Nvidia: Datacenter Dominance

Nvidia seeks to extend its lead in the datacenter space with advanced machine learning capabilities.

Moore’s Law, a tenet of electrical engineering from the mid-1960s which states that the number of transistors in a processor doubles every two years, has come to a halt[1]. As Moore’s law has stalled, the amount of digital data has exploded[2], which requires more computing power. This need for computational improvements has spurred interest in using the full power of the parallel computing power available in graphics processing units (GPUs).

Computing has become increasingly visually complex, moving from two color graphics in the 1980s to the high definition displays in an iPhone today[3], powered by specialized graphics chips. Nvidia’s roots are in high performance desktop video gaming[4], which requires high computational power to display rapidly shifting, complex, visually detailed environments at high frame rates. Machine learning programs run especially well on hardware that is designed for massively parallel calculations, which is precisely what Nvidia’s family of GPUs do. A central processing unit (CPU) could be analogized as a long and complex assembly line compared to the GPU’s batch process.

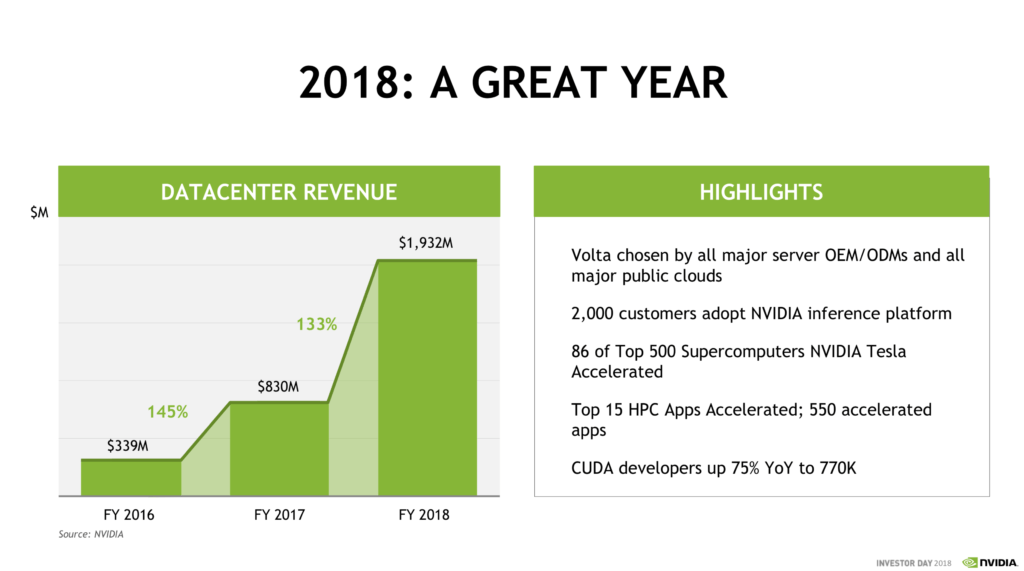

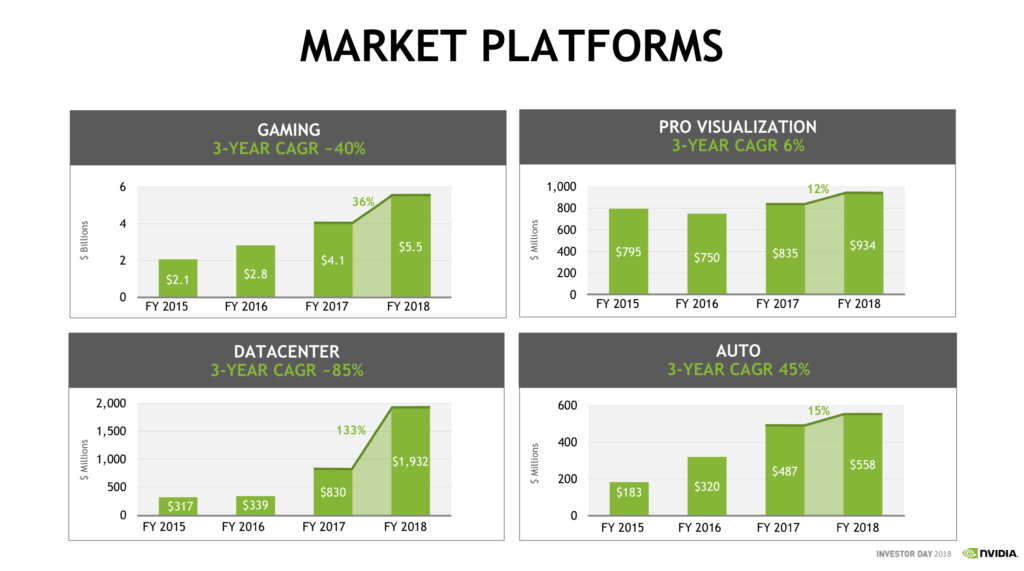

Machine learning needs large amounts of parallel computational capacity to crunch ‘wide’ data sets. The machine learning revolution has pulled Nvidia away from its core market of video gaming and thrust their GPUs into data centers. CEO Jensen Huang has the opportunity to be the machine learning leader, in a market that is estimated to be worth $50B in data center sales alone[5].

Nvidia’s core challenge is how to serve innovative technology companies with valuable services and hardware while keeping competition from AMD, Intel, and startup chipmakers at bay[6].

In the short term, Nvidia is driving hardware innovation with graphics cards that surpass what AMD can offer, such as the 10th generation GeForce series and the Titan V professional card which offer dramatic increases in generalized compute performance over the competition[7] and superior performance per dollar[8]. In addition, Nvidia has responded to highly specialized needs in promising markets, such as Drive CX and Drive PX[9], in the autonomous automotive market. These two products combine hardware and software to provide real time high performance machine learning for cars to offer assisted or full autonomous driving capability[10].

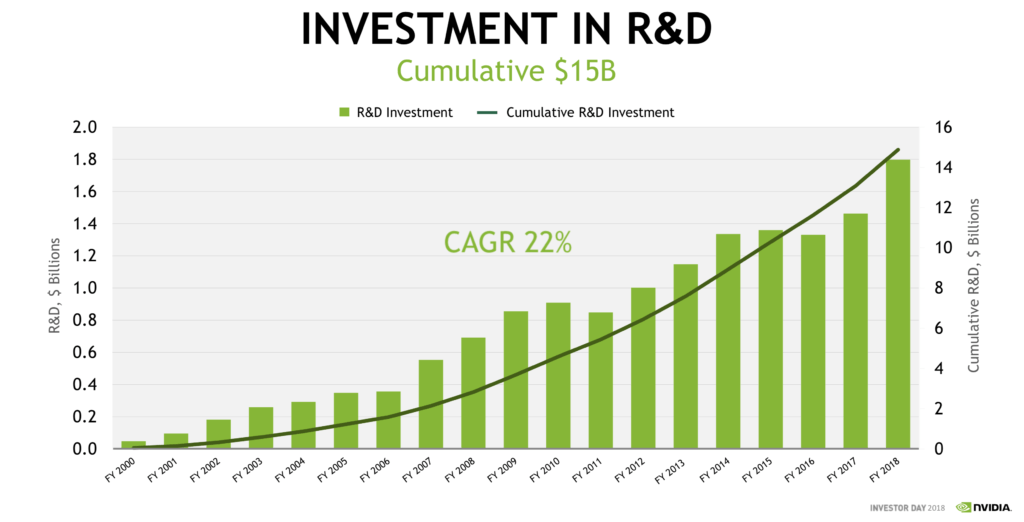

Longer term, Nvidia needs to keep its GPU products at the forefront of computationally intensive tasks. Currently, Nvidia partners with businesses across industries such as automotive, genomics, medical devices, and manufacturing as well as top universities to provide advanced software developed advanced and optimized hardware and software[11]. In the five years since 2013, Nvidia has flipped from employing 60% hardware engineers to 60% software engineers to support these partnerships[12]. The company has also launched a program called Nvidia Inception[13], designed to provide access to technology, software support, expertise, market exposure and capital to 1,300 startups that are applying machine learning[14].

Nvidia’s core challenge is to maintain its lead in GPU hardware and to ensure that existing and potential customers develop machine learning software that runs best on Nvidia.

Given the existence of powerful and inexpensive cloud computing platforms that use Nvidia like Amazon Web Services[15] and Google Cloud[16], it does not make sense for Nvidia to build its own cloud offering. Instead, Nvidia should target companies that need a high performance on-premise solution, such as national research laboratories, the defense industry and universities.

Second, Nvidia should design an enterprise customer hardware leasing and upgrade program on top of the existing software partnerships for use in specialized applications. In the driverless car space, customers would receive faster DrivePX hardware every year that would simply be plugged into the car, bringing faster processing and advanced autonomous features. In both the driverless car space and medical imaging, faster hardware means safer cars and more accurate diagnoses[17]. This program would ensure that customers across all industries will have the latest and greatest hardware running increasingly sophisticated software.

Lastly, Nvidia cannot forget about the consumer gaming business. This is the one segment where AMD offers real competition to Nvidia and continued dominance is predicated upon wise research and development spending. The datacenter division may be the fastest growing segment, but gaming is still by far the largest business at $5.5B in FY2018 and is still growing fast enough that gaming added $1.4B year over year, when the entire datacenter business in the last year was $1.9B[18].

Given the tension in computing between proprietary, closed and high performance systems vs open source, standardized systems, how do you perceive Nvidia’s market strategy? How would you persuade customers to use your machine learning hardware and software, while also hosting their precious business data, in an era where companies want complete control over data?

(761 words)

Citations:

1. Simonite, T. (2018). The foundation of the computing industry’s innovation is faltering. What can replace it?. [online] MIT Technology Review. Available at: https://www.technologyreview.com/s/601441/moores-law-is-dead-now-what/ [Accessed 13 Nov. 2018].

2. Marr, B. (2018). How Much Data Do We Create Every Day? The Mind-Blowing Stats Everyone Should Read. [online] Forbes. Available at: https://www.forbes.com/sites/bernardmarr/2018/05/21/how-much-data-do-we-create-every-day-the-mind-blowing-stats-everyone-should-read/#492a4e860ba9 [Accessed 11 Nov. 2018].

3. Apple. (2018). iPhone XS – Technical Specifications. [online] Available at: https://www.apple.com/iphone-xs/specs/?afid=p238%7CseQ7NTZol-dc_mtid_20925d2q39172_pcrid_305083747190&cid=wwa-us-kwgo-iphone-slid– [Accessed 11 Nov. 2018].

4. YouTube. (2018). The Future of Autonomous Vehicles | Nvidia CEO Full Interview. [online] Available at: https://www.youtube.com/watch?v=RKjxg-gsoZ8 [Accessed 11 Nov. 2018].

5. Nvidia 2018 Annual Investor Presentation. https://s22.q4cdn.com/364334381/files/doc_presentations/2018/03/NVIDIA-2018.pdf

6. Nytimes.com. (2018). Big Bets on A.I. Open a New Frontier for Chip Start-Ups, Too. [online] Available at: https://www.nytimes.com/2018/01/14/technology/artificial-intelligence-chip-start-ups.html [Accessed 11 Nov. 2018].

7. Hochstenbach, T. (2018). The first Volta: Nvidia Titan V review. [online] Hardware.Info. Available at: https://us.hardware.info/reviews/8071/the-first-volta-nvidia-titan-v-review [Accessed 11 Nov. 2018].

8. Congleton, N. (2018). AMD vs. Nvidia GPUs: Who’s Winning the 2018 Graphics War? – Make Tech Easier. [online] Make Tech Easier. Available at: https://www.maketecheasier.com/amd-vs-nvidia-who-is-king-of-gpus/ [Accessed 12 Nov. 2018].

9. Smith, R. and Ho, J. (2018). NVIDIA Tegra X1 Preview & Architecture Analysis. [online] Anandtech.com. Available at: https://www.anandtech.com/show/8811/nvidia-tegra-x1-preview/4 [Accessed 12 Nov. 2018].

10. NVIDIA. (2018). Autonomous Car Development Platform from NVIDIA DRIVE AGX. [online] Available at: https://www.nvidia.com/en-us/self-driving-cars/drive-platform/ [Accessed 11 Nov. 2018].

11, 14. YouTube. (2018). GTC 2017: Growing Deep Learning Ecosystem, Iray Demo (NVIDIA keynote part 5). [online] Available at: https://www.youtube.com/watch?v=yPJaWvxnYrg [Accessed 11 Nov. 2018].

12. S22.q4cdn.com. (2018). Nvidia 2018 Annual Investor Presentation. [online] Available at: https://s22.q4cdn.com/364334381/files/doc_presentations/2018/03/NVIDIA-2018.pdf [Accessed 11 Nov. 2018].

13. Nvidia.com. (2018). Nvidia Deep Learning Partnerships. [online] Available at: https://www.nvidia.com/en-us/deep-learning-ai/startups/, [Accessed 11 Nov. 2018].

15. Amazon Web Services. (2018). New – Amazon EC2 Instances with Up to 8 NVIDIA Tesla V100 GPUs (P3) | Amazon Web Services. [online] Available at: https://aws.amazon.com/blogs/aws/new-amazon-ec2-instances-with-up-to-8-nvidia-tesla-v100-gpus-p3/ [Accessed 11 Nov. 2018].

16. Google Cloud. (2018). NVIDIA and Google Cloud Platform | Google Cloud. [online] Available at: https://cloud.google.com/nvidia/ [Accessed 11 Nov. 2018].

17. YouTube. (2018). NVIDIA Self Driving Car presentation. [online] Available at: https://www.youtube.com/watch?v=_rC2KsROMMU [Accessed 12 Nov. 2018].

18. Sec.gov. (2018). Nvidia Form 10K. [online] Available at: https://www.sec.gov/Archives/edgar/data/1045810/000104581018000010/nvda-2018x10k.htm [Accessed 11 Nov. 2018].

Great post Everett! I completely agree that Nvidia should avoid building its own cloud offering. I also agree that Nvidia shouldn’t forget about the gaming industry, especially with the rise of virtual reality and longer console lifecycles which would increase the appeal of Nvidia’s offering. I’m not sure if Nvidia’s video game offering currently targets gaming consoles as well but that could be an attractive market. Given the question you raise about hosing business data, I wonder if there would be a way for Nvidia to focus solely on the hardware, allowing another player to worry about convincing businesses to relinquish some control over their data. Additionally, by moving to software I worry that Nvidia would stray too far away from its core competency.