“Smart Home, Intelligent Factories” – Haier’s Journey of Building Interconnected Factories

As China’s home appliance market comes to maturation, Chinese home appliance manufactures are now forced to confront the problems that they got away with during times of easy growth. Can they reinvent themselves in Industry 4.0? Or are investments into digitalization what’s necessary to keep their heads above the water?

After a decade of double digit growth fueled by rising disposable income, China’s home appliance market slowed in recent years as ownership level reaches maturation. Home appliance giants like Haier find it increasingly important to sustain market share through product innovation, and to drive profit through improving supply chain efficiency.

In addition, Haier largely relies on an archaic distribution system that consists of multiple tiers of distributors which are often slow-moving state-owned companies. Visibility through the supply chain is low. As growth slows, price wars inevitably start to happen at the retail level, as distributors continue to estimate demand based on historical data and rule of thumb and subsequently have to slash prices to clear inventory.

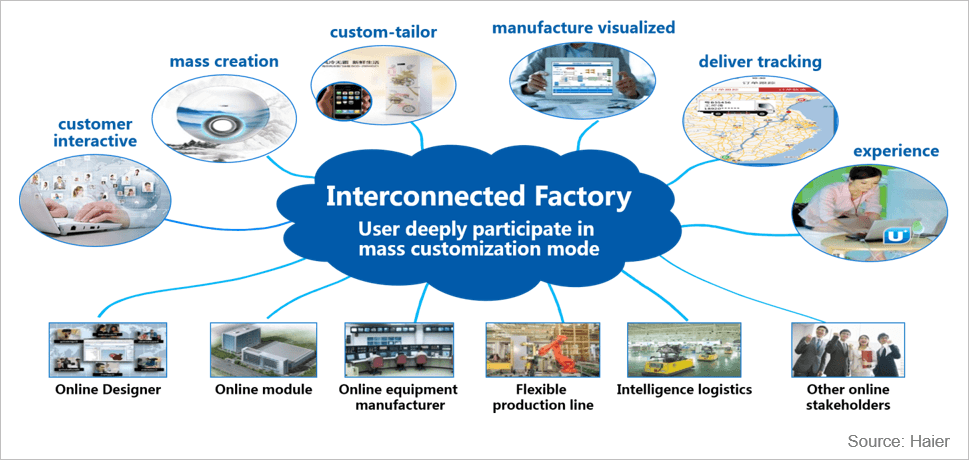

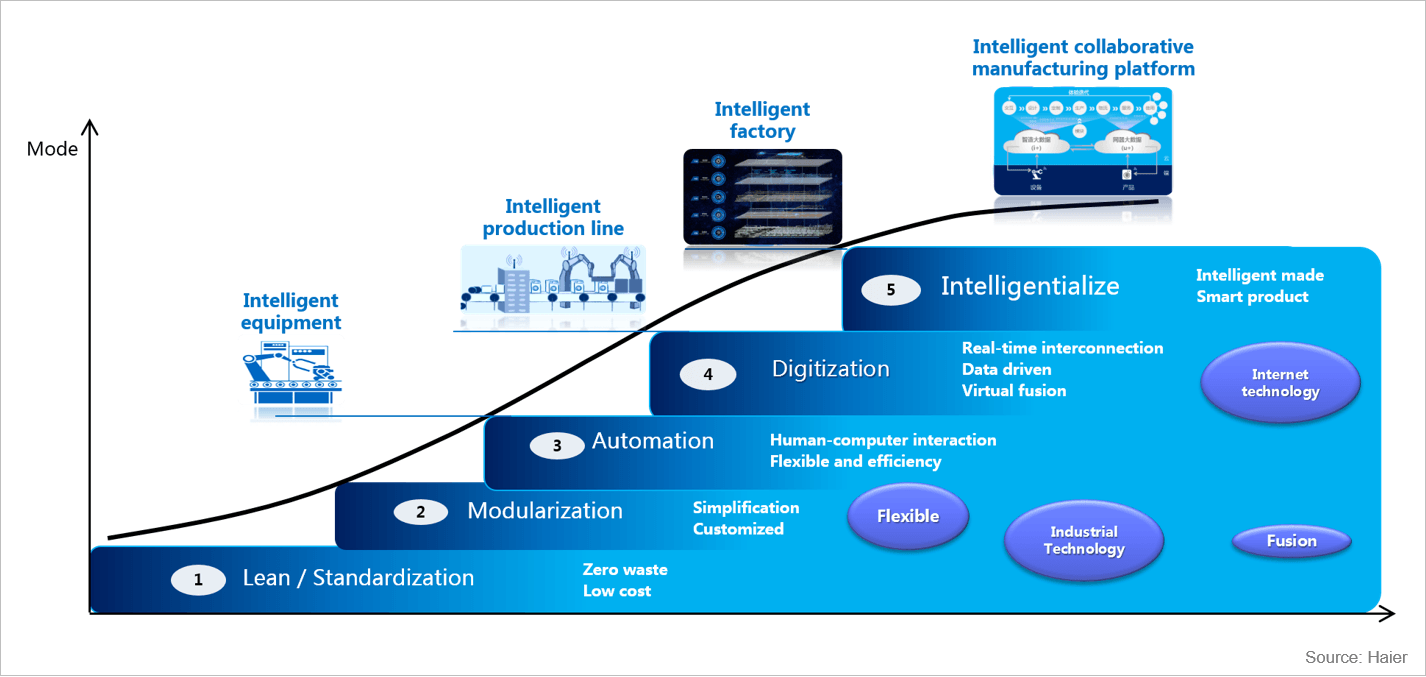

To respond to those challenges, Haier started exploring ways to reinvent itself through building “interconnected factories”. The goal is to digitally connect customers, distributors, factories, products, supply chain, R&D and marketing functions[1]. Since 2012, all of Haier’s new factories are automated and digitally enabled[2]. The company aims to have 10 interconnected factories by the end of 2017[3].

From mass production to mass individualization. To connect with the consumer and enable the transition to mass individualization, Haier built its own eCommerce channel where customers are now able to customize the color, size, and features of their appliance. Orders are directly sent to the factory with modularized production. Haier subsequently uses demand data generated from users to inform their product design.

More transparent supply chain. Demand data is selectively shared across design partners, suppliers, e-Commerce/logistics partners, which resulted in 67% reduction in order fulfillment cycle time[4].

Device-driven feedback: Haier’s products are end-point connected with the platform through wi-fi. After delivery, data on how users engage with the product get sent back to the Haier. Users can also remotely control appliances on mobile phones, or use applications (e.g. recipe sharing) through the touch screens on the appliances.

The effort produced impressive results. In 2016, 1.09mm units produced from interconnected factories. However, compared to the total volume of 65mm units sold[5], Haier still has a long way to go.

The bigger challenge going forward is how to implement interconnected factories on a larger scale. To achieve that, Haier needs the participation of the entire ecosystem of app developers, internet service providers, suppliers and logistics partners. Longer-term, Haier envisions seamless linkage across all ecosystem participants and that all its products being customized[6].

Does Haier have the level of influence it needs to push forward the standardization of interfaces through the ecosystem? Majority of Haier’s sales are still generated through offline and online retail partners. How should Haier manage those relationships when more and more customers directly order from the factory, bypassing the channel partners? More importantly, as a state-owned company with 78,000 employees, majority of whom are Haier lifers, how does Haier realign the workforce to shift from a product-first to a customer-first mentality?

I will attempt to address one of them and leave the rest as food for thought. To address the standardization problem, I would suggest Haier to collaborate with competitors to move towards a unified standard. As a state-owned company with rich resources that many private sector competitors do not have, Haier is uniquely positioned to leverage on its influence on the government to implement incentives that benefit the entire industry.

In addition, data collected from wi-fi connected appliances would be very valuable to other ecosystem participants. For example, the data on usage frequency and mode of washing machine could allow eCommerce channel partners such as Alibaba to anticipate demand for laundry detergent and push the type of detergent relevant to the consumer’s specific need, hence helping Alibaba generate additional sales outside of home appliance. Given Alibaba’s central position in the ecosystem, it then would have stronger incentive to influence the rest of the ecosystem (competitors, developer community, logistics partners) to innovate around one unified standard.

(701 words)

[1] Gartner, High-Tech Manufacturing Supply Chainovators 2017: Demand-Driven Digitalization

[2] China Economic Net, Haier forays into Internet factory

[3] China Daily, Haier Focuses on Interconnected Factories

[4] Gartner, High-Tech Manufacturing Supply Chainovators 2017: Demand-Driven Digitalization

[5] Haier annual report, 2016

[6] Gartner, High-Tech Manufacturing Supply Chainovators 2017: Demand-Driven Digitalization

I’d be interested to learn more about how far along Chinese manufacturers are in implementing smart manufacturing technology- on the consumer side, I also wonder about the relative maturity of the IoT market compared to the West. My sense is that Haier is ahead of its domestic competitors in this respect, but behind some of the higher-end appliance manufacturers in the West.

In terms of the US import market for appliances, this move is a “keep your head above water” play- appliance manufacturers are doing everything they can to automate manufacturing to reduce the high labor content of production processes- as labor costs increase in China, Haier would find itself in an uncompetitive position. Moreover, the emerging likelihood of increased tariffs on imported Chinese goods would further increase the cost base. In the Chinese domestic market, however, there should be increasing opportunity to sell to the emerging middle class, as people move from first-time homeownership to being higher end consumers that see the value proposition of a connected home.

It’s very interesting to see how SOEs in China – typically the least innovative companies – are responding to the changes in the market by leveraging digitalization. I definitely agree with you that the close association with the government and regulatory bodies can give them great advantages in gaining favorable policies.

However, I think that other two groups of stakeholders are equally important in pushing Haier’s strategy further – the distributors and the consumers. Firstly, the distributors – especially the offline distributors – do not seem to have much incentive in collaborating and helping Haier in pursuing the SCM changes. Moreover, these distributors may lack the capability to promote such changes. Therefore, Haier, with no direct link to the consumers, may have an even bigger challenge pushing its changes to consumers.

Therefore, I am curious to see how Haier will bring their distributors and consumers on board with its new SCM strategy.

The analysis points to the benefits of digitization to all members of the supply chain via data capture and analysis. Two questions this raises are: (1) to what extent can Haier control the information systems through which data is transferred, and (2) what are Haier’s rights and responsibilities when it comes to customer usage data.

One of the main challenges to the realization of the Industrial Internet of Things is the lack of industry standard when it comes to information systems. In order to leverage data up and down the supply chain, each player’s information system must be able to communicate. Should Haier develop and implement its own proprietary information system? Or should it leverage a third party’s platform (i.e. General Electric’s Predix platform)? Then, once Haier captures manufacturing data from the supply chain as well as usage data from the customer, is it in Haier’s best interest to share the data with other members of the supply chain in pursuit of operational efficiency? Given the data has value, would Haier benefit from trying to monetize the value of the data? What is the risk of competitors gaining access to the data from mutual suppliers/distributors?

It is particularly interesting to think through these questions in the context of a state-owned enterprise. Haier is arguably better positioned to affect regulatory policy within China than any of its international competitors.