Net-a-Porter: Bringing Luxury Online and Around the World

Not many Internet companies can claim that they’ve been around since 2000, let alone e-commerce businesses (did we even know what e-commerce was in 2000?). Natalie Massanet, magazine editor turned Internet entrepreneur, founded Net-a-Porter in 2000 in London with little institutional backing, only money from family and friends (2). What started as an idea to globalize the Pashmina trend (large scarves women use to wrap their shoulders) by selling them online (4) has become an e-commerce behemoth, with separate women’s (Net-A-Porter) and men’s (Mr. Porter) luxury full-price platforms, a discount platform (The Outnet), a fashion magazine (Porter), and a new fashion social netoworking platform (The Net-Set).

Net-A-Porter generated £54.2 million (about $82 million) of EBITDA in 2015, up 43% YoY, and has been EBITDA positive since 2012 (1). The site attracts nine million visitors per month and has up to 70,000 people shopping at any given time (4). It is a superb model of a tightly integrated business and operating model.

Business Model

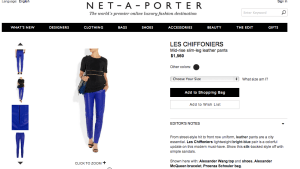

At its core, Net-A-Porter’s business model is to sell full priced women’s clothing. The vast majority of clothing and accessories sold on Net-A-Porter are in the luxury (Gucci, Oscar De La Renta) or “high street” (A.P.C., Kenzo) segments – think bags selling for $2,000 or skirts selling for $750 or more. When Net-A-Porter started, operating in these segments presents a problem for e-tailers: with such a high price tag, customers expected to be able to try on clothing in a high-end store environment with superior customer service.

With price tags as high as Net-a-Porter’s, its target market is much smaller than a moderately priced retailer. To compensate for this, Net-a-Porter must sell to high-end consumers all over the world. While style differs tremendously across the world, Net-a-Porter focuses on fashion that transcends geographies. Massanet believes “Karl Lagerfeld is Karl Lagerfeld, and a red-soled shoe is a red-soled shoe” (2).

To increase the tangibility, Net-a-Porter offers three-day shipping and free returns to satisfy the “instant gratification” feeling of shopping. Orders arrive in a high-end black box wrapped with black ribbon. The clothing inside is wrapped like a gift – tissue paper and all.

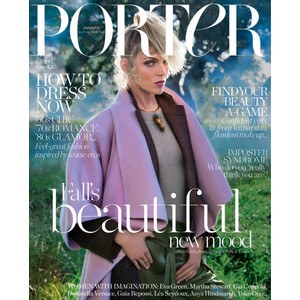

Importantly, Net-a-Porter founded Porter magazine. The magazine is a new format to advertise the company’s offerings – one with glossy pages and the implicit approval of the luxury brands that advertise in it. 88% of Net-a-Porter customers cite print as their preferred media for fashion content (3).

Operating Model

Focus on Design: To compensate for the lack of tangibility, Net-a-Porter’s online interface creates a “luxury” environment. The homepage strikes the viewer more as a digital magazine with options to view multiple editorials and photo shoots instead of an e-commerce site. Additionally, when on an actual shopping page, the item is presented in a curated outfit.

Porter Magazine – Integration of Technology into Print: A person who subscribes to Porter increases site visits by 25% and spends 125% more while shopping on Net-a-Porter (3). To facilitate this, Net-a-Porter has tightly integrated the magazine with their mobile app. Customers are able to scan an issue with the Net-a-Porter app and be directed to a purchase page with items from that issue (5).

Organizational Structure: Net-a-Porter offers the same assortment of goods across geographies. Therefore, they have centralized buying teams, technology teams, and customer service teams. To address different geographies’ needs, Net-A-Porter separates the marketing teams by region (2). Additionally, according to Theresa Austin, Strategic Programme Manager, goals are aligned by team. For instance, the operations and customer service groups focus on proficiency and efficiency, whereas the mobile, marketing, and data insight groups focus on innovation and “open-minded changes” (2).

Office Layout: Net-a-Porter’s office promotes information flow and integration between teams. It is laid out as one large trading floor with 90,000 square feet of open space and no offices or doors (4). Additionally, to emphasize the global scale of the business, large screens are throughout showing real-time data of where orders are being place.

I love that you highlight all the elements that make the experience shopping at Net-a-Porter as exciting as a physical shopping experience. I would agree that these unique “touches” you mention have been critical in maintaining the firm as the premier online luxury retailer. I found it interesting that Porter subscribers tended to spend a lot more than the average shopper. Since a lot of the magazine is available online for free public consumption, I would have thought that this may incentivize some to view the editorial material and then pick between online retailers for the lowest price on a given item. Sites like ShopStyle make it very easy for items to be compared across multiple competing e-commerce platforms. On the other hand, the engagement with Net-a-Porter’s content and the expectation of superior customer service seem to lure luxury shoppers to stay loyal.

Great post! I agree with Tehsina and believe that the multitude of e-commerce shopping sites has caused customers to have very low site loyalty. Shoppers’ decisions seem to be driven by price and availability. Their Porter magazine is a real competitive advantage, and I’d be curious to know how the ROI and data differs for converting new customers vs repeat customers. One way traditional retailers such as Intermix have improved loyalty is by having brands design exclusive lines for the retailer. This is a strategy that could benefit Net-A-Porter especially since increasing private label offerings is less useful for its luxury customer target that is likely very brand-focused.

Interesting article. Net-A-Porter seems to be another digitally native retailer that has expanded into a more physical presence (others include Warby-Parker and Amazon). The physical magazine approach is unique and seems really well suited for their particular target demographic. Also, thought that the small touches – the luxurious black box goods arrive, the magazine-esqe quality of the website – help appeal to their high-end clientele. I wonder if it makes sense for them to stay independent, or do become part of a larger luxury / retail business? Seems like it would fit well in LVHM’s portfolio, or as the high-end arm of Amazon / Alibaba, which would allow them to leverage the operational capabilities of the larger organization but still focus on their traditional customers.

downeaster,

It’s interesting you say that. Richemont (luxury goods conglomerate) actually sold Net-A-Porter and merged it with Yoox (Italian e-tailer) earlier this year. Richemont seems, like you, to think that Net-a-Porter will benefit from the logistical expertise and physical synergies of a larger organization – and I agree.

I love Mr Porter and what sets them apart for me when compared to other online sites is the curation of designers and clothes available. I am often able to find up and coming deisgners on their site that aren’t even avaialble in brick & mortar retailers. What did you find about their operating model that enables them to achieve such high quality curation?