Soylent – Winning your heart with your stomach

Soylent has successfully created the anti-consumer packaged food, sacrificing taste for function and looks for efficiency. At the same time, much of the value it creates for users is emotional–linked to values and identity over nutrition.

Soylent, the food substitute designed to be a source of “whole human nutrition”, has an operating model particularly well-aligned with its business model across both functional and abstract forms of value-creation. Soylent offers two products currently: Soylent 1.5, a powder that’s designed to be mixed with water; and Soylent 2.0, a ready-to-drink version. Both products taste exactly the same—something like watery milk with a hint of Cheerios. This neutral taste is meant to reduce flavor fatigue when consumed meal after meal, and appeal to (rather, not repulse) the broadest possible set of consumers. Soylent is also characterized by it’s minimalist packaging, just a white bottle or bag, and complete reliance on word-of-mouth and news media demand generation rather than paid advertising. Soylent is sold directly by the company over the internet; there are no physical stores that carry the product.

Soylent’s business model begins with a distinct commitment to two functional benefits. The product is first meant to be an extremely time-efficient source of energy. Not only does the product require little-to-no prep time, but by narrowing dining flavors to a single option, users waste no time deciding what is for dinner. Next, Soylent is also extremely inexpensive. Someone can live on Soylent powder for about $9 per day – roughly the cost of lunch in Spangler.

The company’s operating model is aligned with these two functional goals in that it has intentionally limited its offerings to optimize for either speed or price while scoring relatively high on both. Someone particularly pressed for time can opt for the bottled version and pay ~60% premium to the mix. Furthermore, the company has outsourced manufacturing to a contract manufacturer in order to achieve economies of scale, keep costs low, and respond to rapidly increasing demand.

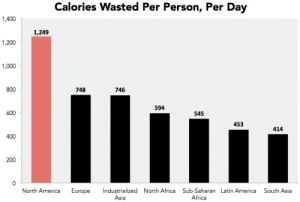

Beyond its functional value, Soylent also appeals to abstract, emotional needs of its users. The company’s positioning and messaging is purposefully extreme, as evidenced by the name (Soylent is an allusion to a film, Soylent Green, in which a dystopian government feeds its citizens with human remains) and many of the statements made publicly by its founder, Rob Rhinehart. Among his more interesting comments link our current approach to food to anachronism. For instance, in describing foodies, Rhinehart commented: “Everyone’s like, ‘The natural, organic way is the best.’ And it sounded a lot like fundamentalist Christianity.” Other comments highlight Soylent’s functional superiority: “I have not set foot in a grocery store in years. Nevermore will I bumble through endless confusing aisles like a pack-donkey searching for feed while the smell of rotting flesh fills my nostrils, fluorescent lights sear my eyeballs, and sappy loves songs torture my ears.” As a result, Soylent users are able to imagine themselves as joining a tech-forward, progressive community rather than excommunicating themselves from the church of food. The company’s management also criticizes traditional food systems on a more concrete level by pointing out the incredible amount of food wasted in the U.S. Soylent’s distribution model, engage users directly, is an extremely important enabler to create this kind of value—and rare in the food industry.

While the existing operating and business models are well-aligned today, the company is on the path to further improve. First, Soylent is in the process of developing an at-scale, in-house manufacturing process that would use algae as the primary food-stock. While this has the potential to meaningfully improve the cost structure, it also has the potential to reduce the environmental impact of producing Soylent. The next meaningful improvement on this dimension will also come from a more traditional distribution system—pushing the product to physical stores rather than relying on direct shipping. Consistent with the company’s push for scale, the Soylent is also looking at ways the product could be distributed as a source of nutrition in geographies suffering famine or disaster. This initiative has a second order benefit as well in supplementing the social elements of the value proposition. Indeed, if Soylent is to remain ahead of its competitors, the company must either lead on functional benefits, efficiency and cost structure, or improve the social, non-functional elements of its value proposition enough to support a premium price.

Sources:

General information on Soylent – https://www.soylent.com/

Cost of Soylent powder vs. drink – https://discourse.soylent.com/t/will-convenience-outweigh-cost-for-2-0/23378

Quotes from Robert Rhinehart, CEO – http://www.businessinsider.com/soylent-ceo-rob-rhinehart-quotes-about-the-future-of-food-2015-10

Interview with Robert Rhinehart, CEO – http://motherboard.vice.com/read/soylent-how-i-stopped-eating-for-30-days

Long-run manufacturing plans – http://motherboard.vice.com/read/soylents-real-plan-is-to-replace-food-with-algae

Thank you for this introduction to Soylent – I’ve heard of it on multiple occasions but had no knowledge of its distribution or marketing strategy. From the founder’s criticism of the traditional food system, my understanding is that Soylent aims to be a comprehensive meal replacement product, in the sense that its ultimate goal is for consumers to forgo non-Soylent food entirely. The fact that Soylent raised another round of funding at the start of the year to research ways to cut down its already very modest price tag (http://techcrunch.com/2015/01/14/soylent-20m/) also indicates to me that the company is looking to scale up (lowering margins without increasing scale seems like poor business planning).

My concern with this is that while Soylent’s limited product offering and avoidance of paid marketing and physical store distribution are perfectly aligned with its functional and emotional emphasis on simplicity, they may be problematic if Soylent hopes to achieve broader reach. Users such as the one who commented “I have not set foot in a grocery store in years” seem more like extreme than regular customers, it’s difficult for me to imagine Soylent can substitute all or even most meals for a mainstream demographic without either diversifying its product line or relying on more aggressive distribution.

Would be interested in your thoughts on whether you think it’s necessary for the company to move in this direction going forward, or if not, what alternative approach you think it should take.

Thanks for your response.

Yes, I think in the long-run, a more traditional approach to marketing and advertising will be necessary elements of competing here — to complement the more traditional approach to distribution.

In time, there will be less focus on educating the consumer on the benefits of meal-replacement and more investment in differentiating Soylent relative to competitors.

Great write-up – thank you! The growth of Soylent has been fascinating to me. A few thoughts on the future potential for the company:

(1) Replicable model: The Soylent model seems to be easy to replicate. The functional benefits of providing a fast, inexpensive, nutritionally rich meal beverage are not unique. What is really differentiating besides the brand positioning as the one-size-fits-all “whole human nutrition?”

(2) Growth potential: I would think that there is a pretty limited number of potential customers want to not think about eating. It will be interesting to see how much Soylent is able to push this limit as it pursues further growth.

(3) Product evolution: Right now the focus of Soylent is on growing two products that nutritionally work for everyone. In parallel, science is becoming more refined, and doctors are better able to understand an individual’s unique nutritional needs, given his/her genetics and lifestyle. Could greater customization be a future direction for the company? Would that run counter to their current positioning?

Hi Meredith, good points!

1) I think you’re right here, and with time, there will be many more competitors. I think the long-run defensibility comes from massive scale that lead to a position of cost leadership and a brand that gives the company some pricing power. A lot of people look at these meal replacement products with suspicion, so being in market for a while, generating a strong track record of healthy users, provides some differentiation. It’s also such a cheap product that consumers aren’t likely spend a lot of time price-checking. There’s some potential for technical differentiation on the manufacturing side (like moving to algae production).

2) I think we’re early in the adoption curve. Based on the comments, it sounds like there are a few users in the section. It’s likely that as there’s broader awareness around meal replacement alternatives, people will appreciate the convenience of replacing one or two of their meals each day. Speaking personally, I would have been all over this in high school and college. I was super broke, and I used to go to McDonalds or Taco Bell, order two dollar menu items and eat for $2.17. My guess is that there’s a big group out there that will gravitate toward this option out of preference, necessity, or some combination of the two.

3) Absolutely. Even now, Soylent has an “open source” project that encourages people to try combinations of different sources of nutrition. Many people use Soylent as the backbone for this mix and then add in other sources of nutrition (or flavor) to tailor to their preferences. I think it’s consistent with their current positioning. You can check out the forum here: https://diy.soylent.com/

Thanks again!

Great insight into the Soylent business model! I’ve been a Soylent consumer for about 6 months now, and have benefited greatly from the efficiency it brings to nutrition. As a pioneer in its space, Soylent has spent a lot of time developing the flavor and texture of its offerings while optimizing for nutritional completeness. I’d be curious to know more about how it has managed this innovation aspect of its operations. In this post, you aptly point out that Soylent’s goal in terms of taste is broadest appeal (or at least lack of repulsion). How is this optimized in the course of development operations? How can things like taste be quantified or tested at scale?

Great question!

Thus far, Soylent has done a lot of their product testing in a distributed fashion. There’s a huge section on the Soylent site dedicated to new recipes submitted by users and feedback on various changes. That said, I think the focus on functional benefits will eventually give way to an interest in improving the flavor. When that happens, I think the company will transition to the more sophisticated flavor trials that CPG companies has employed for decades: a combination of blind taste tests, focus groups, and distributed consumer surveys.

Super interesting company and insightful critique! I’ve been a Soylent customer for about a year now and think it offers an excellent customer value proposition. The major area that I think the company will struggle with is customer acquisition. As a revolutionary food product, I’m not sure how successful Soylent can be at achieving scale outside of its core users (especially given struggles to achieve a palatable version). However, I do see a lot of opportunity to use the product to provide cheap, nutritional food to people at the bottom of the pyramid. There are three reasons this could be achieved 1) it packs a big punch! Soylent mass is very low for the calories that it provides, making it easy to transport, 2) it is easy to use (just add water), and 3) it is non-perishable. The company continually strives to reduce the product’s weight and price while still offering the same nutritional benefits and calories to customers. Especially if this product can be produced locally in poor countries, it could provide a breakthrough in affordable healthy food. I would be interested in your thoughts on shifting its business model in this direction.

I agree that this is a really exciting opportunity in the long run. In the next few years however, I think the company will be much more focused on acquiring customers with the greatest lifetime value–essentially its target market today. These consumers generally have a lot of disposable income, and because they are adopting Soylent for its functional benefits (rather than survival) they are likely to be developing much more durable habits.

Finally, even if Soylent is cheap, someone still needs to pay for it when delivered to the developing world. This could be very challenging in the setting described above.

Thanks for the insight on what to me is a pretty novel company. A few questions about the business model and operating model.

– It seems to me that the real value created by the company is in creating a sense of community and uniqueness amongst consumers. While the marketing of the product itself is focused on the minimalist functionality of the product, I think it is fair to say that there is no real functional superiority in this product in achieving basic and hassle-free nutritional requirements for users, relative to a plethora of other basic nutritional options — this is essentially carbs, protein and a multi-vitamin. Customers could easily eat cereal, a protein shake and a multi-vitamin every day and achieve the same nutritional outcome for an even lower cost. Thus, I think the real appeal right now is in targeting a specific demographic (the archetype to me appears to be young tech entrepreneurs) and making them feel unique and counter-culture by using the product. Given this potentially fad-like root of the value proposition, I worry about the long-term sustainability

– In terms of the operating model, if the company does wish to portray itself and the product as a one-stop solution to all nutritional needs, I worry about whether the company has the resources and expertise necessary to credibly play that role. The founders are essentially young tech entrepreneurs, not nutritional experts — the science of Soylent being all one needs to survive is basically taken from existing and potentially incomplete nutritional research, and anecdote (e.g. the founder living off of the product for a long period of time). Many nutritional experts are highly skeptical of the product. Additionally, the company doesn’t currently manufacture it’s own product in-house, which would seem to be a necessary capability if the company wants to tout itself as an expert in the field and a provider of the highest quality nutritional products.

Thanks for your comment!

To your first point, I think a big part of the value prop is definitely the association with a counter-culture tech startup lifestyle. That said, if there was some compelling functional benefits (cheap and convenient), I don’t think it would stand on its own. I think the company’s hope is to ride the “fad” for a while while it builds an even stronger functional value prop with scale. To your point about cereal / protein shake / multivitamin as an alternative: 1) I don’t think that would yield a great balanced diet, there’s very little fiber there, and 2) between the store and the multiple steps, it’s less convenient and less portable.

To your second point, the company has closed some of the talent gaps that were certainly present in the early days. The product remains controversial among nutritionists, but it’s the nature of their industry. I don’t think we’ve come to agreement among nutritionists whether multivitamins are a good idea, despite all the research that’s been conducted. Good point on in-house manufacturing. I think that’s a necessary next-step, and will likely come as they actually develop some differentiated technology on the manufacturing side and it makes sense to bring in it.

Thanks again!

Thanks Ben for the wonderful introduction to Soylent. While I have heard of the product and company due to the multiple funding rounds, I didn’t have much understanding of the product value proposition, distribution and marketing strategy. I believe that Soylent is a product with tremendous scope and potential. Given it is an evolving product and company, I had a few questions on the future for Soylent.

1. Substitute vs Supplement – While Soylent is being marketed as a food substitute, is there value in marketing it as a food supplement especially for those slow adopters?

2. Scaling up – From a utilitarian perspective, Soylent could transform the way organizations like the WFP do nutritional programs in under-developed or famine stricken countries. Soylent could be a boon for the malnourished population. While the operating model to execute on such a business model is completely different from what they possess today, what are your thoughts on this strategy? Would Soylent be willing to gain scale through food/relief programs in under-developed countries?

3. What will be the cost implications of moving from outsourced manufacturing to in-house manufacturing?

4. How is Soylent’s unit economics? Does it make money on unit sold at $9? If yes, what are the drivers of the low cost position – is it process efficiency, procurement, choice of ingredients or product innovation?

Thanks for sharing! I had never heard of Soylent before, really interesting concept. I’m curious about the decision for the product to be settle for “not repulsive” rather than objectively tasty. I imagine Soylent will be competing in the general meal supplement and substitute space – green juices, protein bars, etc – and I question whether they’ll really be able to compete effectively if the taste is just meh.

Do you think their business and operating model is sustainable in the long term? What is the barrier to entry in the industry and how would Soylent maintain its competitive advantage in the long run?