Solar Wars: the Battle for the US Solar Industry

American solar manufacturers are struggling against Asia-based competitors who have flooded the US market with a glut of low-priced solar panels. How should the federal government respond to the failure of American industry to compete in this global supply chain?

In April 2017, Suniva, a Georgia-based solar panel company, filed a petition that could dramatically alter the future of clean tech in the US. They demanded that the federal government impose a 120-160% tariff on future crystalline silicon solar panel imports to protect domestic manufacturers from cheap Asian competitors [1]. At stake is a multi-billion-dollar industry with huge economic significance and a rising tide of protectionist trade policies.

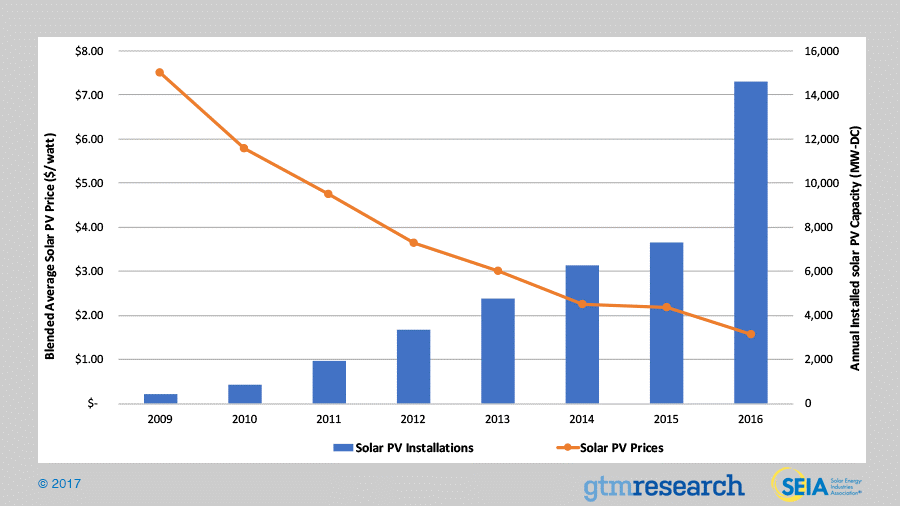

Photovoltaic (PV) installations in the United States have grown exponentially in the last decade, mirrored by plummeting PV unit prices. While PV currently makes up only about 1% of the US energy supply, this percentage is projected to more than double by 2020 [2]. Given the explosive economic growth of PV, plus the positive environmental impact of the technology, the solar panel industry has the potential to be a cornerstone industry of the 21st century, giving it international strategic importance. Despite this attention, however, US solar manufacturers are significantly lagging the rest of the world.

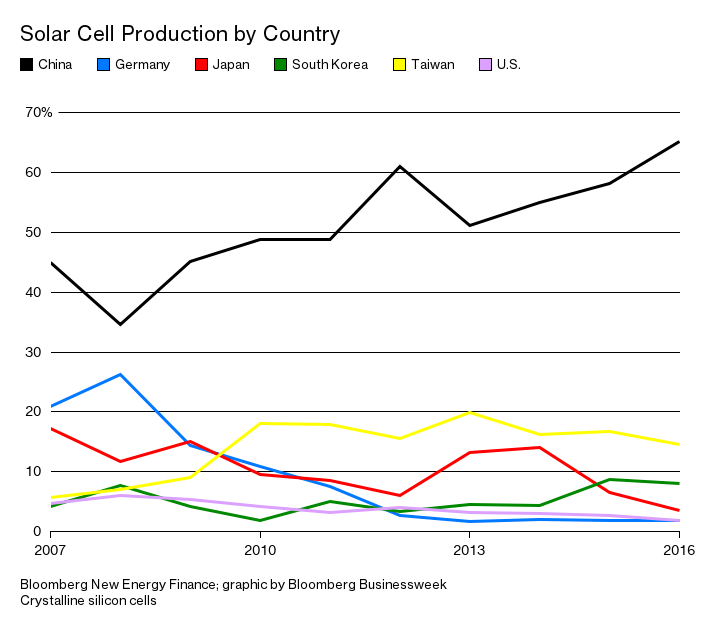

Internationally, China and Taiwan have a dominant market share [1], producing around 80% of the world’s solar cells. Even in the US domestic market, only about 10% of the solar panels installed are manufactured in the US [3]. American solar manufacturers like Suniva, and Oregon-based SolarWorld blame intentional overcapacity and unfair governmental support on the part of Asian manufacturers as the root of this discrepancy. They have been joined in these complaints by Turkey, India, and the EU [4]. With growing protectionist sentiments around manufacturing and the political spotlight on “green collar” jobs in the United States, it has fallen to the federal government to determine how to support the solar industry.

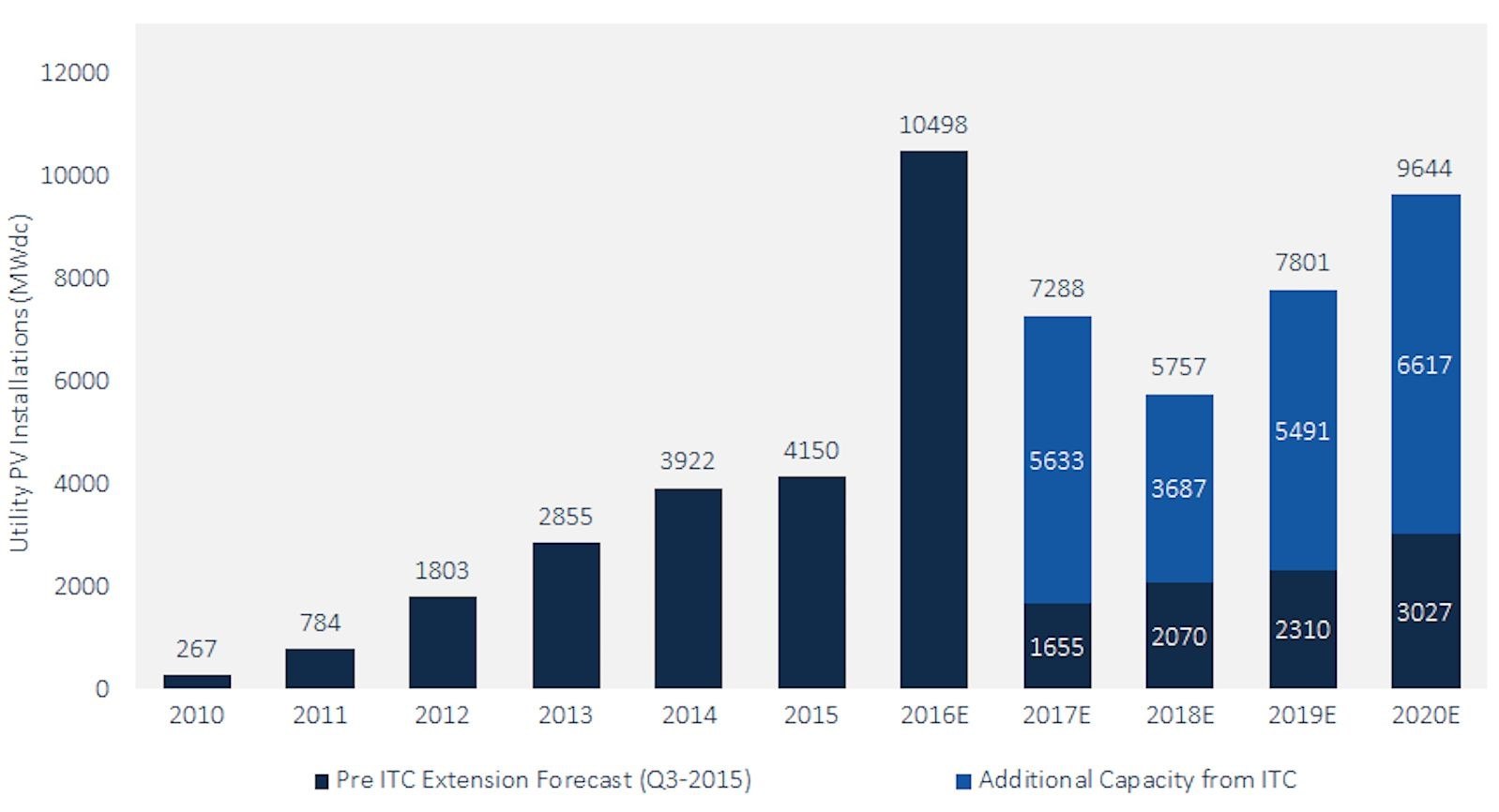

In the short term, the US government has several key strategic decisions to make. In October 2017, the US International Trade Commission reviewed the case brought by Suniva and recommended tariffs of up to 35% [5]. The Trump administration has until January to decide whether to implement this recommendation. Meanwhile, the government must also decide the fate of the solar investment tax credit (ITC). This tax credit provides a 30% rebate on investments in solar property. While the solar ITC was renewed in 2015, these credits could be cut as part of recently announced tax code reforms. A cut in the ITC will not directly affect solar cell manufacturers, but it could deeply affect demand in the United States—with projected installations falling by around 50% [6].

In the medium term, the federal government appears to be continuing to maintain a high level of subsidies for the solar industry through direct grants, tax subsidies, and federally supported R&D. In 2013, these expenditures totaled 5.3 billion dollars [7]. As long as renewable energy remains politically attractive on both sides of the aisle, this government support is likely to continue for the next decade.

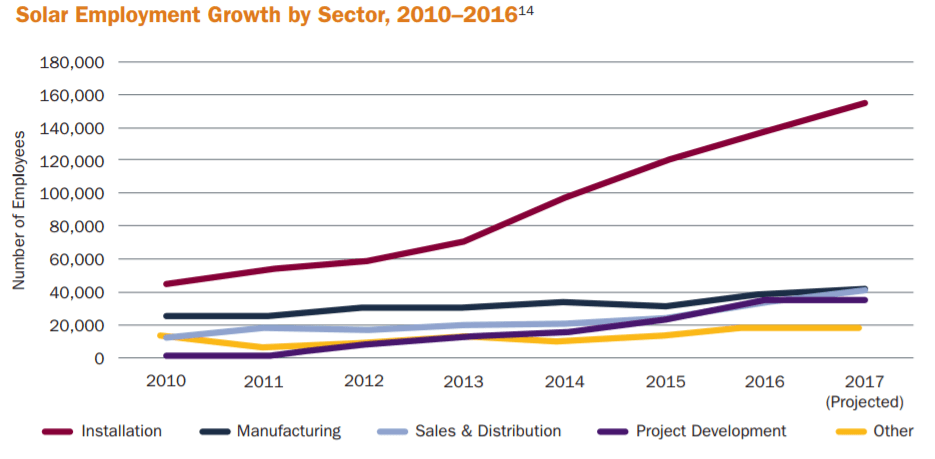

To make the most beneficial decision for all stakeholders, the federal government must consider all steps in the supply chain. First, while a tariff on solar panel imports would likely benefit domestic manufacturers, the vast majority of domestic employment and employment growth in the solar industry comes from installation services, not manufacturing [8].

The 150,000 people employed in installation are largely opposed to restrictions on cheap imports from abroad, as these cheap solar panels keep costs low and drive exponential adoption of the technology [9]. Furthermore, the solar supply chain is much more than just cell manufacturing. While Asian PV producers are world-leaders in low-cost PV manufacturing, a significant amount of the equipment used to manufacture the cells is purchased from the US [10], suggesting that the industry is not nearly as nationally siloed as it might appear. The US government should resist imposing a tariff and instead focus on supporting the higher-tech parts of the manufacturing supply chain that are successful domestically.

Second, the US government should strive to maintain solar tax credits and direct governmental support. The staggering growth of the US solar industry has been greatly helped by federal assistance. A few hundred thousand jobs are supported by these programs and have effectively primed the pump so that the solar industry is increasingly commercially viable on its own. To support local innovation, this strong local demand must be sustained.

Several uncertainties remain, however. Can large-scale US solar manufacturers ever compete against low-cost Asian competitors? How long should federal subsidies be maintained before the industry is deemed ready to stand on its own? And how can the federal government leverage the American edge in Photovoltaic R&D to produce manufacturing success as well?

(Word count: 751)

[1] Joe Ryan and Jennifer Dlouhy, “This Case Could Upend America’s $29 Billion Solar Industry,” Bloomberg Businessweek, June 15, 2017, [https://www.bloomberg.com/news/articles/2017-06-15/this-case-could-upend-america-s-29-billion-solar-industry], accessed November 2017.

[2] Solar Energy Industries Association, “Solar Industry Data,” https://www.seia.org/solar-industry-data, accessed November 2017.

[3] Allan Marks, “Dark Skies For American Solar Power? ITC Recommends Tariffs In Suniva Trade Case,” Forbes, November 7, 2017, [https://www.forbes.com/sites/energysource/2017/11/07/dark-skies-for-american-solar-power-itc-recommends-china-tariffs-in-suniva-trade-case/#4b9a27783b6a], accessed November 2017.

[4] Anindya Upadhyay, “India Initiates Dumping Probe Into Chinese Solar Imports,” Bloomberg, July 24, 2017, [https://www.bloomberg.com/news/articles/2017-07-24/india-initiates-dumping-probe-into-chinese-solar-imports], accessed November 2017.

[5] Ana Swanson, “To Protect U.S. Solar Manufacturing, Trade Body Recommends Limits on Imports,” New York Times, October 31, 2017, [https://www.nytimes.com/2017/10/31/business/solar-industry-import-tariffs.html], accessed November 2017.

[6] Stephen Lacey, “Repealing the Investment Tax Credit Could Cut the US Solar Market in Half,” Greentech Media, November 15 2017, [https://www.greentechmedia.com/articles/read/repealing-the-investment-tax-credit-could-cut-americas-solar-market-in-half#gs.Bym3wRI] accessed November 2017.

[7] U.S. Energy Information Administration, “Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013,” https://www.eia.gov/analysis/requests/subsidy/, accessed November 2017.

[8] The Solar Foundation, “Solar Employment Growth by Sector, 2010-2016,” 2016 National Solar Jobs Census (February 2017), https://www.thesolarfoundation.org/national/#wow-modal-id-1, accessed November 2017.

[9] Will Stone, “In Solar Trade Dispute, Will Proposed Tariffs Cost Industry Jobs?,” NPR, August 22, 2017, [https://www.npr.org/2017/08/22/544544791/in-solar-trade-dispute-will-proposed-tariffs-cost-industry-jobs], accessed November 2017.

[10] John Deutch and Edward Steinfeld, “A Duel in the Sun: The Solar Photovoltaics Technology Conflict between China and the United States,” MIT Future of Solar Energy Study Working Paper, 2013, https://energy.mit.edu/wp-content/uploads/2013/05/MITEI-WP-2013-01.pdf, accessed November 2017.

I really enjoyed your thoughts in this!

I find it difficult to imagine a world where US-based manufacturers are able to compete directly with the low-cost manufacturing operations in Asia. In the absence of government subsidies and protective measures, the China and Taiwan based manufacturers who control 80% of global solar cell production will always have an economies of scale advantage that is coupled with lower labor costs.

However, the cost of shipping these panels to the US needs to be factored in. With the increase in shipping volumes, logistics service companies are investing in bigger capacity shipping vessels. For example, CMA CGM recently placed an order for 9 ships with ~22,000 TEU capacity (the biggest vessel ordered to date) to be ready by end of 2019. If shipping capacity increases in line with or faster than demand, this should create some stability in transportation costs.

Perhaps the best way is for the US to allow the more competitive Asia-based manufacturers in. This will support the installation of solar panels that increases adoption of clean energy as well as employment for those involved with the sales, installation and maintenance process.

I also thought this was a great article. Luke Anusha, I agree it is hard to see US companies competing with low-cost Asian producers of low cost, standardised, high-volume equipment (although if PV unit costs fall far enough, then presumably transportation costs will come to represent a larger relative cost per unit, and so source of competitiveness for domestic manufacturers).

In the meantime, perhaps US companies could look to develop or acquire their own manufacturing capability in Asia to increase their competitiveness? Either way though, I agree with the suggestion in your essay that it makes sense to double down on the sources of US comparative advantage, e.g. R&D, in order to position for success in the long run.

More fundamentally though, there seems to be a trade-off between protecting US domestic producers (e.g. through tariffs) and minimising the cost of renewable energy for businesses and households overall – exposing a key tension at the heart of efforts to roll back globalisation.

Kyle – thanks so much for sharing this interesting piece! I really enjoyed reading your thoughts and learning more about the potential trade wars coming in the solar manufacturing industry. I appreciated the way you succinctly presented the context of the industry and of course your title.

I appreciate also your assessment of restrictions on imports from abroad, and the implications this would have on the market at large.

I would have loved to hear a bit about why exactly Taiwan and China are able to so decisively out-produce the U.S. on solar cells. I’d imagine it has a great deal to do with labor costs and availability of raw materials, but this would have helped me to better assess the options for U.S. policymakers, and to be able to answer the questions of whether US solar manufacturers can ever compete against low-cost Asian competitors.

Ultimately though you are right, solar energy could be the cornerstone of the 21st century economy, and it appears we are only in “Episode 1” of the Solar Wars, with much more of the story to be played out. I look forward to staying tuned!

The question for me is not whether the US solar industry can compete with low-cost Asian producers, the question is whether the US solar industry can compete with artificially subsidized low-cost Asian producers. And to that question, my answer is “Who cares?” If the Chinese government is willing to subsidize silicon wafer manufacturing, then by all means we should be willing to pay cheaper prices for the solar panels they’re subsidizing. We get cheaper (home-grown) energy, more installation jobs due to falling prices for panels, and this all will require less of a government subsidy for the energy price to be competitive with dirty fossil fuels. I’ll happily trade a few manufacturing jobs that will be automated in the next 10 years anyway, but an entire industry of installers and solar service providers. Now, the risk is whether China plans on driving all foreign silicon competitors out of business and then raising prices, but so long as the US maintains leadership in ancillary products (e.g., inverters) then this risk is overblown.

Your article does a great job laying out the key issues the government faces around regulating a nascent industry: that of stimulating demand for a good that many see as having positive externalities vs. protecting US manufacturing interests. Whatever the government does, it should take a holistic approach to regulation – it does not make sense to both offer tax subsidies driving demand for the PVs, only to offset those subsidies with tariffs which would increase the cost again.

My gut reaction is that the government should not do anything to lessen demand for solar technology at this stage in its growth by applying tariffs, especially when it still struggles to compete with other forms of energy from a pure cost perspective. However, the fact that other countries such as Turkey, India, and the EU have had the same issues competing with subsidies in China lends credence to Suniva’s argument. As a way to kill two birds with one stone, could the government shift its tax breaks over to subsidies to the US manufacturers that would then allow them to compete on an even footing with China, without affecting demand in the US?

In a world where US solar manufacturers are largely automated, and Chinese labor becomes expensive, similar to Fuyao Glass [1], I could see it being cheaper to produce solar panels in the United States eventually. One must also consider while federal energy subsidies for solar might end, trade barriers might be erected to make it easier for US companies to compete with Chinese competitors. The current presidential administration views trade practices with China as a key issue to be resolved and wants to end what it sees as unfavorable practices [2].

In my opinion, federal energy subsidies should likely be stopped soon to allow market forces to bring the cost down soon, rather than allowing American manufacturers to compete artificially, akin to using training wheels.

In terms of putting R&D to action, the federal government can instead incentive and create loans for companies that deploy R&D in the field at scale at a certain quality level (either through manufacturing at volume or deploying at volume) – thus allowing photovoltaic technology to exit the lab quicker and be deployed at scale faster.

References:

[1] Shih, Willy. “Fuyao Glass: Americas Sourcing Decision.” Harvard Business School Case 618-007, August 2017. (Revised November 2017.)

[2] Lynch, D. (2017). Trump fires opening shot in China trade battle. [online] Washington Post. Available at: https://www.washingtonpost.com/business/economy/trump-fires-opening-shot-in-china-trade-battle/2017/11/28/fcbad7fc-d474-11e7-b62d-d9345ced896d_story.html?utm_term=.83cbb97c31fb [Accessed 1 Dec. 2017].