Starbucks, mobile payments underdog, takes gold

Starbucks has become an unlikely leader in the mobile payments space, and mobile payments could account for over 50 percent of U.S. store transactions within a few years.

A slow start for quick and easy mobile payments

We’ve all heard the buzz around the future of mobile payments from the usual tech-giant suspects who launched Android Pay and Apple Pay. Still, we hardly ever see people paying at restaurants or stores with these mobile payment options. Launched in late 2015, Android Pay is Google’s second attempt to break into the mobile wallet space. Google originally launched Google Wallet in 2011 to little success and since repositioned it as a Venmo-like payment service between friends and family. Getting a later start in the space, Apple launched Apple Pay in 2014.

Still, mobile payments have taken off more slowly than many anticipated. Mobile payment systems allow customers to make contactless payments using their smartphone at participating retailers. While smartphone penetration in the United States is nearing 80%1, the same consumers haven’t felt the need to abandon traditional payment methods, and merchants have been hesitant to accept the shift to mobile payments2. After all, is it too much hassle to swipe or insert a credit card to pay for groceries or a cup of coffee?

Starbucks leads the way in mobile payments

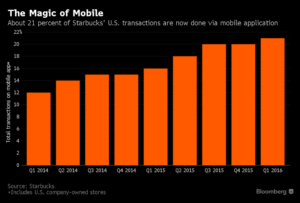

The only place where I regularly notice mobile payment in action is Starbucks, and customers are not using Android Pay or Apple Pay. Starbucks customers use the Starbucks app. Starbucks managed to get mobile payments right early on, launching a first version of mobile payment through its app in 2011. By 2013, Starbucks was responsible for 90% of the $1.6 billion spent in U.S. stores using a smartphone3. Figure A highlights the subsequent adoption pattern of the Starbucks app’s mobile payment functionality. As of Q3 of 2016, mobile handset payments now account for approximately 26% of Starbucks’ total in-store purchases in the United States2. Per Adam Brotman, Starbucks’ chief digital officer, mobile could account for over 50 percent of transactions in company-owned U.S. stores within a few years4.

Developed mostly in-house, the Starbucks app has become a key part of the company’s strategy4. How has Starbucks managed to achieve impressive mobile payment penetration by encouraging its customers to adopt the Starbucks app? For one, timing contributed immensely to the app’s stickiness. Since Starbucks launched its own branded mobile payment function before technology companies could successfully enter the space, many users became accustomed to mobile payments through Starbucks first.

Moreover, the Starbucks app combines mobile payment functionality with other features. Basic features include a store locator, Starbucks e-giftcard giving, and music recommendations that link to a user’s Spotify account. Most importantly, the app has always linked to customers’ Starbucks Rewards loyalty program and, more recently, began offering order-ahead capabilities. Loyalty customers dominate Starbucks’ in-store spend, and Starbucks executive Matthew Ryan explains that 38% of spend comes from rewards or gift cards, 33% of which are registered and enrolled in Starbucks Rewards2. The coffee chain’s order-ahead offering, Mobile Order & Pay, launched in late 2015. This added benefit will further boost growing digital sales. Mobile Order & Pay was responsible for 7% of U.S. sales in September, up from 5% in Q2 of 20162. Some locations have up to 20% of orders coming through Mobile Order & Pay during peak hours2.

What challenges and opportunities might Starbucks face?

Could Starbucks license a version of its mobile app to other companies? Would this digital platform work for other companies? While Brotman has acknowledged that the app wouldn’t be available for licensing anytime soon, he also mentioned great, ongoing conversations with other companies4. However, maybe this digital ecosystem only works for Starbucks thanks to a loyal customer base and the habitual nature of drinking coffee.

Should Android Pay and Apple Pay become widely used, will people feel less inclined to use the Starbucks app? Android Pay and Apply also offer compatibility with retailers’ rewards programs. Will these mobile payment systems render the Starbucks app irrelevant? Customers may limit the number of mobile payment systems they use for simplicity’s sake. Customers often have a limited number of apps that they use frequently. Will Starbucks make the cut? Smartphone users might download 40 apps to their phones but regularly use only 155.

How can Starbucks continue to increase app adoption? Customers want the setup of a new app to be fast and simple. Downloading the Starbucks app takes about two minutes, including the time it takes to set up an account. Then, it takes about another minute to set up a payment method by entering credit card information. Some might argue this process takes too long and could discourage adoption. How can Starbucks minimize app setup time? Other apps allow users to skip entering credit card information by capturing pictures of a card. Starbucks might consider adding this feature to reduce barriers to customers fully setting up the Starbucks app.

(Word Count: 797)

———–

Sources:

[1] comScore, “comScore Reports February 2016 U.S. Smartphone Subscriber Market Share”. April 6, 2016. https://www.comscore.com/Insights/Rankings/comScore-Reports-February-2016-US-Smartphone-Subscriber-Market-Share , accessed November 2016.

[2] Business Insider, “Here’s how Mobile Order & Pay could lift Starbucks”, November 7, 2016. http://www.businessinsider.com/heres-how-mobile-order-and-pay-could-lift-starbucks-2016-11 , accessed November 2016.

[3] Forbes, “Once Again, Starbucks Shows Google And Apple How To Do Mobile Payment”, January 22, 2015. http://www.forbes.com/sites/roberthof/2015/01/22/once-again-starbucks-shows-google-and-apple-how-to-do-mobile-payment/#7ab83fc72b65 , accessed November 2016.

[4] BloombergTechnology, “Starbucks Takes Its Pioneering Mobile-Phone App to Grande Level”, March 30, 2016. https://www.bloomberg.com/news/articles/2016-03-30/starbucks-takes-its-pioneering-mobile-phone-app-to-grande-level , accessed November 2016.

[5] Harvard Business Review, “For Mobile Devices, Think Apps, Not Ads”, March 2013. https://hbr.org/2013/03/for-mobile-devices-think-apps-not-ads , accessed November 2016.

Thanks for sharing – this is great coverage! I’m curious to understand how Starbucks aims to monetize their payment app, beyond having another avenue to increase stickiness and offer means to order ahead. Are there further opportunities to monetize the use of the app itself? It would also be interesting to have detail around the various components of the app. Take Spotify, for example – how many users engage in that, and is it worth any fees Starbucks has to pay Spotify for a partnership (if any)?

Interesting post! I absolutely agree that mobile payment is a area where significant potentials are anticipated, yet many have not adopted using despite technology being prevalent in current society. From this respect, Starbucks approached the mobile payments in a unique way that differentiate itself from other players – i.e., introducing loyalty program as its main driver for the consumers and adding mobile payment to augment the loyalty experience. I believe this approach eroded any barriers that consumers might have with mobile payments and opened an easy path to try new form of payments. That being said, I am still very reluctant on how this approach will be applied to other companies.

Fantastic technology topic. Starbucks again got this one right. As you mentioned, the timing of this introduction was advantageous for Starbucks, but even further, as we discussed briefly in marketing, this app complimented the Starbucks clientele nicely too. Effortlessly integrating the rewards points with the in-house payment app enhanced Starbucks consumer loyalty and economic moat, ensuring the Starbucks faithful have another reason to return. Even within this app too, the operational game-changer is the mobile order and pickup, all while paying through the app. The improved efficiency, again for a Starbucks consumer who loves efficiency, combined with the easy payment system will continue to reap benefits for the firm.

Great post! It’s really interesting to see how Starbucks has been able to win in the payments space considering that many haven’t been able to get this right. I like how you pointed out how Starbucks’ success may not be easily replicated by other firms since they have a large loyal following and that it is a habitual purchase. Moreover, I recall in my research on JPMorgan Chase’s digital efforts that they are partnering with Starbucks to promote adoption of Chase Pay, the company’s Chase-branded digital wallet. In JPMC’s annual letter to shareholders in 2015, the company mentioned that the partnership was a significant win since Starbucks customers would be able to pay with the mobile app at more than 7,500 company-operated Starbucks locations. I wonder how / if this partnership will change Starbucks promotion of its own mobile payments app.

Great post, it is very interesting to analyze Starbucks success in mobile payment sector and try to understand its key elements. The post mentioned the convenience aspect and the importance of the reward program.

One point that was not touched was the correlation between the typical Starbucks customer and the adoption of this new technology, and I believe this was a critical factor to explain such a quick ramp-up in adoption. Starbucks’ customer are (or like to see themselves) as tech savvy and early-adopter. Furthermore, they are is high loyalty to the brand. This is why, I think, the Starbucks model will be hard to replicate for other companies.

On the other hand, the threat from standardize payments is not one to be ignored. It fascinating to observe the tension in the app world between the proliferation of app with specific functions in all services (messaging, photography, dating, airlines) and other app that try to consolidate by creating a all-in-one platform (Apple wallet, Facebook). I think big firms will end up taking the majority of the pie while smaller and specific ones will struggle. Starbucks was a first-mover itself, maintaining its success is only one tap away… will the coffeecaramelskimmacchiatograndewithdoubleshotofespresso users be willing to endure a separete platform? The reward system is a great idea but I am not sure if it will last.

Great post. Super interesting and feels especially relevant after having studied the case in class. One point which would be good to explore further is why Starbucks was able to successfully crack the digital payments space while the others were not. Was it specifically the ease of use, the loyalty program they instituted, the industry lending itself to this kind of payment more easily than other industries or was it because they had a superior tech team / mindset and invested in this when the others did not?

Another question I have is on licensing the app. Given how different business operate, do you think it might be able to do it for other industries as well or would it be restricted to the F&B industry? Moreover, given the low barriers to entry, what “edge” would Starbucks provide over developing the app in-house? One thing I can think off would be licensing it out to smaller companies that may not be able to invest in technology as heavily (but then again, those probably wouldn’t be chains so not sure if it would work as well) but would love to hear your thoughts.

Great post. I think the loyalty program is critical to getting people to download and use the Starbucks app. Based on my own experience with the app, I think Starbucks has an opportunity to engage with customers who have left for other daily coffee rituals (e.g. offering customers a free drink who haven’t been in a long time). Do you know if they have any strategies like that to drive re-adoption?

This is news to me. As a loyal Starbucks coffee drinker, I wasn’t aware of the ability to make mobile payments. I will definitely download the app and make use of it next time I buy a Starbucks coffee!

I completely agree with your proposition – the main reason for the success of mobile payments at Starbucks is its fully integrated app, linking payments to rewards and gift cards. This is also convenient for time sensitive ‘grab and go’ customers. To increase traction and get more customers to use mobile payments, I think Starbucks should promote it more. Customers may be unaware of mobile payments (just like I was!). Once awareness increases, I’m sure it will ‘stick’ with customers.

Also, given the minimal usage of Android Pay and Apple Pay, I don’t think Starbucks needs to license its app at this point. However, if other forms of mobile payments become popular, it may need to reconsider but at the same time maintain its edge of a fully integrated platform for its customers.

Great read! I believe Starbucks has done a tremendous job of connecting and combining its loyalty program with the digital payment system in an extremely simple, user-friendly way. Given that the app and payment system can only be used at Starbucks locations, what are your thoughts on the possibility of expanding the application further?

As a user of the Starbucks mobile payment app, I found this article really interesting. I agree that the setup time is too long – I was once accidentally logged out of my Starbucks app, didn’t remember my password, and then used a regular credit card at Starbucks for several months because I found that getting back into my account. I also agree that the rewards program is what drives people to use the app over Apple Pay. I was not aware that Apple Pay offered compatibility with other companies rewards programs but would like to learn more about it. How does that system work? Are you able to use the Apple Pay system at a retailer or must you use the retailers app and just link the payment to apple pay? I think the adoption of Apple Pay would greatly increase if it was all accessible through just the Apple Pay app.

The Starbucks app has been a huge lifesaver! The addictive nature of coffee and the frequency with which I drink coffee means I am willing to do anything to optimize the experience. The features are easy to use and the app is well tailored to its core customer base. It was brilliant for them to move their “Starbucks reward cards” to the app – I now load up my card and will sometimes forget I have money there.