Nordstrom: introducing customers to the future of multi-channel retail

Digitalization has allowed new online-only competitive players to enter the retail market, but it has also brought a wide range of opportunities to traditional retailers willing to engage with technologies to better serve their multi-channel customers

Digitalization is impacting every single facet of the retail industry. Incumbent players are struggling, both financially and strategically, to stay relevant in a fast evolving landscape, where disruptive e-commerce-only players are introducing new business and operative models, and competing aggressively by offering lower prices, faster and cheaper delivery, and endless assortments. However, traditional retailers are best positioned to benefit from a multi-channel retail, as research indicates that omnichannel customers spend two to five times more than customers who buy in only one channel[i]. Nordstrom, a leading high-end department stores, has already seized the opportunity by successfully leveraging innovative technological solutions across multiple areas, with the goal of delivering on its original mission of “providing a fabulous customer experience by empowering customers and the employees who serve them[ii]”:

- Customer service:

- Offers since 2010 “pickup in-store” option to online shoppers; in 2016 started offering “curbside pickup” option, allowing consumers to drive by a Nordstrom location, where a salesperson would wait for the shopper at the door, to “grab and go” an order placed online[iii]

- Allow for returns across channels (“buy online, return offline”) and across its many retailers (ie: buy on HauteLook.com or Nordstrom.com and return at Rack physical outlet store).[iv]

- Empower salespeople with a 3-D scanning technology that allows to scan consumers` feet and make more accurate and data-driven shoes recommendations[v]

- Salespeople learn about customers’ preferences by leveraging social media (ie Pinterest), and tag the most popular items in store with a red Pinterest tag, linking their online and offline worlds[vi].

- IT:

- Enabled in-store mobile checkout by introducing mobile point-of-sale devices[vii]

- Integration of consumer information across channels and creation of a single consumer history database

- Inventory system

- Introduced in 2002 perpetual inventory system[viii], and later enabled “pick-up in store” option for online purchases

- Further integration of Nordstrom.com and app with the inventory management system enables customers to find what they want in one place and have it delivered from somewhere else to a third place[ix]

- Logistics:

- Development of B2C fulfillment capabilities through the creation of an e-commerce only distribution center able to fulfill order within 2 days[x], to compete against major online retailers (ie: Amazon Prime 2 days-delivery)

Nordstrom has integrated digital capabilities from newly acquired innovative players: Hautelook (enabling innovative flash sale site), Shoes of Prey (online footwear store that allows women to customize shoes), Trunk Club (cloud-based men’s personalized clothing service), Bonobos[xi] (online player addressing trousers sizing issues via physical “guide shops”). While the digitalization of Nordstrom’s business has allowed the company to grow overall revenues by more than 50% in the last five years[xii], and grow online sales to 21% of total revenues[xiii], it has also impacted negatively its bottom line[xiv], as the cost to service increasingly demanding consumers increased. Going forward, Nordstrom must focus in finding ways of remaining competitive while tackling the main sources of increasing expenses:

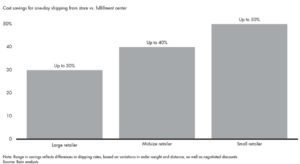

- Introduce Cost-effective Express Delivery: Leverage the broad network of physical stores and their inventories to fulfill orders in major metro, thereby cutting delivery time down to 2-hours delivery, and diminishing costs (Exhibit 1[xv]).

- Minimize Product Returns: improve recommendations engines to offer “the right product to the right consumer”’, by leveraging in-house technology shared by Trunk Club; address size and fit challenges by enabling 3-D printing solutions for consumer to be able to try on samples.

- Optimize Performance Marketing: improve ability to accurately attribute return of media spend across channels, thereby better targeting marketing investments; introduce beacon to track customers` cell phones throughout stores and offer instant in-store cross-channel offers.

- Lower Retail Store Rent: deploy Bonobo “guide shops”, by replacing future large and costly store openings with smaller try-on showroom with no inventory, where consumers can try on items in-store and then complete the order online; “magic mirrors” would allow consumer to virtually try-on endless assortment even if limited inventory is available in-store[xvi].

- Fix Inefficient Purchase Experience: younger consumers are no longer willing to spend time looking for merchandise across large stores and queuing for checkout: leverage beacons to record the path to purchase to optimize store layout, and introduce RFID technologies that enable “on the go” payment, as seamlessly as paying for an Uber ride[xvii].

In conclusion, the advent of digitalization has allowed new competitive players to enter the retail market, but it has also brought a wide range of opportunities to companies like Nordstrom, willing to engage with technologies not as an end to themselves, but as enablers to better serve multi-channel customers.[xviii]

(777 words)

[i] http://www.bain.com/publications/articles/three-rules-for-building-the-modern-retail-organization.aspx

[ii] https://hbr.org/2015/01/why-nordstroms-digital-strategy-works-and-yours-probably-doesnt

[iii] https://www.internetretailer.com/2015/05/05/nordstrom-tests-curbside-pickup-option-20-stores

[iv] http://fortune.com/2015/02/20/nordstrom-ecommerce/

[v] http://www.intel.com/content/dam/www/public/us/en/documents/marketing-briefs/nrf-2016-nordstrom.pdf

[vi] https://hbr.org/2015/01/why-nordstroms-digital-strategy-works-and-yours-probably-doesnt

[vii] http://www.pwc.com/us/en/increasing-finance-function-effectiveness/finance-effectiveness-benchmark-study/nordstrom-technological-transformation.html

[viii] https://hbr.org/2015/01/why-nordstroms-digital-strategy-works-and-yours-probably-doesnt

[ix] https://hbr.org/2015/01/why-nordstroms-digital-strategy-works-and-yours-probably-doesnt

[x] http://fortune.com/2015/02/20/nordstrom-ecommerce/

[xi] http://fortune.com/2016/03/21/nordstrom-ecommerce-2/

[xii] https://hbr.org/2015/01/why-nordstroms-digital-strategy-works-and-yours-probably-doesnt

[xiii] http://fortune.com/2016/03/21/nordstrom-ecommerce-2/

[xiv] http://www.wsj.com/articles/nordstroms-high-cost-for-online-sales-1456174730

[xv] http://www.bain.com/publications/articles/modern-retail-supply-chains-backbone-for-omnichannel.aspx

[xvi] http://fortune.com/2015/10/08/rebecca-minkoff-technology/

[xviii] https://hbr.org/2015/01/why-nordstroms-digital-strategy-works-and-yours-probably-doesnt

I like your analysis and am impressed with Nordstrom’s recent moves to keep up with a changing retail environment. However, one of things they are currently doing and one of the things you suggest they are doing seem at odds and I would be interested in hearing your take. You mention their push to increase store pickup and cost effective express delivery that leverages inventory at physical stores. I agree that both of these are things the consumer will want. You can see that curbside, a company that enables curbside pick up raise $25 million last year from prominent investors, signaling interest in the consumer service (https://techcrunch.com/2015/06/25/same-day-shopping-app-curbside-picks-up-25-million-more/). However, for Nordstrom to execute on these things, they will rely on keeping a high level of inventory in stores. Another thing you suggested was to lower retail store rent by creating smaller footprint “showroom” like stores. This attractive new retail model relies on little to no inventory in store, with orders shipping from centralized fulfillment centers. While both models are attractive, their very different methods will likely force Nordstrom to make a decision in one direction or another, at least in the short term.

I disagree with you that there is only one way forward. In fact, the most effective strategy would be one that combines large existing stores that hold inventory, but smaller new showrooms without inventory. Currently, Nordstrom owns and operates huge stores across the country. It would be insanity for them to shut them all and replace those stores with showrooms. The existing locations that hold inventory should be leveraged by Nordstrom as potential distribution center for 30 minutes express delivery. What I am suggesting is to complement that network of department stores with smaller and more nimble operations to increase the penetration in major cities. Here is an example: Nordstrom is planning on opening its first NY flagship department store in Mid-town in 2017 (http://nypost.com/2013/08/26/nordstrom-buys-its-57th-st-store-jumbo-skyscraper-pending/); one store alone in the largest retail hub of the world is not enough. That one store, which by the way will cost >$100M to build, will attract very few loyal customers travelling from Downtown NYC. In my opinion, Nordstrom should consider open “neighborhood” showrooms across the city (think of what Bonobo is doing) to serve those customers that are looking for a different experience altogether.

It sounds like Norstrom’s is taking many steps to improve their customers’ omni-channel experience. I think allowing in-store returns regardless of which channel the purchase was made is a huge win; customers view a retailer’s physical and online presence as one entity so it’s important to avoid friction as customers navigate between the two.

Tomcat makes a good point that the rise of store pickup and the concept of showrooming seem to be at odds in the sense that one requires significant inventory and one is seemingly predicated on a lack of inventory. However, it is possible that the two can co-exist if Nordstrom adopts a ship-to-store model. There are two primary reasons for a customer to choose store pickup instead of home delivery: speed (usually available same day) and security (depending on where a customer lives and what they’re ordering, they may find it risky to have packages left at their home). A ship-to-store model (in which items which aren’t currently present in the store are shipped there for the customer to pick up at a later date) doesn’t provide the speed benefit of traditional store pickup, but it does still provide the security benefit.