State-owned copper mining: climate change vs. country development

Copper is essential for developing countries. Copper mining also generates substantial amounts of greenhouse gas emissions. Is it fair for developing countries to tax carbon? This article will explore this question through Codelco, the world’s largest copper producer.

In this article, I will argue that climate change will negatively impact the copper industry, which might ultimately hurt the developing world and reinforce inequality within the globe.

Due to its electrical conductivity, copper is used in electronics, cars, and wires. This makes copper critical for highly developed countries. It is also an essential construction material, that developing countries need to build its infrastructure and catch up with the rest of the world. But, who needs copper the most?

According to the Oracle Mining Corporation, developed countries still consume more copper per capita than developing countries (10 kg in US vs. 5.4 kg in China). However, copper demand stagnated or decreased in developed economies, while the opposite is true in the developing world. Developing economies’ copper demand has steadily grown over the last decades, fueling economic and social improvement. By 2011, China already represented 40% of the demand.

However, copper mining significantly contributes to climate change. Directly, the copper production process generates CO2 emissions from fossil fuel combustion. Indirectly, copper production inputs and logistics also contribute. Copper is usually transported by trucks, trains, or vessels that burn fossil fuels. Also, copper production uses vast amounts of electricity in smelting and refining. Thus, it is reasonable to assume that carbon taxes could be introduced, given these environmental externalities. What would be the impact of this measure? Let’s explore this through a specific example.

Codelco is a state-owned Chilean mining company and the world’s largest copper producer. Based on their annual report and USGS statistics, they produced ~10% of the world’s copper in 2015 and own 8% of global reserves. They are also a large producer of greenhouse gas emissions. Last year, Codelco produced 3,2 t CO2e/millions tmf from both indirect and direct effects, and in 2011 it consumed 12% of the total national electricity supply.

Copper is a key driver of growth and economic wealth for Chile. As Patricio Meller, PhD. in Economics, mentions: Copper was one of the key components of Chile’s development since the market opened in 1990. Since then, contributions increased 10-fold, becoming 20% of total fiscal income by 2011. What would happen if the industry is taxed?

If only Chile taxes the industry, Codelco might become less competitive given additional costs. As Chile’s growth still heavily relies on copper revenue, it is reasonable to assume that local government will avoid doing this, unless the rest of the world does it. This is proven by press clippings that show that a CO2 tax in electricity could start impacting the industry in 2017-2018, but the tax is meant to affect all Codelco’s competitors not generating a mayor competitive disadvantage.

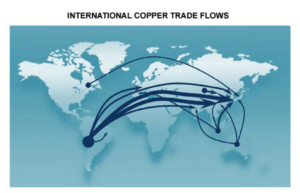

However, even if the entire world were to tax mining, Codelco would probably still be in bad position. Global demand for copper would probably decrease as prices rise, and Australia may become a more competitive supplier given its closer location to China and India, which would reduce relative transportation costs (see Figure 1). Regardless of the scenario, Codelco’s success to survive climate change regulation hinges on its ability to become the most efficient player in the market.

Source: Oracle Mining Corp.

But, how is Codelco doing in this area? Its sustainability report shows that they have been taking increasing care of reusing water and reducing energy consumption. Also, newspapers clippings show that they have implemented cost cutting programs, aimed to reduce costs in US$700 MM by 2016.

Nevertheless, Codelco’s actions are likely not enough for the long term. Labor costs are not expected to fall as Codelco faces incredibly powerful unions and Chile is continuously becoming more developed, which is rising overall wages. Also, according to BBVA, electricity costs in Chile are expected to become the 2nd highest in the world, after Congo.

What can Codelco do, then? In addition to cost cutting, Codelco could consider entering the recycling copper industry, as energy prices are driving “virgin” copper costs up. As mention by the International Copper Association, Copper is the only element that is 100% recyclable, it needs 85% less energy to be produced than pure copper and will reduce its carbon emission per ton of copper too. Based on press clipping, Codelco is not publicly looking to enter the recycle market, but in a raising cost environment, it might make sense to start developing this capability soon.

Even if Codelco stays relevant after climate change regulations, significant doubts remain as enviromental damage is being generated as we speak and nowbody is paying for it. Also, an increased in copper price due to taxes on CO2 could slow down developing countries growth. Is it fair that developing countries pay the price of carbon emissions that developed countries didn’t paid during their growth period? Will my great-grandchildren think that we made the right decision when deciding to sell our Chilean copper without including the full negative externalities costs into it?

(796 words)

Sources

Codelco

https://www.codelco.com/memoria2015/pdf/memoria-anual/memoria2015-mensajes.pdf

http://www.t13.cl/noticia/negocios/presidente-codelco-anuncia-metas-reduccion-costos-division-2016

Copper industry

http://minerals.usgs.gov/minerals/pubs/commodity/copper/mcs-2016-coppe.pdf

http://www.decodedscience.org/causes-effects-increasing-global-copper-demand/52768

http://www.aminerals.cl/wp-content/files/Sntesis_El_valor_del_cobre_para_que_Chile_alcance_el_pleno_desarrollo.pdf http://www.madehow.com/Volume-4/Copper.html

http://www.oracleminingcorp.com/copper/

https://www.bbvaresearch.com/wp-content/uploads/sites/4/2015/10/Sector-Minero-Chile-2015.pdf

Recycling copper

http://publik.tuwien.ac.at/files/PubDat_228367.pdf

http://copperalliance.org/wordpress/wp-content/uploads/2013/03/ica-copper-recycling-1405-A4-low-res.pdf

Others

http://info.goldavenue.com/info_site/in_glos/in_glos_productioncosts.html

http://www.spe.fazenda.gov.br/noticias/seminario-politica-fiscal-verde/imposto-anual-sobre-a-emissao-de-poluentes-locais-e-carbono-chile

Great post! I agree that Chile is unlikely to impose a CO2 emission tax on its national mining company. Global CO2 emissions taxes will eventually be levied and should impact all copper producers in proportion to their carbon footprints. If Codelco can improve its operational efficiency to reduce its carbon emissions per tonne of copper production relative to competitors, it may actually get a competitive advantage.

However I wonder if going into the recycling business is an attractive alternative. The economics of the recycling business are materially weaker than copper mining. The profitability of a mining operation is largely linked to the mineral endowment that is being mined, and access to this mineral endowment constitutes a competitive advantage for the company operating the mine. The metals recycling business however is a different beast – the barriers to entry are only the capital required to build the recycling plant, and availability of scrap copper. As an example, the EBITDA margin of Aurubis, one of the largest copper recycling companies, is 3-4%, compared to high quality copper mines which typically have EBITDA margins in the 40-60% range. Why would the Chilean government want Codelco to go into an economically far less attractive business?

Excellent point Sander! I too agree that considering current prices, the recycling business is not as profitable as the primary mining business, neither for Codelco nor for the Chilean Government . Nevertheless, with raising extraction costs, and better technology for the recycling processes, it is fair to think that recycling copper could become an attractive business in the future. If Chile and Codelco start developing capabilities today, maybe in the future Chile could be exporting its recycling copper and who nows even its technology.

Awesome Post, thanks for getting the conversation started.

An interesting aspect developing in Chilean mines arose from a natural resource problem. While the Copper mineral reserves are vast, the water needed for extraction was at an all-time low regarding availability. Simply put, the economics of supplying mines with water did not add up. This, however, is when humans (and companies) best perform, and today desalination is actually a great business in and on itself. While I agree that some punitive measures are needed to desuade inneficiencies, I believe most companies possess resouerces and technology to improve their operations and allow innovation to occur. I truly believe innovation, not taxation, is our only way out of the mess we have made of this greenhouse-filled world.

Thanks for the thought provoking post! I agree with you that a Chilean carbon tax might make Codelco less competitive given the increase in costs (so increasing operational efficiencies would be the way for them to maintain competitiveness) but I’m not sure if the carbon tax would necessarily impede Chile’s economic development — it would all depend on how carbon tax revenues are used by the government. If the government uses the revenues to expand social transfers, it would be welfare-enhancing for low income households, reduce inequality, and push the country onto a stronger path for development. If the government wanted to maintain the mining industry’s competitiveness, it could also use carbon tax revenues to reduce corporate taxes, lessening the burden on companies like Codelco. Government funds are not always that fungible (i.e. can be easily moved across different ministries), but as long as the carbon tax is set up thoughtfully, I think it could potentially be a positive force for Chile’s overall development.

Very interesting post! From the data on per capita copper consumption to the fact that Codelco consumed 12% of Chile’s electricity supply, these were some facts I had never come across before!

I like the way you think about the problem and the solution you’ve chosen (in considering a shift to the recycle copper industry). My concern here is twofold. The first is what it means for operations. My knowledge base is very limited but my understanding was the production of copper that used recycled copper as a primary input is much different from the production of copper that uses concentrate as the primary input (aka normal copper production). Though I’m not sure how feasible it is, maybe mines could supplement there concentrate use with recycled copper use (as opposed to switching over to primarily recycled copper use). My thinking is that this will allow them to benefit from some of the power savings without having to significantly change their operations.

My second concern is the availability of recycled copper. The availability of recycled copper is correlated with the price of copper. As the price falls, people are less willing to sell stockpiles. My worry is that as prices falls, not only will they see reduced prices for the product they are selling but that they will also see reduced availability of what they have made a crucial input (as opposed to normal operations where availability of raw materials is just a function of Codelco’s ability to mine).