Stitch Fix: Bringing Big Data and Artificial Intelligence to Fashion

Over the last six years, Stitch Fix has achieved success in the fashion retail space by revolutionizing the shopping experience. But is their business strategy differentiated enough to stay competitive?

The Personalized, Convenient Platform

When Stitch Fix was founded in 2011, the concept revolutionized retail fashion. The online styling service provides a personalized shopping experience without leaving one’s home. Their subscription model allows customers to choose a delivery frequency ranging from 2-3 weeks to three months. After customers fill out their own style profiles, a personal stylist hand picks pieces to match their tastes and budget and mails the items directly to them. They keep what they love and send the rest back in a prepaid envelope. Stitch Fix charges a $20 styling fee that acts a credit toward any of the items customers keep. [1] One big advantage to this model is that customers often try on and purchase items they might not have selected for themselves.

Stitch Fix’s business model was designed to address consumers’ need for a more convenient, personalized shopping experience. But in the last few years, the landscape has changed, with many more online and offline competitors.

Some of the Competition

Amazon Prime Wardrobe

Prime Wardrobe is a new Beta service from Amazon which lets shoppers order clothing, shoes, and accessories at no upfront charge, take seven days to decide what they love, then only pay for what they keep. Prime Wardrobe is included for free with Prime memberships. [2]

Le Tote

Le Tote is a personal styling subscription service that allows customers to choose and rent five items at a time for $50 per month. Customers keep those five items as long as they want, then ship them back to receive new items. [3]

Trunk Club

Trunk Club can be used in three ways. The primary method is for a shopper to submit their preferences online so that a stylist can select apparel and ship them directly to the customer. A $25 styling fee is credited toward any purchases customers keep. The secondary method is via their clubhouses, where customers can go in for a fitting and have a stylist show them a selection of clothes that fit their style and budget. The last method is a custom tailoring service for men where specialists design and produce custom suits, button-downs, and outwear based on customer’s measurements and specifications. [4]

Traditional Retail Challenges

While Stitch Fix’s online platform was very innovative, in many ways, Stitch Fix still faces similar challenges to traditional retail. For example, Stitch Fix’s success is dependent upon on their ability to recognize trends, forecast customer tastes, and deliver merchandise that fulfills demand in a timely manner. In addition, lead times complicate forecasting, as fashion trends at the time of purchase from manufacturers might differ from the new apparel trends at the time of sale. [5]

Figure 2: Source [6]

Competitive Advantage

Stitch Fix is still leading the charge relative to its imitators. Personalization is their strongest weapon, especially as the company aims to go public and battle Amazon directly. Stitch Fix’s strongest competitive advantage relative other competitors is their ability to combine online convenience with access to personal stylists, reducing shopping effort and simplifying decision making for customers.

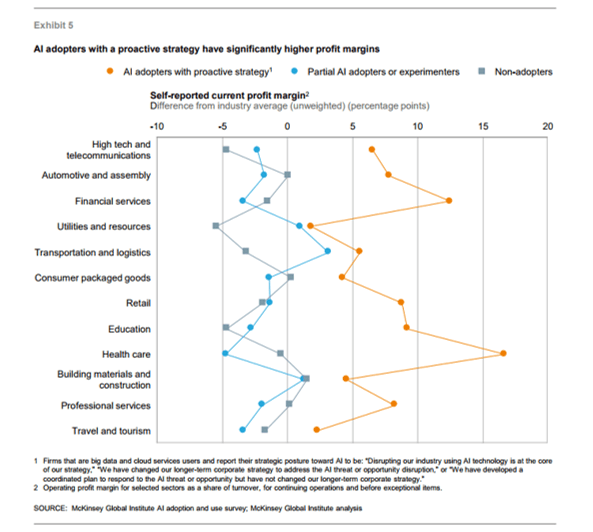

Figure 3: Source [7]

Stitch Fix combines human expertise with Artificial Intelligence (AI) systems. Their big data-backed approach is another strategic advantage, especially when paired with machine-learning techniques to identify customer insights and foster innovation. Not only does this technology enable the company to increase the speed at which stylists can provide recommendations, but it also enables new fashion styles to be born entirely from data. The company’s algorithm starts with existing styles that are then randomly modified over many “generations” to create whole new garments. [8]

What’s Next?

Stitch Fix should double down on their personalization focus and AI investments. Specifically, if they can continue to use big data to hone in on what each customer is looking for right from the first delivery, their customer acquisition and retention will increase, and their overall inventory should decrease due to reduced returns. Over the long term, these technology investments are essential to stay competitive and differentiated, and enable them to meet customer demand.

Stitch Fix filed for IPO on October 19, 2017 – this raises several critical strategic questions, among them: will the additional monetary benefits of going public enable the company to take their business to the next level? Are big data and AI enough for the technology-based retail company to compete in the retail space? Is personalization enough for Stitch Fix to compete with Amazon?

(Word Count: 766)

[1] Stitch Fix. https://support.stitchfix.com/hc/en-us/articles/204222994-What-is-Stitch-Fix-How-Does-it-Work-FAQ accessed November 11, 2017

[2] Amazon. https://www.amazon.com/learn-more-prime-wardrobe/b?ie=UTF8&node=16122413011 accessed November 11, 2017

[3] Le Tote. https://www.letote.com/ accessed November 11, 2017

[4] Trunk Club. https://www.trunkclub.com/boston accessed November 12, 2017

[5] SEC. Stitch Fix SEC Filing. October 19, 2017. https://www.sec.gov/Archives/edgar/data/1576942/000119312517313629/d400510ds1.htm accessed November 13, 2017

[6] Stitch Fix. Algorithms. http://multithreaded.stitchfix.com/algorithms/ accessed November 6, 2017

[7] McKinsey & Company. Artificial Intelligence the Next Digital Frontier?, June 2017. https://www.mckinsey.com/~/media/McKinsey/Industries/Advanced%20Electronics/Our%20Insights/How%20artificial%20intelligence%20can%20deliver%20real%20value%20to%20companies/MGI-Artificial-Intelligence-Discussion-paper.ashx accessed November 11, 2017

[8] HBR. How One Clothing Company Blends AI and Human Expertise. November 21, 2016 https://hbr.org/2016/11/how-one-clothing-company-blends-ai-and-human-expertise accessed November 14, 2017

I think the introduction of AI into the retail space is an interesting one. Previously, much of the value proposition of different retailers rested on their customer service strategy. Nordstrom and others made a name for themselves on both their personalized and personal service they offered their clients, helping them craft a unique sense of style that reflects an individual’s personality.

With the advent of AI, I wonder if retailers are truly tailoring their approach to each customer, or rather, ineffectively bucketing clients based on an algorithm. People’s choice of clothing is a manifestation of their personality, for better or worse, so I wonder if clients will be proud to present their personal fashion choices as a product of a computer generated model (e.g. Stitch Fix told me to buy this!). In order to differentiate, I think Stitch Fix needs to be the leader in making the consumer feel like they are a partner in the selection process as much as possible by increasing and improving interactions with the human stylist, making their experience and unique and personalized as possible.

As a former Stich Fix customer it is interesting to look at how the increased use of AI played out on the consumer end. As a relatively early adopter of the service I found the process to be pretty easy and straightforward- answer a couple of questions about your preferences, link to a Pinterest board of things you liked, and you were off. As the service evolved I was asked to answer more and more questions about my preferences. These questions were no doubt used in the AI algorithms to predict what I would like best and therefore buy in subsequent shipments.

While this seemed like a good move, I think that there are potential dangers to relying too much on data when selling women’s fashion. Fashion is inherently an emotional purchase. While AI is likely to do a good job at predicting your normal buying trends, over reliance on the information is provides would be at the detriment of the service Stitch Fix provides. As the company moves forward I think it is smart to use the data now available to them to analyze trends on a large scale and to provide initial steers in providing customers with new products. However, Stitch Fix must not do so at the expense of the ‘personal stylist’ part of their customer promise.

Besides revolutionizing retail fashion concept with a subscription service model, Stitch Fix also innovated in the sector by enabling customers to access less-known up-and-coming brands, providing unique items to customers and constantly changing their inventory [1]. In the age of Amazon domination and the convenience of getting majority of your products and services from one stop shop, I think Stitch Fix’s sourcing from niche labels is one of the most defensible aspects of its business model. Given that personal styling likely requires a human element to truly connect with the customers and build an emotional connection to the brand as stated above, I think Stitch Fix should invest more of their big data / AI efforts into identifying emerging promising brands to bring into their product offering to continue offering exciting and unique products (e.g., by following Instagram influencers and monitoring activity on their fashion posts, evaluating traffic of new labels of Pinterest, etc.).

1. https://support.stitchfix.com/hc/en-us/articles/203484470-About-our-clothing

While Stitchfix helps refine consumers’ taste profile by having customers try out new items that they may have not otherwise been exposed to, I wonder if the product-centric fashion model will suffice for customers who oftentimes buy products for more emotionally charged reasons (i.e., the story and messaging behind a collection of products rather than the product itself). This ‘push’ model shifts how consumers approach fashion (which is obviously working based on the company’s success), but if I were working with the organization, I would attempt to evaluate if this diagnostic model will be sustainable to the customers’ needs and expectations when shopping. By selling products on a one-off basis, the company may miss additional sales that other firms capture by instead focusing on selling products as a collection or outfit set. Stitchfix may be able to create a similar ‘collection-based’ experience by leveraging their data and AI algorithms to identify the optimal way to bundle outfits / build collection and instead, mailing these groupings of products to consumers in addition to a story tied to these products.

My worry for Stitch Fix and their competitors is that traditional retailers have caught up in the last couple of years to deliver the same key value propositions (personalization and free returns). StitchFix is left without much else to offer, and thus may be doomed to remain a niche product, or worse, a fad.

Traditional retailers (e.g. Nordstrom) and e-commerce focused retailers (e.g. Revolve or ShopBop) have made big investments in personal recommendation algorithms. For example, Nordstrom has leveraged Amazon’s AWS platform to streamline personal recommendations [1], and has partnered with TrueFit [2] to recommend personal sizing for its customers. Judging from personal experience, these recommendation algorithms deliver great results that have vastly improved over the last couple of years.

Suddenly the incremental benefits of StitchFix are slim – it simply removes any control or effort on the part of the consumer to choose their clothes. And I think the amount of consumers willing to pay for this incremental benefit is small – it seems to me that most people who are clued in enough on fashion trends to want to try a service like StitchFix also want some degree of control over what they wear.

I doubt that personalization is enough for StitchFix to continue to compete, and I question how big a market StitchFix can reach and ultimately how long they’ll be around.

[1] “AWS Case Study: Nordstrom” https://aws.amazon.com/solutions/case-studies/nordstrom/

[2] “Happy Anniversary to You, Nordstrom” https://www.truefit.com/en/Blog/July-2016/Happy-Anniversary-to-You,-Nordstrom

One of Stitch Fix’s biggest competitive advantages is the ability to track customer data and aggregate consumer buying information to assess demand trends in the market. This data advantage informs the company’s buying decisions by having such close access to customer preferences.

Is there a way for Stitch Fix to further monetize this data by selling it to more traditional retail channels? Given Stitch Fix’s value proposition to customers, I don’t believe this would represent a threat to the business.

Ruksi, thanks for a great post. As a happy StitchFix customer, I have a couple of thoughts. While I think AI has a role here and might be a competitive advantage, the bigger competitive advantage I see with StitchFix is that someone who has the badge of “stylist” thinks that something might look good on me or might look good as an ensemble. Additionally, I often find that my buying decision is swayed by a personalized note that comes with each package of clothes, written to me by my stylist. She suggests outfits that might go with other things I have in my closet and will put it in the context of my life. For instance, she knows that I am in business school at HBS and will suggest outfits for going out to the bars once it starts getting cold or going to class or to an interview. It’s not just the personalization (easily replicated through AI), but the human touch, that keeps me as a customer.

I thought it was interesting to follow the IPO and days since — their IPO was considered “busted” as they closed the day up just 1% after pricing below the previously-communicated range [1]. This seemed due mainly to all the concerns voiced above (i.e., undifferentiated business model that could be attacked by Amazon). Since then, however, their stock has traded up (including +17% so far today) and is at trading at $23.5, up 57% from the IPO with no material business developments between 11/16 and today besides a strong Black Friday industry-wide. It seems like WalMart’s positive earnings news gave some folks confidence that there may indeed be multiple winners in any given industry, and that Amazon may not be conquering everything in such an absolute way as previously thought.

That said, I do think StichFix needs to do a lot more than invest in machine learning / automation. Amazon has far more customer data than they do, and a more robust tech / data science platform. I think StichFix will need to compete via more qualitative methods (fashion sensibility, brand selection, exclusivity of private-label merchandise) as these can’t be as easily copied by Amazon. I have a hard time seeing how Amazon won’t win the “data-driven clothes in a box” war, especially given their ability to fund that operation at a loss for a long time.

1. https://www.marketwatch.com/story/stitch-fix-fumbles-ipo-despite-strong-underlying-business-2017-11-17

Personally, I disagree that StitchFix has a competitive advantage that will allow the company to outcompete Amazon and other online retailers. The focus on personalization through AI is important but with limited inventory, this concept can only go so far. When shopping online or at a physical store, I’d imagine most people already know what they’re looking for and might resist paying extra to shop with a stylist who doesn’t have a true perspective on their body type or style. If I’m going to pay for a stylist, I’d want to have that experience in person and get instant feedback on the look. I can’t speak for all shoppers, but I’m perfectly satisfied with the “filter” button on the websites where I shop. Here are a few key flaws I see in the current StitchFix model:

1. Subscribers – Online subscription models are nearly impossible, and Stitch Fix does not have the marketing power or brand recognition to acquire and retain subscribers.

2. Cost – Unlike Amazon, StitchFix does not have the scale to gain purchasing power over its suppliers.

3. Shopping behavior/existing competitors – For many, shopping is either reactionary (need a dress for a party tonight) or a treat (just for fun with plenty of time). There are so many alternatives (brick-and-mortar, Amazon, Rent the Runway) that already satisfy shoppers, some of which use AI to personalize outfits and pieces for consumers.

I think the market for companies such as StickFix is limited and the competition is fierce. I agree that currently their competitive advantage has been their technology and their consumer data. That being said, if Amazon decides to enter this space aggressively (they are trying to get their overall apparel game in-line), then they can easily out compete anyone on both those dimensions of technology and data. They have so much consumer data, beyond someone’s fashion style that they can do a much better job of recommending. In addition, they have a much wider product assortment and can really customize their recommendations for each customer. Currently Amazon’s problem is they have too much going on so its hard for consumers to find clothes. Once they do a better job at managing their assortment, they will easily win this game.

On top of their data and technology, they have awareness and convenience. They don’t have to burn money to acquires customers on their platform because they already have so many prime members.

As an investor, I would not bet on StichFix in the long-run. I think they will be fine in the short run.

Great article, and timely given last week’s IPO.

I’m very worried about the threat that Amazon poses to Stitch Fix. Right now, the equity story that Stitch Fix is telling the public markets is that its competitive edge – the “moat” it has built – is its level of personalization, achieved through advanced data techniques; they’ve even said that investors need education to understand how importance data science is to their model.

As you cited, Amazon unveiled Prime Wardrobe this summer. My sense is that Amazon can replicate this level of personalization in their Prime Wardrobe through machine learning fairly quickly. After all, they have the machine learning know-how, engineering and data talent, a huge existing customer base, and ample data on their existing customers’ preferences. (As the story goes, they recommend diapers to you before you even know you’re pregnant.) As seen with Blue Apron, Amazon’s decision to go into markets in a focused way can crush a new public challenger’s stock price.

Moreover, I’m dubious about Stitch Fix’s claims that data science can, in addition to customize recommendations, effectively gauge consumer trends and forecast fashions. In my view – and as we learned in the GAP case, predicting trends is more of an art than a science. Moreover, they would be in even more of a position of strength if they worked to dictate trends, which would be done by creative directors, not data analysts.

Finally, I think an interesting dynamic here is the fact that Katrina Lake and a couple of her early investors still – post-IPO – control the company through a special class of stock with higher voting rights. What affect do you think this will have on management, strategic priorities, and do you think this fact is baked into/bringing down the stock price at all?

Having never used or heard about Stich Fix, I must say I am pretty amazed that it has survived as a business. Moving to America one of the biggest perks has been online shopping, being able to get everything in 2 business days is great but being able to return it for free if I don’t like it is AMAZING. The only reason I would consider trying Stich Fix would be if 1) the stylist was able to make recommendations on items that I wouldn’t have thought of on my own 2) the stylist could find deals on clothing pieces I really liked. In my opinion although AI can help with the recommendation system I feel the whole value lies on the quality and ability of the stylist. Stichfix should focus on differentiating by focusing on being the go to stylist for the millennial women, that is something Amazon can’t replicate.