Supply Chain as Source of Competitive Advantage

Digitalization of the Supply Chain: The future is now.

What has changed?

The consumer goods industry is facing one of the biggest changes in the competitive landscape: the rise of the digital consumer [10]. Procter & Gamble (P&G) is relying on the application of digital technology and advanced analytics to meet the increasing needs of the digital consumer, and drive better innovation, higher productivity, lower costs, and the promise of faster growth [1].

Digitization brings down the walls, and the supply chain becomes a completely integrated ecosystem that is fully transparent to all the players involved — from the suppliers of raw materials, components, and parts, to the transporters of those supplies and finished goods, and finally to the consumers demanding fulfillment [1].

Product Flow through Supply Chain

P&G’s march towards digitization

P&G is leading transformation across several pillars of the end-to-end supply chain to minimize the cost of operations, reduce inventory and offer impeccable service without compromising on quality.

Immediate focus areas:

- Manufacturing plants: Digitize the production line data so any product can be tracked as it gets manufactured in the plants through various processing steps. This would enable real time troubleshooting and thus enhances productivity. Also, P&G is working on integrating the operational system with the financial system to see the costs of the product at the same time [1].

- Transport & Logistics: P&G created a digitally enhanced operational program to reduce “deadhead” movement by about 15 percent. This aids in customer service improvement and reduction in inventory across the supply chain [1].

- Retailers: P&G uses and supports Global Data Synchronization Network, which is basically a standardized data warehouse that allows them to do commerce with their retail partners in a totally automated way, with no human intervention. This helps minimize errors in orders between retailers and suppliers, and thus avoiding potential cost hurt [1].

- Advance Planning & Optimizer (APO) system: APO is a suite of supply chain planner applications that increase overall knowledge of the supply chain and provide forecasting, planning and optimization. P&G is transitioning the ordering systems to APO. Supply and demand signals would originate at any point and travel immediately throughout the network. Low levels of a critical raw material, the shutdown of a major plant, a sudden increase in customer demand — all such information will be visible throughout the system, in real time. This would make the supply network both resilient and responsive [3].

Long March:

- Improving data at source: P&G tracks key metrics on a cockpit interface on the computers, and deep dive immediately if anything goes beyond tolerances. Because the company rely on external data partners, getting the data becomes part of the currency for the relationship. While doing the joint business planning with retailers, P&G would have a scorecard, and the algorithm is all about value creation [1].

- Improving sales forecast accuracy: The use of big data and analytics to sense and adapt to fluctuations in demand, and to respond accordingly when unexpected changes arise [10]. P&G is partnering with predictive analytics experts to improve sales forecasting and better understand the impact of macro-economic factors on demand. This has the potential to reduce the safety stock inventory by around 15% [7].

- Leveraging artificial intelligence: P&G also focuses on such applications as AI-based “bots” for customer service payment processing (which can also be used for IT support and operations), and machine learning for optimizing marketing spend, supply chain, and trade promotion (which benefits both P&G and its retailer customers) [12].

Supply chain professionals expect digitization to bring significant economic benefits to both top and bottom lines: Companies with highly digitized supply chains and operations can expect efficiency gains of 4.1 percent annually, while boosting revenue by 2.9 percent a year [3].

Additional Recommendations

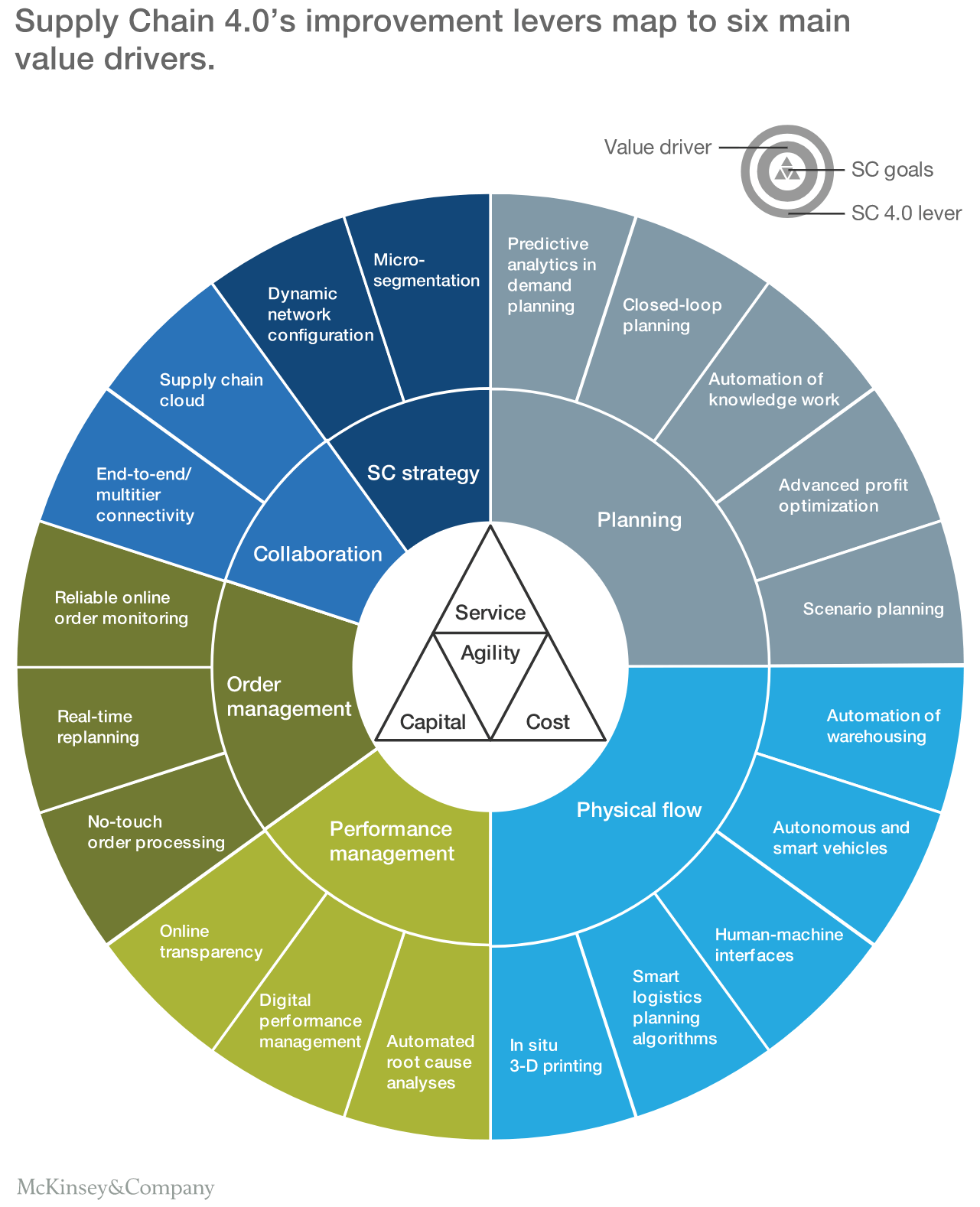

There is some progress but a long way to go. P&G would have to increasing operational efficiency across many more areas at a faster pace by leveraging Supply Chain 4.0 (model developed by Mckinsey [4]) – the Internet of Things, advanced robotics, analytics, and big data – to jump-start performance, and customer satisfaction. Supply Chain 4.0 will affect all areas of supply-chain management. This is evident in the way the main Supply Chain 4.0 improvement levers shown in the outer circle of Exhibit map to six main value drivers (the inner circle). In the end, the improvements enable a step change in service, cost, capital, and agility.

Have we figured out everything? May be not

- As supply chain becomes more digital, the challenge is to ensure the supply chain remains resistant to cyber attacks. How?

- For most of the multi-national companies, maximum growth is coming from emerging markets. Will emerging markets be able to keep pace with digitization, and that too in a cost effective way?

(word count: 791)

Sources:

- McKinsey & Company. (2017). Inside P&G’s digital revolution. [online] Available at: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/inside-p-and-ampgs-digital-revolution

- Harvard Business Review. (2017). Digitizing the Supply Chain. [online] Available at: https://hbr.org/webinar/2017/10/digitizing-the-supply-chain

- Berttram, P. and Schrauf, S. (2017). Industry 4.0: How digitization makes the supply chain more efficient, agile, and customer-focused. [online] Strategyand.pwc.com. Available at: https://www.strategyand.pwc.com/reports/industry4.0

- McKinsey & Company. (2017). Supply Chain 4.0 in consumer goods. [online] Available at: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods

- McKinsey & Company. (2017). Five Fifty: The digital effect. [online] Available at: https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/five-fifty-the-digital-effect

- https://www.bcg.com. (2017). As Grocery Goes Digital, How Should CPG Supply Chains Adapt?. [online] Available at: https://www.bcg.com/publications/2017/consumer-products-supply-chain-management-grocery-digital-cpg-supply-chains-adapt.aspx

- Forbes.com. (2017). Forbes Welcome. [online] Available at: https://www.forbes.com/sites/baininsights/2017/06/07/rules-for-growing-digital-in-consumer-products/#35d4b1e97bfb

- EVRYTHNG IoT Smart Products Platform. (2017). The Biggest Driver of Digital Transformation in the Supply Chain: End-to-End Visibility | EVRYTHNG IoT Smart Products Platform. [online] Available at: https://evrythng.com/the-biggest-driver-of-digital-transformation-in-the-supply-chain-end-to-end-visibility/

- Manufacturing.net. (2017). Digitizing The Supply Chain: Which Comes First, Data Or Collaboration?. [online] Available at: https://www.manufacturing.net/blog/2017/01/digitizing-supply-chain-which-comes-first-data-or-collaboration

- GT Nexus. (2017). What Digital Transformation Means for the Consumer Goods Supply Chain. [online] Available at: http://www.gtnexus.com/resources/blog-posts/what-digital-transformation-means-consumer-goods-supply-chain

- Forbes.com. (2017). Forbes Welcome. [online] Available at: https://www.forbes.com/sites/forbesinsights/2017/05/25/how-a-digitized-supply-chain-can-give-you-a-competitive-edge/#5c345ebe316a

- Harvard Business Review. (2017). How P&G and American Express Are Approaching AI. [online] Available at: https://hbr.org/2017/03/how-pg-and-american-express-are-approaching-ai

This essay captures a broad range of digitalisation impacts on supply chain management. Immediate focus areas and the long march considerations show that information exchange, forecasts and coordination can benefit greatly from digitising supply chains. As supply chains become totally dependent on data and digitalisation, cyber security will become increasingly common. This article lays out just how critical this aspect is:

http://www.sdcexec.com/article/12369570/protecting-supply-chains-against-cyber-attacks

Companies should prepare plans to prevent and to react to such attacks. Strict implementation of protocols should help in prevention of attacks, while clear communication and quick reactions are critical to limit damage after a breach.

The question regarding emerging markets is interesting. While digitalisation of supply chains should theoretically be beneficial as well in such an environment, there are more potential sources for mistakes and problems than in industrialised countries. Government authorities in emerging markets might decide case by case, causing volatility that is hard to account for in digitalised supply chains. Transportation systems might break down more frequently, sourcing of supplies can be more difficult. These problems can be solved, but only if vertical integration of the supply chain is deep enough to enable a company to control as many of these volatile aspects as possible.

This case very well summarizes what a well-developed consumer goods company such as P&G can do in order to stay “ahead-of-the-curve” in the world of rapidly digitizing supply chains. The Supply-chain 4.0 framework is also a comprehensive “ready-reckoner” for companies to adopt the best-practices in digital supply chain.

Few areas which we could explore further based on this is the scale of capital investments that have been made by P&G to develop the infrastructure and how they plan to be cost-competitive after introducing these. For e.g. will there be significantly more infrastructure that they need to set up physically and in terms of human capital to run this smoothly?

In addition, I would also be interested to know how downstream players in the supply chain respond to this. For e.g. as the case rightly points out, in emerging markets such as India where technology penetration is low, it will be considerably hard to implement such solutions in isolation and hence I think implementation of Supply-Chain 4.0 could be tricky. Potential solutions could involve joint investments along the supply chain by large distributors and retailers along with manufacturers to streamline the entire supply-chains across regions.

This is a terrific summary of P&G’s digital supply chain strategy. As supply chains are digitized, cyber security becomes a near top concern. This is a primary method by which terrorists can wage war to bring down infrastructure and even espionage can be conducted between competing firms. The best likely way to secure their severs is to bring in expert firms to help craft cyber security strategies. Given that it is not P&G’s core competency, this is unlikely to be something they do in-house.

While the developed world has adopted supply digitization, the developing world may still struggle. In order to have a digital supply chain, the tracking and analytics required must be advanced. While emerging markets will eventually reach a level of complexity with regards to their supply chain, this progress will likely lag countries in the developed world. With regards to cost, it is possible that after best practices are created in the developed world, developing countries can replicate these models to help reduce their costs.

This is a great write-up on P&G’s supply chain. I am particularly impressed by the choice to address the short and long-term approach. As I think about the question posed “For most of the multi-national companies, maximum growth is coming from emerging markets. Will emerging markets be able to keep pace with digitization, and that too in a cost effective way,” I wonder how different a supply chain in the developed world is than a supply chain in the emerging markets. And further, I wonder if supply chains that “end” in developed markets already have substantial emerging market operations. Globalization will require that in order to digitize a supply chain that feeds into a developed market you must digitize the emerging market component of the chain as well. Thus as business growth occurs in emerging markets, the supply chain becomes more localized and the points of initiation will already have the digital component.

As for the cyber security threat, that’s a terrifying reality that I do not have a handle on.