Nio – A Chinese Tesla Disrupting The World’s Supercar Industry

Can Nio, a three-year old Chinese electric vehicle company, with the help of favorable policies in fighting climate change from the China government, rise to be the next Tesla and disrupt the market?

In November 2016, a Chinese electric vehicle (EV) company Nio unveiled an extremely stylish high-performance prototype EP9 with 1,360 horsepower (which propels the car from rest state to 160 mph in just 7.1 seconds). The supercar matches the performance of top hybrid supercars such as LaFerrari and McLaren P1 [1], rivals Tesla’s Model X, and makes itself the world’s fastest EV. Can the company become the next Tesla, with its breathtaking design, breakthrough technology and strong support from the China government in fighting climate change?

Nio delivers the concept of future lifestyle, via cars – a closer look at Nio. The startup was formed three years ago. Backed by a number of top venture capital firms, including Chinese tech giant Tencent, and Temasek, Sequoia Capital, Lenovo, and TPG, is valued around $3bn [2]. It has hired top talents from Tesla, Ford, and Lyft. In early 2017, Nio announced another EV concept – Nio Eve by 2020, which is autonomous and equipped with AI. Some remarkable features: the NIO Eve has a panoramic roof, lounge-like seating, and digital displays provided on the active glass. It shoots for an implausible range of 600 miles, with a wireless charging system that will provide 200 miles with a 10-minute charge. [3]

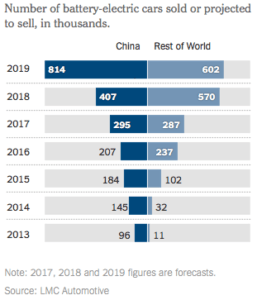

China’s push for EV shows its industrial ambitions can endure big political shifts. Is it an opportunity or a threat to Nio? Propelled by vast investment of government money and the hope of dominating next-generation technologies, China has become the world’s biggest supporter, maker and seller of EVs. Chinese buyers have snapped up almost 300,000 of EVs in 2017, three times the number expected to be sold in the U.S. and more than the rest of the world combined [4]. The Chinese government has called for one out of every five cars sold there to run on alternative fuel by 2025, and issued new rules that would require the world’s carmakers to sell more alternative-energy cars to them if they wanted to continue selling regular ones. However, if not executed properly, the policy could slow down the EV conversion process and hurt companies such as Nio in two major ways:

- Automakers could take the favorable EV tax credit and renege on their promises, creating too much competition and a waste of capital in EV market.

- High-profile accidents from tech/AI malfunctions could deter public acceptance.

Could EVs bring a meaningful reduction in the greenhouse-gas emissions that are causing global climate change?

Could EVs bring a meaningful reduction in the greenhouse-gas emissions that are causing global climate change?

The short answer is yes. According to researchers at MIT, roughly 90% of the personal vehicles on the road daily could be replaced by a low-cost EV available on the market today [5]. That would more than meet near-term U.S. climate targets for personal vehicle travel. However, the adoption of EV might be mostly limited in dense urban areas such as New York because of the range constrained by current battery technology.

(Image to the left: Nighttime image of New York City, with the red showing a large population density. Source: Flickr user Doc Searles/CC)

To build a sustainable business, Nio first should overcome its major bottlenecks in supply chain, particularly in battery and mass production. A complete supply chain of an EV includes vehicle manufacturing, energy storage, energy infrastructure, distribution, and value-added service. In China, the last three are mostly operated by state-owned entities, which makes battery and manufacturing open to competition.

Battery and battery management system (BMS) are the heart of an EV. “Buy or build battery?” was a question Tesla faced, who ultimately decided to build its own Gigafactory. Nio on the other hand, purchases batteries from third-party OEMs. In terms of BMS, Nio picks battery-swap as solution, instead of investing in energy density technology. Further, without the ability of mass production, Nio might never make a profit through economy of scale, and will ultimately lose favor with investors.

The management of Nio has taken some steps to address the supply chain issues. In a short term, the management outsourced its entire production to JAC, an established Chinese automaker through a $1.5bn joint-venture [6]. It has successfully attracted capital funding to a total of $2.1bn [7] and another $1bn from Tencent in early November this year [8]. For the next 5-10 years, the management expressed its intent to build own battery lab and manufacturing facilities.

In my view, the above measures from the management are too slow and far from enough. I believe more aggressive investment needs to be allocated to R&D. I also think it should leverage the power of its high-profile Chinese investors to lobby the China government for more favorable terms in building its own manufacturing and battery charging facilities, instead of outsourcing. And the bigger question for Nio remains – how can an EV company with the mindset of rewriting rules of luxury supercars manufacture the cars for everyone at scale and cost?

(Word Count 780)

———————————————————————————————————————

[1] Forbes Website https://www.forbes.com/sites/neilwinton/2016/11/21/chinas-nextev-launches-nio-brand-and-worlds-fastest-electric-car/

[2] Economist, China’s audacious and inventive new generation of entrepreneurs, September 23, 2017

[3] Nio Company Website https://www.nio.io/visioncar

[4] The New York Times, China Hastens the World Toward an Electric-Car Future, October 9, 2017 https://www.nytimes.com/2017/10/09/business/china-hastens-the-world-toward-an-electric-car-future.html

[5] Electric Cars Could Replace 90% Of The Vehicles On The Road, MIT Study Finds http://www.huffingtonpost.co.uk/entry/electric-vehicles-could-replace-90-of-the-vehicles-on-the-road-mit-study-finds_uk_57b330a9e4b0730aab64b084

[6] Financial Times, Nio plans to speed into China’s electric car market, https://www.ft.com/content/21a82856-a1d2-11e7-8d56-98a09be71849

[7] Crunchbase, Nio, https://www.crunchbase.com/organization/nextev

[8] Bloomberg News, Tesla-Partner Tencent Plans Its Own Driverless Technology

Great essay! To your question of how can an EV company with the mindset of rewriting rules of luxury supercars manufacture the cars for everyone at scale and cost? Back to Nio’s case – it is more like a R&D center than a car manufacturing company today. Its EVE model is combining autonomous vehicle, electrical vehicle and luxury supercar into one concept. Despite the large hurdles on the R&D side, even assuming EVE model is ready for production, I still do not see how Nio could manage to integrate it with manufacturing to scale. I have been to Nio car show in Shanghai this year, and this EVE concept car will be priced on par with other non EV supercars, which I viewed as a very similar strategy as Tesla – using the high pricing to control demand. If Nio plan to target only the supercar/luxury EV car market, then it might be successful. However, to become a lifestyle car that servicing the greater China, where purchasing power is highly limited in most cities. I am skeptical about Nio’s ability to scale up and meet market demand. Furthermore, if Nio is viewed as a company only servicing the wealthy, will the government still extend its support?

Great Essay! Electric cars are definitely the future manifested today. But approaching it purely from a cost dynamic though, one might need to question what happens in the event of discovery of new sources of oil or other fossil fuels in the world. What happens if the oil industry reduces prices due to excess supply? In that event he cost dynamics of EV industry would look less attractive for a consumer. As it stands the success of EVs depend on the continued reduction in battery cost. Which in turn is dependent on wide spread adoption and increase in energy density. In countries like India there is also a question on how “clean” the electricity generated for use of battery charging is and how quickly the charging infrastructure in the country can scale up . But in China these concerns seem to be addressed.

Thank for writing about Nio – super fascinating company, and one that I had not heard of before (especially when competing against the likes of Tesla)! I have several thoughts to share on this topic. First, reflecting on our Chateau Margaux discussion today and the Chinese “luxury buyer”, I wonder how much of the push towards purchasing EV vehicle is around wanting to own the latest supercar as a status symbol vs. actually buying into the EV revolution for sustainability purposes? Perhaps the motivation doesn’t matter, as long as the outcome is positive. However, my fear is that the Chinese mainstream market will be slower to adopt EVs as a result – if the motivation proves to be around owning luxury supercars. One of the differences from the US EV market is that beyond Tesla, we also see many affordable EV options, such as the Prius and Volt. Second, I would be curious to learn what additional investments the Chinese government is making towards EVs, beyond monetary incentives/credits. I would imagine that there would also need to be some infrastructure changes and investments, beyond the individual consumer. Finally, there is a risk with the supply chain piece, as you alluded to in this essay. We have already seen this time and time again with Tesla. However, as more auto companies enter the EV space and move towards fully electrical offerings, I think it benefits the ecosystem as a whole as suppliers become more accustomed with providing parts for EVs.

I agree with you about how management needs to make more aggressive investment in the complete supply chain of their EVs. I also believe that they should revisit their decision to outsource battery manufacturing since this is arguably the most important part of an EV since it directly impacts performance and cost. I think the battery piece goes a long way in addressing your question about moving down market and producing at scale and cost. If they can produce batteries for other energy storage applications that could help speed up the innovation and cost reduction cycles for the batteries destined for their cars. Very interesting article, thanks for sharing!

I very much enjoyed reading your article and was heartened to see that electric vehicles could make a significant impact on stemming or at least decreasing the rate at which the threats of climate change are disrupting ways of life around the world. One key challenge for Nio to overcome, which you point out, is if they want to succeed not only as a business but also in their goals to help combat climate change will be to optimize its supply chain management to lower costs and ultimately bring the price of their EV vehicles (luxury or economy) to be competitive with traditional vehicles. As you mentioned in your article, perhaps heavy involvement of the Chinese government in both investment in Nio and in regulation of supply chain management overall will accelerate this process.

Very interesting article. It was great to read about the Chinese competitor to Tesla especially given how hard Musk is working to penetrate the market. I am very surprised by NIO’s willingness to outsource seemingly critical functions to third parties who are industry incumbents. I see this as a major disadvantage for them because the incumbent’s motives are likely to differ from NIO’s given they are trying to disrupt the status quo. If NIO is working to revolutionize the technology in vehicles, they should look to keep more functions under their control where they can observe and improve. I believe the success of this company will largely rest in the hands of the Chinese government who has control of not only the policy affecting EVs, but also the SOEs that the company must rely on when building out their charging networks. Finally, I am concerned that the company is not being aggressive enough in pursuing battery improvement and production. One of the key initiatives that Tesla has been working on to gain a competitive advantage in the industry is its joint-venture with Panasonic – the Gigafactory. It will be extremely difficult for NIO to compete with Tesla if the cost and efficiency gains from the Gigafactory are as significant as Tesla expects.

Brilliant essay, Yin!

It’s so interesting to hear about the strategy a direct Tesla competitor is employing. Ultimately, I do agree with you that controlling the key IP (in this case energy density technology) is a key to success, but perhaps it’s not the key to success in the US and not in China. Here, I think we have two factors playing in Nio’s favour in the Chinese market. 1) The government support for EVs – as the Chinese government has mandated that 1 in 5 cars be run on alternative fuel by 2025, I think that it’s in Nio’s best interest to get as many cars in the market as possible over the next few years – which means that time and resources should not be allocated to developing IP, but to increasing productivity. 2) Tesla as a competitor – I think luxury car consumers in China looking for an EV alternative are likely to be making a choice between Tesla and Nio. In this situation, Tesla might win if Nio is not offered at a more affordable price point. Outsourcing battery development is a cost saving that can be passed on to the consumer in the form of a lower price point.

Looking forward to hearing more about Nio in the future!

Yin,

Thanks for sharing your insights on Nio and the emerging Chinese EV market.

My biggest concern with Nio’s prospects is the competitive landscape in which it is attempting to reach its business objectives. As you mentioned, the Chinese government is devoting substantial resources and regulatory weight behind a push to reduce air pollution and incentivize the development of electric vehicles. This would seem to be an unambiguously positive fact pattern for Nio: the more government subsidies and backing, the better. However, the incentives are so good that they have resulted in the creation of over 200 companies who have publicly stated plans to commercialize new-energy vehicles in Asia. [1] That is an outstanding number of start-ups focused on the same fundamental problem, creating a cost-efficient EV, in an automotive industry where scale has been a primary driver of cost reduction and business success. The Chinese government is aiming for 7 million units to be sold annually in the country by 2025. [2] Although I am confident that the aforementioned incentive structure will help the country achieve this lofty objective, ‘picking winners’ will be a highly uncertain and unpredictable exercise. What is the source of Nio’s sustainable competitive advantage that will turn it into China’s Tesla? What gives us confidence that any of the many other players are not better positioned to achieve this objective? The resounding failure of Chinese conglomorate LeEco to achieve its electric vehicle objectives, despite being viewed by the Chinese government as a preferred national company par-excellence, serves a sobering reminder that the future is uncertain even when we are trending toward something that appears within reach. [3]

To the extent a path to success exists here, I would echo your emphasis on solving the supply chain question first and foremost, but I am cautious around the degree to which throwing additional capital at the problem will actually result in a desirable outcome, e.g., in a cheaper battery technology. As we saw in our sailing case, product development is a science whose success is a function of critical elements that go beyond funding: strategy and execution. On the strategy front, Nio intends to manufacture vehicles via a contract manufacturer. Although this saves them upfront capital expenditures required to build their own cars, it comes at the cost of margin, as the manufacturer extracts some economic value from the system, that could have otherwise been used to continue to push the innovation frontier in a competitively differentiated manner. Similarly, as it relates to batteries, they have made a strategic choice to buy batteries from third parties. The unfortunately reality of this strategy is that those third parties are free to sell their battery technology to the highest bidder or any number of bidders. In this context, battery innovation, to the extent it occurs, is likely to create rents for the battery OEMs, not for Nio. It is not clear how being at the mercy of powerful suppliers, for both technology advancement and production execution, positions Nio to win the race to China EV dominance.

Overall, a company that serves as a design shop that plays in an industry structure with 200 competitors where required innovations will come mostly from suppliers does not smell like a winning bet, no matter how much money Tencent et al put behind it over the near-term.

[1] Emily Feng, “China Puts a Stop to Electric-Car Gold-Rush,” Financial Times, June 2017, https://www.ft.com/content/891d8264-5016-11e7-bfb8-997009366969, accessed November 2017.

[2] Ibid.

[3] Qian Chen, “China’s LeEco Set Out to Change the World. Its Failure Has Changed China,” CNBC, November 2017, https://www.cnbc.com/2017/11/13/a-chinese-company-wanted-to-beat-netflix-tesla-and-apple–its-turned-into-a-multibillion-dollar-mess.html, accessed November 2017.

Thank you for the essay. I would like to add the following – when one discusses questions related to electric vehicles (EV) there is a lot of debate whether EVs are actually good for the environment considering the carbon emission footprint associated with producing the battery. In reality, there are a number of assumptions that one has to make to estimate when such footprint is zeroed – the range on average is 2.5 – 5 years [1], which is more than enough to consider replacing cars with EVs as a positive move. I think that environmental impact is one aspect of the future of EVs, the other being – EVs are simply more efficient in converting energy into movement. Efficiency for EV engines is ~60% in comparison to the efficiency of internal combustions engines of ~20% [2], so at the end of the day – considering depleting oil reserves, EVs might a good solution for the future transportation problems.

[1] http://www.popularmechanics.com/cars/hybrid-electric/news/a27039/tesla-battery-emissions-study-fake-news/

[2] https://www.fueleconomy.gov/feg/evtech.shtml

Thank you for a great article, Yin! I think the Chinese automobile industry at large is in quite an enviable position to emerge as the next major international player, which, to be honest, might be an unlikely suggestion just ten years ago. That said, you have described Nio’s issues with supply chain and production speed. In my understanding, there is also the problem of meeting international safety standards which have historically prevented the Chinese car industry from generating a lot of buzz abroad. However, if Nio is, in fact, able to meet said international safety standards, I believe it is only a matter of time before it is a major success despite the slow timeline/supply chain issues.

Nio is entering a market that is effectively resetting in many ways, with the advent of electronic cars fast-emerging and autonomous vehicles just around the corner. As a result, many large car manufacturers around the globe are having to rethink their supply chains, combustion engine designs, and marketing with the newfound pressure from governments and environmental advocates toward climate-friendly automobile production.

Like Tesla a few years ago, Nio is effectively starting from scratch but not weighed down by history or an existing customer base. Its focus on EV and autonomous vehicles continues to draw the interest, attention, and funding of many investors, helping to address the same cash flow issue that Tesla appears to be successful in fighting thus far.

Therefore, when Nio eventually does figure out its supply chain and capital issues, and hopefully clears the hurdle of international safety regulations, I see no reason why it can’t follow the path that Tesla has paved. And the EP9 would be the perfect way to ride this path! With its elegant design and elite performance as well as Nio’s visionary emphasis on environmentally-friendly production, the EP9 not only looks sexy but thinks sexy too. It’s beauty and it’s brains!

Thank you, Yin! Very interesting article. I believe that the key to introducing EVs for everyone at scale is to reduce the unit cost per vehicle and make EVs affordable. To reduce the unit cost per vehicle, it is essential to manufacture a large quantity of EVs to achieve the economies of scale. And in generating a large demand, it is critical to craft people’s perception that EV is a cool item to own and that it is not impossible to own, although it’s somewhat more expensive than a regular gasoline vehicle. For this purpose, I believe EVs need the value proposition in that EV does not only save fuel costs in the long run but also enhances the owners’ brand equity or societal status among their communities.

To gain people’s mindshare, it does make sense for EV manufacturers to market luxury EVs first as Tesla did. I think at this point, Chinese market is at an early stage and Nio is still developing the brand awareness to attract people’s attention. I believe it takes time, but EV will never be an affordable vehicle for everyone unless it captures a large consumer attention and turns the attention to real demand.