Teaching an old Deere new tricks: machine learning product development at John Deere

Leveraging machine learning to improve crop yields, reduce farmer costs, and grow revenue

Selling what farmers need

The U.N. Food and Agriculture Organization projects global food consumption to grow 70% between 2007 and 2050 but total arable land to grow less than 5%[i]. Farmers will need to dramatically improve crop yields to meet this demand, but they will face a host of new challenges to do so, from climate change to increasing plant resistance to herbicides.

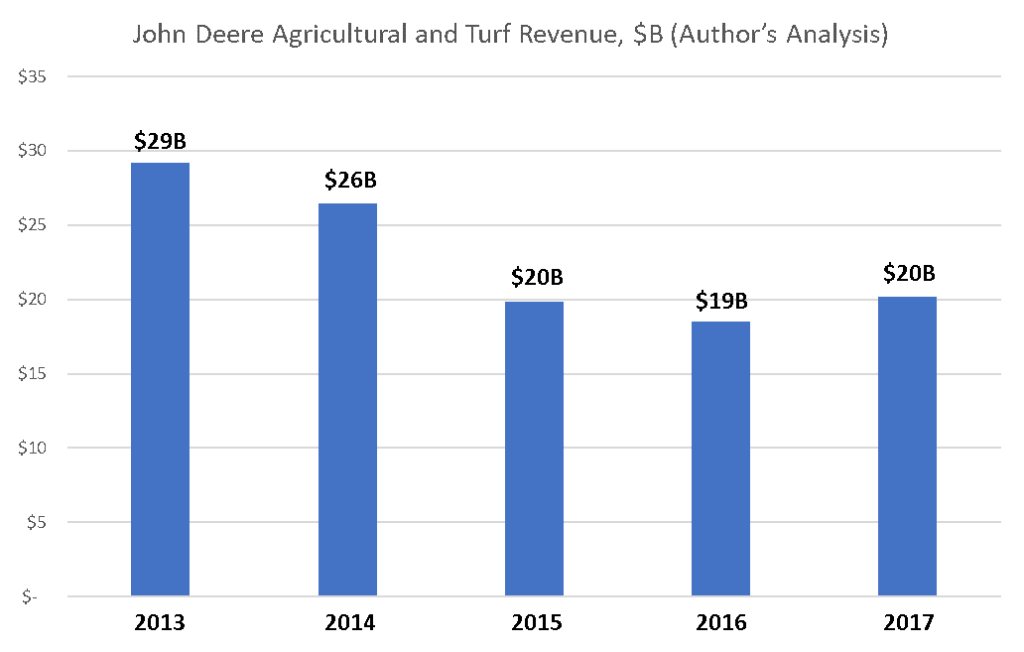

Increasing demand for crops has not translated to growth for all agricultural businesses, however. In the US, the $38B agricultural machinery industry declined 5.6% per year from 2013-2018[ii]. John Deere, the subject of this paper, saw agricultural/turf revenue decrease from $29B in 2013 to $20B in 2017[iii]. Part of this decline was driven by macroeconomic factors, such as commodity deflation reducing farmer discretionary spending. But at some basic level, if farmers aren’t increasing the amount of land they farm, they don’t need to purchase more tractors.

Instead of selling more tractors, Deere can – and has begun to – leverage machine learning to sell better tractors. Farming is a particularly ripe field for machine learning, for three reasons. First, farms hold an enormous amount of data, from weather to soil data to crop yields. Second, farming questions are reasonably self-contained – the data required for machine learning algorithms is largely available. And third, farmers are generally excited to test new technologies. By integrating machine learning techniques into its products, Deere can go beyond selling a tool to selling insight.

Turning Blue into green

On September 6, 2017, John Deere announced its $305M acquisition of Blue River Technology and rocketed ahead in its deployment of machine learning[iv]. Blue River’s core innovation is a technology called “See & Spray.” See & Spray is an attachment to a tractor that views all plants in a field, uses machine learning to determine which plants are pests, and then fires a concentrated stream of herbicides at the offending plants[v]. By targeting only invasive plants instead of entire fields, the technology can reduce herbicide use by 90%, potentially saving farmers billions[1][vi] and substantially benefiting the environment. In its Q4 2017 earnings call, Deere projected that Blue River would increase 2018 operating profits by $60M[vii].

See & Spray “seeing” an invasive plant in a cotton field[viii]

Longer term, the machine learning opportunities for Deere are vast. Blue River’s machine learning algorithms can likely be modified for smarter planting, smarter fertilizing, and smarter harvesting (e.g., picking only ripe products), and the product can be expanded globally. Deere views these opportunities as foundational: the company recently opened a tech office in San Francisco (Deere Labs), and in a 2018 interview, John Stone, SVP of Intelligent Solutions, explained: “AI and machine learning is going to be as core to Deere as an engine and transmission.”[ix]

Key recommendations

I have two key recommendations for John Deere as it increasingly relies on machine learning to drive growth.

In the short term – Deere should be hyper-focused on maintaining an entrepreneurial culture. It acquired an innovative tech business in Silicon Valley – this is a business that looks and operates very differently from Deere. There’s a real risk that the innovation at Blue River will dry up if Deere imposes its culture or will too strongly. Deere should give Blue River and Deere Labs a lot of space and a lot of budget. The California offices can be “skunk works.”

In the medium term, I’d recommend Deere explore products and solutions that fit potential futures of farming, not just today’s farming. Deere is selling Blue River attached to tractors today because that’s how farmers deliver herbicides – but what if advances in technology enable entirely different and more effective ways of farming? What if herbicides in ten years will be delivered by smart drones tethered to the ground? It’s hard to know what the future holds, but I recommend Deere keep a very open mind about potential innovations and dedicate substantial budget towards R&D and exploring new technologies and solutions.

Questions for classmates:

- What pricing model should Deere pursue for its machine learning products?

- How should Deere think about when to compete with, partner with, or acquire the next Blue River Technologies?

Word count: 800 words

[1] The EPA estimates ~$10B annual US pesticide sales

[i] U.N. Food and Agriculture Organization, “Global agriculture towards 2050,” http://www.fao.org/fileadmin/templates/wsfs/docs/Issues_papers/HLEF2050_Global_Agriculture.pdf (October 2009)

[ii] IBIS World, “Tractors – Agricultural Machinery Manufacturing in the US Industry Report” (October 2018)

[iii] CapIQ Segment Reporting, Accessed November 2018

[iv] Fortune, “John Deere is paying $305 Million for this Silicon Valley Company,” http://fortune.com/2017/09/06/john-deere-blue-river-acquisition/ (September 2017)

[v] Blue River Technology, “See & Spray,” http://smartmachines.bluerivertechnology.com/ (November 2018)

[vi] US EPA, “Pesticides Industry Sales and Usage 2008-2012,” https://www.epa.gov/sites/production/files/2017-01/documents/pesticides-industry-sales-usage-2016_0.pdf (2017)

[vii] John Deere 4Q 2017 Earnings Call, https://s22.q4cdn.com/253594569/files/doc_financials/2017/4Q_2017_Earnings-Call-Presentation.pdf (November 2017)

[viii] V ibid

[ix] IOT News, “The AI and machine learning innovations taking John Deere to the next level of precision agriculture,” https://www.iottechnews.com/news/2018/mar/22/ai-and-machine-learning-innovations-taking-john-deere-next-level-precision-agriculture/ (March 2018)