The Devil Wears Digital: Condé Nast Reinvents Itself

“It is in some fundamental way over…I think magazines are going to be somewhat like department stores. They’ll stay in business, but you’ll wonder why, since you get everything in them from other places, usually with a better customer experience.”

–James Truman, former Editorial Director of Condé Nast [1]

How has Condé Nast been impacted?

Condé Nast (CN) is no stranger to transformation. The company was founded on reinvention, beginning in 1909 when Condé Montrose Nast bought American weekly Vogue and turned it into a monthly magazine. It became an industry leader, priding itself on “creating excellent, exciting content that is engaging, visually arresting.”2 Its iconic brands include: Vogue, Vanity Fair, GQ, and The New Yorker.3 However, the speed and urgency of transformation has increased significantly with the advancement of technology and the rise of digital.

This has posed challenges to CN’s traditional sources of revenue:

- Circulation: The advent of the internet has made consumers accustomed to free online content, particularly through mobile platforms.4 While CN’s brands once dictated style and culture trends by pushing printed content out to consumers, blogs and social media have created star influencers who interact daily with their massive fan bases (Michelle Phan has 9 million YouTube subscribers and 2 million Instagram followers). 5 As a result, subscriptions and newsstand sales are in decline. In the US, wholesalers purchased 18.5% fewer magazines in the first six months of 2015, relative to the same period in 2014.6 Brands are responding by cutting subscription prices or increasing newsstand cover prices, though both strategies have had adverse effects on newsstand sales.7 Glamour, once seen as a jewel in CN’s portfolio, saw a decrease in circulation of 18.9% for the first six months of 2016.8

Source: The New York Times

- Advertising: As circulation and readership falls, it becomes less compelling for advertisers to continue reaching consumers through print. Compare the median cost of a single, one-page magazine ad to the web version: $140 per thousand readers versus <$0.50.4 Furthermore, programmatic advertising is unlocking new opportunities that are better targeted and much more easily tracked. Across the industry, publishing revenues have fallen 43% since 2007.9 There are signals that CN is feeling the pressure – buyers reported that CN publishers are now willing to negotiate rates, which they resisted until recently.10

How has Condé Nast responded?

In the face of these existential threats, what unique steps has CN taken to adapt?

- Seeking alternative revenue sources:

- Entering affiliate marketing through the service Skimlinks. Product mentions in articles become links so readers can click through to purchase. CN then receives a cut of sales.11

- CN’s tech-focused brands, led by Wired, created a membership program targeting executives who want to stay abreast of trends. For an annual membership at $4,000, they can access events with industry insiders, newsletters, and an online community.12

- It’s impossible to address digital transformation without mentioning data. CN launched Spire, combining their massive amounts of consumer data with 1010data’s insights platform, to optimize online advertising campaigns and to offer more value to advertisers.13

- They launched 23 Stories to begin offering native advertising, though it had previously resisted, maintaining a separation between their editors and branded content.3,6,10

- Embracing video content:

Source: AdWeek - In 2011, CN launched Condé Nast Entertainment (CNÉ) to enter the TV and film business. They realized that several successful projects have developed from their stories (Argo, Eat Pray Love, and Brokeback Mountain), but they didn’t see any profit. By vertically integrating, CN can take the development process into their own hands.

- CNÉ has launched “The Scene,” a social video platform with an app and content relevant to its brand portfolio.14

- CNÉ developed a scripted series, Invisible, in 360° virtual reality. It is launched exclusively for Samsung VR and sponsored by Lexus, which embeds product placement into the content.15

- Restructuring and cutting costs:

- In a massive restructuring, CN is breaking down the silos of its brands. In the past, functions rarely collaborated across publications since they could be considered competitors to one another. Now, teams will be organized by functions (creative, research, copy) shared across brands.16

- CN developed PubWorx LLC, a joint venture with competitor Hearst, to consolidate back-office operations (procurement, circulation, and production of print issues) and to achieve economies of scale.17

What else could they do?

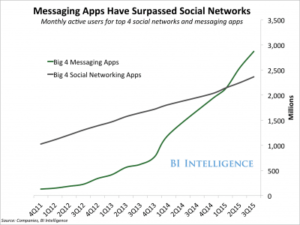

CN should adapt content for messaging apps, particularly for their international audiences (LINE and WeChat dominate in Asia). The top messaging apps have actually overtaken the top social media apps in monthly active users, so it would be wise for CN to begin integrating content into these products. The Wall Street Journal is already pushing this frontier.

In leaping from print to video, CN overlooked the growing popularity of audio content. Podcasts lend themselves well to CN’s storytelling capabilities, particularly for brands like The New Yorker or Vanity Fair. Spotify has recently expanded into this area.18

CN is moving in the right direction by embracing storytelling through new platforms and experimenting with alternative revenue sources, but they will need to continue reinventing themselves to maintain their lead.

(789 words)

Citations

1 Bernstein, J. “James Truman, a Crown Prince in a New Kingdom.” The New York Times, August 18, 2013. August 16, 2013. Accessed November 17, 2016. http://www.nytimes.com/2013/08/18/fashion/james-truman-a-crown-prince-in-a-new-kingdom.html.

2 Heritage | Condé Nast International. Accessed November 17, 2016. http://www.condenastinternational.com/heritage/history/.

3 About Us | Condé Nast. 2016. Accessed November 17, 2016. http://www.condenast.com/about-us/about-us.

4 Abrahamson, D. “The Future of the Magazine Form: Digital Transformation, Print Continuity.” The Journal of Magazine and New Media Research, Fall 2015, 16, no. 1. Accessed November 17, 2016. http://www.academia.edu/21573486/_The_Future_of_the_Magazine_Form_Digital_Transformation_Print_Continuity_.

5 Entis, L. “100,000 Subscribers or Bust: What It Takes to Be a YouTube Star.” Fortune, November 1, 2016. Accessed November 17, 2016. http://fortune.com/2016/11/01/youtube-star/.

6 Sherman, L. “What’s Going On at Condé Nast?” Business of Fashion, December 2, 2015. Accessed November 17, 2016. https://www.businessoffashion.com/articles/intelligence/whats-going-on-at-conde-nast.

7Vasquez, D. “What’s Really Killing Magazine Newsstand Sales.” Media Life Magazine, May 3, 2016. Accessed November 17, 2016. http://www.medialifemagazine.com/whats-really-killing-magazine-newsstand-sales/.

8 Roberts, L. “Glamour Supersizes Print and Puts Digital First.” The Industry, November 17, 2016. Accessed November 17, 2016. http://www.theindustrylondon.com/glamour-supersizes-print-puts-digital-first/.

9 Sass, E. “Newspaper, Magazine Revenues Fell in 2015.” MediaPost, March 11, 2016. Accessed November 17, 2016. http://www.mediapost.com/publications/article/271086/newspaper-magazine-revenues-fell-in-2015.html.

10 Moses, L. “On ad pricing, Condé Nast bows to the reality of digital.” Digiday, August 31, 2015. Accessed November 17, 2016. http://digiday.com/publishers/conde-nast-digital-reality/.

11 Li, S. “There’s money to be made in linking to Amazon.” Los Angeles Times, October 24, 2016. Accessed November 18, 2016. http://www.latimes.com/business/la-fi-amazon-affiliate-20161024-snap-story.html.

12 Moses, L. “Wired, with other Condé Nast tech publications, starts a $4,000-a-year-membership program.” Digiday, November 3, 2016. Accessed November 18, 2016. http://digiday.com/publishers/wired-media-group-launches-4000-year-membership-program/.

13 “Condé Nast Introduces ‘Condé Nast Spire,’ A Groundbreaking New Data Offering Harnessing the Company’s One Trillion Monthly Data Points.” Condé Nast, Press Release, June 20, 2016. Accessed November 18, 2016. http://www.condenast.com/press/conde-nast-introduces-conde-nast-spire-a-groundbreaking-new-data-offering-harnessing-the-companys-one-trillion-monthly-data-points/.

14 Steel, E. “Condé Nast Goes Into Show Business.” Condé Nast, April 3, 2016. Accessed November 18, 2016. http://www.nytimes.com/interactive/2016/04/04/business/media/conde-nast-film-tv-virtual-reality.html?rref=collection%2Ftimestopic%2FCond%C3%A9%20Nast%20Publications.

15 “30 Ninjas and Legendary Director Doug Liman, Condé Nast Entertainment, Jaunt and Samsung Unveil 360° VR Series, Invisible.” Condé Nast, Press Release, October 21, 2016. Accessed November 18, 2016. http://www.condenast.com/press/30-ninjas-and-legendary-director-doug-liman-conde-nast-entertainment-jaunt-and-samsung-unveil-360-vr-series-invisible/.

16 Guaglione, S. “Condé Nast Restructures: Consolidates Art, Copy, Research.” Condé Nast, October 21, 2016. Accessed November 18, 2016. http://www.mediapost.com/publications/article/287371/conde-nast-restructures-consolidates-art-copy-r.html.

17 Trachtenberg, J. “Condé Nast, Hearst Form Joint Venture for Print Magazines’ Back-Office Operations.” The Wall Street Journal, February 4, 2016. Accessed November 18, 2016. http://www.wsj.com/articles/conde-nast-hearst-form-joint-venture-for-print-magazines-back-office-operations-1454601665.

18 Pang, J. “The Future of News and Publishing.” TechCrunch, February 17, 2016. Accessed November 18, 2016. https://techcrunch.com/2016/02/17/the-future-of-news-and-publishing/.

Thanks JZ! Great post. I like your recommendation on the messaging apps. I’m amazed at the growth that those have relative to traditional social media. On the podcasts, I think that’s a really great idea too but I feel like the beauty of magazines whether they’re digital or in print is the visual component. Seeing the edgy shoots and all of the designer clothes. That being said, I’m sure there’s a way they could integrate visual with the podcast so that the user still gets the full experience.

See the article below. It talks about some of the challenges with digital publications, an avenue that CN and other magazines have started to go down. Obviously, it’s way more convenient to have a magazine on a tablet rather than in-hand but I think consumers aren’t as likely to flip through the entire magazine as they would be if it was on their coffee tables in hard copy. A way that CN and other magazines could get around this is having shorter publications, quick look-books to still distribute content, but in shorter bursts. I imagine customer attention spans have declined so this would be a way to potentially mitigate that.

https://www.wired.com/insights/2014/10/are-digital-magazines-dead/

Very interesting article JZ! In addition to great recommendations above, I wonder whether CN could focus more on the model newspapers such as NYT and WSJ have, which is to push for greater adoption of their app and mobile content. It seems from this source (https://www.statista.com/statistics/191796/us-magazine-audiences-2010-vogue/) that 11% of readers still access Vouge via mobile web and don’t actually download the application. They could drive the increased adoption by simplifying their offerings on the app store – if you type in vogue in the app store now, you get 6 official vogue apps that offer different types of content (Magazine, collections, runway and many country specific apps). The could consider become the one stop indispensable fashion app, that allows users to access news, editorials, runway updates for both local and international markets. This could drive significantly higher in-app advertising revenue.