. https://www.theguardian.com/business/2017/nov/21/airbus-boss-says-brexit-risks-losing-uk-aviations-crown-jewels-to-china. Accessed on November 30th, 2017

Maud – I enjoyed reading your post. Echoing Madeline’s comment, I found the Brexit scenarios quite enlightening. Considering the three possible scenarios, I believe that, unfortunately, the “Hard Brexit” scenario is the most likely, given the hard blow that U.K. prime minister, Theresa May, and the conservative party suffered last June, after losing a special election that May herself called. May’s goal by having this election was to gain more seats for her party in the British Parliament, with the aim to have a stronger hand in Brexit negotiations with the EU. May’s miscalculations may prove costly for the U.K. and firms, such as Airbus, that have multinational supply chains. Upon triggering article 50, the U.K. will have to renegotiate all the previous trade agreements with the EU within two years, and, if new agreements are not reached, the old agreements will default to the hardest possible scenarios. Additionally, regardless how valuable of a trading partner the EU may think the U.K. is, the EU is specially incentivized to make the negotiations as difficult as possible to dissuade any other countries from leaving the EU. In the event of a “Hard Brexit”, it will be interesting to see the path that Airbus takes. Do they relocate their operations in other EU countries? Or, do they pass the additional costs down the value chain?

Great read, Maud. It’s interesting to see the suggestions in your essay, as well as from TS and Sara, that Airbus could consider relocating more of its manufacturing to the U.S. Airbus has actually just ramped up its U.S. manufacturing operation in my home state of Alabama via its deal with Bombardier, which sees it take a majority stake in Bombardier’s C-Series airliner business so that their planes can be produced in the U.S. rather than produced abroad and forced to face Trump’s import tariffs – another example of isolationist movements on this side of the pond [1]. Given this, I wonder if there remains any additional capacity to produce more Airbus jets in the U.S. without the huge capital expenditure required to build a new plant and all the associated ramp-up costs. I would be interested to see how they would weigh opening a new plant in the U.S., with local talent already identified to help train new staff but higher costs, versus shifting to China as mp.osorio has highlighted.

[1] Reid, David. “Boeing versus Bombardier: here’s what happens next.” https://www.cnbc.com/2017/10/17/boeing-and-bombardier-next-steps-in-the-trade-battle.html. Accessed on November 30th, 2017.

Maud – very interesting read! Thanks for sharing. I really appreciated your assessment of how the U.K.’s pullout of the E.U. endangers Airbus’ position in the single market. I can see how Airbus could be in trouble, considering it’s two large industrial sites in the U.K. You helped me to understand how a move like exiting the E.U. presents massive challenged to complex global supply chains like Airbus’. I also thought your exhibits and figures helped highlight the points.

I agree with your assessment that Airbus needs to maintain a fluid and integrated supply chain as further delays to delivery would have great harm on their business and reputation. I would love to hear though how you think they should move forward with their U.K. facilities? Should they move them out of the U.K. entirely? Do you recommend a preemptive move before the U.K. and E.U. finalize their trade agreements, or wait and see?

Very interesting article! I agree that Airbus must keep its supply chain robust to avoid production delays and that should be one of their highest priorities. I also agree that Airbus should consider additional manufacturing capabilities in other parts of Europe.

I disagree that Airbus should definitely expand their production in China. Without seeing more data to support this conclusion, I’m skeptical because many of the components that go into final assembly appear to be quite large and heavy. I think that this would necessitate these larger components to be manufactured close to the final assembly location to keep transportation costs down.

I also think many of these same conclusions apply to the United States. Where possible, component production and final assembly/shipment should be localized. However, a thorough analysis should be done with scenario forecasts to consider the implications of potential transportation costs, tariff costs, and workforce resources.

Thanks Maud for a very interesting analysis. While Airbus thinks about managing risks imposed by increased isolationist policies, it should also look towards the opportunities that this new political reality presents. To build on TS’ comments, governments like the US have demonstrated that they are willing to engage in direct negotiations with companies around tax breaks (and even favorable regulatory treatment) in exchange for the relocation of manufacturing facilities and the promise of jobs. Isolationism creates a system in which different government actors are negotiating against each other to drive private fund flows and employment. This marketplace is less efficient in an isolationist world because trade agreements typically make such partnerships and negotiation terms more transparent. From this inefficiency is an opportunity for Airbus to leverage its size and market potential to yield effective deals by moving its manufacturing operations.

Airbus will need to think about this on national as well as regional levels. They will need to weigh the economic and political cost and benefit across their portfolio of operations and development projects. If they are able to do this effectively and proactively, they can drive a competitive advantage in this rapidly changing geo-political ecosystem.

Maud, very interesting, thank you for sharing your views. The challenge that Brexit poses for businesses in the UK stems from the uncertainty created by the current political brinkmanship being played out by the UK and the EU. Whilst most outcomes look negative for fully UK based businesses, companies such as Airbus do have the potential to take advantage of the situation. As you mention, the split of European production across Germany, France, and the UK, and China provides management with the opportunity to lobby governments on both sides of the Brexit divide to potentially make special dispensations for the airline industry. So far management has issued hard demands on the UK government (http://www.bbc.com/news/uk-england-bristol-41278970) – perhaps by working in concert with governments across Europe, companies such as Airbus could more positively contribute to the Brexit dialogue and outcome.

Thanks for sharing this article, Maud! I really enjoyed reading it. It will be very interesting to see how Airbus will reduce the Brexit impact on their supply chain, especially when the UK sites produce complex and large components that incur high transportation costs. As a result, I agree with your analysis that Airbus should look at potentially building manufacturing capabilities within the wider European Union, in order to be closer to the final assembly lines in both Germany and France.

One challenge, however, is that the UK sites not only manufacture components, but also engage in significant Research & Development (Reference [1] in your article), which would be hard to replicate in other countries if they lack a capable workforce. As a result, addressing Nick’s questions, Airbus might not be in a position to exit the UK.

With regards to Airbus’ production expansion in China, I do agree with Eddie’s comments above and his analysis as to why that might not make sense, unless Airbus develops the wider supply chain to support final assembly. One aspect of Airbus’ initial decision to build production capabilities in China was driven by their desire to sell more planes to the Chinese airlines, “where commercial aircraft purchase is controlled by a government keen to develop its own aircraft manufacturing capability” [1]. This, however, poses challenges as to what technologies can Airbus transfer to the Chinese market, without risking the company’s know-how being used for the manufacturing of other airplanes in China?

[1] Jiang, Sijia. “Airbus, Boeing in new battle for China market share”. http://www.scmp.com/business/companies/article/1919491/airbus-boeing-new-battle-china-market-share. Accessed on December 1st, 2017.

The interesting dilemma I see from this essay is how the capital-heavy infrastructure of this global supply chain can really anchor a firm to its geography. Logistically, I can see the appeal to source all parts of a plane to a centralized European country, but once you’ve done that in an industry such as this the ability to flex the supply chain or the final sourcing destination can present a really tricky situation for management. Moving centralized sourcing to a different location would be appealing should the “hard” Brexit circumstances present themselves and I would assume most companies are not wiling to weather the US political storm right now. So as a manager how do you decide between the better of two evils? Stay anchored and face the circumstances of familiarity? Or make the bold move to the unknown?

Thanks for sharing this interesting article, Maud. I agree that Airbus should consider diversifying its production capabilities (outside of Europe), given the risk for additional delays and increasing production costs.

The change that Airbus will need to go will certainly come at a cost, but I agree with Sara’s hypothesis that consumers will see a cost impact on the medium term but that cost impact will normalize in the longer term.

It would be interesting to see how other multinational companies (both in this industry and outside) are dealing with the uncertainty that Brexit brought.

What an interesting article! I had no idea that Airbus had such a global, diverse supply base – it’s almost hard to believe that something as complex as an airplane is actually the amalgamation of factories all over the world producing very distinct parts. I think you great up a great point regarding isolationism not being limited to just Europe – there are definitely underlying currents of isolationism playing out across the United States today.

During Donald Trump’s election, his inauguration speech included the explicit promise that he would “Make America First” – implicitly implying that globalization and the perceived outsourcing jobs has hurt the middle-class in the United States. He’s publicly launched attacks against companies like Ford, Carrier, and Apple, all companies that have built extensive supply chains outside of domestic borders. These companies face very real threats in the current administration. Over the short-term, my impression is that Trump’s inflammatory rhetoric has, at the margin, deterred some global companies from more aggressively trying to enter the U.S. – we’ll need to see how this plays out over the longer-term to ascertain whether this is just a blip on the long road to increasing globalization, or if this is a U-turn back to the protectionist policies of the 20th century.