Skyworks Solutions: The Technology in Everyone’s IPhone That Will Change the Future

The entire world as we know it is about to change…

Imagine a world in which when the light bulbs, printer ink, or water filter are depleted, your home or office is wired intelligently to automatically order replacements from Amazon. That’s what Skyworks Solutions (SKWS) is doing via smarter technology in the Internet of Things “IoT”. The company does it all…they make semiconductors that connect your phone to everything: the internet, cell towers, Wi-Fi, and Bluetooth. In fact, they are one of the main semiconductor suppliers for the radio frequency chips for both Apple and Samsung, allowing people to place calls, connect to other devices, check email, and surf the web. This alone has made the company a technology giant, but the company also has a growing separate division. This division supplies the automotive industry, wearable technology companies, industrial companies, medical companies, and the military with technology to connect these devices to the IoT. The IoT is a massive opportunity, as industry experts predict the number of connected devices across the world will go from 25 billion currently to 70 billion in 2020.[i] Because of this, Skyworks will be one of the most interesting companies of the next decade, as they leverage their business model and operating model to capitalize on the revolution occurring in the Internet of Things.

Currently, Skyworks is divided into two main segments, semiconductors for mobile phones/tablets and other radio frequency circuits for various applications in the IoT. They are highly leveraged toward mobile phones and tablets, as their integrated mobile systems business makes up 52% of company revenues. Within this segment, the company is dangerously leveraged toward Apple, as they disclosed that “one customer” makes up more than 10% of company revenue. Wall Street analysts, such as Oppenheimer’s Richard Schafer, think this number could be as high as 35-40%[iii], which explains why the company has taken a hit in revenues and earnings when Apple struggles. However, the company is now starting to focus on diversifying its operating model by focusing more on the IoT, and is ramping up its production of technology in connected smart home systems.

This has negatively affected the business in the past when Apple faces cyclical downturns in iPhone and IPad sales. Therefore, Skyworks must make the supply of semiconductors to original equipment manufacturers in 3rd world countries a core business segment, such as the Chinese and South American phone manufactures for the middle and lower end markets. These phone manufactures in the emerging markets (such as Huawei in China for example) are seeing massive growth in sales[v], and should be a much bigger percent of revenues. This action will diversify the business model and make the Skyworks supply chain more robust.

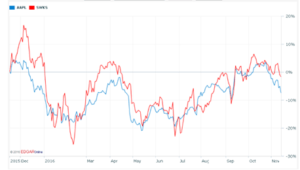

My first recommendation is to diversify the business model away from mobile. The company’s business model is to dependent on wireless sales from Apple, so much so that the company has a very close beta with their main customer (see below one year chart).

Many technology companies are at the forefront of acquiring patents in their respective fields to keep a choke hold on their competition, so that competitors cannot infringe on their technology. Skyworks currently has developed a small patent portfolio internally that allows them to innovate, but they could be doing so much more. Currently, industrial and technology patents tend to sell in the auction market for $300,000 for a well-served patent. Savvy technology companies and investors are using their resources to bundle these patents into well-connected portfolios, thereby raising the value of individual patents as companies have to pay to play in their competitors’ field. Skyworks currently has $1.6 billion on their balance sheet[vi], and could use a small portion of this to acquire a targeted patent portfolio from one of the private equity companies invested in the space. This would allow them to secure their position as the leader in the IoT, fend off competition, and invest in their business model for the future. When bundled together in a package of patents in a dynamic investment space, these patent portfolios can carry extremely large value, and Skyworks is well positioned as the industry expert to acquire a portfolio that would make their competition quiver.

Word Count: 779

References:

[i] Payne, Charles. “Skyworks Solutions Inc. : Investing in the New World.” January 21, 2016. Accessed November 15, 2016. http://investorplace.com/2016/01/skyworks-solutions-inc-investing-in-the-new-world-swks/#.WCtWD_krJPY.

[ii] Skyworks, (2016), Get Filings [ONLINE]. Available at: http://www.getfilings.com/sec-filings/091130/SKYWORKS-SOLUTIONS-INC_10-K/a54461a5446101.gif [Accessed 16 November 2016].

[iii] Sun, Leo. “Time to Get Greedy with Skyworks Solutions Inc Stock?” August 16, 2016. Accessed November 15, 2016. http://www.fool.com/investing/2016/08/16/time-to-get-greedy-with-skyworks-solutions-inc-sto.aspx.

[iv] “Stock Comparison: Compare Skyworks Solutions, Inc. (SWKS) to Other Stocks.” November 15, 2016. Accessed November 15, 2016. http://www.nasdaq.com/symbol/swks/stock-comparison.

[v] Steven Smigie, “Skyworks Solutions,” Raymond James & Associates. accessed from Capital IQ, Inc., a division of Standard & Poor’s. March 8, 2016. accessed November 16, 2016.

[vi] Steven Smigie, “Skyworks Solutions,” Raymond James & Associates. accessed from Capital IQ, Inc., a division of Standard & Poor’s. March 8, 2016. accessed November 16, 2016.

Title photo reference: Bidness, (2016), Skyworks Solutions Inc. Outgrowing Reliance on Apple [ONLINE]. Available at: http://www.bidnessetc.com/58157-skyworks-solutions-inc-outgrowing-reliance-on-apple/ [Accessed 16 November 2016].

Very interesting! I was surprised to see how far along the Internet of Things actually is, and how strongly Skyworks Solutions is positioned to take advantage of it. This company will definitely become a household name in the years to come. However, it seems odd that a semi conductor manufacturer would have the capabilities required to become the leader in the IoT market. Even though they have experience in technology and also have an existing relationship with powerful companies, it seems they might be getting into something out of their reach. I know it is supposed to be a diversification strategy, but there must still be some kind of synergy between the efforts for it to be a positive for the company. Is semiconductor manufacturing the right place to start? Hopefully it is.

Great post. The internet of things will undoubtedly continue to revolutionize the way we interact with technology and with each other. I’m curious as a semi-conductor company how secure Skyworks Solutions is in holding their marketshare. Semi-conductors seem like a commodity product and thus open to any competitor that can produce them for cheaper. Given this I definitely agree with your plan to diversify and to innovate in capitalizing on their knowledge of the internet of things. It will be exciting to see what kind of products Skyworks Solutions comes up with in the coming years.

Thanks for sharing this interesting post, Brad. I found it particularly interesting to learn how leveraged the company is to Apple. While Skyworks doesn’t directly sell its products to Apple, it sells them to Foxconn, which is a major supplier of Apple. In fiscal years 2015 the total percentage of revenue derived from Foxconn was 44%. [1]

I appreciate how you support many of your claims with well-researched numbers, and how you visually show the strong correlation with the AAPL stock price. I also fully agree with your recommendation that SKWS should focus more on Chinese phone manufacturers, and diversify the business model away from mobile.

While Skyworks seems to be one of the first adopters to the IOT, they still only provide part of the value chain, i.e. the semiconductors [2]. The IOT obviously represents an enormous opportunity to sell more chips, but I wonder how easily these chips become commoditized, and what you view as Skyworks’ competitive advantage to other semiconductor companies?

[1] Seeking Alpha. 2016. Skyworks Solutions Steering Away From Reliance On Apple – Skyworks Solutions, Inc. (NASDAQ:SWKS) | Seeking Alpha. [ONLINE] Available at: http://seekingalpha.com/article/4024708-skyworks-solutions-steering-away-reliance-apple. [Accessed 20 November 2016].

[2] Wikipedia. 2016. Skyworks Solutions – Wikipedia. [ONLINE] Available at: https://en.wikipedia.org/wiki/Skyworks_Solutions. [Accessed 20 November 2016].

Very interesting post, Brad. Thank you for sharing. There are thousands of IoT companies racing to take a piece of the pie. There will undoubtedly be a shake up in the industry as technologies advance and revenue models are solidified. This will likely create a massive opportunity for scaled players such as Skyworks that can consolidate the industry and capitalize on the massive data opportunity.

Super interesting! On a side note, I have to think that the name “Skyworks” has to somehow be connected to the “Skynet” of the Terminator franchise, given the products they’re peddling…

I like your recommendations for both diversifying and working to increase market share. Relationships with what companies do you think would best help Skyworks to get fully diversified?

As long as it stays on the front end of innovation, it seems that Skyworks could truly have a piece in just about every item in one’s home in 10-20 years. The sky’s the limit, provided they play their cards right.

Awesome post! Great way to learn about IoT and how it implies the relationship between machines and sensors (as opposed to the largely held view of the relationship between machines and machines). It will be interesting to see how Skyworks will leverage the data they collect through their sensors in order to make future recommendations for users. I was surprised at how pervasive the spread of IoT is: as we have smart cars we can have smart bridges that could collect the data such as impact of freezing temperatures on the state of building materials-avoiding major fissures). [1] It will be truly interesting to see the way this company will evolve!

WIRED. 2016. The Internet of Things Is Far Bigger Than Anyone Realizes | WIRED. [ONLINE] Available at: https://www.wired.com/insights/2014/11/the-internet-of-things-bigger/. [Accessed 21 November 2016].

Interesting post, Brad. However, like Clemens touched on, I’m a bit more skeptical on the competitive advantage that Skyworks can hold through the transition away from mobile into a more IoT centric marketplace.

While semiconductors are a critical piece of almost all integrated circuits (which there will be undoubtedly a larger demand for with the rise of the IoT revolution), how can Skyworks hold on to the competitive advantage that they hold? What will prevent commoditization of their products? I agree that diversification away from mobile is inevitable, but I think they need to do more than that. Building product-level competitive advantage into their semiconductors will be critical as demand skyrockets and competition rises in the space. Maybe they can look into vertical integration downstream into additional hardware plays? Something similar to what Raspberry Pi has done with their cheap, fully built micro computer might be able to compete very well in the IoT space. [1] Also, it seems that your thoughts on buying and packaging patents may have some merit, but I’m concerned with the regulatory risk here. Current patent regulation in the technology space is already under heavy fire, and with the new administration, who knows what could happen to the current regulatory framework.

[1] Raspberry Pi. 2016. Help Videos – Raspberry Pi. [ONLINE] Available at: https://www.raspberrypi.org/help/videos/. [Accessed 21 November 2016].

Very interesting article Brad. When we think about IoT we often think about the software associate with it, and how tech giants such as Apple, Google, and Amazon are embedding AI platforms in their technology to function with internet enabled technology. They seem to be focused on having the best AI interface while sometimes ignoring the additional competitive advantage can actually come from the hardware employed. Skyworks could benefit from either keeping their technology vendor neutral and expanding their reach as you suggest, or also by partnering with the tech giants to develop technology that works with the Apple platform (or only Samsung, Amazon, or Google etc.). That way, as the IoT, Skyworks can help these companies protect their monopolies by selling the company specific hardware to third-party IoT manufacturers.

Thank you for sharing an interesting topic and company. I wonder what you think of their future over 10 years, given that electronic component makers have very uncertain futures. A few companies that came to mind are AMD/ATi, Motorola Semiconductor/Freescale, Broadcom, Qualcomm, Intel. They all experience significant roadblock as completion in the area is quite high. For IoTs, I believe there will also be many strong competitors for Skyworks. What’s your thoughts on the volatile nature of the industry?

Super interesting post and topic Brad! I am very interested in the LoT and would like to learn more about it. It would have been great if you included a little bit more of Skyworks´ strategy in this line of business. What I loved about your post was how you backed everything with numbers and evidence, while at the same time providing your own financial analysis. I mean, you even made your own graph comparing Apple´s performance to Skyworks! Its impressive how much this company is dependent on Apple. I think the company should focus more on its LoT line of business going forward in order to diversify its revenues as today it only provides one part of the LoT supply chain and does not have a competitive advantage that it can leverage to gain market share.