Navigating the Risks of “America First” Trade Policy

How should multi-national manufacturing companies mitigate risk in an uncertain political climate?

Trump’s “America First” trade policy has introduced tremendous uncertainty for global companies operating in the US with significant offshore manufacturing or import exposure. [1,2] Immediately after his election, global manufacturers urgently began to assess their risk to potential trade shocks, a task made more difficult by the lack of clarity about policy specifics in the GOP blueprint available at the time [3]. Many of these manufacturing firms called on consultancies to help size the likely impact and develop plans to mitigate risks or take advantage of any new competitive opportunities. Companies with high exposure relative to their competitors developed contingency plans for a time when foreign sourcing and manufacturing might become a disadvantage. Conversely, domestic manufacturing supply chains that have yet to seize the opportunity for lower labor costs in other countries held a potential advantage over offshored competitors. Bain argues that the automotive industry will likely be hit the hardest by any changes to NAFTA or by the imposition of a border adjustment tax, given the extent to which those supply chains rely on goods manufactured or sourced outside of the US [4].

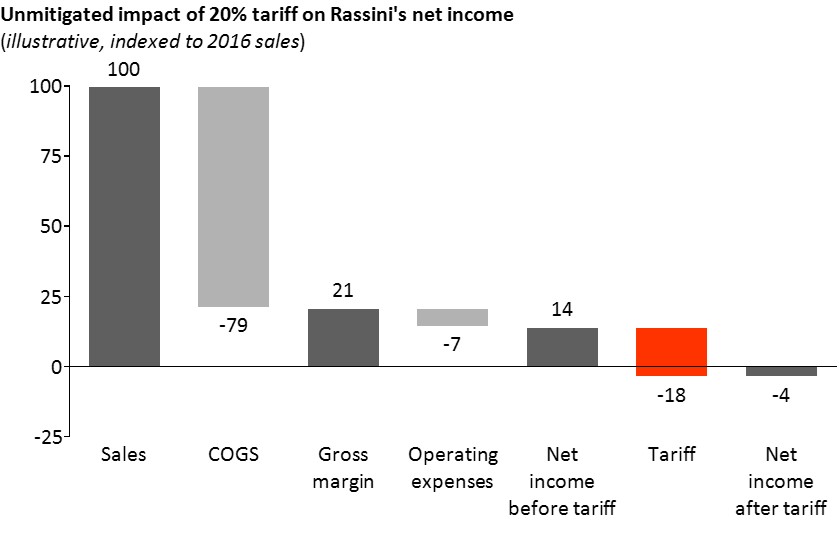

To illustrate the potential impact of these changes, consider Rassini, an autoparts producer headquartered in Mexico that primarily serves automakers operating in the US (e.g., Ford, GM, Toyota, Honda, Volkswagen, Audi) via manufacturing sites in Mexico, the US, and Brazil. US customers comprised ~90% of its total 2016 sales of ~$900M, suggesting a substantial portion of its revenues are vulnerable to policy changes under consideration by the Trump administration [5, 6, 7]. There is little consensus about the specific policy to be implemented, but for the sake of clarity, let’s consider a simple scenario revealing the impact that a 20% penalty, like the one Trump’s former White House press secretary suggested earlier this year, might have on the company if we assume all of their products sold in the US are manufactured outside its borders [7, 8].

This scenario may be unlikely, but it approximately bounds the worst case impact of Rassini’s US trade exposure and can serve as a helpful starting place for developing contingency plans. In the implausible event of a 20% tariff on the ~90% of sales in North America, Rassini risks becoming unprofitable.

Rassini has proactively taken several actions that help mitigate these risks, including:

- Shifting more production to the US by improving plant competitiveness in their Ohio facility, including new automation projects [5]. By serving US customers with a domestic facility, Rassini reduces the share of North American revenue exposed to tariffs

- Strengthening global presence to become less reliant on its US customer base. Rassini recently opened engineering and customer service offices in Japan and Germany [4,5]. This will ultimately reduce the share of revenue exposed to US import penalties in addition to better positioning them to take advantage of growth opportunities outside of the US

- Improving operational efficiency: Rassini invested in modernizing its production to become more competitive globally, which resulted in savings of $1.6M last year [5]. They also invested in “high-tech tools” and the “automation and robotization of manufacturing process in all of [their] facilities” [5]. By improving efficiency, Rassini will have the option of passing only partial cost increases to consumers without necessarily hurting its profit margins

These are critical actions to ensure Rassini has a chance of remaining competitive with US manufacturers in the event unfavorable trade policies are imposed on Mexico, but they’re hardly enough to offset costs in the event of a more punititive tariff. Rassini should considers the conditions under which it may benefit from pulling the following additional levers:

- Increase prices: Rassini may be able to pass cost increases on to their customers, but doing so poses substantial volume risks if US-based manufacturers have more competitive domestic supplier alternatives

- Adjust supply chain sourcing: by considering alternative sources for raw and WIP materials for US manufacturing, Rassini may reduce its tariff burden

- Relocate Mexico facilities: shifting more production to the US can reduce tariff exposure, but at a high cost, not only to relocate facilities but also due to higher labor rates

- Consider M&A: acquiring a US competitor or manufacturing facility may enable them to serve US customers domestically and avoid the tariff

Given the uncertainty of the political climate and policy specifics, Rassini likely cannot yet justify the high cost actions mentioned directly above. However, to be in a position to act fast in the event policy changes are implemented, they need to evaluate bold potential mitigating options in addition to the incremental adjustments already underway.

Going forward, how should manufacturing companies like Rassini approach strategic decisions in the face of such uncertainty? To what extent can exposed organizations build in the operational flexibility to deal with change in the event new policies have a seismic impact on their existing competitive landscape? (800 words)

[1] Pankaj Ghemawat, “Trump, Globalization, and Trade’s Uncertain Future,” Harvard Business Review, November 11, 2016, link, accessed November 2017.

[2] Nick Timiraos, “Donald Trump’s Upset Ushers in Economic Uncertainty,” Wall Street Journal, November 9, 2016, link, accessed November 2017.

[3] GOP Blueprint, “A Better Way: Tax Policy Paper,” 2016, link, accessed November 2017.

[4] Rodrigo Rubio et al., “Is Your Supply Chain Ready for a Nafta Overhaul,” Bain Brief, August, 2017, link accessed November 2017.

[5] Rassini, 2016 Annual Report, link, accessed November 2017.

[6] XE Currency converter, link, accessed November 2017.

[7] Isabella Cota and Maria Levitov, “Mexico’s Peso Plunges as Trump Victory Casts Doubt on Trade Ties,” Bloomberg, November 8, 2016, link, accessed November 2017.

[8] Jeremy Diamond, “Trump floats 20% Tax on Mexican Imports to Pay for Wall, but Considering Other Options,” CNN Politics, January 2017, link, accessed November 2017.

[9] Morningstar, Key Ratios for Rassini SAB de CV A, link, accessed November 2017.

Rassini needs to be ready in the event of the imposed tariff but, as you suggest, should not act prematurely in the event that it is not imposed. The company can therefore take actions that will benefit the business in either scenario, whether or not the tariff is implemented. In addition, the company should have plans lined up in the event that the tariff is imposed. For example, as mentioned in the article, the company’s revenue is currently 90% concentrated in the U.S. As recommended, diversifying this revenue stream would be critical for the company should the tariff occur. However, it would also be strategic to expand and diversify its customer base even without the tariff. This potential tariff thus provides the impetus for Rassini to rethink its business from all angles and improve its operations in the long run, with or without the tariff.

I think an event-driven roadmap around key decision points is the way to go here. Though the uncertainty is difficult to quantify, the value of assessing different areas of risk is key. Rassini may even decide to enter or exit the market for certain auto parts based on a probability tree analysis of the different cash flow scenarios under each policy outcome.

Another key point for Rassini to consider is the cost of simply waiting out this administration until the Oval Office is occupied by an executive more amenable to the economic efficacy of trade deals. It may be that case that although there may be a short-term negative impact, the long-term benefits outweigh these near-term costs. This is a question that can be answered qualitatively and can help provide guidance in terms of the degree of “tolerable short-term isolationism” that Rassini can withstand in order to remain a going concern into the future.

I’m with Cashflow here — this question calls for a Probability Tree! In all seriousness, you are right that Rassini and other global manufacturers need to be weighing their options and preparing a response for a series of probable outcomes. In the meantime, regardless of the risks posed by the political sphere, maximizing operational efficiency via investments in AI will continue to grow in importance as a means of staying competitive in this industry.

SAM, excellent question about how Rassini should face strategic decisions in the face of uncertainty. I think their approach so far has been very wise in that they have made decisions and investments that prepare them for a post tariff reality but also help improve their competitiveness in the short term. In addition to their expansion to other markets, efficiency gains, and shift of some production to the U.S. I think they need to develop an action plan and continue to monitor the situation on how they will respond to any new trade deals. It is likely Rassini has some time to prepare and perfect their action plan as many experts are estimating at least a year to enact a new trade deal. Additionally, there is significant risk that it will take much longer if the deal is not completed before Mexico holds presidential elections within the next year. (http://money.cnn.com/2017/08/16/news/economy/trump-nafta-steps/index.html)

Thank you for an interesting read, Sam! As I read your essay, I was struck by the inherit tension between flexibility and cost reduction implied in your potential solutions. One angle with which to look at flexibility is production-location. Should Rassini attempt to have a someone flexibility production-location strategy, where is “moves” its production shop across borders (both countries and states) to react to trade policy changes, tax policy, etc.? Or should Rassini have high-tech facilities that streamline operations and minimize cost, committing to one production geography even if it later gets priced out of the market? You present some interesting questions, and I look forward to seeing how the NAFDA discussions progress and how Rassini responds.

Excellent analysis of a huge problem facing many automotive parts suppliers. If Rassini acts quickly to mitigate the impacts of a potential nationalist tariff in the US, they can gain a competitive advantage against other foreign suppliers in the US market. However, Rassini must be very flexible in their approach due to the extreme volatility of the political climate and the large variance in the implementation timelines of various political regulations. A tariff can be repealed just as quickly or slowly as it was enacted. Rassini should therefore only consider solutions that require high capital investments as a last resort. I can think of two potential ideas for relatively low cost solutions to address the impending tariff:

1) Rassini should evaluate US-based raw material suppliers. If Rassini moves some of its raw material supply chain to the US, it can potentially avoid or reduce the US tariff by making the argument that the produced components have a large impact on the US workforce and a tariff would harm the US raw material supplier company. Rassini should target commoditized raw materials because they would have a better chance of finding US-based suppliers that can compete on price compared to a foreign supplier.

2) Many automotive parts suppliers provide assembled products to their car-making customers. If Rassini has products in their foreign production facilities that require significant manual assembly, they can perhaps move the assembly portion of the process to a US facility while leaving the component production in its original plant. Therefore, the assembled product would technically be considered a US part because it was completed as a finished good in the US. This would likely increase the cost of the assembled product due to relatively high labor costs in the US, but the increase in labor costs may be smaller than the cost increase required to transfer the component production machinery to the US.

Since the political uncertainty which we are talking about here affects as much as 90% of Rassini’s revenue, I think that it is better for Rassini to diversify risk by moving its operation to serve more customers outside the States.

One of the relocation options would be to move production facilities to countries in South East Asia or China to benefit from lower labor cost and expand its customer base. Rassini should start the expansion right away. Even if the ‘American First’ trade policy wasn’t implemented, Rassini will have more diversified portfolio and bear the less political risk.