Tala: Providing loans for those without a financial identity

2.5 billion people in the world don’t have access to financial services. Tala is a startup trying to access this market by evaluating user’s credit worthiness using only their smartphone data.

Context

There are 2.5 billion people in the world without a financial identity1. Since those people do not have a credit score, fixed income or assets to be used as collateral, they are often left with no financing option on traditional financial institutions.

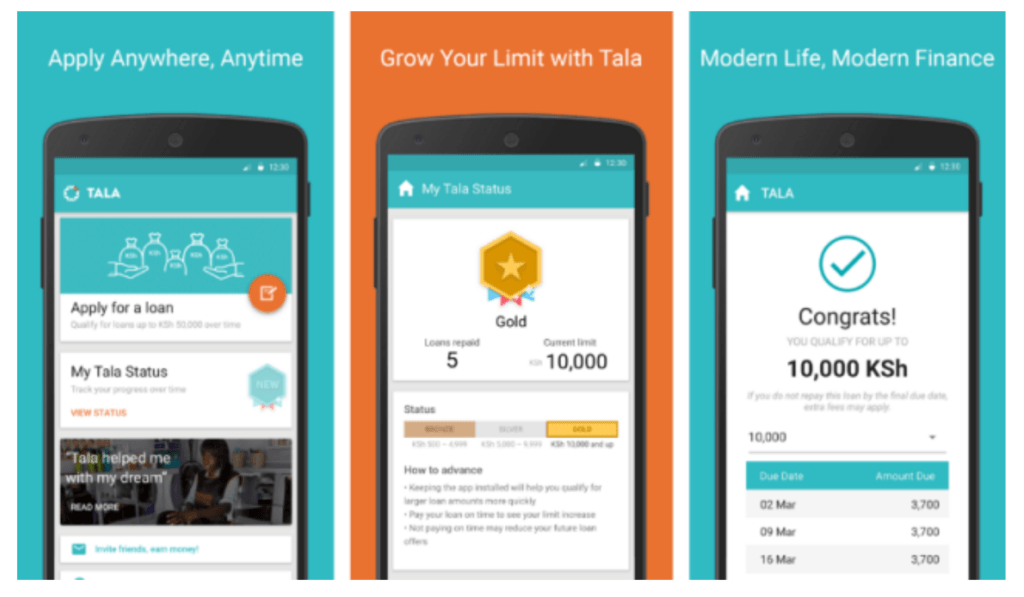

Tala is a microfinancing institution founded in 2011 with the goal of providing credit to such individuals through analysis of data collected from client’s cellphone [exhibit 1]. The company provides unsecured loans ranging from US$ 10 to US$ 500 to clients without any credit history or income proof, having consolidated operations in Kenya, Tanzania and the Philippines.

Current Business Model

To access an individual credit worthiness, Tala`s evaluate over 2.000 data sets available on the client’s phone, informing decision on three different criteria2:

- Verification data: Are the clients who they say they are?

- Credit capacity: What’s the client inferred debt to income ratio?

- Behavioral data: What’s the client willingness to pay?

The company’s business model is a very interesting example of Machine Learning’s application. By analyzing user’s social network, app and email usage, location over time and personal contacts, Tala’s algorithm is able to correlate user’s behavior with its credit worthiness. For example, the algorithm identified that users that have high network diversity and constant contact with that network have a 9% increase in repayment rates1. By allowing the model to continuously iterate the correlations between the data and the user’s repayment rates, Tala has been very successful in having low defaults in such a risky market. As a comparison, Tala has repayment rates of 92%2, versus the average 83.5% in US subprime loans in 20153.

As Tala’s CEO, Shivani Siroya, describes it: “the problem of financial access is, ultimately, a data problem”4. Tala’s intensive use of data and machine learning allowed it to gain two important advantages over traditional microfinancing institutions.

First, it strongly reduced the costs associated with servicing the loan. Typical institutions have a labor-intensive process of loan officers visiting clients to conduct interviews and validate provided information. Since those costs are relatively fixed per client, they carry a stronger burden on the small loans of a microfinancing institution5. Tala has virtually no fixed costs associated with servicing a new loan.

Second, it is able to provide loans at a fraction of the time. 85% of Tala’s clients receive credit scores in less than 10 minutes6. This provides extreme convenience to the clients and allows the company to grow at a rate of 130% quarter-over-quarter.7

While allowing the company to scale fast, Tala’s business model also feeds its own algorithms. With more data, Tala becomes increasingly better at predicting a client’s chance of default, generating additional competitive advantages and increasing barriers to entry.

Future opportunities and challenges

In 2018 the company raised $50 million in its Series C and announced a strategic partnership with Paypal8 in order to fund its growth. Together with the funding, the company is evaluating its priorities for the future. Expansion to huge markets such as India and Mexico seems logical9 but another option could be the development of related products to Tala’s clients, such as savings accounts, insurances and investments.

While Shivani says openly that those products are not the priority now2, I would be inclined to think they are necessary to improve Tala’s client lifetime value and serve as additional barriers to entry for competitors. In the past few years, we’ve seen the proliferation of digital consumer wallets, such as WeChat in China, Venmo in the US and Apple Pay and Samsung Pay across the world. These products generate potential risks for Tala’s business, since they already have the customers, the resources and the data needed to provide loans. In fact, the development of such a product is certainly a major reason why Paypal, itself a wallet, invested in Tala.

In my opinion, Tala needs to increase its touchpoints with clients to protect itself from those competitors. While Tala’s customers use the app to get loans on an average of 6 times a year2, most digital wallets are used daily by clients. With more touchpoints, those wallets have higher chances of converting users to their own microfinancing services. The only way for Tala to survive in that environment might be to offer high frequency products, such as savings accounts or financial education courses.

Even though challenges exist, it’s undeniable that Tala business model is disrupting the existing microfinancing scenario. Nevertheless, a major question surrounding the business persists. Does the access to credit promote higher income for families? Is it sustainable long-term? In fact, research of traditional microfinancing in markets such as India and Mexico has not shown increases in family income following increases in the availability of credit10. Is Tala’s business model innovative enough to provide long term value to it’s clients and the society? <797 words>

Exhibit 1: App screens

Source: Android Play Store

Sources

[1] Shivani Siroya. 2016. TED Talks – A smart loan for people with no credit history yet. Video content. Available at: www.ted.com/talks/shivani_siroya_a_smart_loan_for_people_with_no_credit_history_yet #t-100284. [Accessed 8 November 2018].

[2] Peter Renton and Shivani Siroya. 2017. Lend Academy. Audio content. Available at: https://www.lendacademy.com/podcast-113-shivani-siroya-tala/. [Accessed 8 November 2018].

[3] ProQuest. n.d. Mortgage delinquency rates in the United States in 2015, by loan type. Statista.. Available at: https://www-statista-com.prd2.ezproxy-prod.hbs.edu/statistics/206494/us-mortgage-delinquency-rates-by-loan-type/. [Accessed November 13, 2018]

[4] MIT Initiative on the Digital Economy; Shivani Siroya. 2017. 2017 IIC Winner: Tala. Video Content. Available at: https://www.youtube.com/watch? v=zbCW2Grvt5U. [Accessed 9 November 2018].

[5] Amy Yee. ‘Why microfinance loans have such high rates’, The Wall Street Jorunal, Aug 2015. Available at: https://www.wsj.com/articles/why-microfinance-loans-have-such-high-rates-1439321404?mod=article_inline. [Accessed 8 November 2018].

[6] Finextra. 2018. Lending app Tala targets India, fuelled by $65m in new financing. Available at: https://www.finextra.com/pressarticle/73511/lending-app-tala-targets-india-fueled-by-65m-in-new-financing/retail. [Accessed 11 November 2018].

[7] Medium. 2018. Meet Anay, Tala’s VP of Country Growth! Available at: https://medium.com/tala/meet-anay-talas-vp-of-country-growth-86ceefdd89a8. [Accessed 9 November 2018].

[8] CrunchBase. Available at: https://www.crunchbase.com/organization/inventure#section-overview. [Accessed 8 November 2018].

[9] Tala. Available at: https://tala.co/tala-paypal. [Accessed 8 November 2018].

[10] Odell, Kathleen E. Measuring the impact of Microfinance: looking to the future. Available at: https://www.finca.org/blogs/understanding-the-impact-of-microfinance/. [Accessed 9 November 2018]

This is one of the more interesting applications of machine learning that I have read about. Their low default rates seem to indicate they are doing well, but is it possible to alter your phone usage in a way that ultimately makes you seem more creditworthy? At the individual level, this seems like it would not be a threat, but at scale that could cause significant problems that would ultimately see how quickly the machines can learn.

To your last point about affecting real change in low-income areas, does this need to show some sort of long term change? Or does this just need to disrupt payday lenders and reduce the negative effects of predatory lending in underserved areas?

I love the work that Tala is doing. You list these two data sets that seem incredibly important, but I wonder how Tala can get this information from a person’s phone. What are the data sets that indeed can predict a debt to income ratio? And how can – I imagine, through text messages or data in other apps – Tala determine a client’s willingness to pay for something? I think to the interactions on my cell phone, and I am not sure how much detail I provide in terms of my debt or income. I suspect part of Tala being successful in this is being able to use the data to predict credit capacity and behavior well. Thus, are there other sources of data that Tala can collect from?

Credit capacity: What’s the client inferred debt to income ratio?

Behavioral data: What’s the client willingness to pay?