Telematics: How Flo is Tracking Your Every Move

Usage-based insurance has revolutionized the auto insurance industry and lowered policy premiums, but at what cost to privacy?

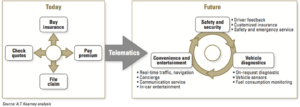

For decades, the $185 billion auto-insurance industry and its business model have remained stagnant.[1] Insurers determine auto premiums based on a driver’s record information collected at the point of sale – age, sex, location, credit score and driving record – with no visibility of driving habits and/or other potential risks.[2] There is little interaction or ongoing feedback between the driver and the insurance company, apart from the regular premium payments and the infrequent claim processes.

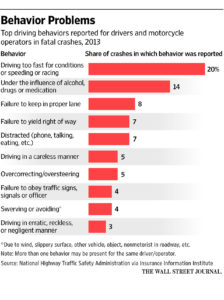

Usage-Based Insurance (UBI), or auto telematics, has shown the potential to drastically alter the way auto insurance industry operates and connects with its customers. By installing or embedding telecommunications devices (telematics) into cars to transmit real-time vehicle data and driving habits, insurers can measure and price premiums more accurately and effectively, and increases affordability for lower-risk drivers.[3] In other words, behaviors of individual drivers are playing a greater role in determining risk, fundamentally changing the way insurers think about and value their customers.

Today, most of the national auto insurance companies in the US offer UBI programs to reward safe drivers with lower premiums. Developed either in-house or through a third party vendor, these UBI programs and their service features are oftentimes a key differentiation between insurers.[4] After a certain monitoring period, not only would the “good” drivers be rewarded with 5% – 30% discounts on policy premiums, they can also review their entire driving activity and program diagnostics through a visual web browser dashboard.[5] As competition intensifies within the insurance industry, these features are intended to lure and retain good drivers by incentivizing good driving behaviors.[6]

Progressive and its SnapShot Program

The first auto insurance company to disrupt the market with a UBI program was Progressive. Launched in 2008, Progressive’s SnapShot Program was designed to provide drivers the ability to control their premium costs by incentivizing them to reduce miles driven and adopt safer driving habits.[7]

The device, which plugs into the On-Board Diagnostics Type 2 (OBD-II) port in the car, collects data to diagnose vehicle activities and driving behavior, and continuously streams the data to Progressive while driving.[8] The program has access to virtually every information system in the car: engine, brakes, transmission, electronics, etc, and can measure a number of elements of interest for premium underwriters:

- rapid acceleration / deceleration;

- hard braking / cornering;

- miles driven;

- time of day;

- vehicle location (GPS);

- routes taken;

- air bag deployment;

- and weather/road conditions

In exchange for this driver data, drivers can receive discounts of up to 30 percent off policy premiums.

Since 2008, more than 4 million drivers have participated in SnapShot.[9] With an increasing number of drivers and driving data flowing into its servers, Progressive is able to develop more accurate data analytics and effectively refine correlation variables in determining risk.[10]

While SnapShot was designed to draw drivers away from its competitors, the program had to also be rolled out to Progressive’s existing customers, who also receive discounts on their current policies. As the UBI technology and data analytics remain highly costly and resource intensive, Progressive is dishing out large dollars to deploy an expensive program to provide additional discounts to its existing customers, who arguably have a higher willingness-to-pay (WTP) than brand new customers. In effect, the insurer is losing money from their existing revenue customer base in an attempt to expand the customer base in a mature insurance industry.[11]

UBI programs have also raised privacy concerns. Many drivers are shocked to learn how much personal information and data can be transmitted through the telematics device. Not only are the majority of consumers uncomfortable with the idea of being constantly monitored, some states have enacted legislation requiring disclosure of tracking practices and devices, forming further obstacles for the proliferation of these devices.[12]

Challenges of the Digital Age

While the digital transformation has enabled Progressive to price premiums more effectively and accurately, it has also lowered the barriers to entry for competing players to enter. With the spread of mobile technology, a wide array of smartphone-based apps and solutions have come to market to track and educate consumers on how to improve their driving, while interpreting vehicle data for service memos and repairs.[13]

In order to stay competitive, Progressive should take advantage of its vast database of driving data, and provide value-enhancing services as further points of differentiation. Instead of using SnapShot purely as a risk assessment tool, Progressive should tap into alternative ways to monetize its data analytics and provide ancillary services such as tracking of stolen vehicle, reduced accident response time, monitoring driver safety. Furthermore, the company can also develop customer engagement programs through the data it has already collected, such as driving diagnostics, gas / repair cost analyses, etc. As UBI programs become more ubiquitous and SnapShot loses its competitive differentiation, Progressive must explore ways to enhance value proposition as well as improve customer loyalty for its massive consumer base.

[Total word count: 792]

[1] Scism, Leslie. “Car insurers find tracking devices are a tough sell.” WSJ. January 10, 2016. http://www.wsj.com/articles/car-insurers-find-tracking-devices-are-a-tough-sell-1452476714

[2] National Association of Insurance Commissions. “Usage-based Insurance and Telematics.” June 6, 2016.

[3] Ibid.

[4] Accenture. Insurance Telematics: A game-changing opportunity for the industry. The Digital Insurer. 2014.

[5] Ibid.

[6] Ibid.

[7] Lanctot, Roger. “SnapShot, the best worst thing to happen to car insurance.” Linkedin Pulse. September 4, 2014. https://www.linkedin.com/pulse/20140904131653-1648721-snapshot-the-best-worst-thing-to-happen-to-car-insurance

[8] Ibid.

[9] Scism.

[10] Insurance Research Council. Auto Insurance Telematics: Consumer Attitudes and Opinion. November 18, 2015.

[11] Lanctot.

[12] Scism.

[13] Lanctot.

Privacy is certainly one of my major concerns with these programs. As these companies amass more and more data with these opt-in programs, they seem to gain an advantage to being able to lock in safe drivers. Admiral Insurance seems to be taking the next step in information gathering using Facebook posts and likes to look for “risky” traits and price policies (https://www.theguardian.com/technology/2016/nov/02/admiral-to-price-car-insurance-based-on-facebook-posts). This almost seemed inevitable, but you have to worry how accurate can a program such as this be? Writing shorter sentences means you are more responsible and therefore should get a lower policy? It sounds like a stretch to me. And although Admiral has stated it will not look at photos, I am sure that will become a public relations nightmare in the near future. It is nice to reward safe drivers, but punishing others for not giving up data or on the fuzzy premise of a single Facebook post could be a slippery slope.