Remember Ask Jeeves? Presenting Operator: the future’s online personal concierge service.

Connect with experts to buy and discover things you’ll love!

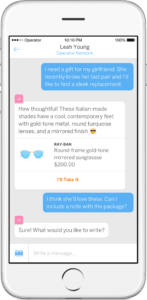

Operator, created by Uber Co-Founder Garrett Camp, is a new platform that connects customers with experts to provide a new and personal way to shop. This “request network”[i] allows customers to text message with experts to receive recommendations, browse hand-curated collections, or simply execute requests like buying a new coffee table.

Similar to Uber, this platform is asset light and uses digital technology to match shoppers with tastemakers. The app provides a secure and seamless mobile shopping experience and purchases can be tracked through delivery. Returns are simple and a price match guarantee ensures the lowest price is received[ii].

Operator’s use of mobile messaging (the dominate way people now communicate) reflects a shift in the e-commerce space. “People are busy, on the go, and don’t feel like researching purchase options or typing in payment info on their phones. They just want what they want.”[iii]

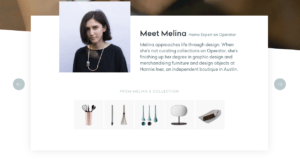

In addition, this platform provides a launching pad for stylists to start their own business and access an expanded virtual customer base. Experts can “plug in” whenever they want to work, have access to a creative community of tastemakers, and are paid when their recommendations are purchased. Currently, expertise is categorized into six categories including fashion, electronics, home goods & décor, beauty, sport & fitness, and gifting.

Operator dials China

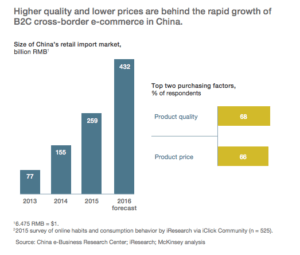

After launching in 2015 and struggling for viral success, Operator’s latest Series B funding round of $15M is pivoting to focus on the Chinese emerging middle class. Chinese consumers shop online for authentic imported products through cross-border e-commerce sites which “amounted to an estimated 259 billion renminbi ($40 billion) in 2015, more than 6 percent of China’s total consumer e-commerce and it’s growing at upward of 50 percent annually”[iv].

Operator will target consumers who want authentic American products but may have trouble reading English reviews. “With Operator, Chinese citizens will be able to text chat with a human shopping expert from the US with Chinese language skills. They can show the customer products that fit the price, quality, and style they’re looking for, even if the buyer is unfamiliar with US brands.”[v]

Cross Border E-Commerce: Windfall or Woes?

People love personalized services, especially when they are easy to use and free. However, pivoting to China is a high risk move for Operator. Regulations for cross border e-commerce were recently tightened by the Chinese central government which reduced the tax free benefit down 70% from the original incentive used to encourage growth[vi]. In addition, Chinese customs were directed by Beijing to increase inspections to reduce illegal goods.

These changes could significantly increase the costs of products imported to China and make them less attractive to consumers. In addition, Operator is looking to compete in the on-demand economy but logistics of shipping products to China, even using air will require multiple days, not hours – the current standard Chinese consumers expect.

This leads one to ask: has Operator truly established a viable business model? Will they be able to create a network effect with a shift in geography or are they just not adding enough value to clients? Focusing on Chinese consumers could be seen as forward thinking given projected demand. It conversely could be a “Hail Mary” play that puts too much stress on their operating model resulting in failure to deliver on their customer promise

Curated Experiences for Millennials

While the jury is out on geography, Operator should revise its categories of expertise and extend its model to focus on experiences. Apparel and beauty are littered with subscription box of the month models that promise personalized style and deliver varying degrees of execution. However, gifting as a category offers Operator an opportunity to differentiate and appeal to millennials in order to reach scale.

Gifting provides an opportunity to extend beyond products and provide services and curated experiences that millennials value. “A study by Harris Group found that 72 percent of millennials prefer to spend more money on experiences than on material things.”[vii] Startups likes Bluedoor are providing corporates with a range of experiences to reward high performers and are indicative of this growing trend. By tapping into millennial fear of missing out (FOMO) which “nearly 7 in 10 (69%) millennials experience”[viii]. Operator can provide a differentiated and attractive value proposition worthy of viral social media fame.

http://video.cnbc.com/gallery/?video=3000515700

(732 words)

[i] techcrunch/Josh Constine. 2015. First Look At Uber’s Co-Founder’s Shopping Concierge “Operator”. [ONLINE] Available at: https://techcrunch.com/2G015/04/22/the-request-network/. [Accessed 17 November 2016].

[ii] Operator/Operator Team. 2016. A new & personal way to shop. [ONLINE] Available at: https://www.operator.com/. [Accessed 17 November 2016].

[iii] VentureBeat/Michael Quoc. 2016. The state of bots: 11 examples of conversational commerce in 2016. [ONLINE] Available at: http://venturebeat.com/2016/06/16/the-state-of-bots-11-examples-of-conversational-commerce-in-2016/. [Accessed 17 November 2016].

[iv] Xia, C, 2016. Cross Border E-Commerce is Luring Chinese Shoppers . McKinsey Quarterly, [Online]. China Pulse, 1-2. Available at: http://www.mckinsey.com/industries/high-tech/our-insights/crossborder-ecommerce-is-luring-chinese-shoppers [Accessed 17 November 2016].

[v] techcrunch/Josh Constine. 2016. Operator harnesses chatbots, humans, and $15M to sell US goods to China. [ONLINE] Available at: https://techcrunch.com/2016/09/22/operator-dials-china/. [Accessed 17 November 2016].

[vi] SCMP.com/Celine Ge. 2016. China’s cross-border e-commerce trade facing uncertainties amid government regulation. [ONLINE] Available at: http://www.scmp.com/business/companies/article/2017646/chinas-cross-border-e-commerce-trade-facing-uncertainties-amid. [Accessed 17 November 2016].

[vii] CNBC.com/Uptin Saiidi. 2016. Millennials are prioritizing ‘experiences’ over stuff. [ONLINE] Available at: http://www.cnbc.com/2016/05/05/millennials-are-prioritizing-experiences-over-stuff.html. [Accessed 17 November 2016].

[viii] CNBC.com/Uptin Saiidi. 2016. Millennials are prioritizing ‘experiences’ over stuff. [ONLINE] Available at: http://www.cnbc.com/2016/05/05/millennials-are-prioritizing-experiences-over-stuff.html. [Accessed 17 November 2016].

Great post! It’s interesting to see how Operator connects potential customers with products via personalized recommendations. It makes sense that Operator is targeting customers outside the U.S., as many retailers in the U.S. have store personnel that can assist customers with purchases or online-chat features on their websites (thereby eliminating the need to use Operator.) Store associates in the U.S. provide recommendations and exceptional service after being incentivized with the additional salary they can make on commissions.

While risky, I think that China is a strategic focus for Operator, given that the purchasing power of the middle class is growing, and that customers in the country are seeking American brands and products (as evidenced by the growing popularity of Alibaba’s Tmall). Additionally, the use of the mobile platform is very strategic, as this is how most Chinese consumers are making purchases. In my opinion, the ability to help overcome the language barrier is Operator’s greatest advantage, and the company should look to this as their point of differentiation. While you mentioned that taxes and the logistics of shipping might present problems for Operator in China, I think the potential benefits of focusing on this market would outweigh the potential risks.

From reading your article, I would love to try Operator! At risk of sounding like the ‘typical’ millennial, I really would like to try their ‘gifting’ feature.

While I agree with Erica’s points above about the benefits of focusing on the Chinese market, I also do see a lot of risk in this decision specifically in the face of an increasingly globalised world. It seems that the major value proposition of the service is giving the Chinese market more knowledgeable access to US products; my worry is that these barriers to purchase will lower with time, so Operator needs to think carefully about its value add to customers to continue to purchase using their platform when these barriers are eroded. For example, you specifically mention that Chinese online shoppers can’t read English reviews – but as English literacy/online translation services (e.g., Google translate) improve, this barrier will be insignificant. Another challenge they would face is US brands entering the Chinese market, which would remove the requirement of customers to purchase these online from the US via Operator. In the face of these challenges posed by globalisation Operator should consider how to make their customer base more ‘sticky’ to their services.

Operator really sounds awesome and has tapped into 2 trends that we see in the startup world: personalization and communication via text messaging.

This service seems like, if it focuses on the US, it competes with Amazon for non-basic items. I’ve noticed lately that when I’ve shopped on Amazon, they are trying to push me to a curated page where they pull together recommendations for well-designed items, instead of your everyday purchases that most people make on Amazon. What they’re lacking and what Operator seems to have achieved is the credibility (from a design perspective)n to make recommendations and an easy to shop interface. With the text messaging feature, Operator has really tapped into a trend that will make on-the-go shopping even easier (especially during the holiday season).

I like the idea to focus on experiences. Given the less tangible nature of an experience (vs. a consumer good), the potential value to be delivered to a customer trying to make a purchasing decision is even larger. Operator could provide that value and potentially create a viable business model in doing so.

One issue that will be persistent for Operator is establishing trust. That is, does the consumer trust Operator to provide accurate, tasteful, and unbiased advice? The latter of these is something that I often struggle with in using a third party to recommend a good or service to me. For example, if I ask a tour guide to recommend a local restaurant, I assume that the recommendation will be colored by incentives between the tour guide and the restaurant. What Operator will need to do is convince a skeptical millennial generation that Operator is different than tour guides, and in fact is providing quality unbiased advice.

Operator sounds great! The ability to strengthen customer engagement of products can work to increase visibility/knowledge of new products and access to new products, as Chinese consumers will have the ability to connect with relevant operators in the U.S. to help make purchasing decisions.

My questions stems from inherit biases that may exist on the platform. How do you ensure that the operators of are knowledgeable of the product, as it seems as though many Asian operators will need to know a vast amount about several different products. What are the cost on training these U.S. Asian operators? I would love to better understand how the workforce model currently works in more detail.