P&G: Bringing CPG into the Digital Age

How P&G’s use of data is transforming the way it goes to market

Tide, Crest, Bounty, Charmin, Pampers, Always, Dawn, Olay and Oral-B. You know these brands, you probably use these brands, but what do they have in common? They are just 9 of 21 brands that sell over 1 billion dollars in sales,1 and are all owned by the largest consumer packaged goods manufacturer in the world, Procter & Gamble (P&G).

P&G’s mission is to “provide branded products and services of superior quality and value that improve the lives of the world’s consumers”2 Since 1837, P&G has been delivering on this promise, but in March of 2000, that came to a halt when P&G’s stock plunged by 30% ($36 billion)3 followed by the CEO, Durk Jager, resigning in June4. These drastic changes forced the company to reevaluate its priorities and really think about who it wanted to be in the changing landscape. One of the biggest mandates that came out of this period was to create an operating model that focused on innovation, but to do that, they first needed to understand their current position, and for that, they needed data.

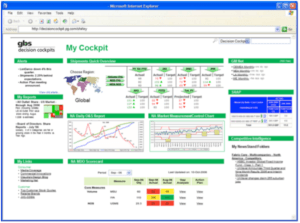

Under former CEO, Robert McDonald, P&G created an agenda to “digitize” the company’s processes from end to end and make data more accessible to its decision makers. Out of this agenda came the Business Sufficiency analytical model, the Decision Cockpits, and Business Spheres, all which combine to create a visually immersive data environment that transforms decision making at P&G by harnessing real time business information from around the globe.

- Business sufficiency analytics is a visual, exception based model, built on SAS analytics software and delivered through dashboards (Decision Cockpits), that gives executives predictions about P&G’s market share and other performance statistics six to 12 months in advance. Using a series of analytical models, P&G can determine what’s happening in the business now, why it’s happening and what actions they can take. The Business Cockpits enables more than 50,000 employees access to this drillable data on their desktops.5

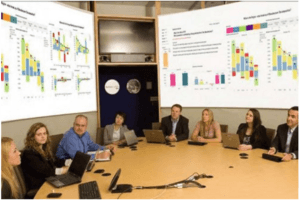

- Business Spheres are meeting rooms with football shaped tables that allow leaders to ‘see’ the data from the Business Sufficiency Analytics and Decision Cockpits by projecting six dashboards across two 30-foot wide projection screens. The dashboards analyze and connect up to 200 terabytes of data which allows it unprecedented granularity and customization.6

In addition, before the digital revolution, creating prototypes for their products cost thousands of dollars and were made by hand. Today, however, P&G uses modeling and simulations, and can test thousands of iterations in seconds. 7

P&G has even gone so far as digitizing “the creation of molecules”. When researching and developing a new dishwashing liquid, they used modeling to “predict how moisture would excite various fragrance molecules so that throughout the dishwashing process, you get the right fragrance notes at the right time”.7

According to former CIO, Brian P. Watson, the end result of digitizing the company end to end is to “[create] an environment that is functioning in real time.” By doing this, P&G can respond to the market faster than before and make better, more-informed decisions to address the needs of their customers and consumers”.8

In this digital world, speed and flexibility will become paramount, but what else should P&G be doing to not only survive, but flourish in this new landscape? While P&G’s data and analytics is great, it means nothing if they can’t translate it to sales. In 2016, Amazon announced that it will begin offering its own private label groceries including coffee and baby food. While Amazon tried (and failed) to sell diapers in 20159, it is only a matter of time before they begin to outsource its private label to a 3rd party and sell it as their own. With consumer spending continuing to shift online, this poses a real threat to P&G who typically sells less than 1% of their global revenue online.10 For P&G to keep up with this digital age, they must harness the power of their data to better understand their customer’s latent needs and create innovate products and brands in categories that don’t yet exist. However, with their high commercial success rate and their drive to digitize their processes, I have no doubt that this 179 year-old company will continue to innovate and succeed. (Word count: 797)

[1] P&G: Our Core Strengths. From P&G website, http://us.pg.com/who-we-are/our-approach/core-strengths, accessed November 2016

[2] P&G: Our Purpose, Values and Principles. From P&G website, https://www.pg.com/translations/pvp_pdf/english_PVP.pdf, accessed November 2016

[3] Matthews, Steve, “P&G Stock Sinks 30% to 3-Year Low,” Los Angeles Times, March 8 2000, http://articles.latimes.com/2000/mar/08/business/fi-6496, accessed November 2016

[4] “P&G CEO quits amid woes,” June 8 2000, CNN Money, http://money.cnn.com/2000/06/08/companies/procter/, accessed November 2016

[5] “P&G turns analysis into action,” September 19 2011, InformationWeek, http://spotfire.tibco.com/assets/bltf3f73e8160d9ba3e/p-g-information-week.pdf, accessed November 2016

[6] Choudhury, Shilpi, “How P&G uses Data Visualization to uncover new opportunities for growth?,” April 16 2014, Fusion Brew, http://www.fusioncharts.com/blog/2014/04/how-pg-uses-data-visualization-to-uncover-new-opportunities-for-growth/, accessed November 2016

[7] “Inside P&G’s digital revolution”, November 2011, McKinsey Quarterly, http://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/inside-p-and-ampgs-digital-revolution, accessed November 2016

[8] Watson, Brian P., “Data Wrangling: How Procter and Gamble Maximizes Business,” January 30 2012, CIO Insight, http://www.cioinsight.com/c/a/Business-Intelligence/Data-Wrangling-How-PG-Maximizes-Business-Analytics-782673, accessed November 2016

[9] Del Rey, Jason, “Amazon Pulls Its Line of Diapers Less Than Two Months After Launch,” January 21 2015, Recode, http://www.recode.net/2015/1/21/11557948/amazon-pulls-its-line-of-diapers-less-than-two-months-after-launch, accessed November 2015

[10] McMains, Andrew, “Sales Are Not the Main Goal for P&G’s New Online Store,” February 7 2010, Adweek, http://www.adweek.com/news/advertising-branding/sales-are-not-main-goal-pgs-new-online-store-107024, accessed November 2016

There are some really interesting implications of this cultural shift to a data-driven mindset that you mention in your post. Having lived P&G’s data driven culture for a few years, I found it to be both incredibly empowering but at times limiting to have access to such seemingly limitless data.

One often overlooked downside to having access to so much data is the way in which decisions are made in some companies. In my experience at P&G, the ubiquity of data genuinely changed the way in which decisions were made – if there was data to back a decision, it was often approved; if it was more intuitive or experience-based recommendation it was often dismissed. This proves particularly difficult in fields of consumer advertising and product innovation, areas in which extreme amount of creativity are required.

Fast forward a few years and interestingly, P&G has begun to pilot in certain business units removing data-based testing entirely for certain pieces of advertising, and instead relying solely on the intuition and experience of the Brand Manager and then relying on in-market sales to determine if the campaign was effective or not. Time will tell which approach (or perhaps a blend of the two) will ultimately drive greater sales.

Really interesting article. There is no consumer company better equipped to evaluate and react to ever changing consumer needs than P&G. The digitization examples that you’ve highlighted in your article seem to be largely R&D based. I wonder what they are doing on the consumer research / marketing side to make sure that a) they are developing the right products for their customers and b) that they are then targeting the right customers with those products. Surely they must be doing some cutting edge stuff in those arenas if they’ve devoted the money to digitize potential laundry detergent molecules!

Agree with Berner here, especially as it relates to targeting the right customers. Given the scope of their data, I wonder if they could use it to reach new markets quickly and effectively. I envision them using this data to draw similarities between consumer bases they know and one’s they are trying to gain market share with. In theory, it would allow them to reduce research time and to penetrate a market more quickly. The risk here is that they draw conclusions about these consumer that do not hold (because the parallels don’t actually exist) but if they account for that risk in how they proceed, hopefully that data base could give them a competitive advantage.

HBS2018 – Very interesting perspective on how a CPG firm is using big data to change its internal decision-making processes. I think Robby and Quinn are right on here in highlighting the opportunities for P&G to take this a step further and apply the same approach to customer positioning and targeting. Considering the investments that other major players, such as Unilever and Coca-Cola, are making in their utilization of big data analysis to monitor customer trends, it’s imperative that P&G expand to customers to remain competitive. Specifically, these competitors are using bio-data to understand which products trigger the “excitement” part of consumers’ brains, monitor sale slowdowns caused by stock-outs via Twitter, and build hyper-targeted niche messaging campaigns. Do you know what efforts P&G is taking to apply big data to its marketing efforts and whether it’s efforts are differentiated from competitors?

Sources:

[1] https://www.warc.com/LatestNews/News/Unilever,_Coke_do_big_data_differently_.news?ID=36953

[2] https://hbr.org/2016/09/building-an-insights-engine

Great article. It was interesting to see how P&G applies digitization in the context of changing organizational systems and processes, making P&G one huge connected company. Do you think P&G can also innovate more on the product platform, having a connected product matrix in a household? For example, one of the ways P&G innovates is using the ‘Tide dash button’ platform with Amazon to re-order more of the detergent. P&G should also partner with all other equipment manufacturers; washing machines etc to create a connected experience with its core customers.