PG&E: A Journey in Smart Grid Design

The Pacific Gas and Electric Company seeks a way to revise its century-old business and operating model to meet the demands of modern customers in a rapidly changing energy landscape.

Pacific Gas and Electric Company (PG&E): An investor-owned electric utility (IOU) based in San Francisco, PG&E provides and delivers natural gas & electric services to approximately 16 million people throughout a 70,000 square-mile service area in northern and central California.1

An Aging Industry  in Flux: For more than one hundred years, public utilities such as PG&E have fueled growth within the United States by providing reasonably priced, reliable, and ubiquitous power via the national electric grid.2 However, the underlying drivers that have enabled this consistent and affordable energy delivery are shifting. In the past, utilities were incentivized to invest heavily in generation and delivery infrastructure that improved power output because regulators increased rates in line with those capital expenditures.3&4 However, the stable demand growth that ensured affordable prices for customers and reasonable returns for utilities has started to decline as a result of increased efficiency, conservation efforts, and increased renewable generation. For PG&E, this change presents a significant challenge as management seeks to balance increasing environmental regulation with a need for reliable service on an aging transmission and distribution system.5

in Flux: For more than one hundred years, public utilities such as PG&E have fueled growth within the United States by providing reasonably priced, reliable, and ubiquitous power via the national electric grid.2 However, the underlying drivers that have enabled this consistent and affordable energy delivery are shifting. In the past, utilities were incentivized to invest heavily in generation and delivery infrastructure that improved power output because regulators increased rates in line with those capital expenditures.3&4 However, the stable demand growth that ensured affordable prices for customers and reasonable returns for utilities has started to decline as a result of increased efficiency, conservation efforts, and increased renewable generation. For PG&E, this change presents a significant challenge as management seeks to balance increasing environmental regulation with a need for reliable service on an aging transmission and distribution system.5

An Evolving Business Model: In a traditional IOU, the business model seeks to provide a return  on investment for its shareholders in the form of dividends or share price appreciation generated by selling power.6 However, PG&E now makes money through a process known as “decoupling” whereby profits are earned not by consumption, but by selling less electricity to consumers.7 In practice, this type of revenue generation creates mechanisms such as “peak pricing” through which PG&E increases the cost for residential, agricultural, industrial, and commercial ratepayers when demand is at its highest. Since utilities must continually run their “baseload” power plants (e.g., nuclear or coal) regardless of demand, “decoupling” encourages rate-payers to either conserve energy or create their own through distributed generation (e.g., rooftop solar).9&10 However, as distributed generation grows, PG&E must find a way to still capture value while also maintaining the aging grid and providing power during periods that exceed the capacity of renewable generation.

on investment for its shareholders in the form of dividends or share price appreciation generated by selling power.6 However, PG&E now makes money through a process known as “decoupling” whereby profits are earned not by consumption, but by selling less electricity to consumers.7 In practice, this type of revenue generation creates mechanisms such as “peak pricing” through which PG&E increases the cost for residential, agricultural, industrial, and commercial ratepayers when demand is at its highest. Since utilities must continually run their “baseload” power plants (e.g., nuclear or coal) regardless of demand, “decoupling” encourages rate-payers to either conserve energy or create their own through distributed generation (e.g., rooftop solar).9&10 However, as distributed generation grows, PG&E must find a way to still capture value while also maintaining the aging grid and providing power during periods that exceed the capacity of renewable generation.

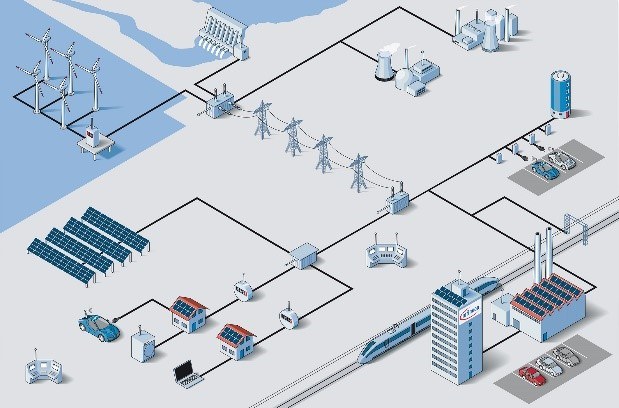

Internet of Thin gs and the Smart Grid: To keep up with an evolving regulatory landscape, PG&E recognizes that it must update its archaic business model and leverage technology to improve asset utilization and reduce cost.11&12 Chris Johns, the former President of PG&E, communicated a vision similar to the Internet of Things called the “Grid of Things” for which his company developed several initiatives focused on increasing interconnectedness among emerging energy technologies (e.g., electric vehicles, rooftop solar, smart appliances, and battery storage).13 PG&E also implemented one of the largest IPv6 networks on earth to great effect in improving energy management and control.14 Furthermore, it spearheaded initiatives to optimize grid performance and increase resiliency through investment in smart grid technology that helps the grid “self-heal” to minimize outages as well as in voltage control technology that manages two-way electricity flow within the grid.15 However, while there is clearly a shift in the operating model for PG&E, its business model is still struggling to adapt to evolving demands.

gs and the Smart Grid: To keep up with an evolving regulatory landscape, PG&E recognizes that it must update its archaic business model and leverage technology to improve asset utilization and reduce cost.11&12 Chris Johns, the former President of PG&E, communicated a vision similar to the Internet of Things called the “Grid of Things” for which his company developed several initiatives focused on increasing interconnectedness among emerging energy technologies (e.g., electric vehicles, rooftop solar, smart appliances, and battery storage).13 PG&E also implemented one of the largest IPv6 networks on earth to great effect in improving energy management and control.14 Furthermore, it spearheaded initiatives to optimize grid performance and increase resiliency through investment in smart grid technology that helps the grid “self-heal” to minimize outages as well as in voltage control technology that manages two-way electricity flow within the grid.15 However, while there is clearly a shift in the operating model for PG&E, its business model is still struggling to adapt to evolving demands.

Recently, the California Public Utilities Commission (CPUC) accepted a new net metering tariff by which customers with rooftop solar can sell excess energy back to the electric grid at retail rather than wholesale prices.16 PG&E had opposed adoption of such measures and, among other recommendations, sought to reimburse solar users at reduced rates. With the new mandate passed by CPUC, they argue that net-metered solar customer’s utility bill reduction will push up to $24 billion in costs to non-participating customers over the next decade.17 However, with a state mandate to obtain half of its energy from renewables by 2030, PG&E must figure out a way to balance non-utility distributed generation with making a profit, developing the smart grid, and expanding renewable capacity.18

Recommendations: As its business model develops, PG&E will continue to create value by providing readily available power to its customer base, but must find a way to stabilize rates for lower income families. This challenge may mean a floating fixed rate fee for those who still require access to the grid or a transition towards service as a platform provider for third-party energy service companies (e.g., New York’s “Reforming the Energy Vision”).19 Regarding its operating model, PG&E needs to expand its regional smart grid initiative to the national stage (e.g., supporting solar and energy storage on the grid and the demand response plug-in electric vehicle program).20 The electric grid is not truly national and, as renewable generation develops, utilities have no way to redistribute excess power across the grid or leverage data on a national level to improve service. The potential for innovation here is high, but we are at a delicate stage in which action at the customer, utility, and governmental level could have impacts for decades to come.

Word Count (excluding citations): 793

Endnotes________________________________________________________________________

1 Pacific Gas and Electric Company, “Company Profile,” [https://www.pge.com/en_US/about-pge/company-information/profile/profile.page], accessed November 13, 2016.

2 Thomas L. Friedman, “Hot, Flat, and Crowded,” (New York: Picador, 2009), p. 265.

3 Ibid, p. 268.

4 Christian Grant, John McCue, and Roby Young, “The Power Is On: How IoT Technology Is Driving Energy Innovation,” Deloitte University Press, January 21, 2016, [https://dupress.deloitte.com/dup-us-en/focus/internet-of-things/iot-in-electric-power-industry.html], accessed November 13, 2016, p. 2.

5 Ibid.

6 Jeff Tarbert, “Public Power’s Business Model: A Primer,” American Public Power Association, [http://www.publicpower.org/files/Media/PP Business Model-Tarbert.pdf], accessed November 13, 2016, p. 6.

7 Robert J. Michaels, “Electric Revenue Decoupling Explained,” Institute for Energy Research, February 13, 2009, [http://www.instituteforenergyresearch.org/analysis/electric-revenue-decoupling], accessed November 13, 2016.

8 Tony Seba, “Clean Disruption” (Silicon Valley, California: Clean Planet Ventures, 2014), p. 70-71.

9 Ibid.

10 Solar Energy Industries Association, “Utility Rate Structure,” [http://www.seia.org/policy/distributed-solar/utility-rate-structure], accessed November 13, 2016.

11 Tim Fitzpatrick, “Adapting the Utility Business Model to a Clean-Energy Future,” Currents: News and Perspectives from PG&E, April 13, 2016, [http://www.pgecurrents.com/2016/04/13/adapting-the-utility-business-model-to-a-clean-energy-future/], accessed November 14, 2016.

12 Christian Grant, John McCue, and Roby Young, “The Power Is On: How IoT Technology Is Driving Energy Innovation,” Deloitte University Press, January 21, 2016, [https://dupress.deloitte.com/dup-us-en/focus/internet-of-things/iot-in-electric-power-industry.html], accessed November 14, 2016, p. 2.

13 “PG&E President Says Utility is Investing Today for the ‘Grid of Things’ TM of Tomorrow,” Business Wire, March 19, 2015, ABI/INFORM via ProQuest, accessed November 14, 2016.

14 Ray Vaswani, “The Next Wave: Utilities, Smart Cities, and the Internet of Things,” Energy Biz Magazine, Summer 2015 (Volume 12/Issue 3), p. 26.

15 “PG&E President Says Utility is Investing Today for the ‘Grid of Things’ TM of Tomorrow,” Business Wire, March 19, 2015, ABI/INFORM via ProQuest, accessed November 14, 2016.

16 John Schuster, “Net Metering in Play in Multiple US States,” Chadbourne & Parke Project Finance NewsWire, April 2016, p. 25.

17 Jeff St. John, “California Utilities Release New Plans to Replace Net Metering: Conflict to Come?”, Greentech Media, August 4, 2015, [https://www.greentechmedia.com/articles/read/california-utilities-plan-for-net-metering-20-fixed-charges-lower-payments], accessed November 15, 2016.

18 California Energy Commission, “Fact Sheets on California’s 2030 Climate Commitments and Related E3 Study,” July 9, 2015, [http://www.energy.ca.gov/commission/fact_sheets/climate_commitments_fact_sheets.html], accessed November 16, 2016.

19 Jeff St. John, “The Future of Utility Business Models, This Time Without Fixed Charges”, Greentech Media, November 9, 2015, [https://www.greentechmedia.com/articles/read/The-Future-of-Utility-Business-Models-This-Time-Without-Fixed-Charges], accessed November 16, 2016.

20 PG&E News Releases, “PG&E’s Smart Grid Delivers Customer Benefits and Improved Reliability,” October 1, 2014, [https://www.pge.com/en/about/newsroom/newsdetails/index.page?title=20141001_pges_smart_grid_delivers_customer_benefits_and_improved_reliability], accessed November 16, 2016.

Interesting post! Reshaping the electric grid, implementing sustainable energy generation, and developing effective mass storage are certainly important problems facing utilities and regulators today. First, most forms of clean renewables (wind, solar, hydro) are all seasonly affected. With an updated grid or mass storage, utilities could smooth the power generation from renewables and reduce their reliance on more consistent forms of power generation.

Ward, thanks for an insightful and well-written post. You bring up a difficult challenge of encouraging consumers to install distributed energy generation at their homes, thereby reducing revenue to PG&E and increasing costs to non-participating users, while ensuring stable prices to lower income families. The link here appears to be the fact that lower income families are less likely to install renewable distributed energy facilities at their homes due to the upfront cost of equipment and labor, or due to uncertainty in future changes in residence. I wonder if it would be in the purview of the California state government to underwrite these investments (and, in turn, reap the returns of electricity sales to PG&E) for families that wish to participate but cannot fund themselves.